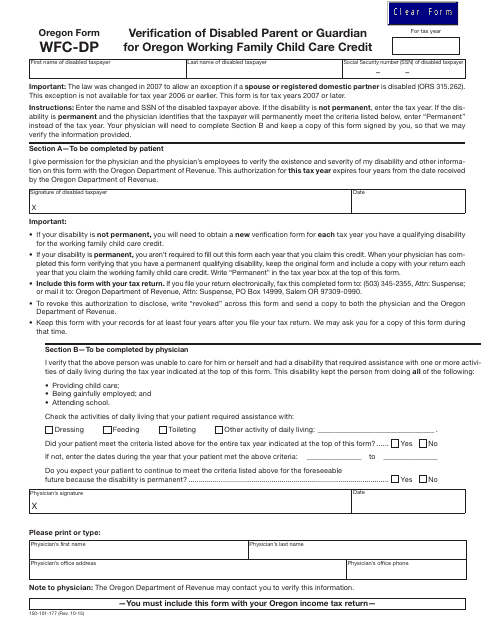

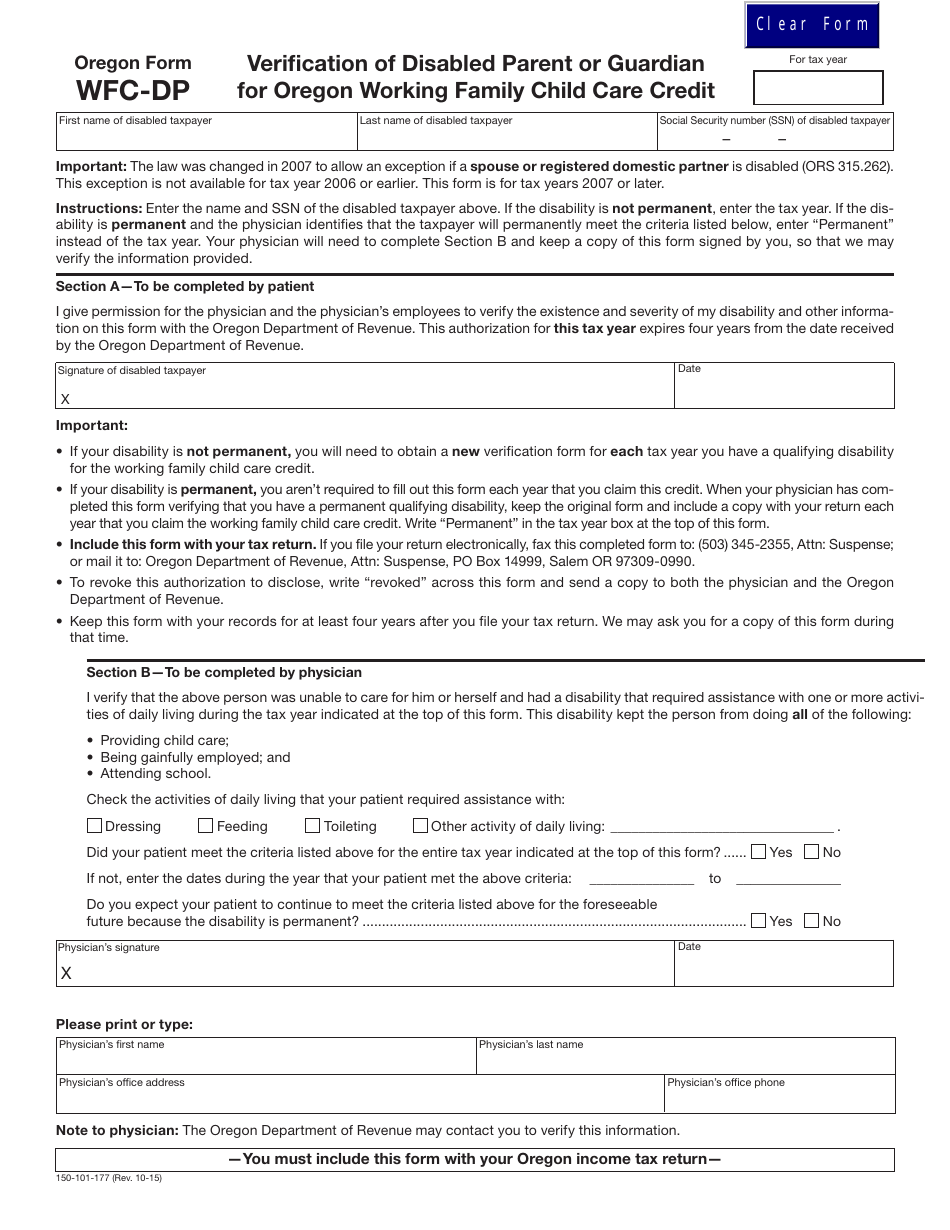

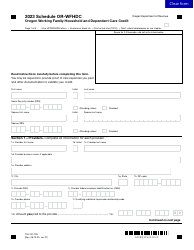

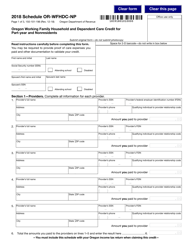

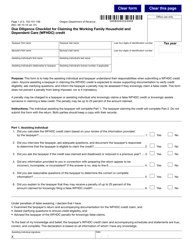

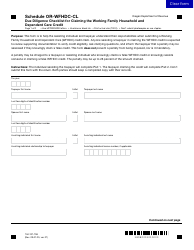

Form 150-101-177 (WFC-DP) Verification of Disabled Parent or Guardian for Oregon Working Family Child Care Credit - Oregon

What Is Form 150-101-177 (WFC-DP)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-177?

A: Form 150-101-177 is the Verification of Disabled Parent or Guardian for Oregon Working Family Child Care Credit - Oregon.

Q: What is the purpose of Form 150-101-177?

A: The purpose of Form 150-101-177 is to verify the disability status of a parent or guardian in order to claim the Oregon Working Family Child Care Credit.

Q: Who needs to fill out Form 150-101-177?

A: Parents or guardians in Oregon who wish to claim the Working FamilyChild Care Credit and have a disability need to fill out Form 150-101-177.

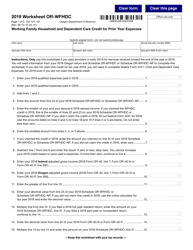

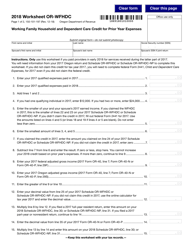

Q: What is the Working Family Child Care Credit?

A: The Working Family Child Care Credit is a tax credit in Oregon that helps eligible families with the cost of child care expenses.

Q: Are there any eligibility requirements for claiming the Working Family Child Care Credit?

A: Yes, to qualify for the credit, you must meet certain income requirements and have a disabled parent or guardian who requires child care in order to work.

Q: Is Form 150-101-177 specific to Oregon?

A: Yes, Form 150-101-177 is specific to the state of Oregon and the Working Family Child Care Credit offered by the Oregon Department of Revenue.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-177 (WFC-DP) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.