This version of the form is not currently in use and is provided for reference only. Download this version of

Form 150-490-008

for the current year.

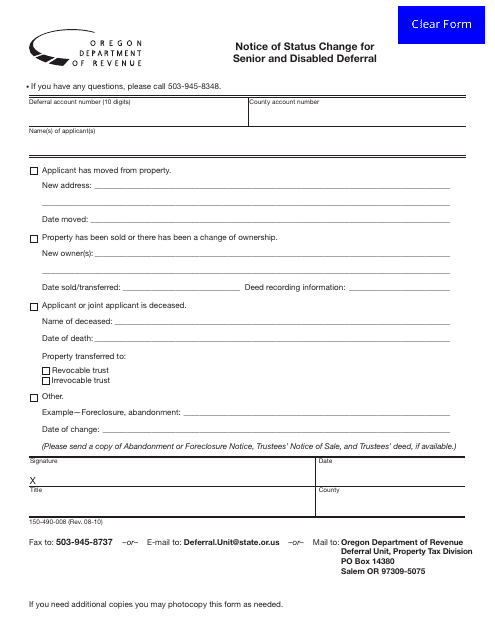

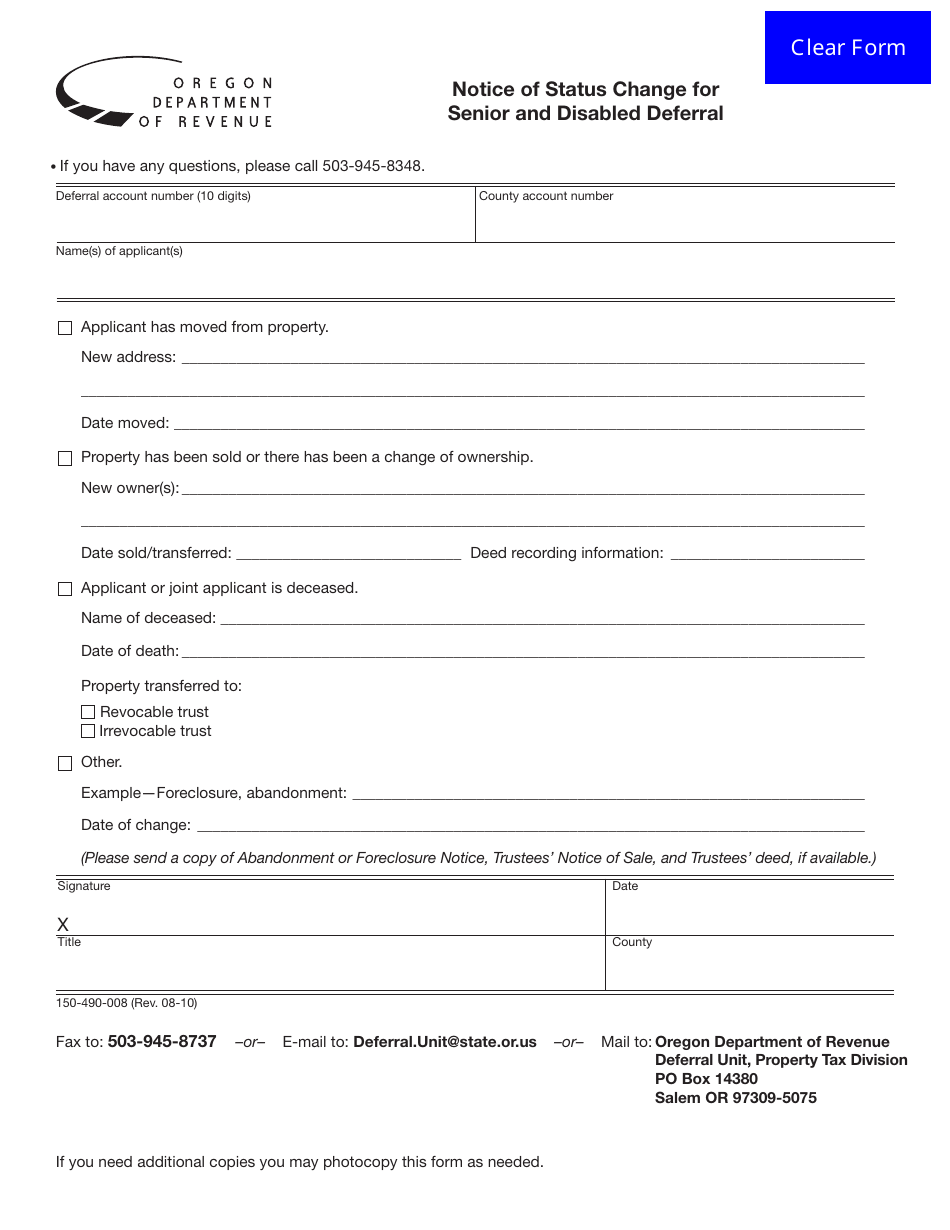

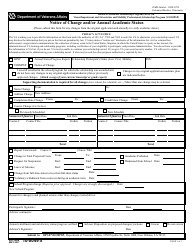

Form 150-490-008 Notice of Status Change for Senior and Disabled Deferral - Oregon

What Is Form 150-490-008?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-490-008?

A: Form 150-490-008 is the Notice of Status Change for Senior and Disabled Deferral in Oregon.

Q: Who is this form for?

A: This form is for seniors and disabled individuals in Oregon who wish to make a status change for their deferral.

Q: What is the purpose of this form?

A: The purpose of this form is to inform the Oregon Department of Revenue about any changes in the status of seniors and disabled individuals who are deferring property taxes.

Q: What information is required on this form?

A: This form requires information about the taxpayer, their property, and the changes in their status that are being reported.

Q: Is there a deadline for submitting this form?

A: Yes, there is a deadline for submitting this form. The specific deadline can be found on the form itself or by contacting the Oregon Department of Revenue.

Form Details:

- Released on August 1, 2010;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-490-008 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.