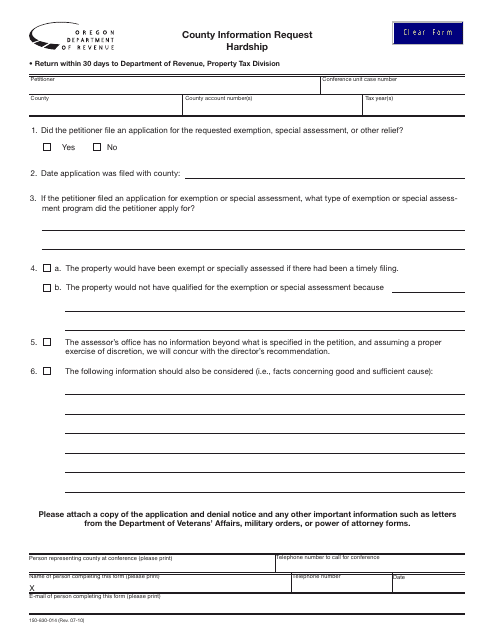

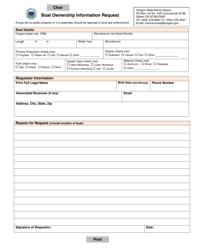

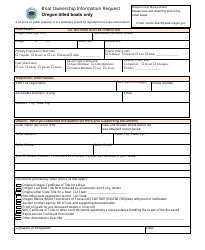

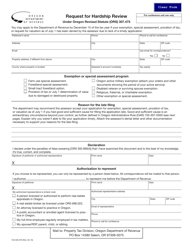

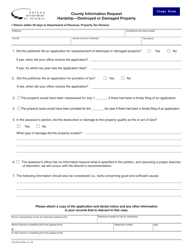

Form 150-830-014 County Information Request Hardship - Oregon

What Is Form 150-830-014?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

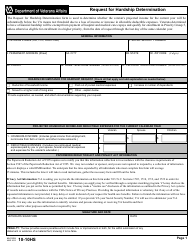

Q: What is form 150-830-014?

A: Form 150-830-014 is a County Information Request Hardship form specific to the state of Oregon.

Q: What is the purpose of form 150-830-014?

A: Form 150-830-014 is used to request information about hardship cases in a specific county in Oregon.

Q: Who can use form 150-830-014?

A: This form can be used by individuals or organizations seeking information about hardship cases in an Oregon county.

Q: Is there a fee associated with form 150-830-014?

A: There may be a fee associated with submitting form 150-830-014. You should check the instructions or contact the relevant county office for more information.

Q: How long does it take to process form 150-830-014?

A: The processing time for form 150-830-014 can vary depending on the county. It is recommended to contact the county office directly for information on processing times.

Form Details:

- Released on July 1, 2010;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-830-014 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.