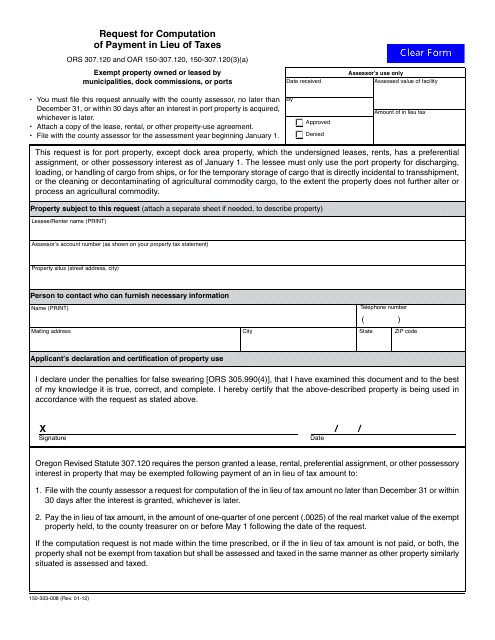

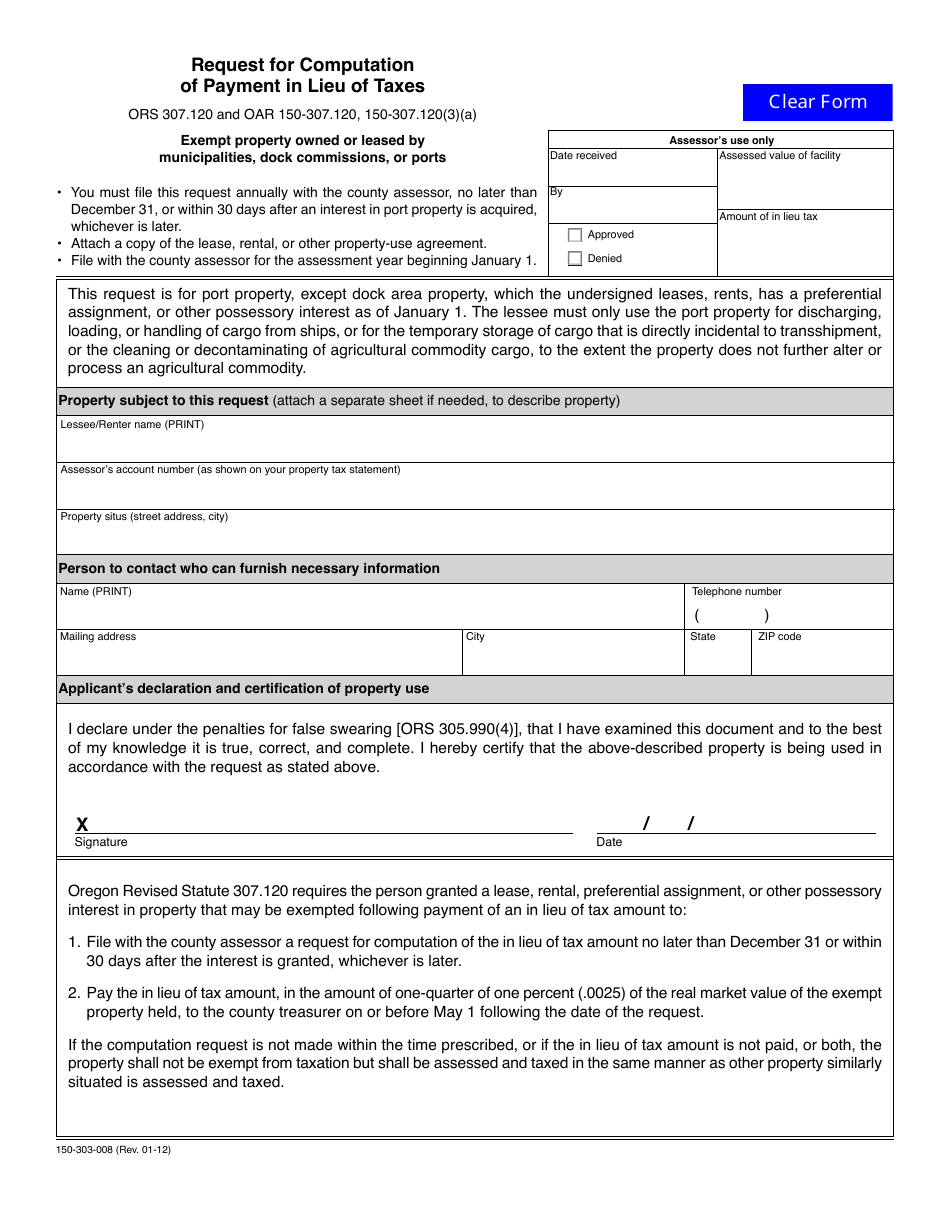

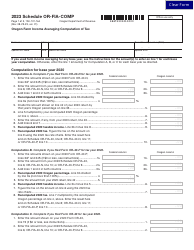

Form 150-303-008 Request for Computation of Payment in Lieu of Taxes - Oregon

What Is Form 150-303-008?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-303-008?

A: Form 150-303-008 is the Request for Computation of Payment in Lieu of Taxes form used in Oregon.

Q: What is Payment in Lieu of Taxes (PILT)?

A: Payment in Lieu of Taxes (PILT) is a program where local governments receive payments from the federal government to compensate for the loss of property tax revenue on certain federally-owned lands.

Q: Who is eligible to file Form 150-303-008?

A: Property owners in Oregon who have eligible federally-owned lands may file Form 150-303-008.

Q: What is the purpose of filing Form 150-303-008?

A: The purpose of filing Form 150-303-008 is to request a computation of payment in lieu of taxes for eligible federally-owned lands.

Q: What information do I need to provide on Form 150-303-008?

A: You will need to provide information such as the property owner's name and address, the assessors' tax lot number, and details about the eligible federally-owned lands.

Q: When is the deadline to file Form 150-303-008?

A: The deadline to file Form 150-303-008 is generally on or before December 31 of each year.

Q: Are there any fees associated with filing Form 150-303-008?

A: There are no fees associated with filing Form 150-303-008.

Q: What should I do if I have more questions about Form 150-303-008?

A: If you have more questions about Form 150-303-008, you should contact the Oregon Department of Revenue for assistance.

Form Details:

- Released on January 1, 2012;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-303-008 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.