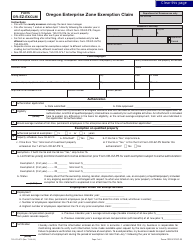

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 150-303-086

for the current year.

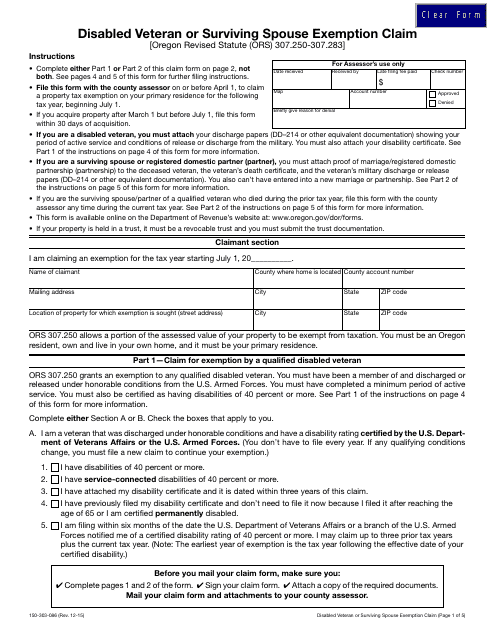

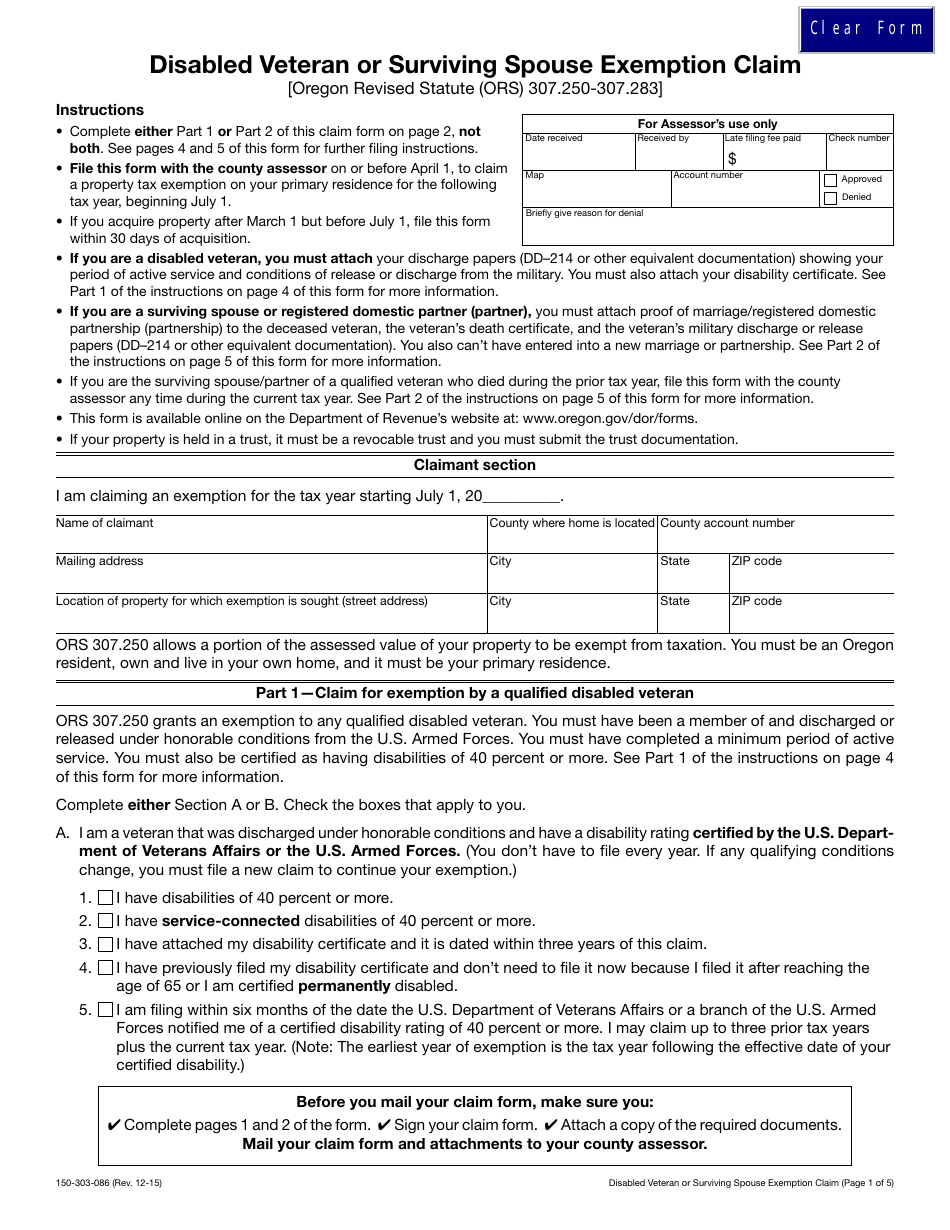

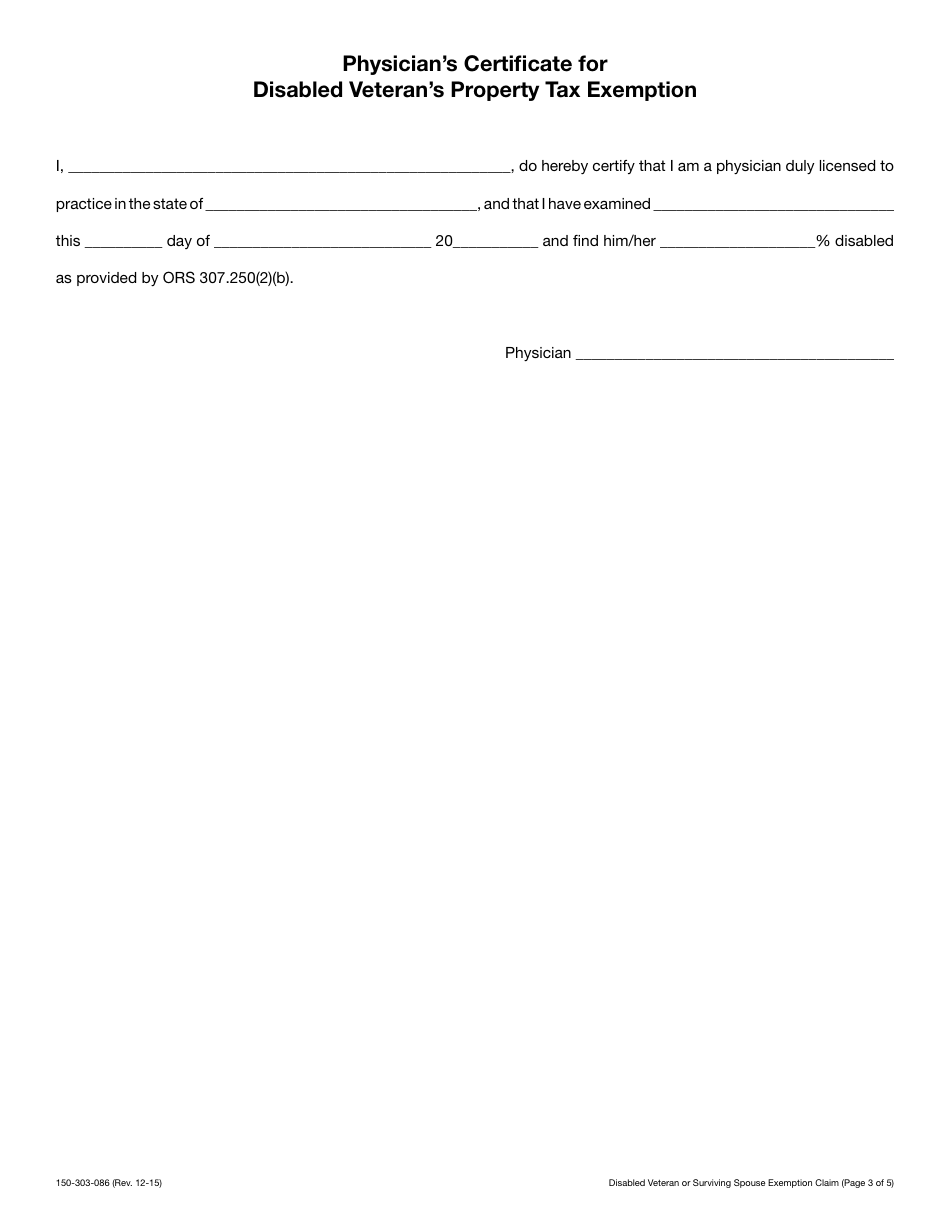

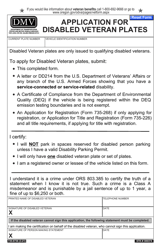

Form 150-303-086 Disabled Veteran or Surviving Spouse Exemption Claim - Oregon

What Is Form 150-303-086?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

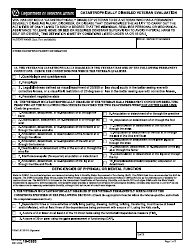

Q: What is Form 150-303-086?

