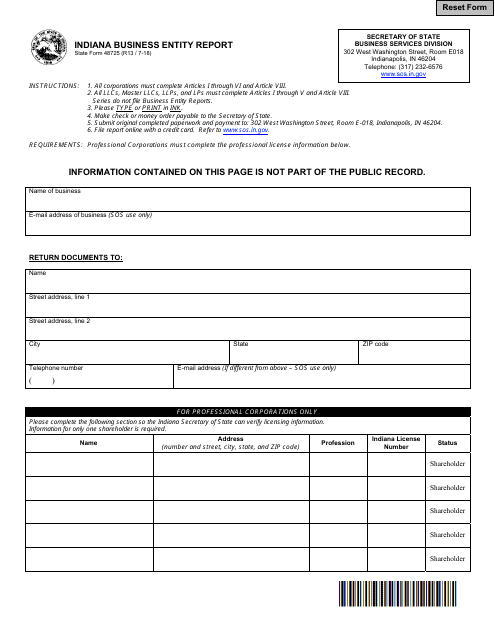

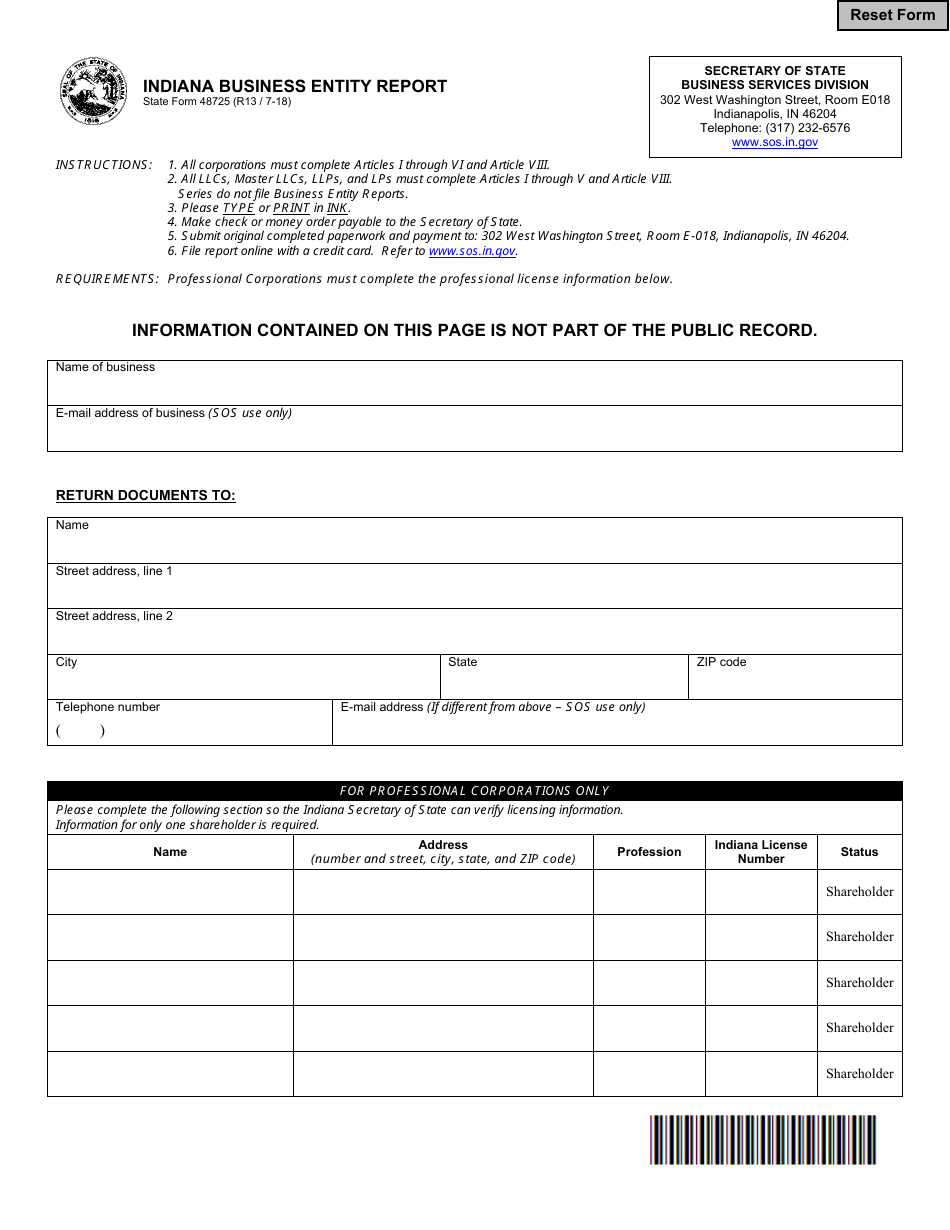

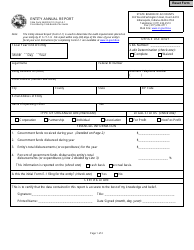

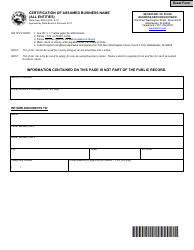

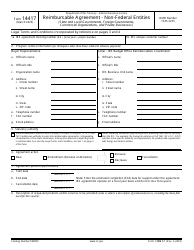

State Form 48275 Indiana Business Entity Report - Indiana

What Is State Form 48275?

