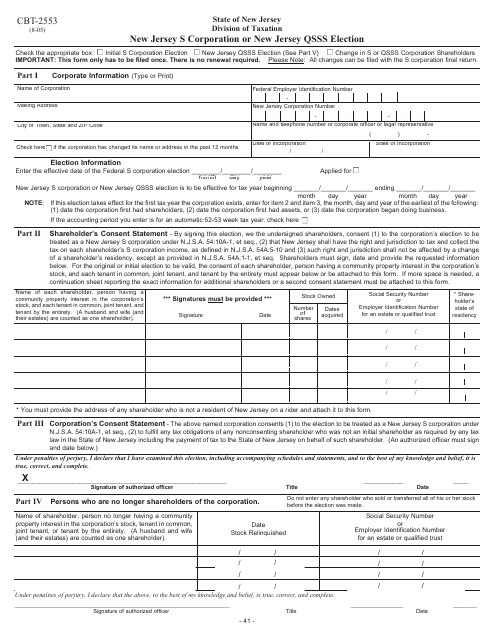

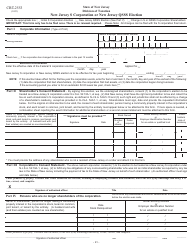

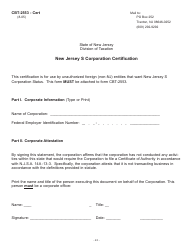

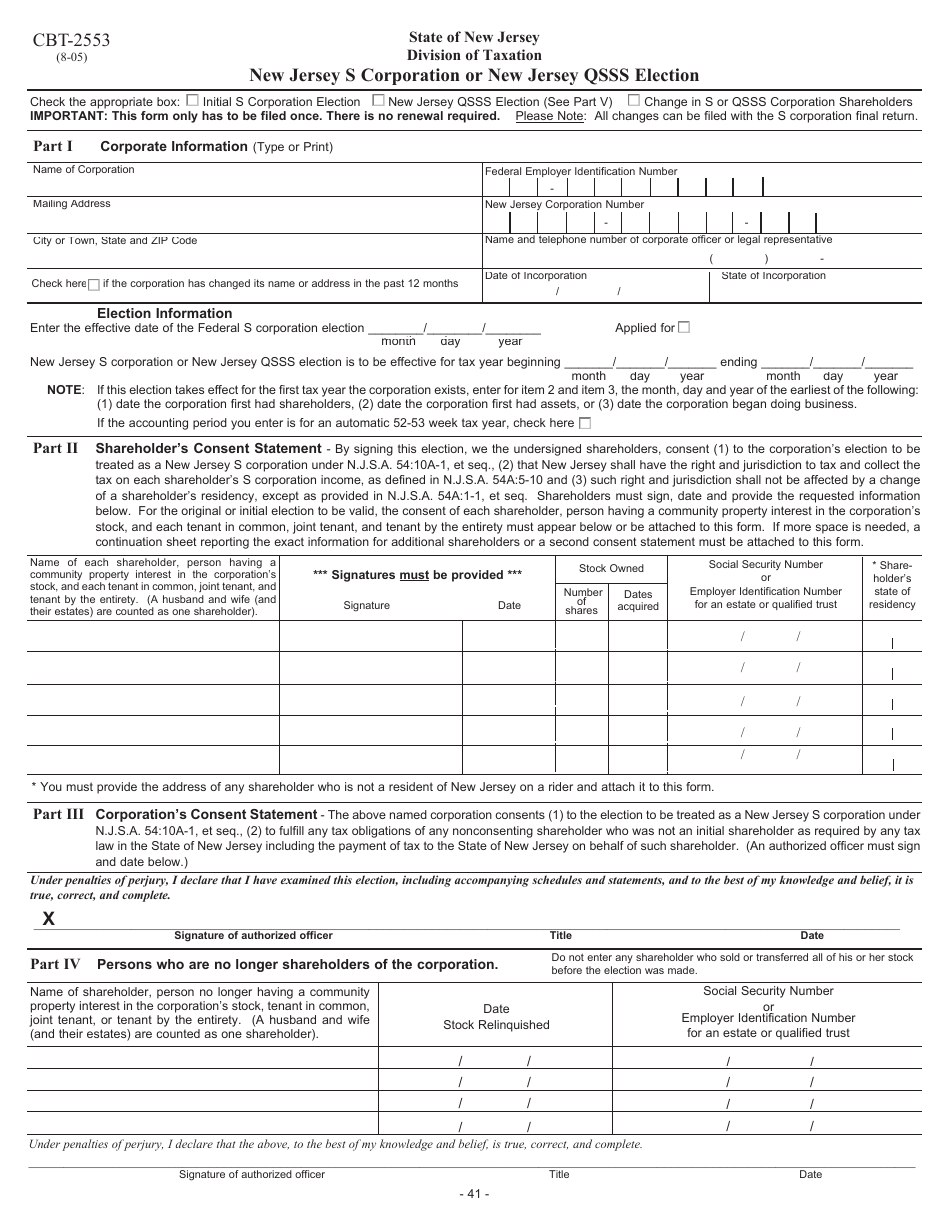

