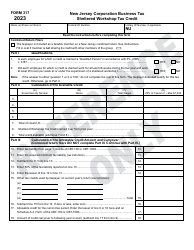

This version of the form is not currently in use and is provided for reference only. Download this version of

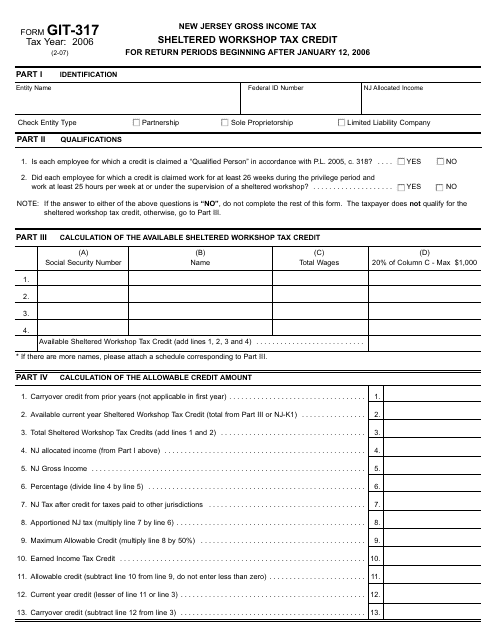

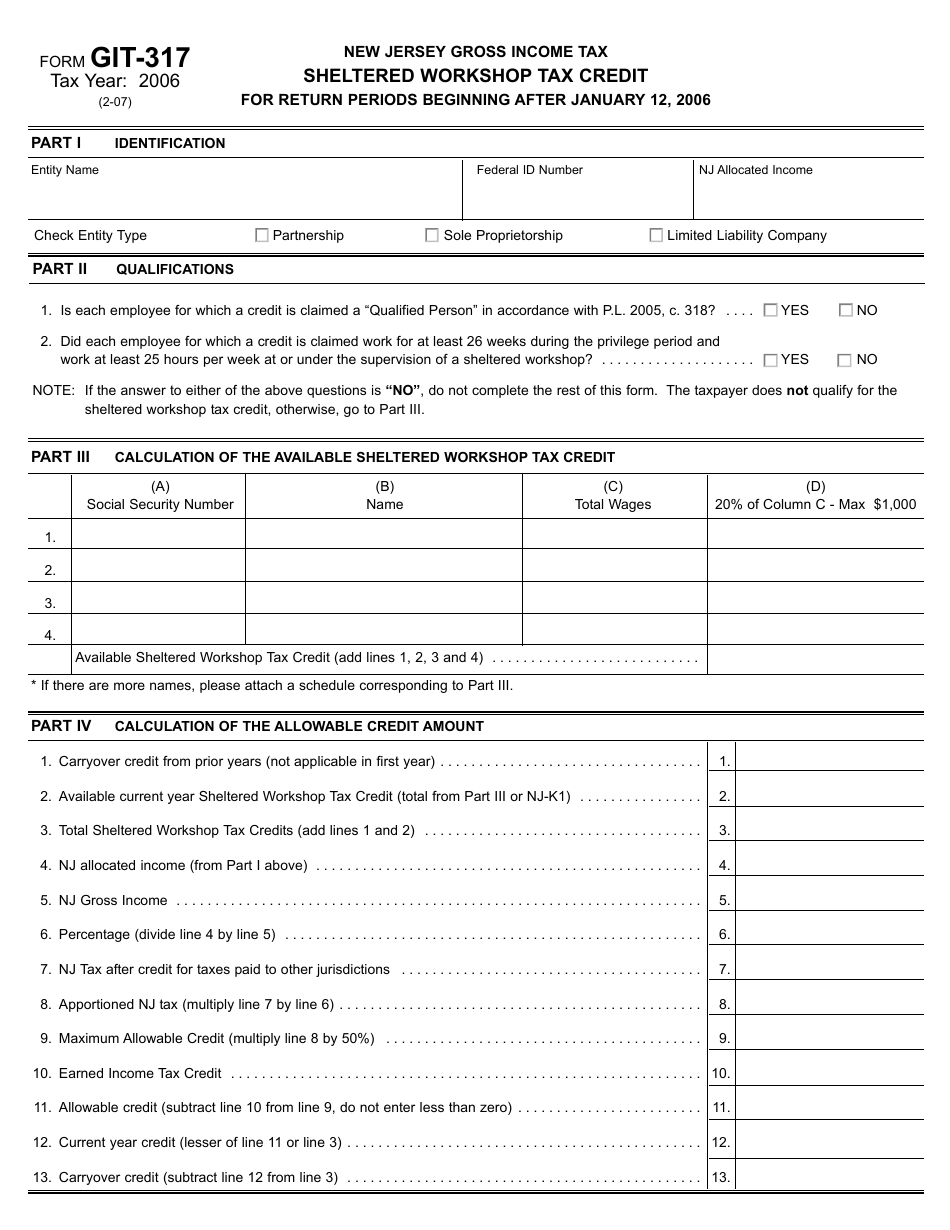

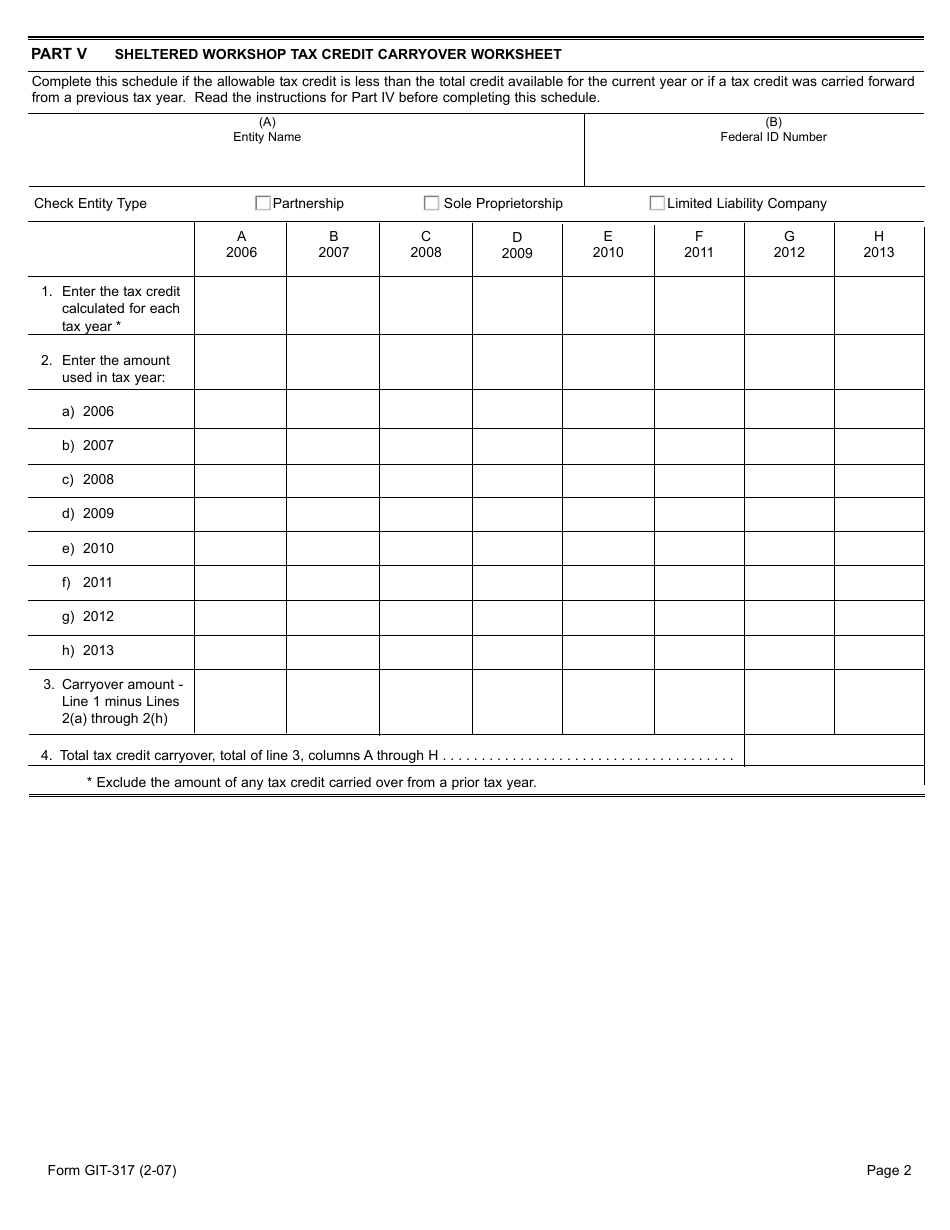

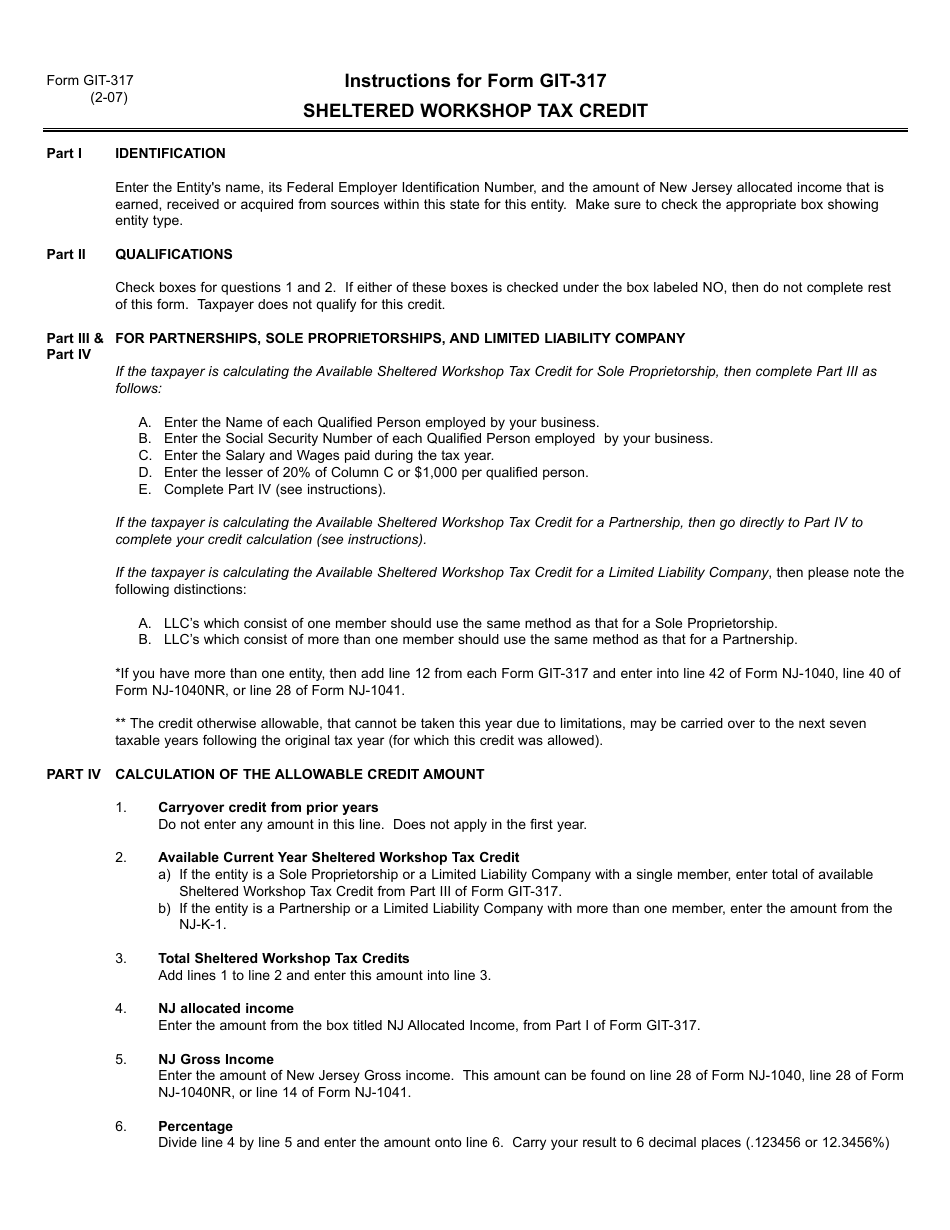

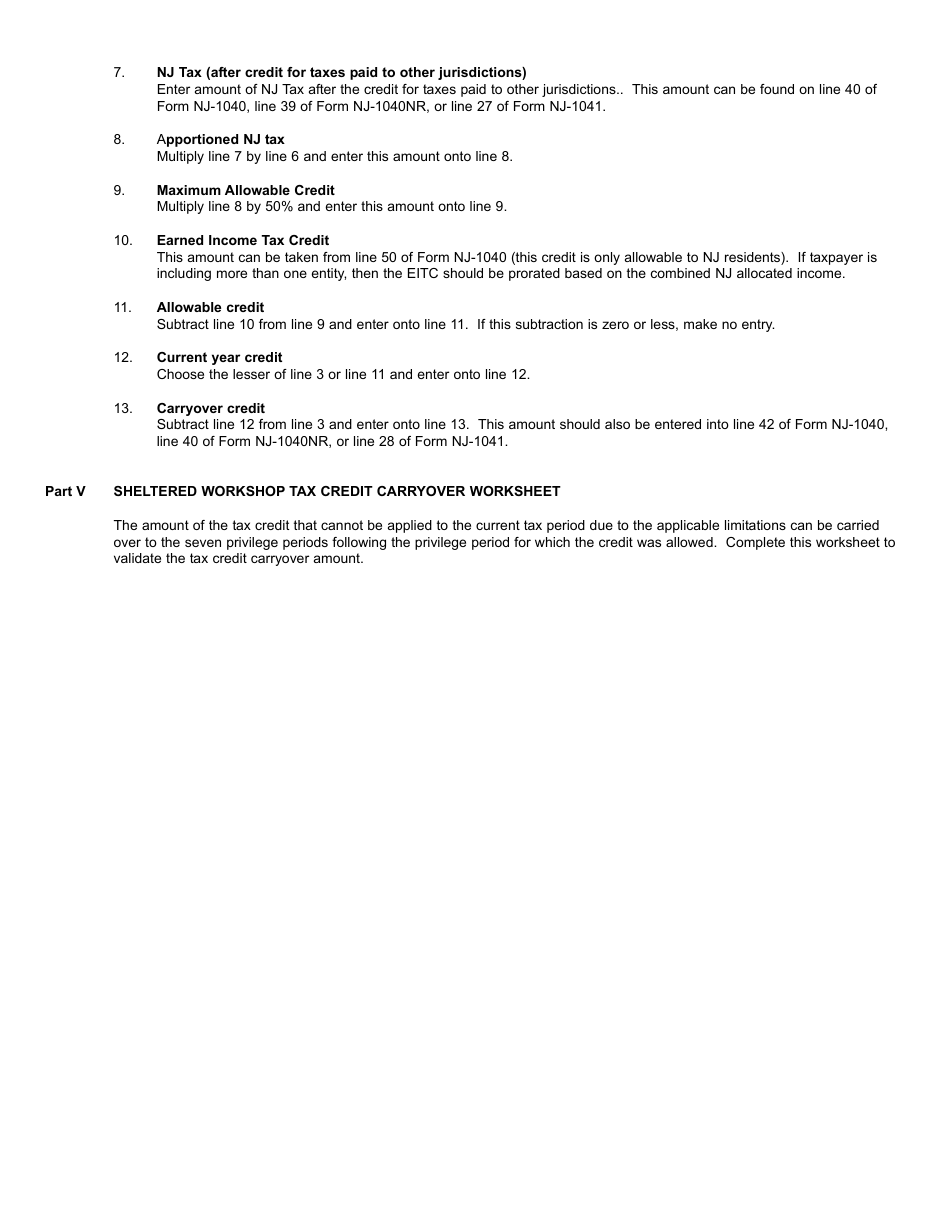

Form GIT-317

for the current year.

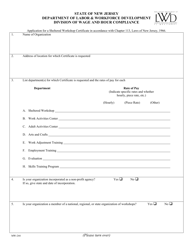

Form GIT-317 Sheltered Workshop Tax Credit - New Jersey

What Is Form GIT-317?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the GIT-317 Sheltered Workshop Tax Credit?

