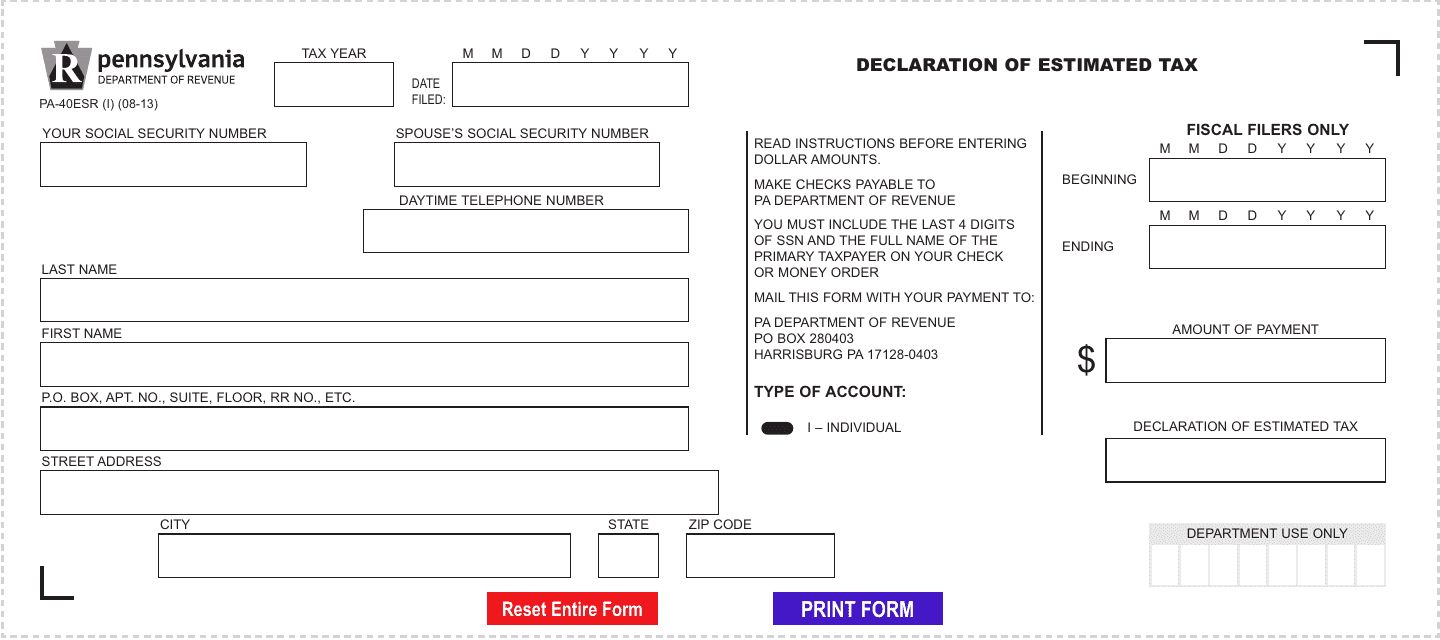

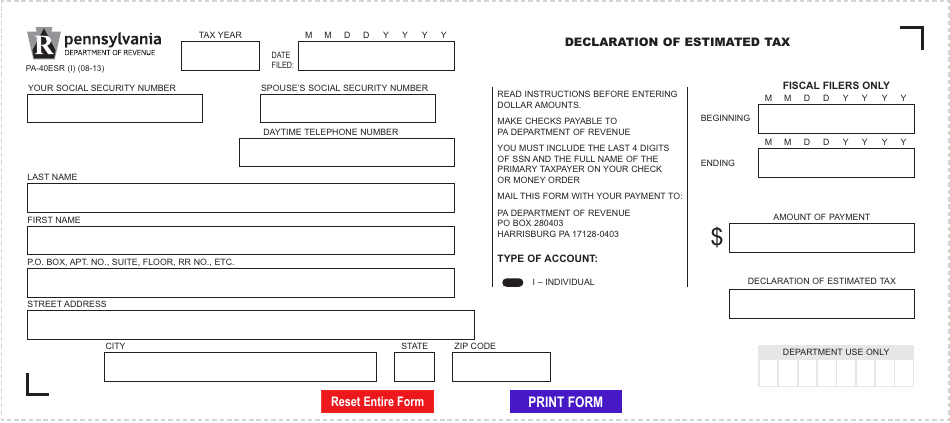

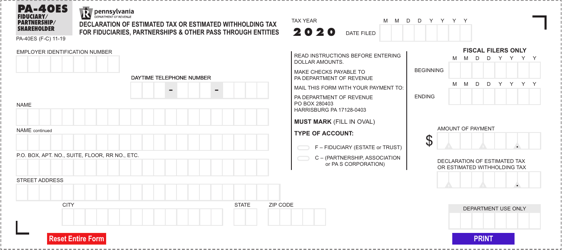

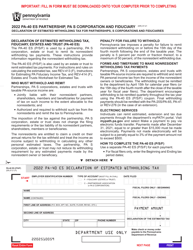

Form PA-40 ESR (I) Declaration of Estimated Tax - Pennsylvania

What Is Form PA-40 ESR (I)?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: what is Form PA-40 ESR (I)?

A: Form PA-40 ESR (I) is the Declaration of Estimated Tax form for Pennsylvania.

Q: Who needs to fill out Form PA-40 ESR (I)?

A: Individuals who have estimated tax liability in Pennsylvania need to fill out Form PA-40 ESR (I).

Q: What is the purpose of Form PA-40 ESR (I)?

A: The purpose of Form PA-40 ESR (I) is to report and pay estimated tax to the state of Pennsylvania.

Q: When is Form PA-40 ESR (I) due?

A: Form PA-40 ESR (I) is due on or before April 15 of the tax year.

Q: What happens if I don't file Form PA-40 ESR (I)?

A: If you have a tax liability and fail to file Form PA-40 ESR (I), you may be subject to penalties and interest.

Q: Is Form PA-40 ESR (I) for residents of Pennsylvania only?

A: No, Form PA-40 ESR (I) is for both residents and non-residents of Pennsylvania who have estimated tax liability in the state.

Form Details:

- Released on August 1, 2013;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 ESR (I) by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.