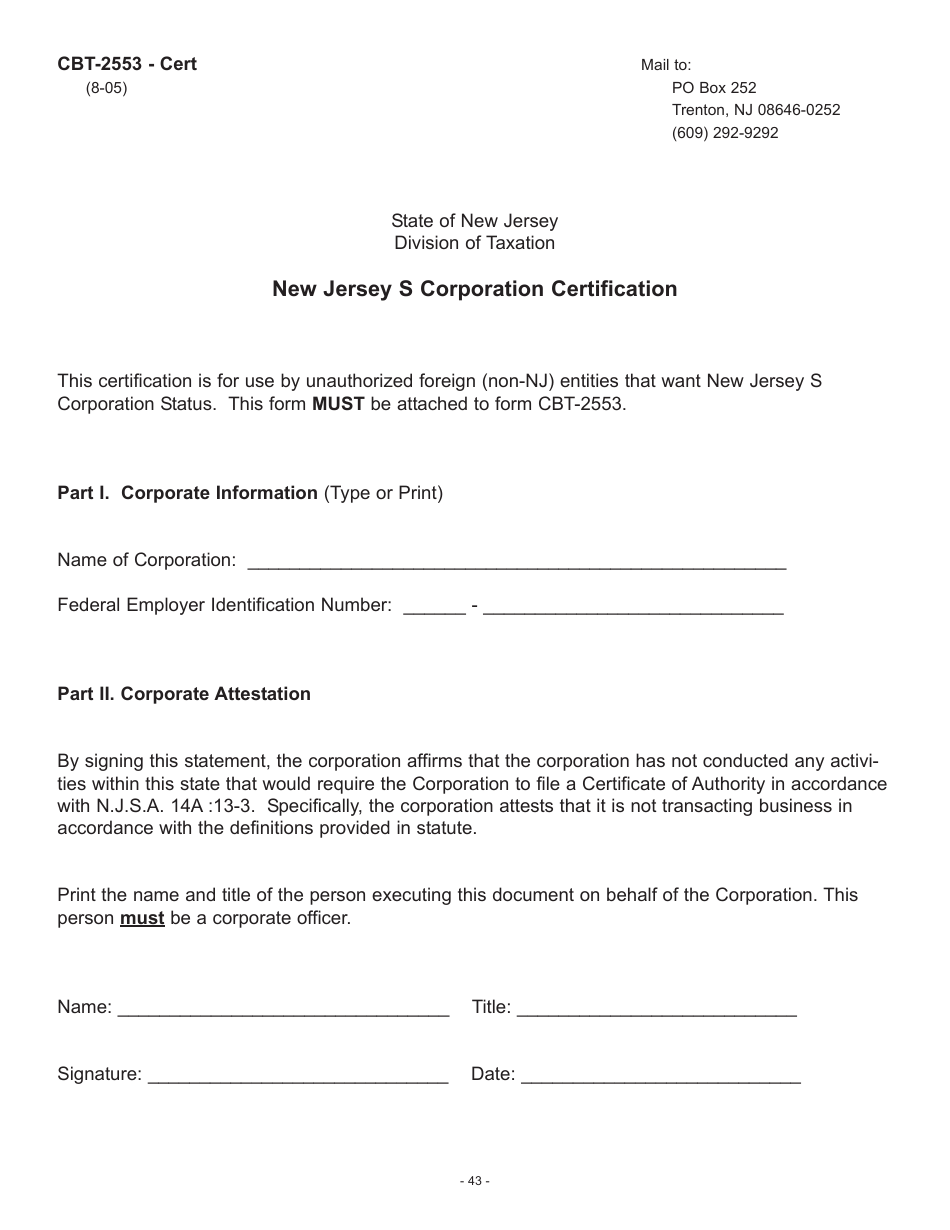

Form CBT-2553 New Jersey S Corporation or New Jersey Qsss Election - New Jersey

What Is Form CBT-2553?