A: Form 150-303-086 is the Disabled Veteran or Surviving Spouse Exemption Claim form used in Oregon.

Q: Who can use Form 150-303-086?

A: This form can be used by disabled veterans or surviving spouses in Oregon to claim an exemption.

Q: What is the purpose of Form 150-303-086?

A: The purpose of this form is to claim an exemption from property taxes for disabled veterans or surviving spouses in Oregon.

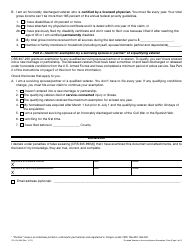

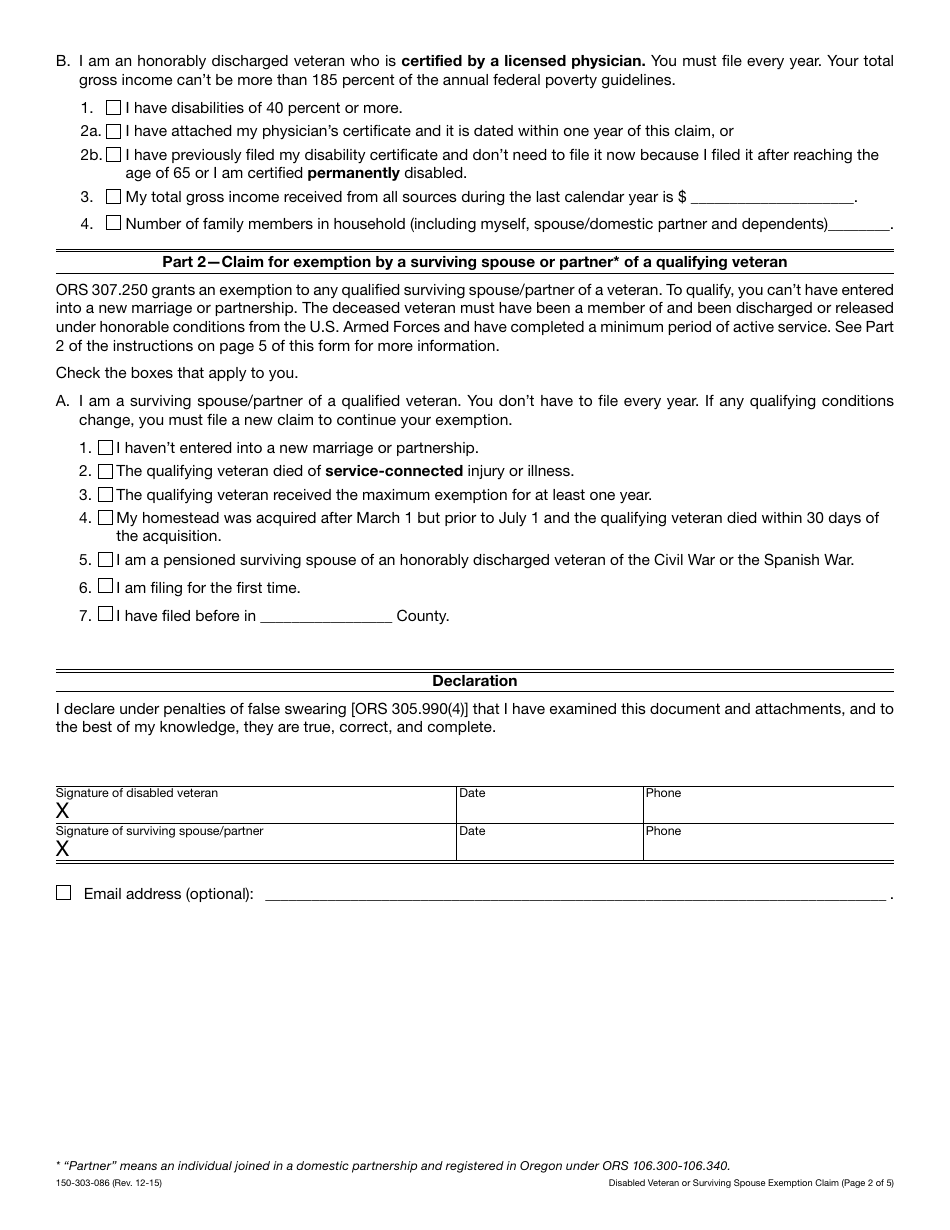

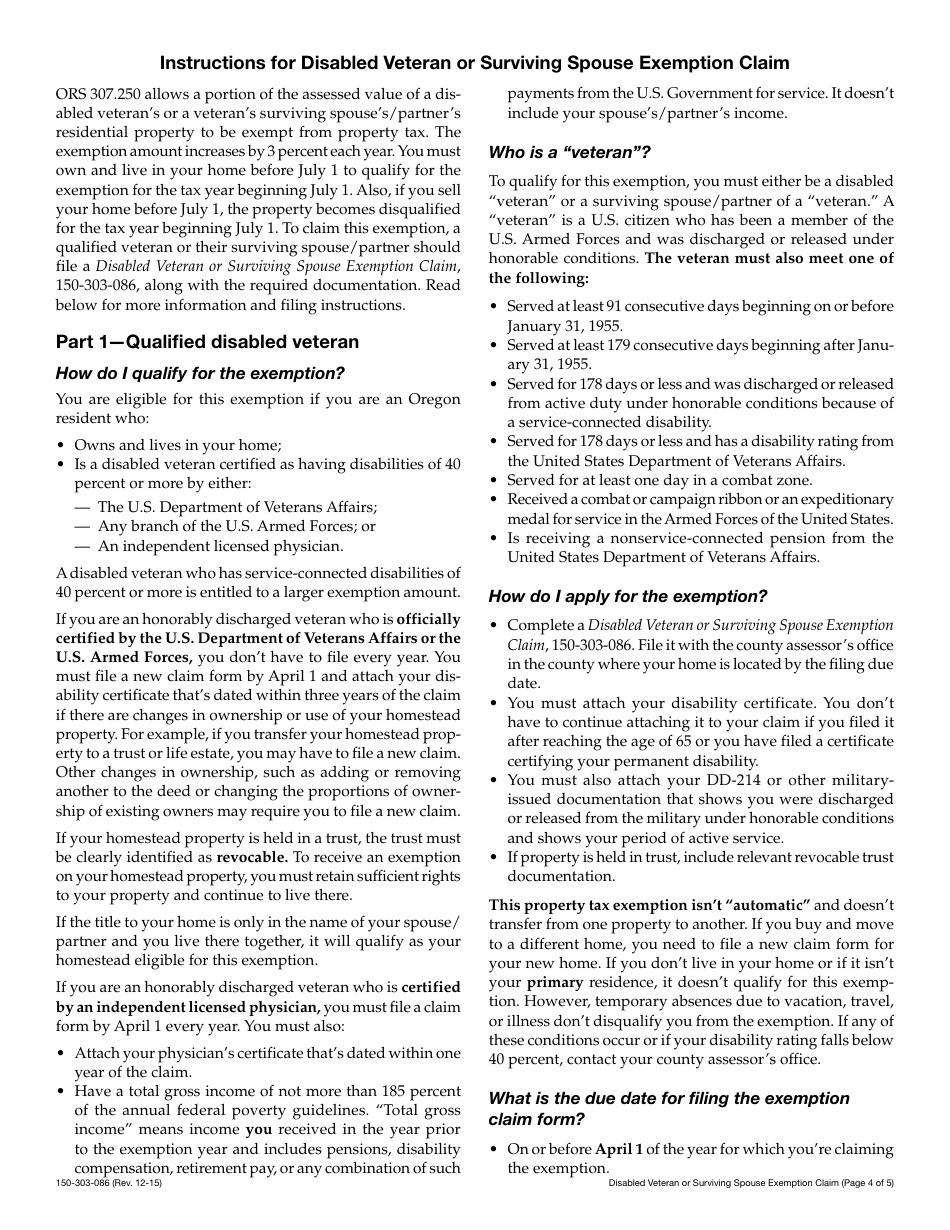

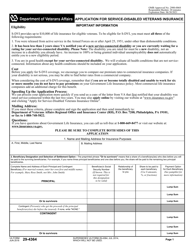

Q: How do I qualify for the exemption?

A: To qualify for the exemption, you must be a disabled veteran or surviving spouse and meet certain criteria set by the state of Oregon.

Q: Are there any fees associated with filing this form?

A: There are no fees associated with filing Form 150-303-086.

Q: What documentation do I need to submit with the form?

A: You will need to provide documentation to support your eligibility for the exemption, such as proof of disability or proof of surviving spouse status.

Q: What is the deadline for filing this form?

A: The deadline for filing Form 150-303-086 is determined by the county in which you reside. Contact your county assessor for specific deadlines.

Q: What happens after I submit the form?

A: After you submit the form, the assessor's office will review your application and determine if you qualify for the exemption.

Q: How long does it take to process the application?

A: Processing times can vary, but you should receive a response from the assessor's office within a few weeks of submitting your application.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-303-086 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.