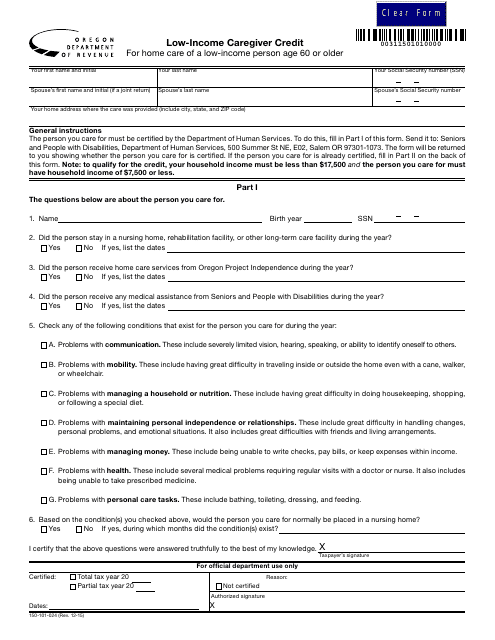

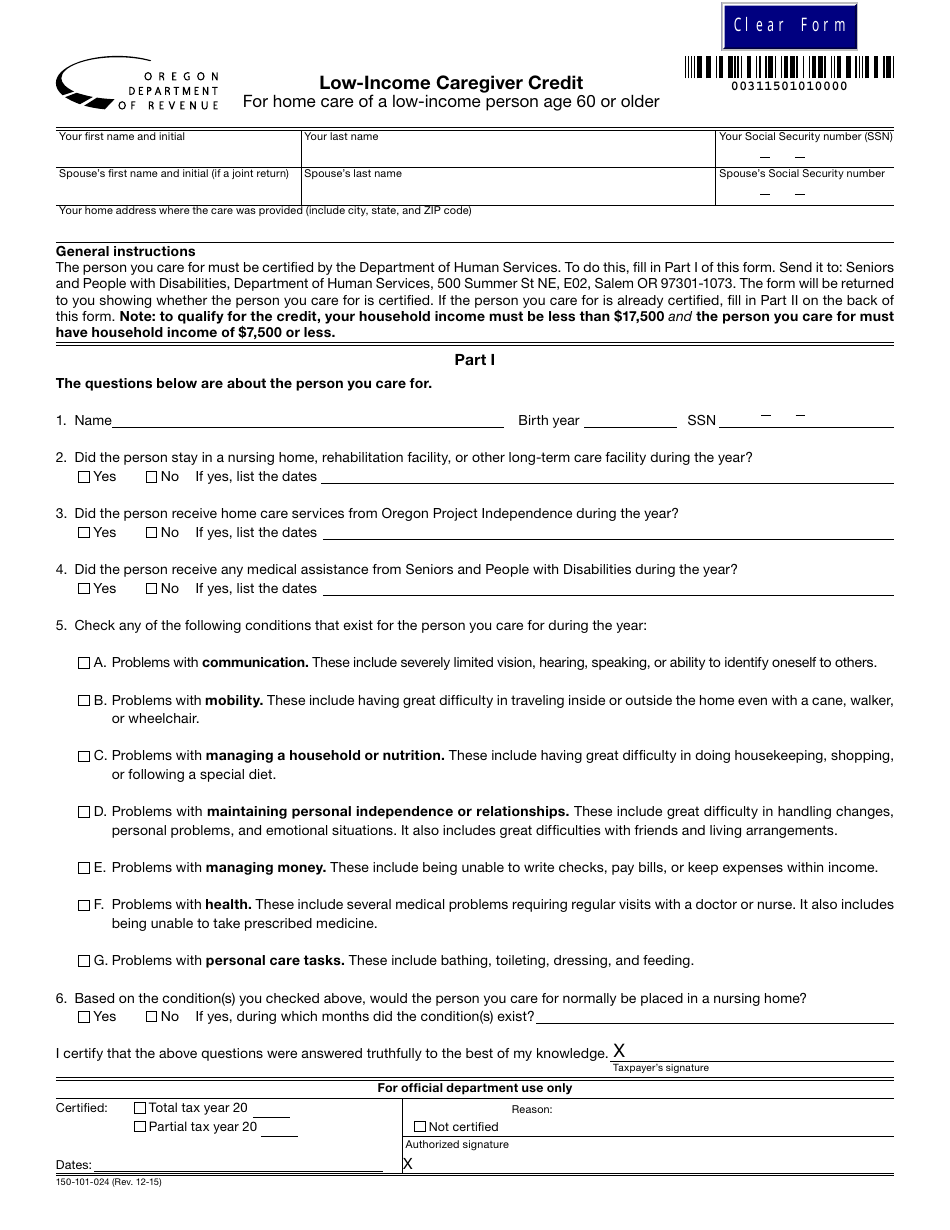

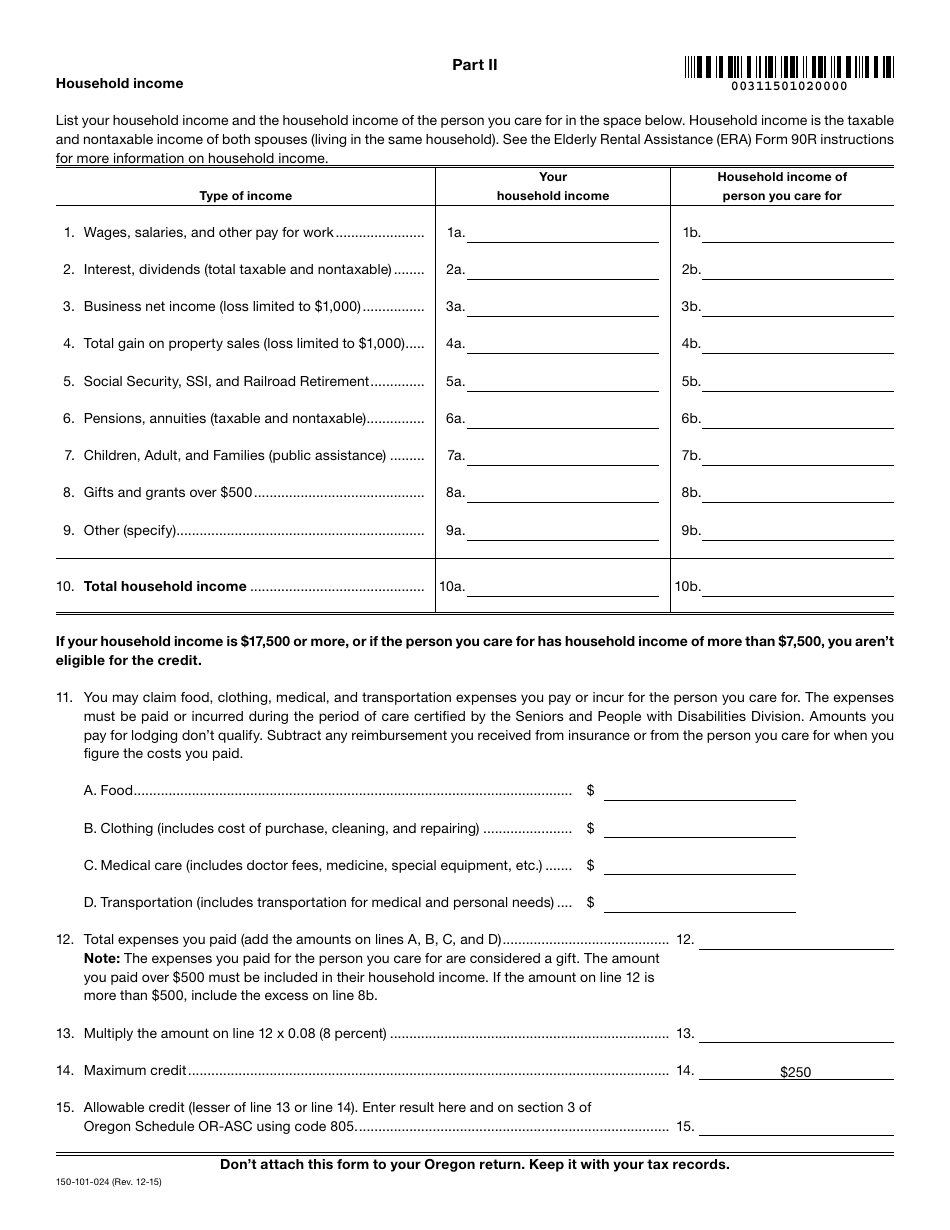

Form 150-101-024 Low-Income Caregiver Credit - Oregon

What Is Form 150-101-024?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-024?

A: Form 150-101-024 is the Low-Income Caregiver Credit form in Oregon.

Q: Who is eligible for the Low-Income Caregiver Credit in Oregon?

A: Individuals who meet the income and caregiving criteria specified by Oregon Department of Revenue are eligible for the Low-Income Caregiver Credit.

Q: What is the purpose of the Low-Income Caregiver Credit?

A: The purpose of the Low-Income Caregiver Credit is to provide a tax credit for eligible caregivers in Oregon.

Q: How can I claim the Low-Income Caregiver Credit?

A: You can claim the Low-Income Caregiver Credit by filling out Form 150-101-024 and including it with your Oregon state tax return.

Q: Is the Low-Income Caregiver Credit refundable?

A: Yes, the Low-Income Caregiver Credit is refundable, meaning you may receive a refund if the credit exceeds your tax liability.

Q: What documentation do I need to provide when claiming the Low-Income Caregiver Credit?

A: You may need to provide documentation such as proof of income, proof of caregiving, and other supporting documents when claiming the Low-Income Caregiver Credit.

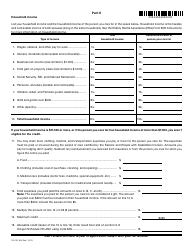

Q: Are there income limits for the Low-Income Caregiver Credit?

A: Yes, there are income limits for the Low-Income Caregiver Credit. The exact limits may vary depending on the tax year and your filing status.

Q: Can I claim the Low-Income Caregiver Credit if I am not a caregiver?

A: No, you can only claim the Low-Income Caregiver Credit if you meet the caregiving criteria set by the Oregon Department of Revenue.

Q: When is the deadline to file Form 150-101-024?

A: The deadline to file Form 150-101-024 is the same as the deadline for filing your Oregon state tax return, which is usually April 15th or the following business day.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-024 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.