This is a legal form that was released by the Indiana Secretary of State - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 48275?

A: Form 48275 is the Indiana Business Entity Report.

Q: What is the purpose of the Indiana Business Entity Report?

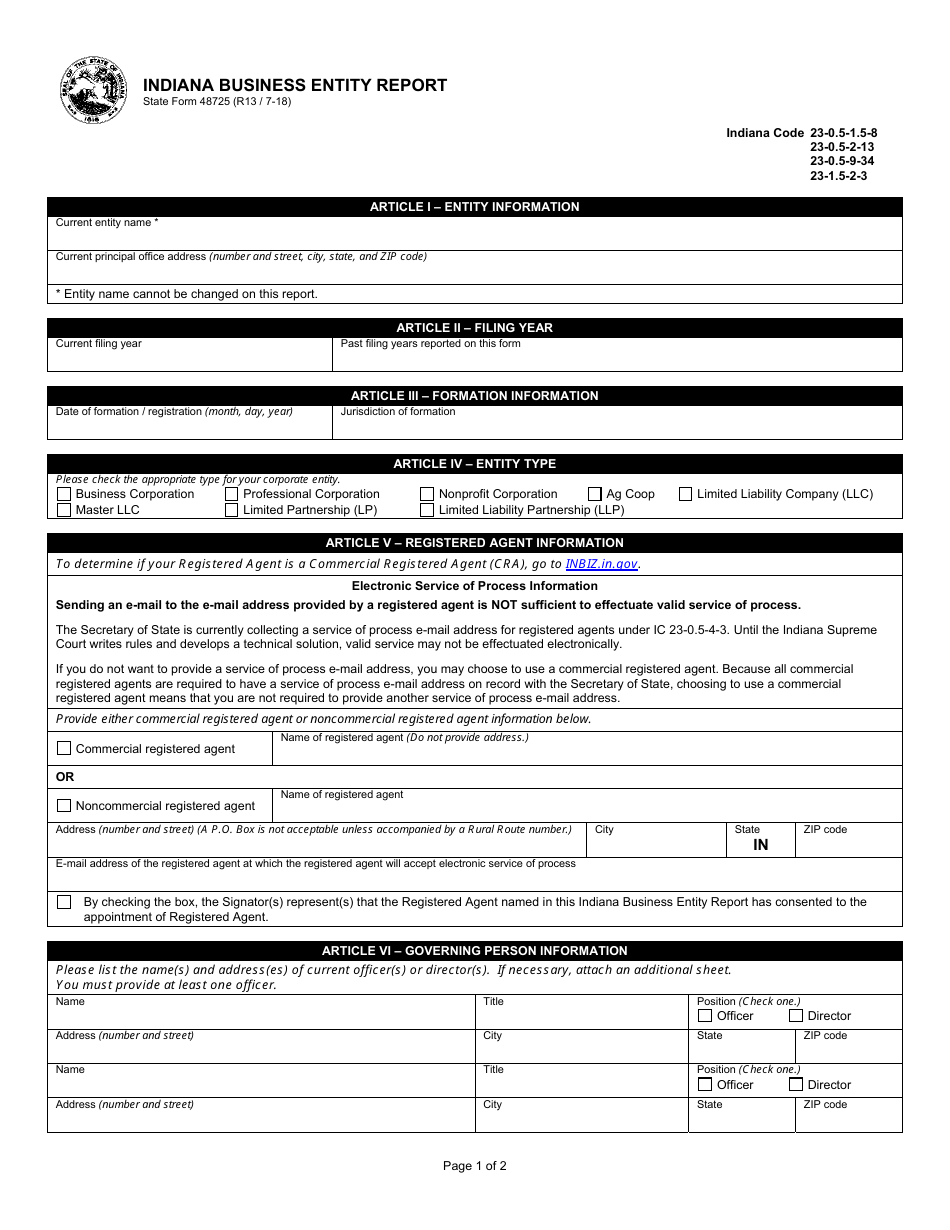

A: The purpose of the Indiana Business Entity Report is to update the state with the current information of a business entity.

Q: Which businesses need to file the Indiana Business Entity Report?

A: All business entities registered in the state of Indiana, including corporations, limited liability companies (LLCs), and limited partnerships, need to file the Indiana Business Entity Report.

Q: When is the deadline to file the Indiana Business Entity Report?

A: The deadline to file the Indiana Business Entity Report is the last day of the anniversary month of the business entity's formation.

