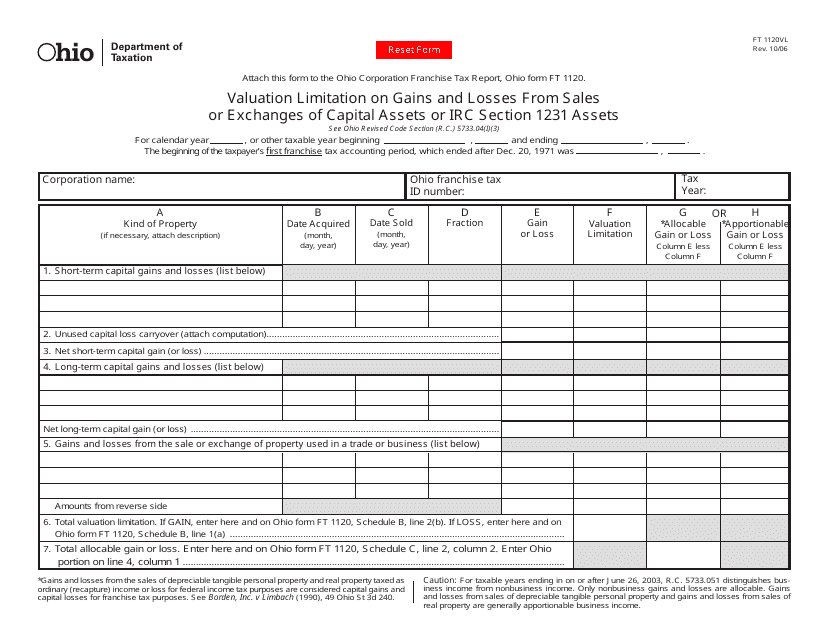

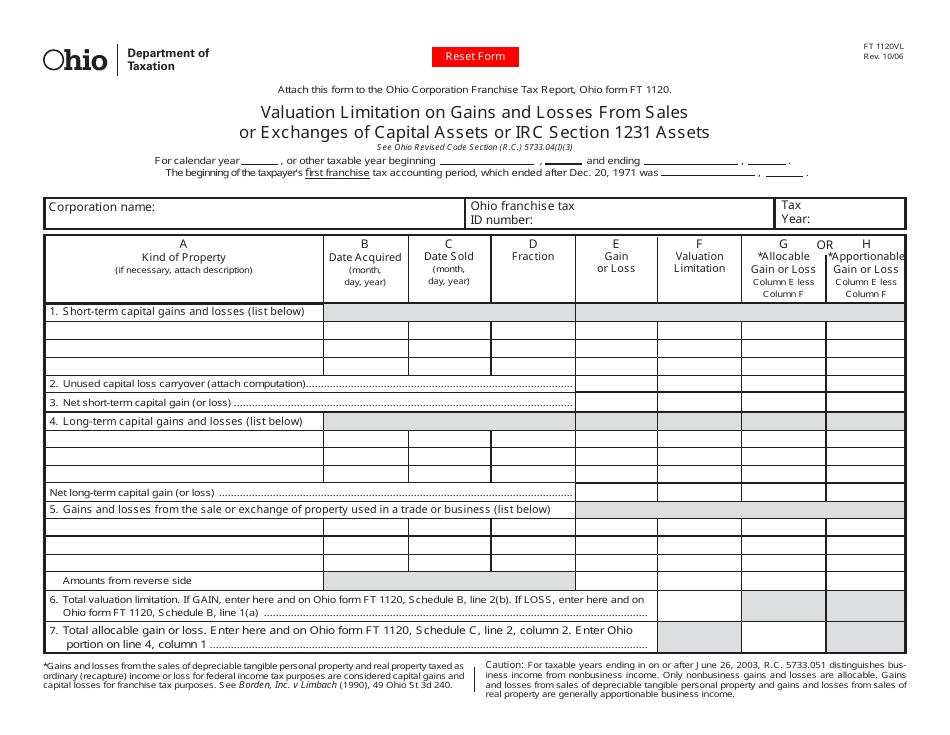

Form FT1120VL Valuation Limitation on Gains and Losses From Sales or Exchanges of Capital Assets or IRC Section 1231 Assets - Ohio

What Is Form FT1120VL?

