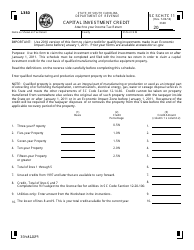

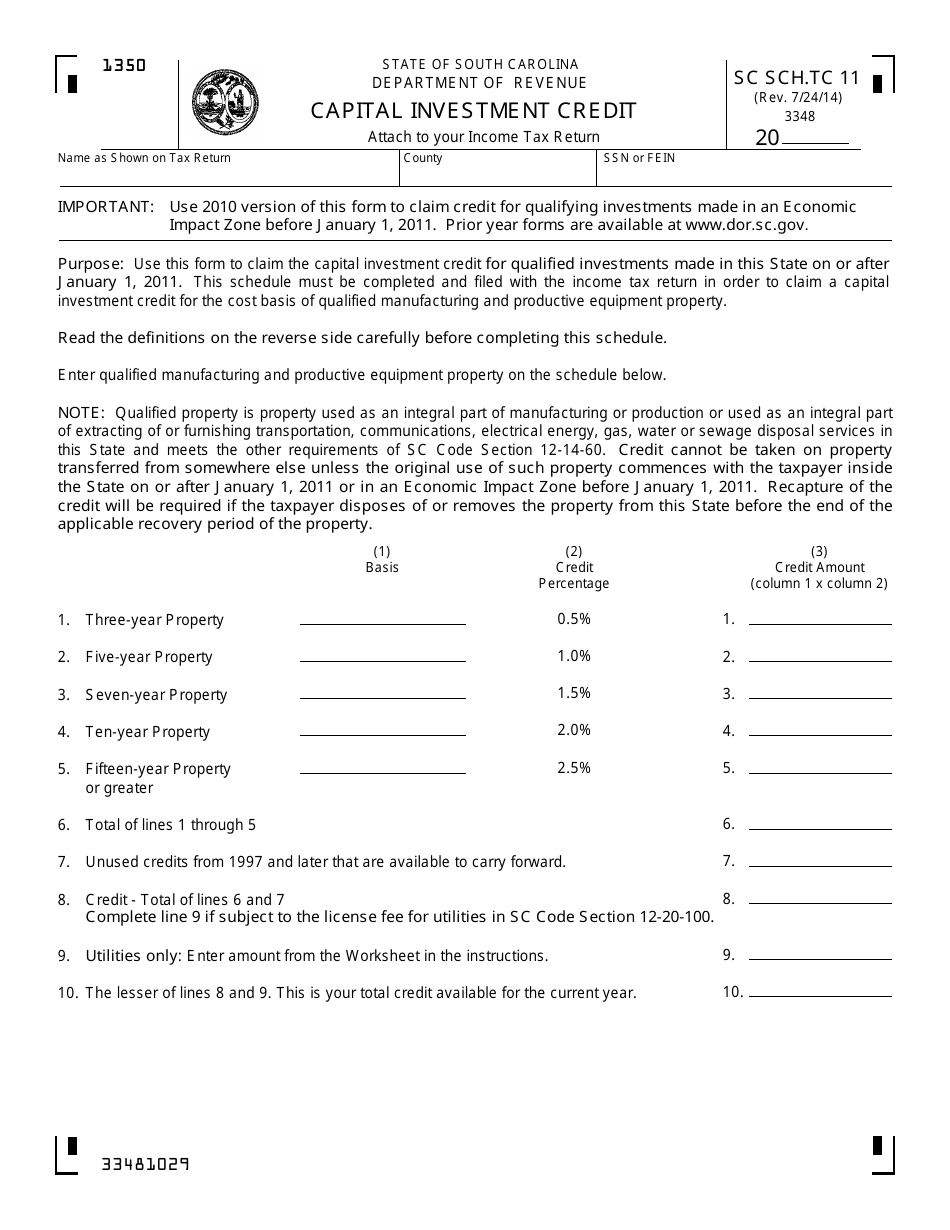

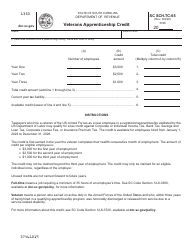

Form SC SCH.TC-11 Schedule TC 11 Capital Investment Credit - South Carolina

What Is Form SC SCH.TC-11 Schedule TC 11?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the SC SCH.TC-11 Schedule TC 11?

A: The SC SCH.TC-11 Schedule TC 11 is a form used in South Carolina to claim the Capital Investment Credit.

Q: What is the Capital Investment Credit?