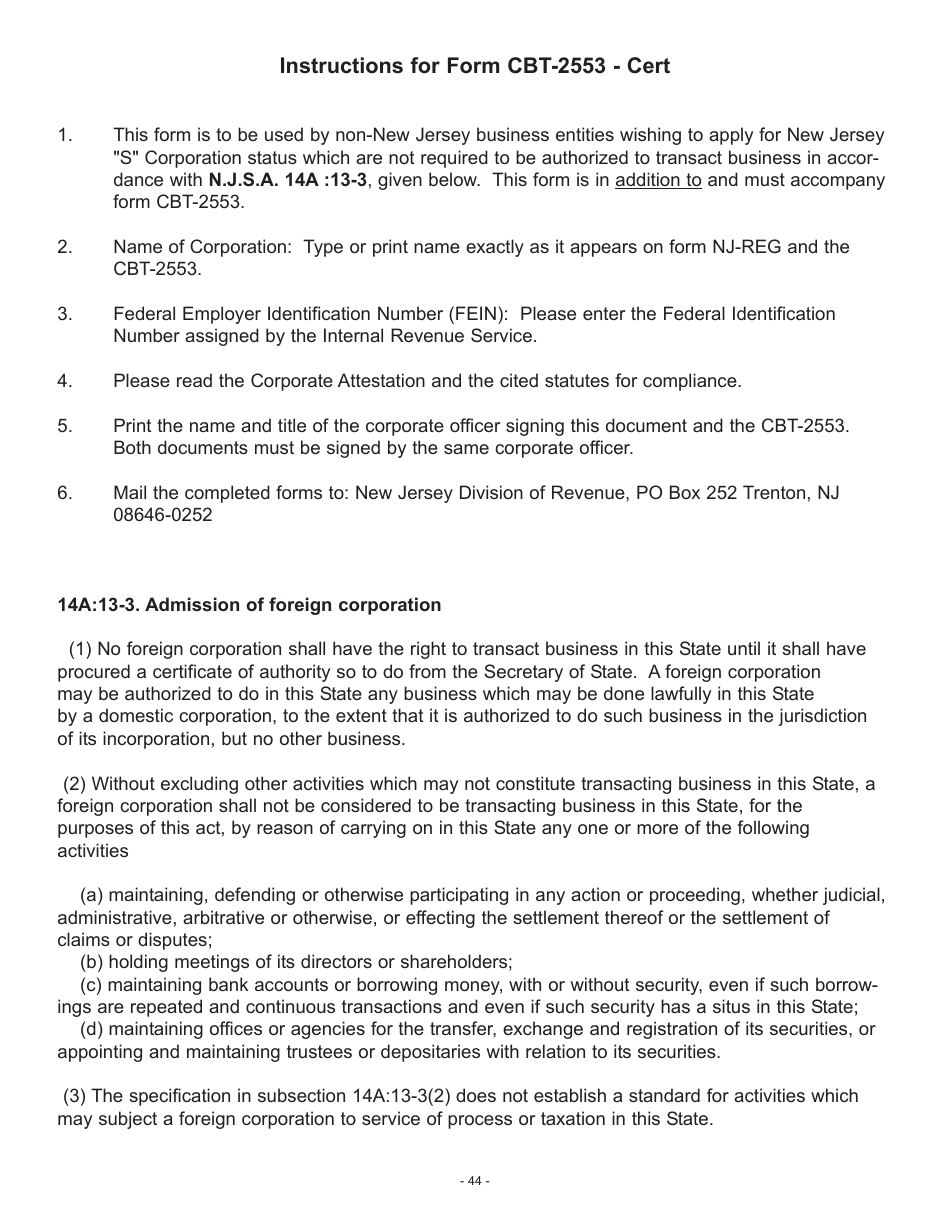

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CBT-2553?