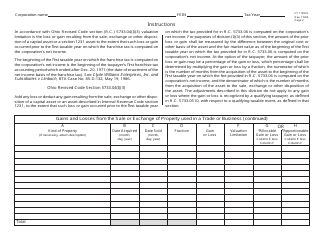

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FT1120VL?

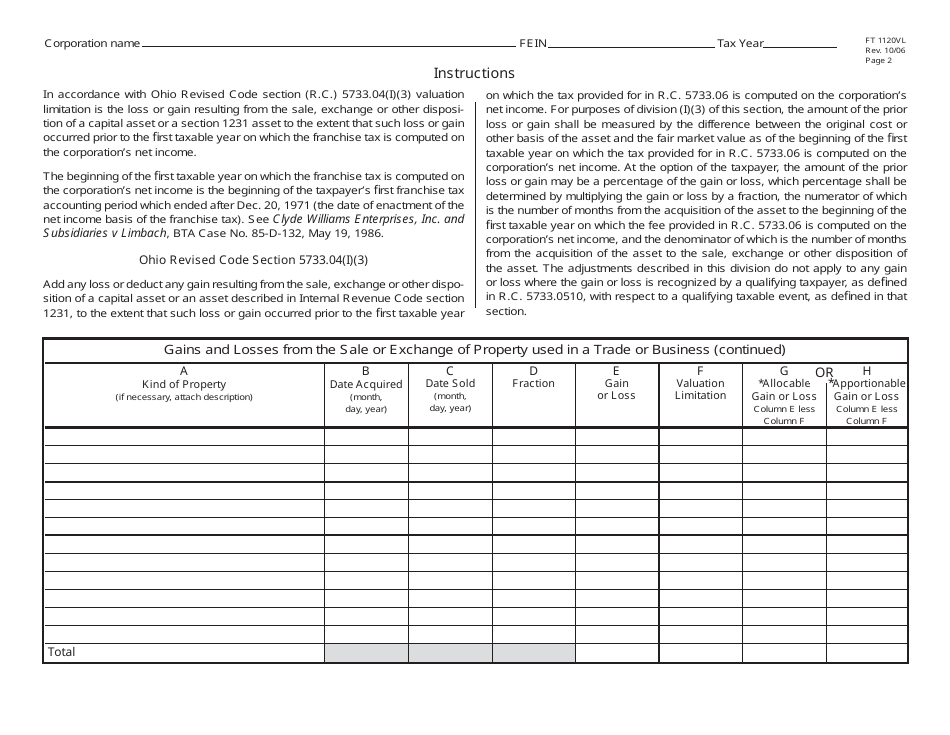

A: Form FT1120VL is a tax form used in Ohio to report Valuation Limitation on Gains and Losses From Sales or Exchanges of Capital Assets or IRC Section 1231 Assets.

Q: What does Form FT1120VL calculate?

A: Form FT1120VL calculates the limitation on gains and losses from the sale or exchange of capital assets or IRC Section 1231 assets.

Q: Who needs to file Form FT1120VL?

A: Taxpayers in Ohio who have capital assets or IRC Section 1231 assets and want to report the valuation limitation on gains and losses need to file Form FT1120VL.

Q: What are capital assets?

A: Capital assets are assets held for investment purposes, such as stocks, bonds, real estate, and other property.

Q: What are IRC Section 1231 assets?

A: IRC Section 1231 assets are assets used in a trade or business, such as machinery, equipment, and buildings.

Q: What is the purpose of the valuation limitation?

A: The valuation limitation is used to determine the amount of gains and losses that can be taken into account for tax purposes.

Q: When is the deadline to file Form FT1120VL?

A: The deadline to file Form FT1120VL is usually the same as the deadline for filing your Ohio tax return, which is typically April 15th.

Q: Are there any penalties for not filing Form FT1120VL?

A: Yes, there may be penalties for not filing Form FT1120VL or filing it late. It's important to file the form by the deadline to avoid any penalties.

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FT1120VL by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.