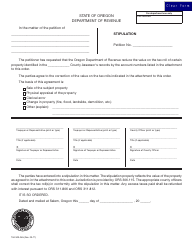

Form 150-303-065 County Assessor Stipulation - Oregon

What Is Form 150-303-065?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-303-065?

A: Form 150-303-065 is the County Assessor Stipulation in Oregon.

Q: What is the purpose of Form 150-303-065?

A: The purpose of Form 150-303-065 is to stipulate the assessed value of property for tax purposes.

Q: Who uses Form 150-303-065?

A: County assessors in Oregon use Form 150-303-065.

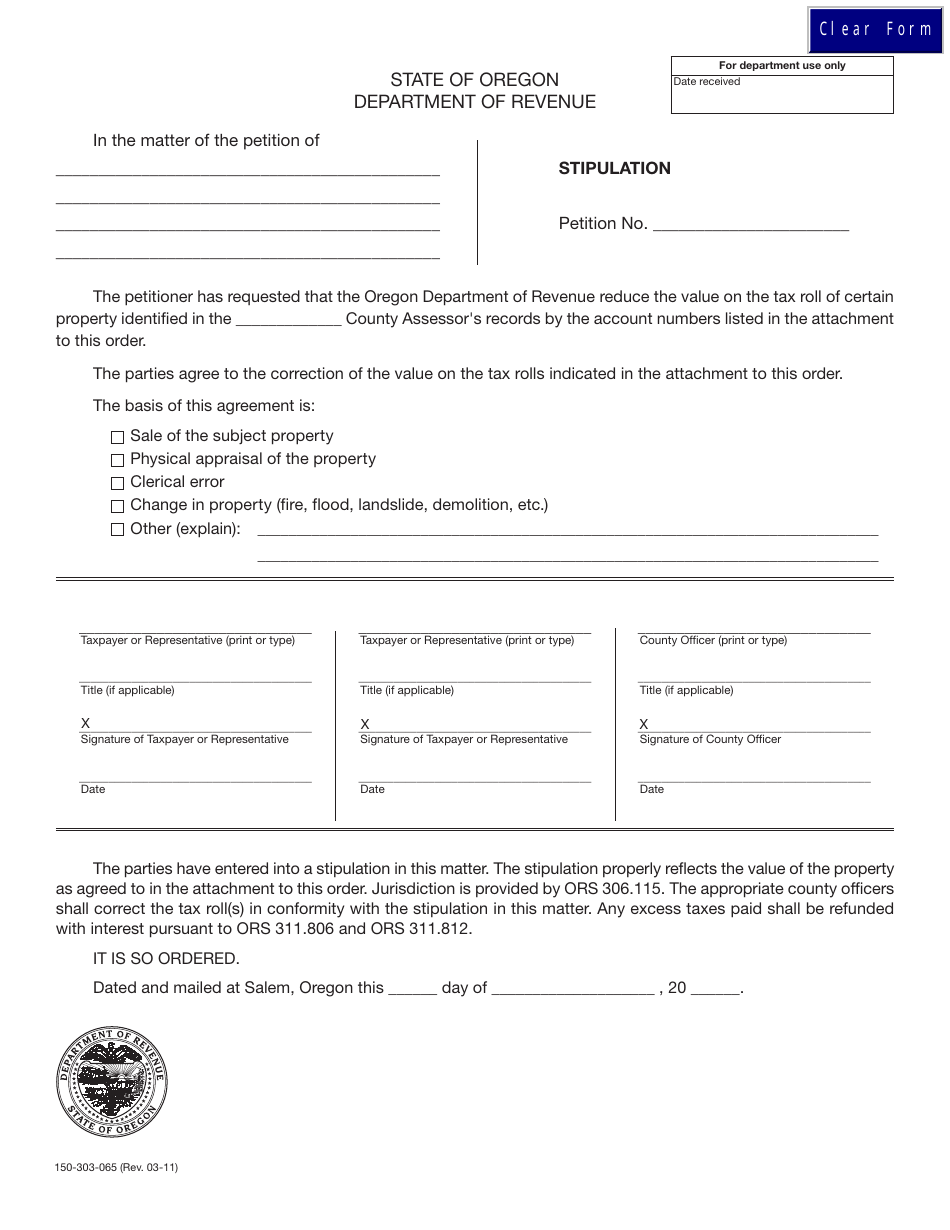

Q: What information is required on Form 150-303-065?

A: Form 150-303-065 requires information such as property identification, taxpayer information, and the stipulated assessed value.

Form Details:

- Released on March 1, 2011;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-303-065 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.