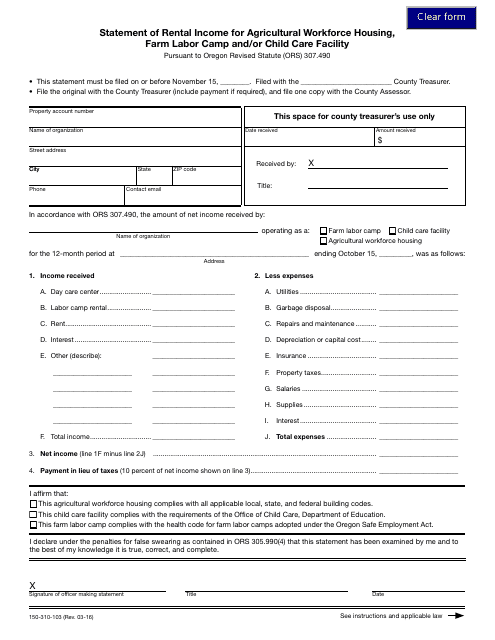

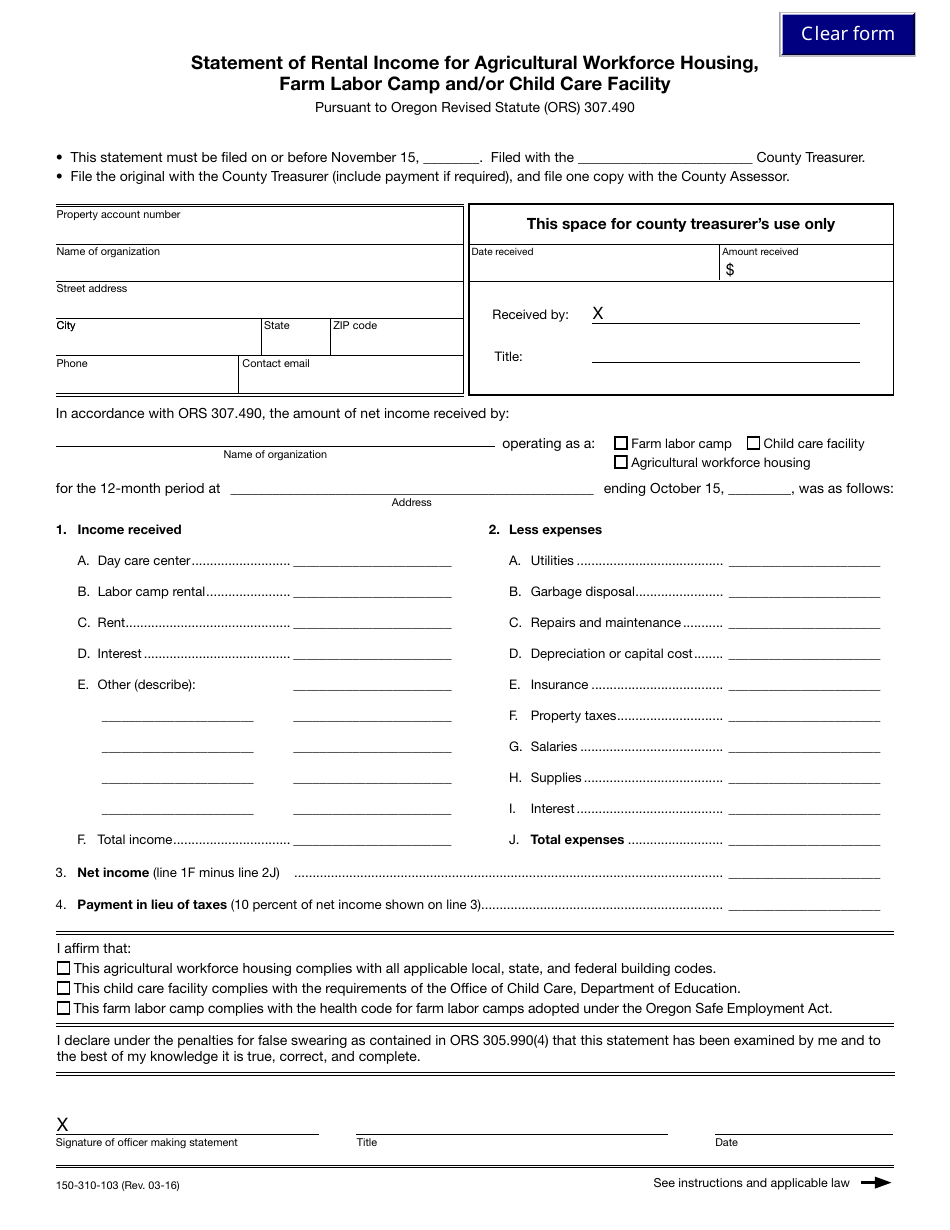

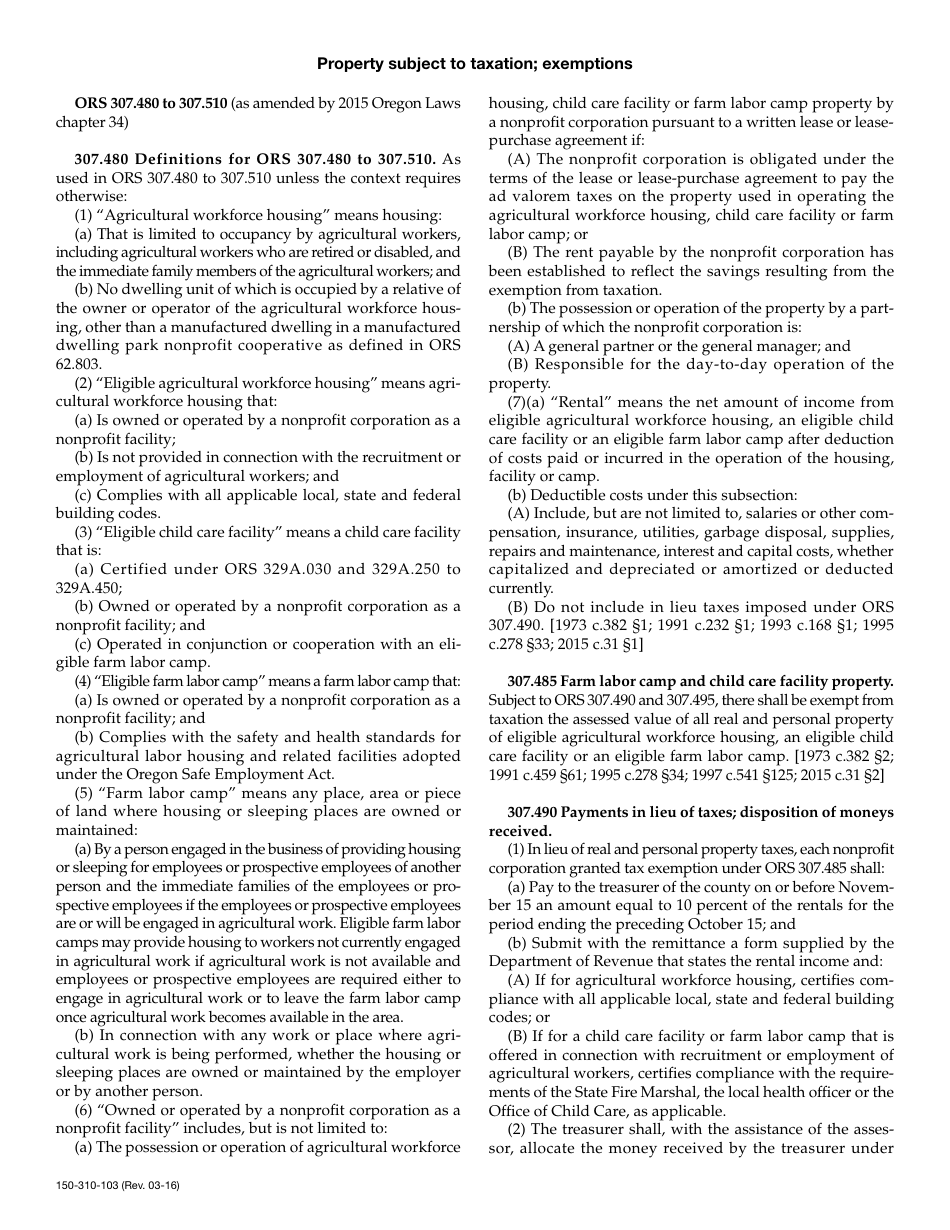

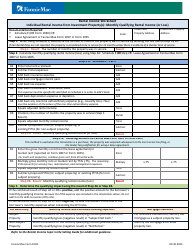

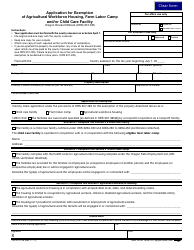

Form 150-310-103 Statement of Rental Income for Agricultural Workforce Housing, Farm Labor Camp and / or Child Care Facility - Oregon

What Is Form 150-310-103?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-310-103?

A: Form 150-310-103 is a statement of rental income for agricultural workforce housing, farm labor camp, and/or child care facility in Oregon.

Q: Who needs to file Form 150-310-103?

A: Individuals or organizations that own or operate agricultural workforce housing, farm labor camps, or child care facilities in Oregon need to file Form 150-310-103.

Q: What is the purpose of Form 150-310-103?

A: The purpose of Form 150-310-103 is to report rental income received from agricultural workforce housing, farm labor camps, or child care facilities in Oregon.

Q: When is Form 150-310-103 due?

A: Form 150-310-103 is due on or before April 15th of each year.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing of Form 150-310-103.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-310-103 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.