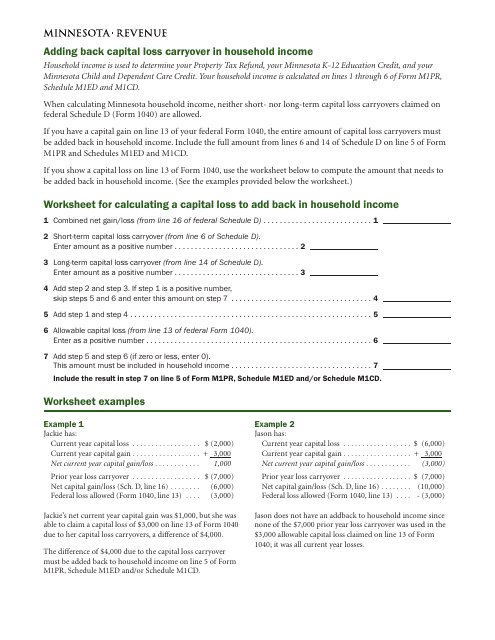

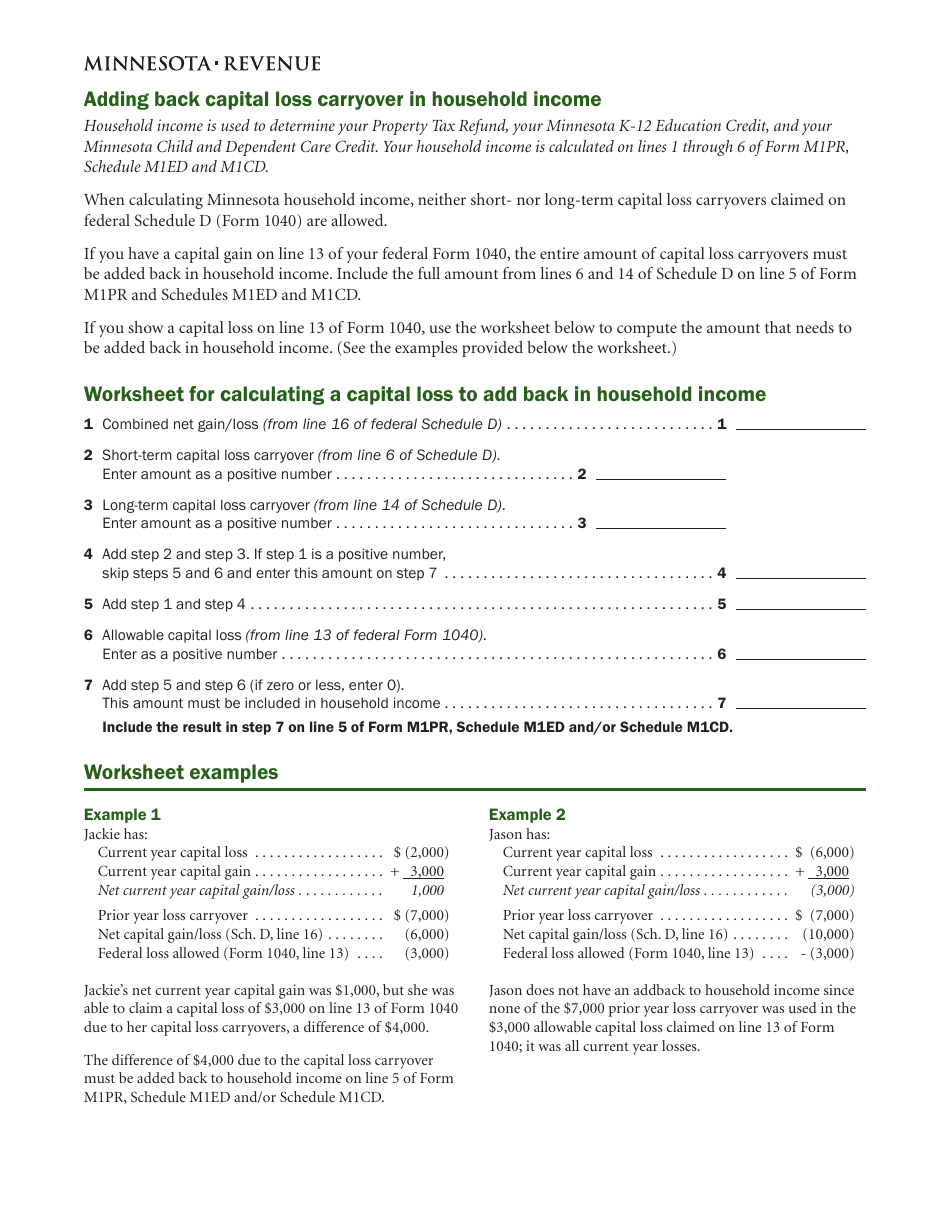

Worksheet for Calculating a Capital Loss to Add Back in Household Income - Minnesota

Worksheet for Calculating a Capital Loss to Add Back in Household Income is a legal document that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota.

FAQ

Q: What is a capital loss?

A: A capital loss occurs when you sell an investment for less than what you paid for it.

Q: Why would I need to calculate a capital loss?

A: You need to calculate a capital loss to add it back to your household income for tax purposes in Minnesota.

Q: How do I calculate a capital loss?

A: To calculate a capital loss, subtract the sale price of the investment from the purchase price or cost basis.

Q: What is the purpose of adding back a capital loss to household income?

A: Adding back a capital loss to household income helps determine your total income for tax calculations in Minnesota.

Q: Are capital losses deductible on my taxes?

A: Yes, capital losses can be deductible on your taxes, but you need to follow specific rules and limitations set by the IRS.

Q: Is this worksheet specific to Minnesota residents only?

A: Yes, this worksheet is designed specifically for calculating a capital loss to add back in household income for tax purposes in Minnesota.

Form Details:

- The latest edition currently provided by the Minnesota Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.