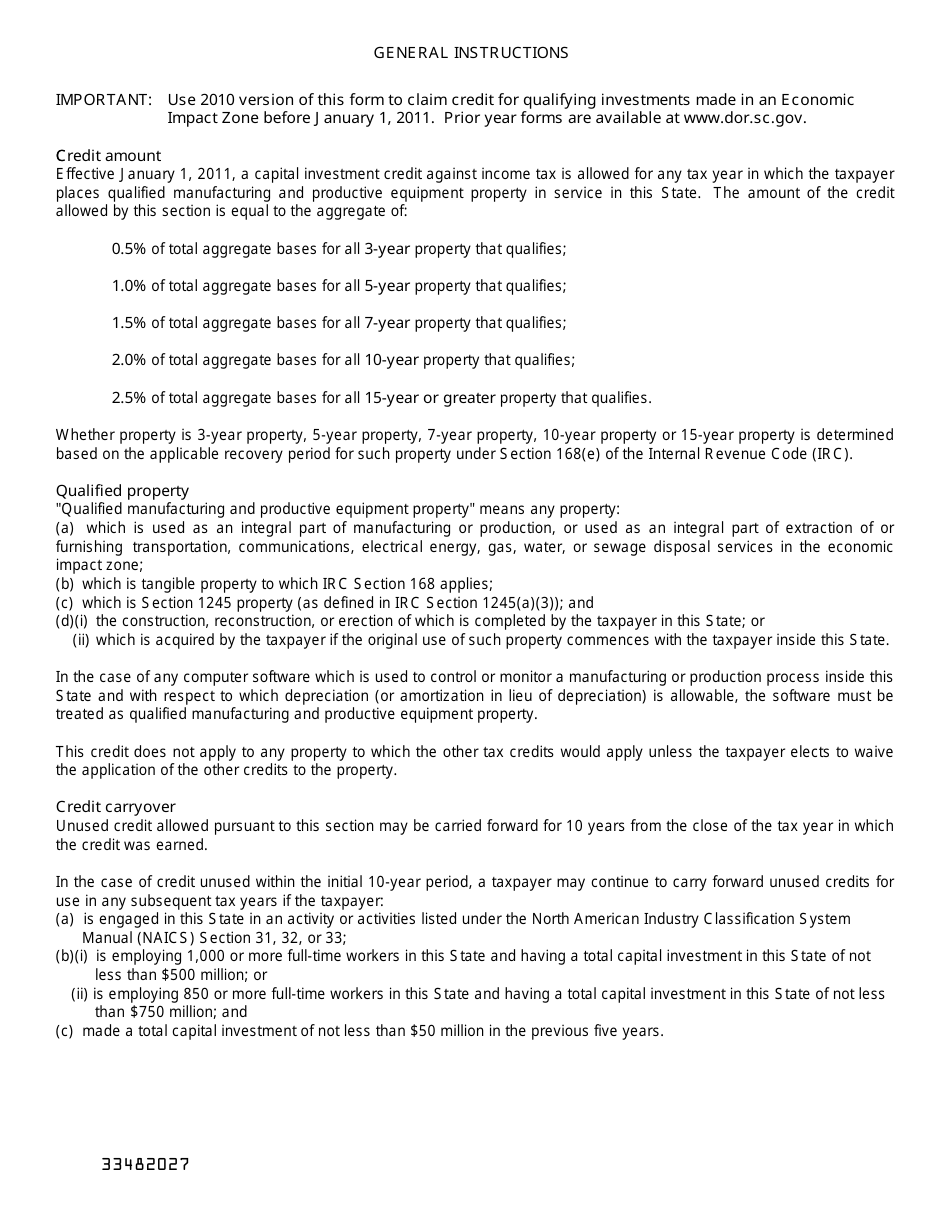

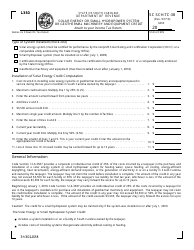

A: The Capital Investment Credit is a tax credit that is available to businesses in South Carolina who make qualified investments in certain types of property.

Q: How do I qualify for the Capital Investment Credit?

A: To qualify for the Capital Investment Credit, you need to meet certain criteria set by the South Carolina Department of Revenue.

Q: What types of property can be eligible for the Capital Investment Credit?

A: Property that qualifies for the Capital Investment Credit includes new manufacturing and distribution facilities, certain types of equipment, and certain infrastructure improvements.

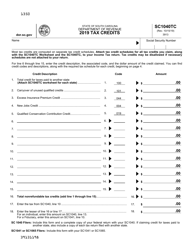

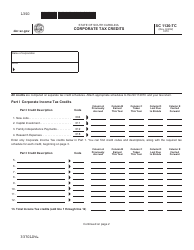

Q: How do I claim the Capital Investment Credit in South Carolina?

