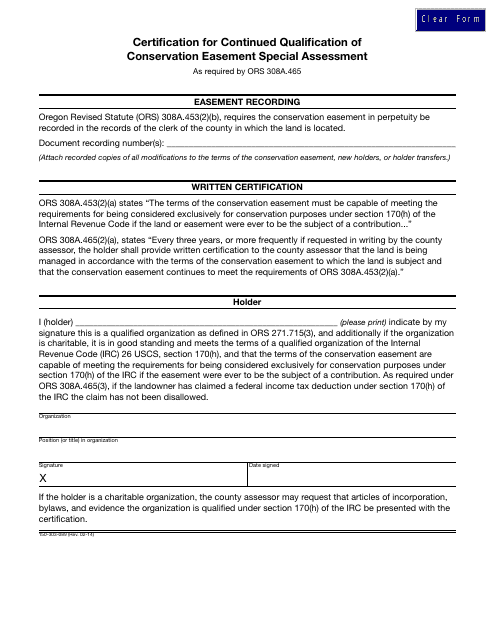

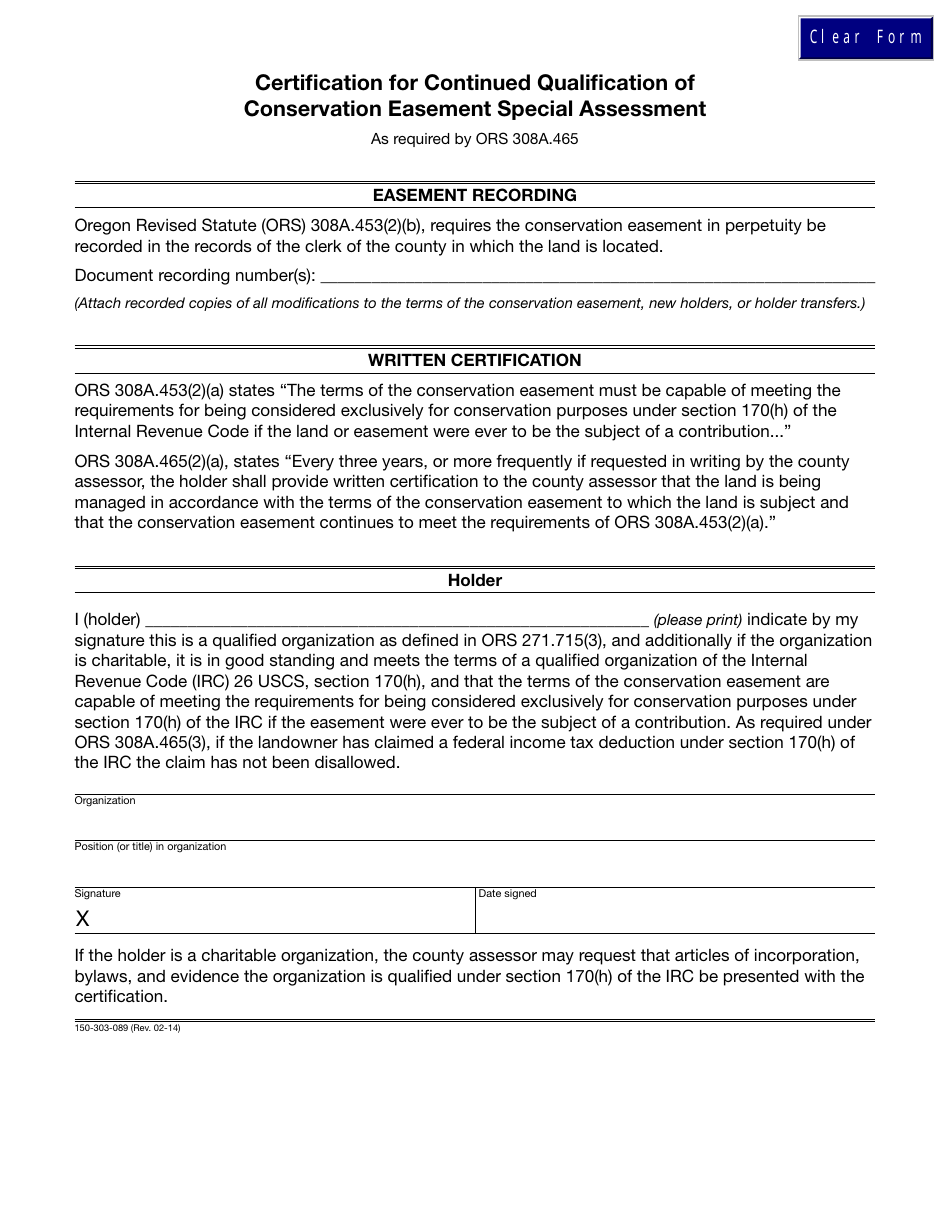

Form 150-303-089 Certification for Continued Qualification of Conservation Easement Special Assessment - Oregon

What Is Form 150-303-089?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-303-089?

A: Form 150-303-089 is a certification form for the continued qualification of conservation easementspecial assessment in Oregon.

Q: What is a conservation easement?

A: A conservation easement is a legally binding agreement between a landowner and a qualified organization to protect the land's natural or cultural resources.

Q: What is a special assessment?

A: A special assessment is a reduced property tax rate for eligible properties that meet certain criteria, such as being used for conservation purposes.

Q: Who is eligible for the conservation easement special assessment?

A: Landowners in Oregon who have entered into a conservation easement agreement with a qualified organization are eligible for the special assessment.

Q: Why would a landowner apply for the conservation easement special assessment?

A: Applying for the conservation easement special assessment can result in significant property tax savings for landowners.

Q: What information is required on Form 150-303-089?

A: Form 150-303-089 requires information about the property, the conservation easement agreement, and the landowner's compliance with the agreement.

Q: Are there any deadlines for submitting Form 150-303-089?

A: Yes, the form must be submitted to the Oregon Department of Revenue by April 1st of each year to maintain the special assessment.

Q: Is there a fee for filing Form 150-303-089?

A: No, there is no fee for filing Form 150-303-089.

Q: What happens if a landowner no longer qualifies for the conservation easement special assessment?

A: If a landowner no longer qualifies, they will be subject to the regular property tax rate for their property.

Form Details:

- Released on February 1, 2014;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-303-089 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.