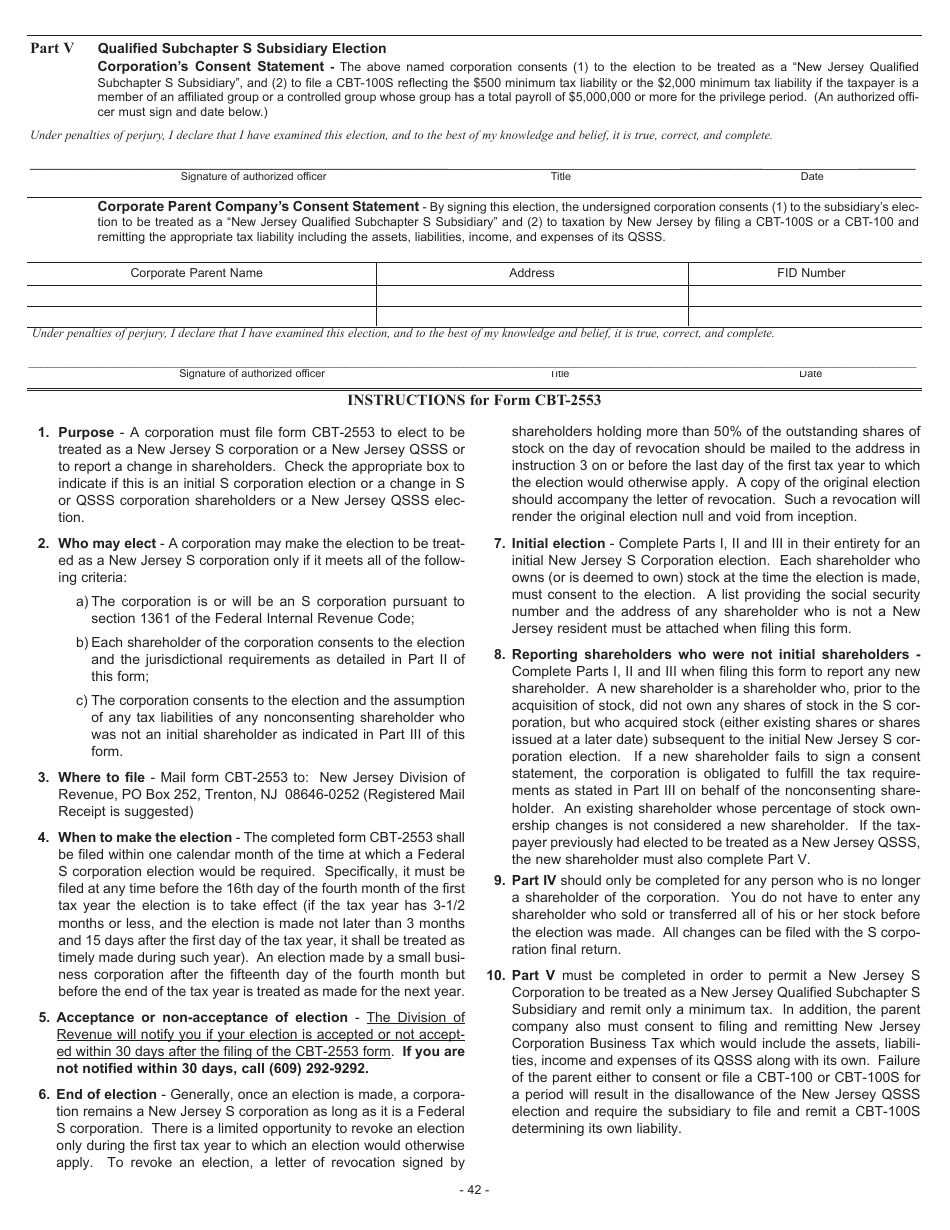

A: Form CBT-2553 is used to elect S Corporation status or QSSS (Qualified Subchapter S Subsidiary) status in New Jersey.

Q: What is an S Corporation?

A: An S Corporation is a type of corporation that elects to pass corporate income, losses, deductions, and credits through to its shareholders for federal tax purposes.

Q: What is a QSSS?

A: A Qualified Subchapter S Subsidiary (QSSS) is a subsidiary corporation that is 100% owned by an S Corporation and is treated as a disregarded entity for federal tax purposes.

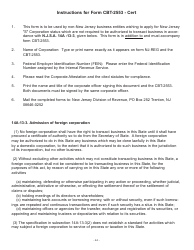

Q: How do I use Form CBT-2553?

A: You should use Form CBT-2553 to elect S Corporation or QSSS status in New Jersey. The form must be filed with the New Jersey Division of Taxation.

Q: Who can use Form CBT-2553?

A: New Jersey corporations that meet the requirements for S Corporation or QSSS status can use Form CBT-2553.

Q: What are the benefits of electing S Corporation or QSSS status?

A: Electing S Corporation or QSSS status can provide tax benefits, such as the ability to pass through corporate income and losses to shareholders.

Q: Is there a deadline for filing Form CBT-2553?

A: Yes, Form CBT-2553 must be filed within 75 days of the beginning of the tax year in which the S Corporation or QSSS status is to be effective.

Q: Are there any filing fees for Form CBT-2553?

A: No, there are no filing fees for Form CBT-2553.

Form Details:

- Released on August 1, 2005;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CBT-2553 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.