A: The GIT-317 Sheltered Workshop Tax Credit is a tax credit available in New Jersey for businesses that employ individuals with disabilities in qualified sheltered workshops.

Q: Who can claim the GIT-317 Sheltered Workshop Tax Credit?

A: Businesses operating in New Jersey that employ individuals with disabilities in qualified sheltered workshops can claim the tax credit.

Q: What is a qualified sheltered workshop?

A: A qualified sheltered workshop is a facility that provides employment opportunities and training to individuals with disabilities, and is certified by the New Jersey Division of Vocational Rehabilitation Services.

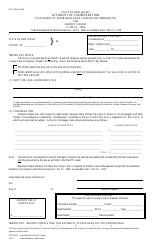

Q: How much is the tax credit?

A: The tax credit is equal to 50% of the wages paid to eligible employees with disabilities in a qualified sheltered workshop, subject to certain limitations.

Q: Is there a maximum amount of tax credit that can be claimed?

A: Yes, the maximum annual tax credit that can be claimed is $5,000 per eligible employee with disabilities.

Q: How long can the tax credit be claimed?

A: The tax credit can be claimed for up to 10 years for each eligible employee with disabilities.

Q: How do I apply for the GIT-317 Sheltered Workshop Tax Credit?

A: To apply for the tax credit, businesses must complete and submit Form GIT-317 to the New Jersey Division of Taxation.

Q: Is there a deadline for claiming the tax credit?

A: Yes, the tax credit must be claimed on an annual basis by filing the required forms by the due date of the business's income tax return.

Form Details:

- Released on February 1, 2007;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GIT-317 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.