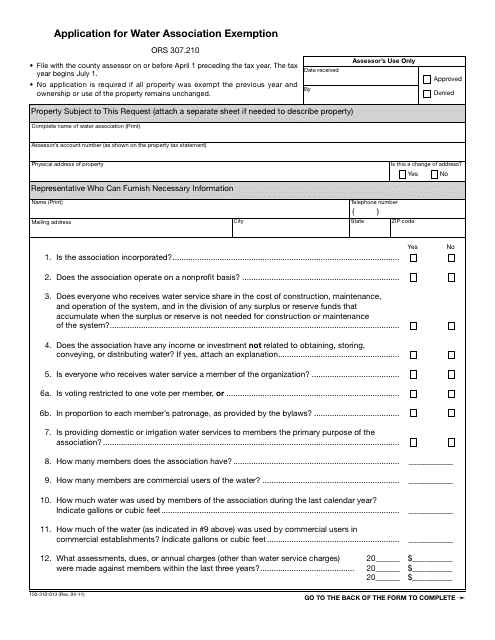

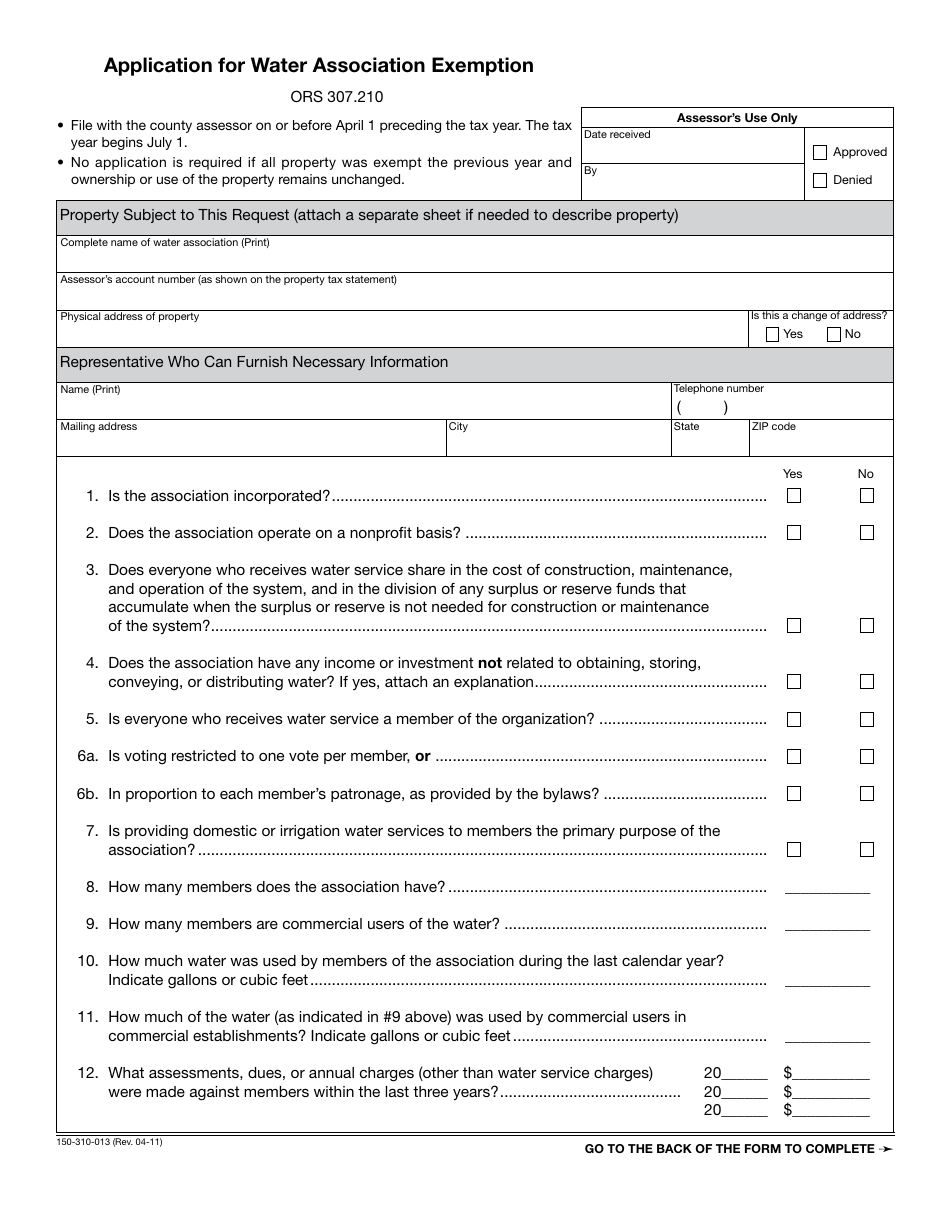

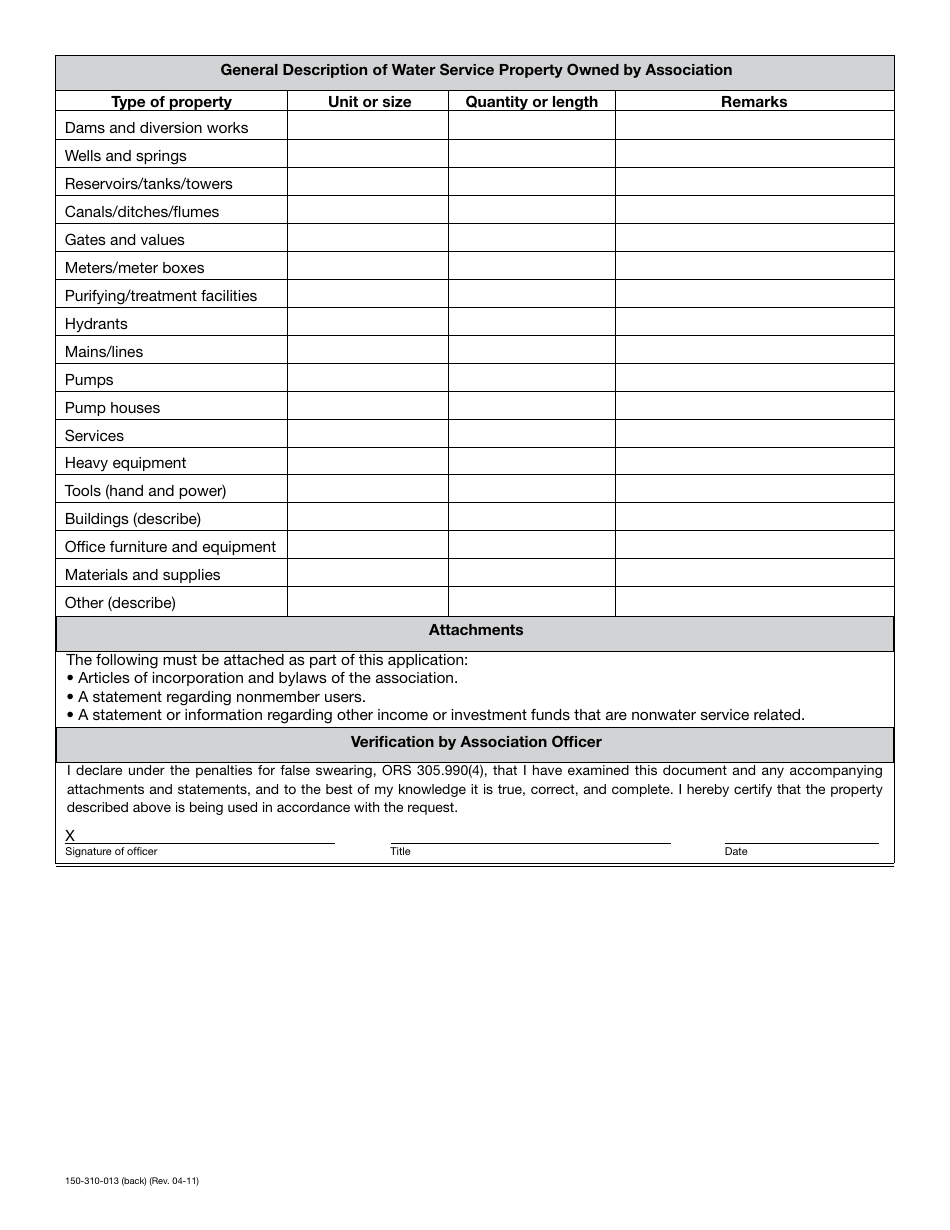

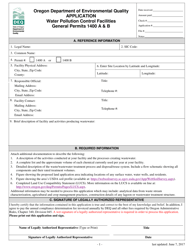

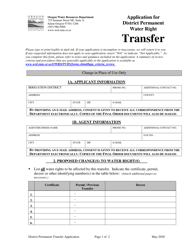

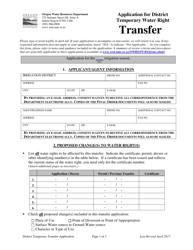

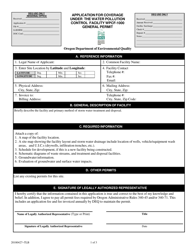

Form 150-310-013 Application for Water Association Exemption - Oregon

What Is Form 150-310-013?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-310-013?

A: Form 150-310-013 is an application for Water Association Exemption in Oregon.

Q: Who needs to fill out Form 150-310-013?

A: Water associations in Oregon who qualify for exemption need to fill out this form.

Q: What is the purpose of Form 150-310-013?

A: The purpose of this form is to apply for exemption from certain tax requirements for water associations in Oregon.

Q: Are there any filing fees for Form 150-310-013?

A: No, there are no filing fees for this form.

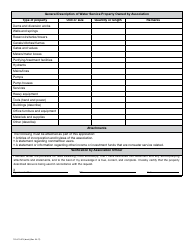

Q: What documentation should be included with Form 150-310-013?

A: You should include supporting documents such as financial statements and organizational documents with this form.

Q: What is the deadline for filing Form 150-310-013?

A: The deadline for filing this form is the 15th day of the 5th month after the end of your association's fiscal year.

Q: Is Form 150-310-013 applicable for both water associations in Oregon and Canada?

A: No, Form 150-310-013 is applicable for water associations in Oregon only.

Q: What happens after I submit Form 150-310-013?

A: The Oregon Department of Revenue will review your application and inform you of their decision regarding your exemption status.

Form Details:

- Released on April 1, 2011;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 150-310-013 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.