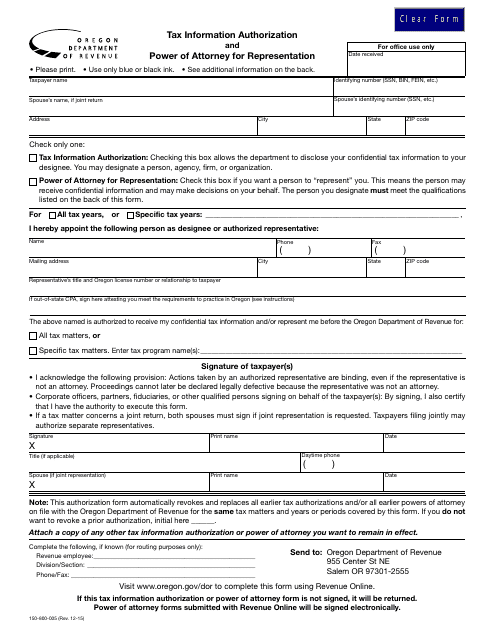

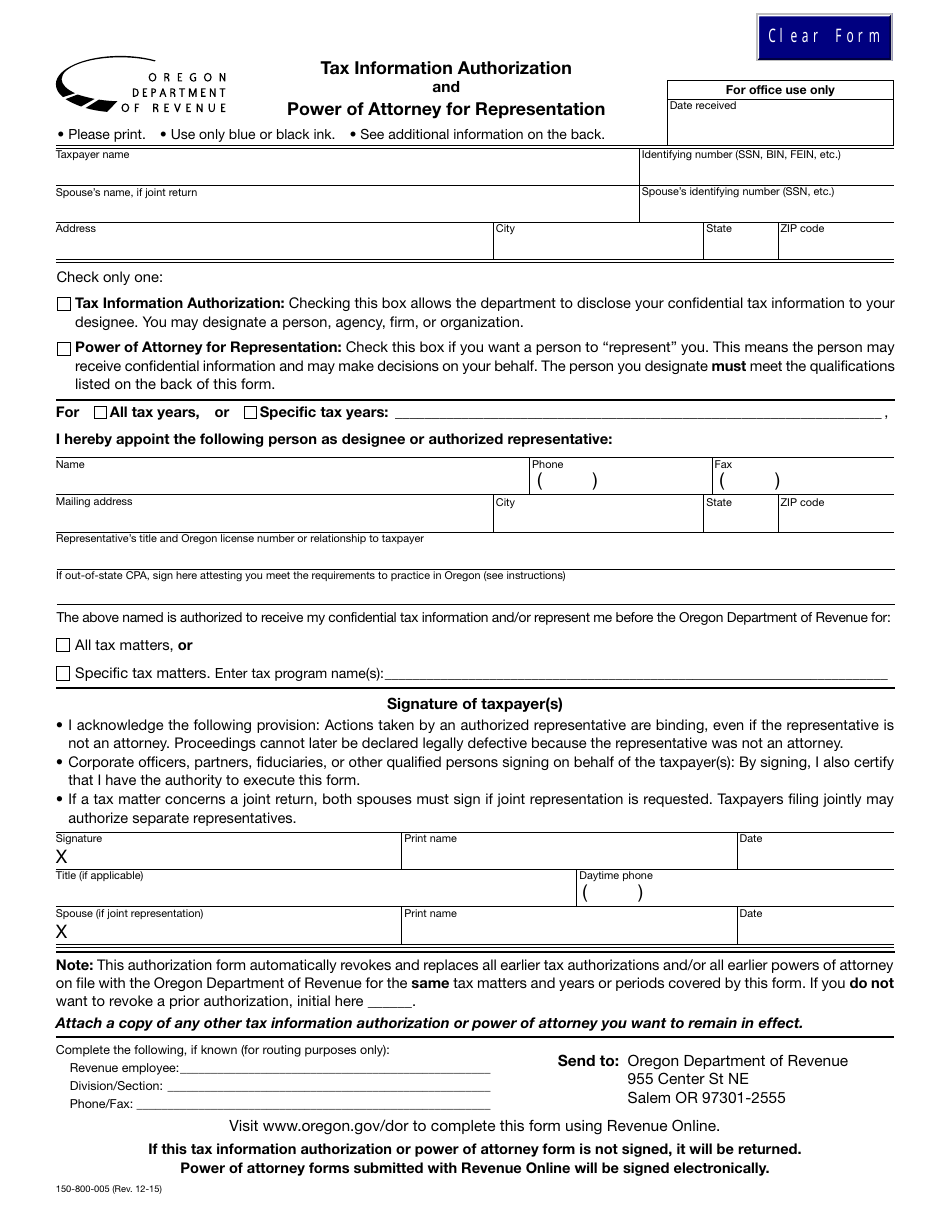

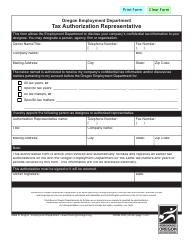

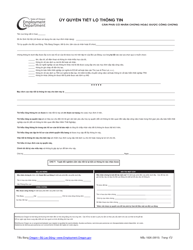

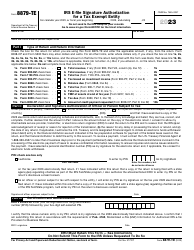

Form 150-800-005 Tax Information Authorization and Power of Attorney for Representation - Oregon

What Is Form 150-800-005?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-800-005?