A: To claim the Capital Investment Credit, you need to complete the SC SCH.TC-11 Schedule TC 11 and attach it to your South Carolina tax return.

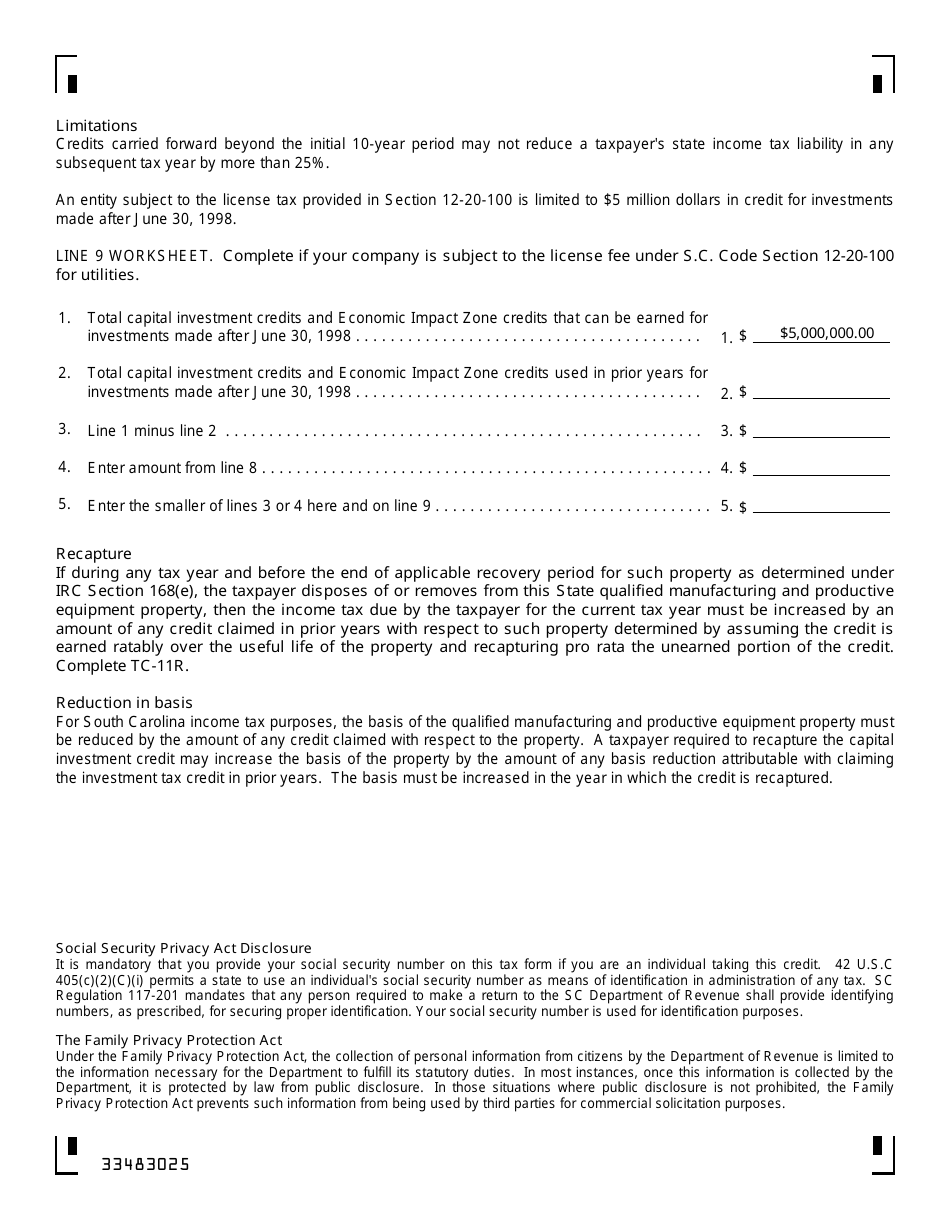

Q: Are there any limitations or restrictions on the Capital Investment Credit?

A: Yes, there are certain limitations and restrictions on the Capital Investment Credit, such as a maximum credit amount and a requirement to hold the property for a certain period of time.

Q: Is there a deadline for filing the SC SCH.TC-11 Schedule TC 11 form?

A: Yes, the deadline for filing the SC SCH.TC-11 Schedule TC 11 form is generally the same as the deadline for filing your South Carolina tax return.

Form Details:

- Released on July 24, 2014;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SC SCH.TC-11 Schedule TC 11 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.