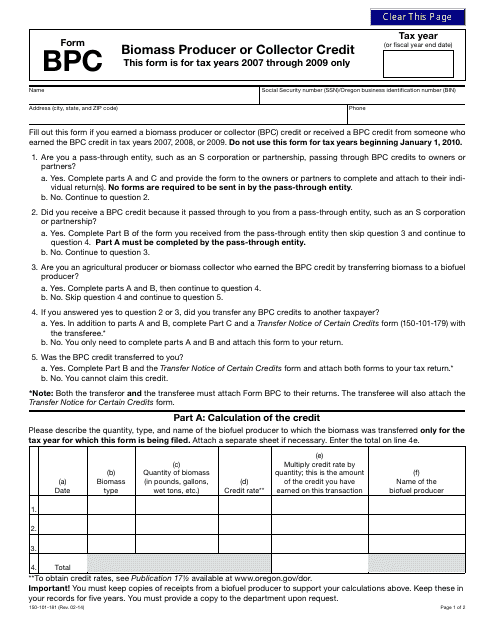

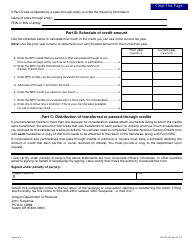

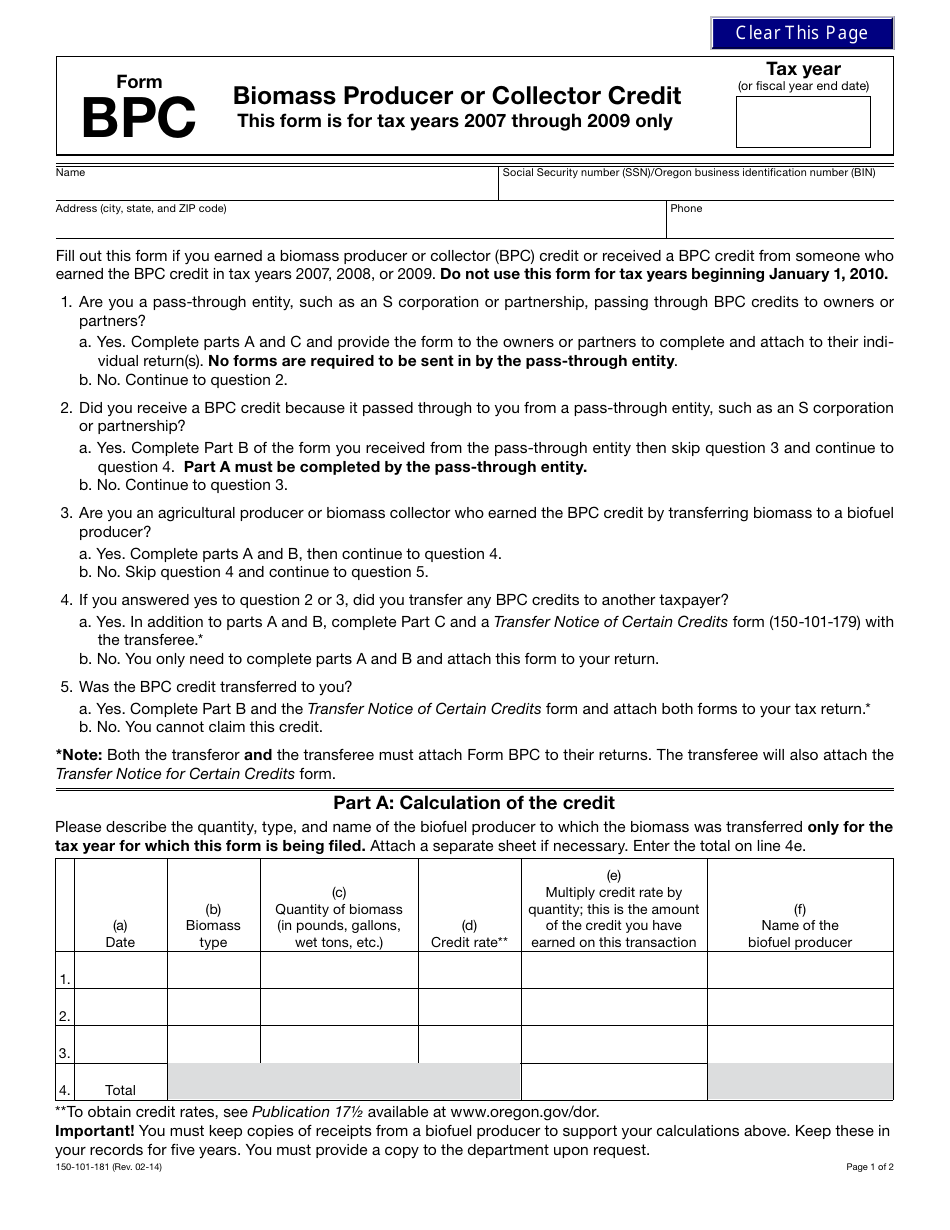

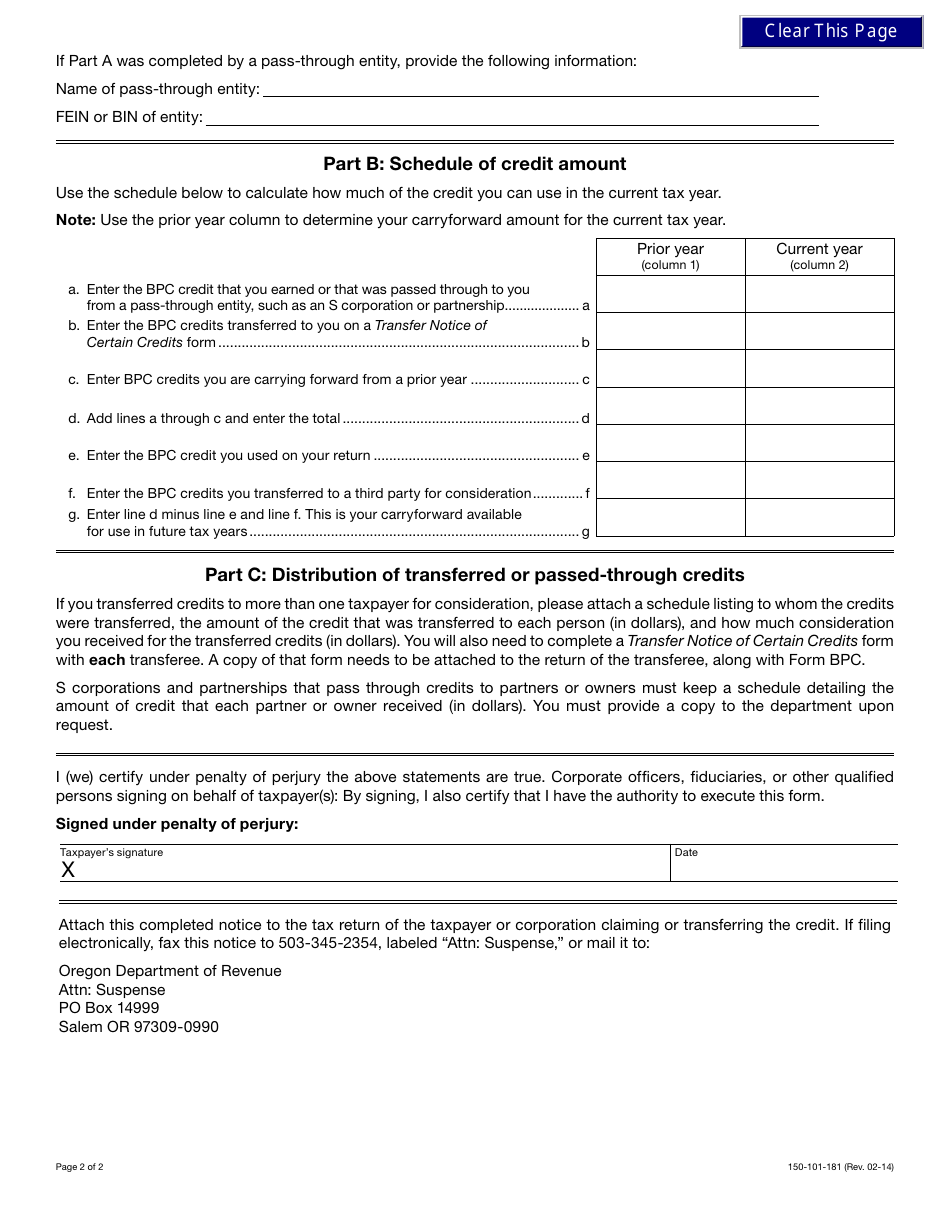

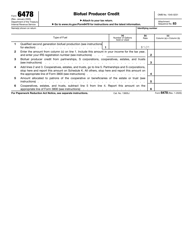

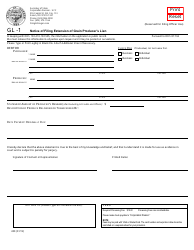

Form 150-101-181 (BPC) Biomass Producer or Collector Credit - Oregon

What Is Form 150-101-181 (BPC)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-181 (BPC)?

A: Form 150-101-181 (BPC) is a tax form used in Oregon for the Biomass Producer or Collector Credit.

Q: Who can use Form 150-101-181 (BPC)?

A: Form 150-101-181 (BPC) can be used by biomass producers or collectors in Oregon.

Q: What is the Biomass Producer or Collector Credit?

A: The Biomass Producer or Collector Credit is a tax credit available to individuals or businesses that produce or collect biomass in Oregon.

Q: What is biomass?

A: Biomass refers to organic materials, such as wood chips or agricultural residue, that can be used as a fuel source.

Q: What information is required on Form 150-101-181 (BPC)?

A: Form 150-101-181 (BPC) requires information such as the amount of biomass produced or collected, the type of biomass, and the tax identification number of the biomass producer or collector.

Q: How do I claim the Biomass Producer or Collector Credit?

A: To claim the Biomass Producer or Collector Credit, you must complete Form 150-101-181 (BPC) and include it with your Oregon tax return.

Q: Are there any limitations or restrictions on the Biomass Producer or Collector Credit?

A: Yes, there are limitations and restrictions on the Biomass Producer or Collector Credit. You should refer to the instructions for Form 150-101-181 (BPC) for more information.

Q: Is the Biomass Producer or Collector Credit available in other states?

A: The availability of the Biomass Producer or Collector Credit may vary in other states. You should check with the tax authority of your state for more information.

Q: Can I claim the Biomass Producer or Collector Credit if I am a residential homeowner?

A: The eligibility for the Biomass Producer or Collector Credit may depend on various factors, including the residential or commercial nature of the biomass production or collection. You should consult the instructions for Form 150-101-181 (BPC) or seek professional tax advice for more information.

Form Details:

- Released on February 1, 2014;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-181 (BPC) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.