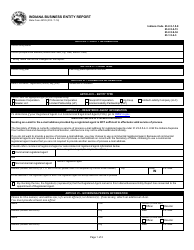

Q: What information is required to be reported on the Indiana Business Entity Report?

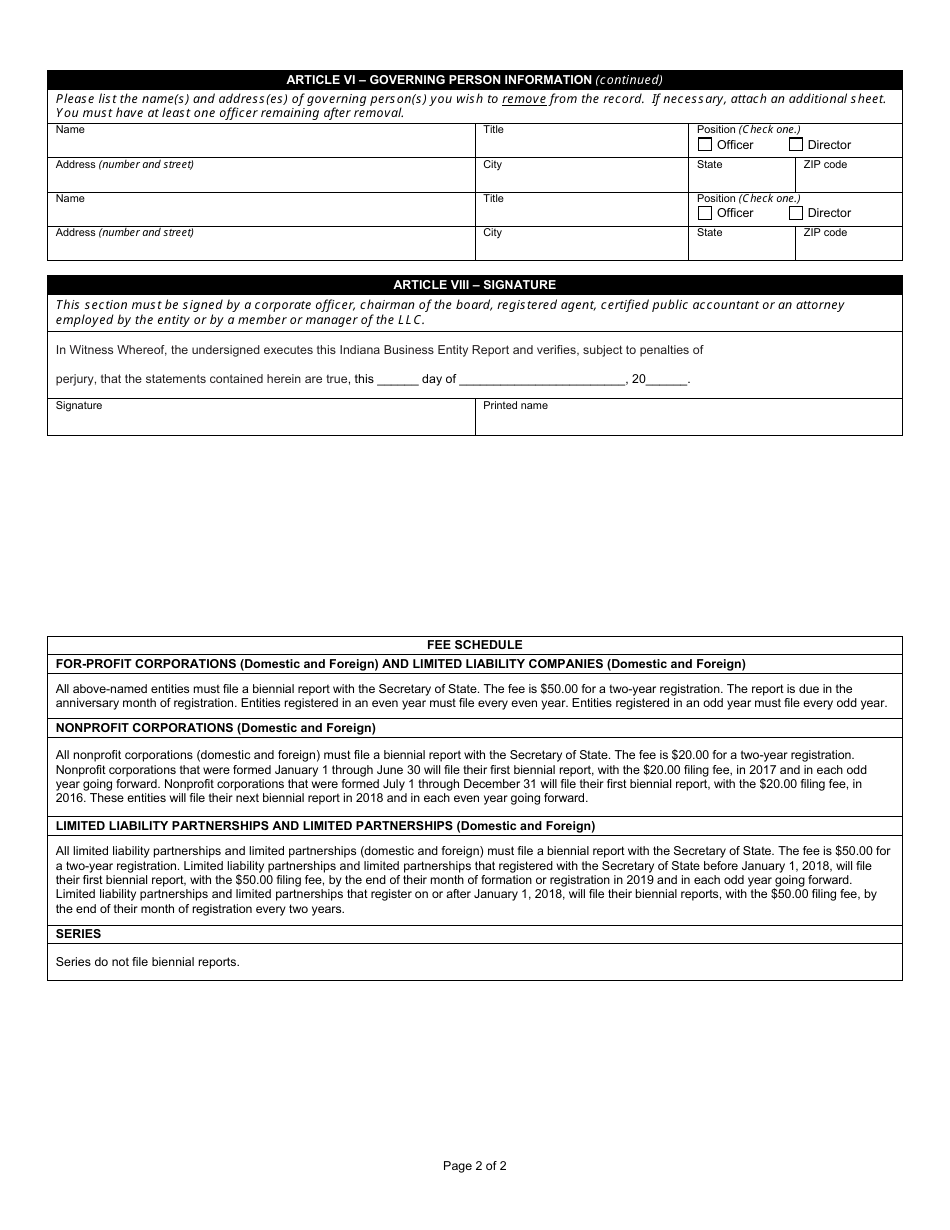

A: The Indiana Business Entity Report requires information such as the business entity's name, principal office address, registered agent, and the names and addresses of officers, managers, or partners.

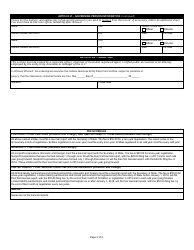

Q: What happens if a business fails to file the Indiana Business Entity Report?

A: If a business fails to file the Indiana Business Entity Report, it may be administratively dissolved or have its status revoked.

Q: Is there a fee to file the Indiana Business Entity Report?

A: Yes, there is a fee to file the Indiana Business Entity Report. The fee amount depends on the type of business entity.

Q: Is the Indiana Business Entity Report the same as the annual report?

A: Yes, the Indiana Business Entity Report is the same as the annual report for business entities in Indiana.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Indiana Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 48275 by clicking the link below or browse more documents and templates provided by the Indiana Secretary of State.