A: Form 150-800-005 is the Tax Information Authorization and Power of Attorney for Representation form in Oregon.

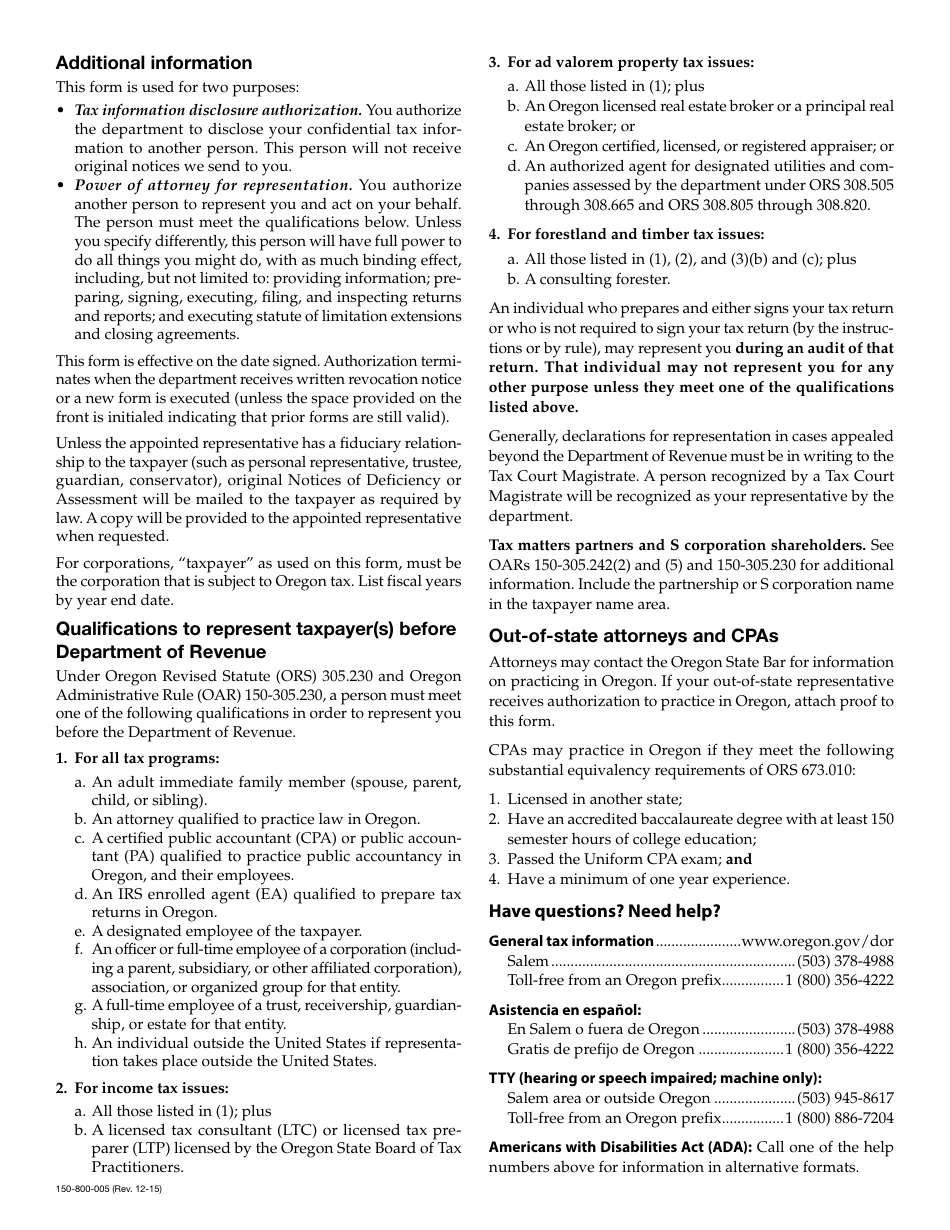

Q: What is the purpose of Form 150-800-005?

A: The purpose of Form 150-800-005 is to allow someone to act on your behalf as a power of attorney for tax matters in Oregon.

Q: Who can use Form 150-800-005?

A: Any individual or entity who wants to authorize another person to represent them in tax matters in Oregon can use Form 150-800-005.

Q: Is Form 150-800-005 specific to Oregon?

A: Yes, Form 150-800-005 is specific to Oregon and is used for tax matters in the state.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-800-005 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.