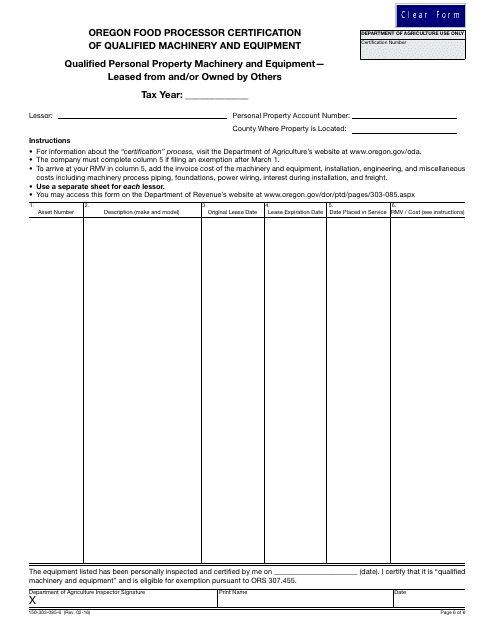

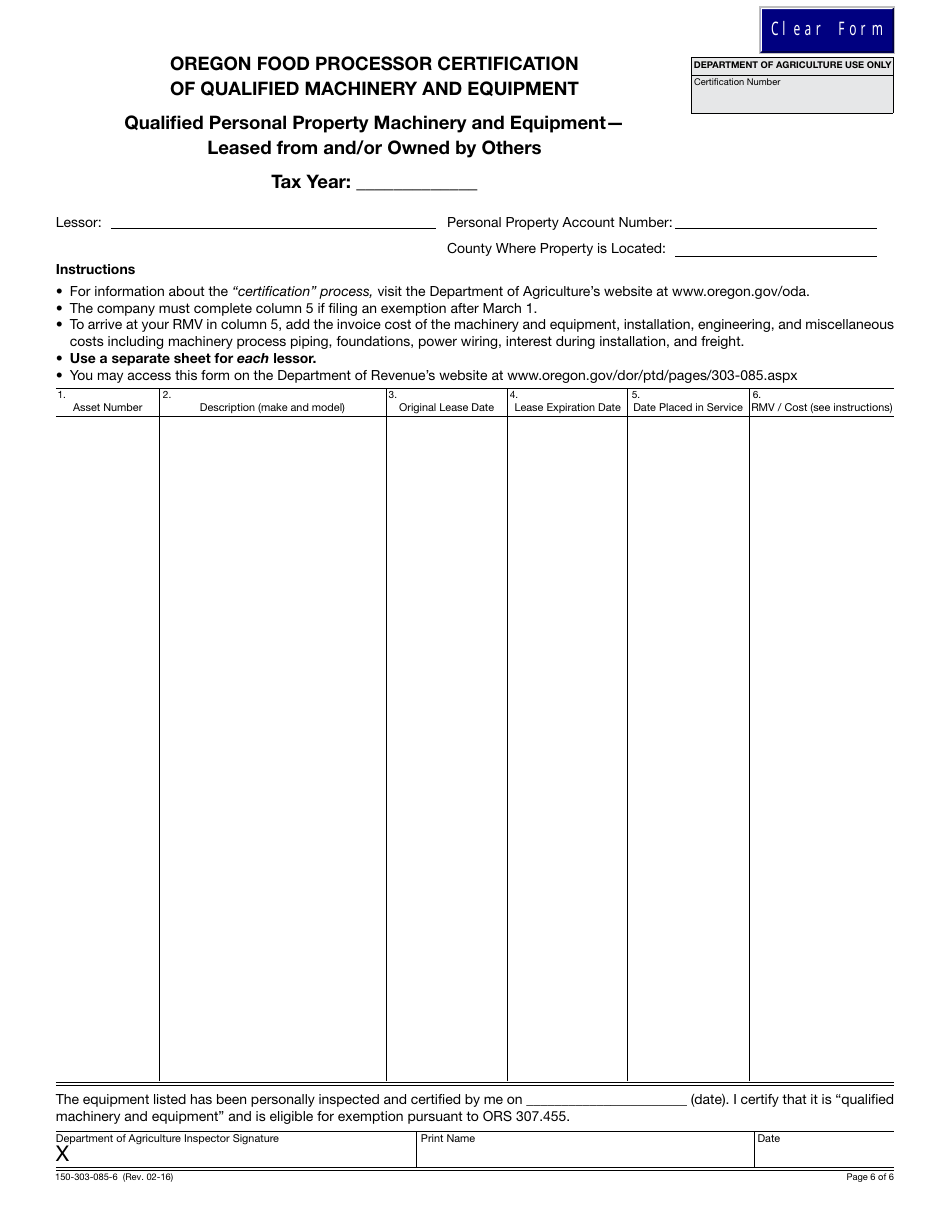

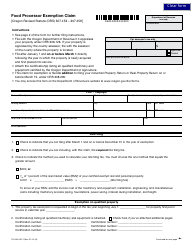

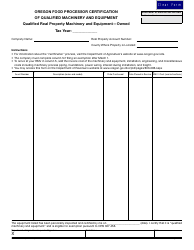

Form 150-303-085-6 Oregon Food Processor Certification of Qualified Machinery and Equipment - Leased From and / or Owned by Others - Oregon

What Is Form 150-303-085-6?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-303-085-6?

A: Form 150-303-085-6 is a certification form for food processors in Oregon.

Q: What is the purpose of Form 150-303-085-6?

A: The purpose of Form 150-303-085-6 is to certify the qualified machinery and equipment leased from and/or owned by others by Oregon food processors.

Q: Who needs to fill out Form 150-303-085-6?

A: Oregon food processors who lease or own qualified machinery and equipment from others need to fill out Form 150-303-085-6.

Q: What does the form require?

A: The form requires information about the leased or owned machinery and equipment, including identification, lease or purchase details, and usage.

Q: Are there any fees associated with the form?

A: No, there are no fees associated with filing Form 150-303-085-6.

Q: When should the form be filed?

A: Form 150-303-085-6 should be filed within 30 days of leasing or purchasing the machinery and equipment.

Q: Are there any penalties for not filing the form?

A: Failure to file Form 150-303-085-6 may result in penalties and interest.

Q: Who should I contact for more information?

A: For more information, you can contact the Oregon Department of Revenue.

Form Details:

- Released on February 1, 2016;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-303-085-6 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.