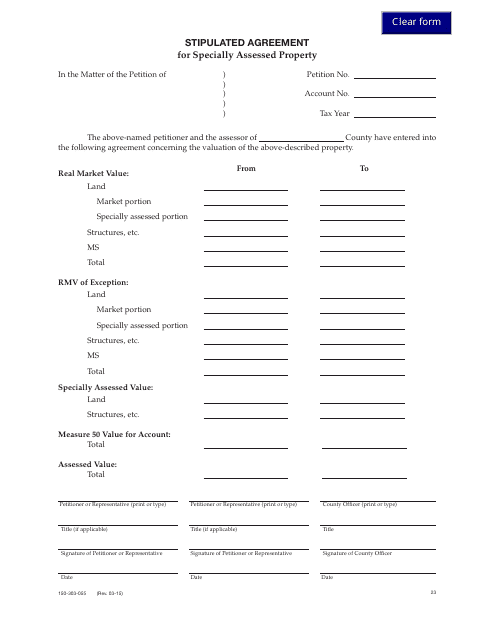

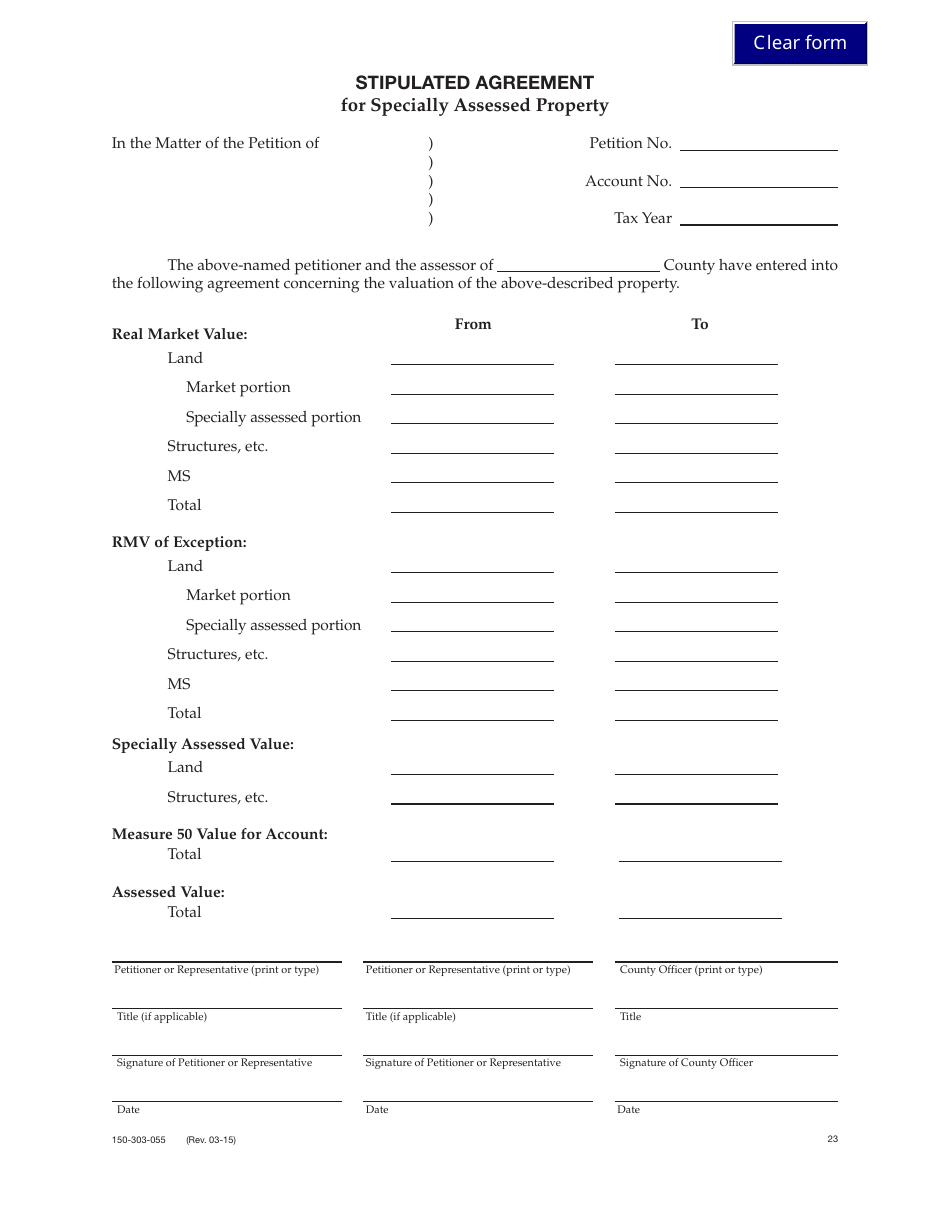

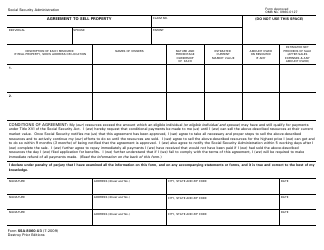

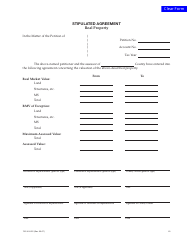

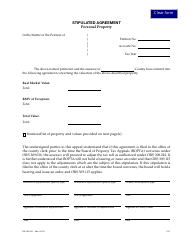

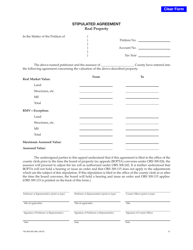

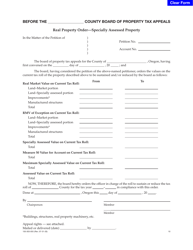

Form 150-303-055 Stipulated Agreement for Specially Assessed Property - Oregon

What Is Form 150-303-055?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-303-055?

A: Form 150-303-055 is the Stipulated Agreement for Specially Assessed Property in Oregon.

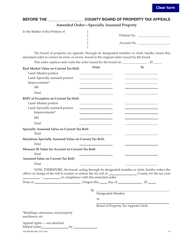

Q: What is the purpose of Form 150-303-055?

A: The purpose of Form 150-303-055 is to establish a mutually agreed upon value for specially assessed property in Oregon.

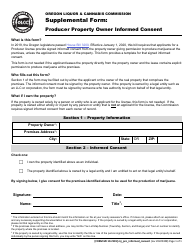

Q: Who needs to fill out Form 150-303-055?

A: Form 150-303-055 needs to be filled out by property owners and the local government assessing authority in Oregon.

Q: What information is required on Form 150-303-055?

A: Form 150-303-055 requires information about the property, its current value, and the agreed upon value.

Q: Are there any filing fees for Form 150-303-055?

A: There are no filing fees associated with Form 150-303-055 in Oregon.

Q: Is Form 150-303-055 specific to certain types of properties?

A: Yes, Form 150-303-055 is specifically used for specially assessed properties in Oregon.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-303-055 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.