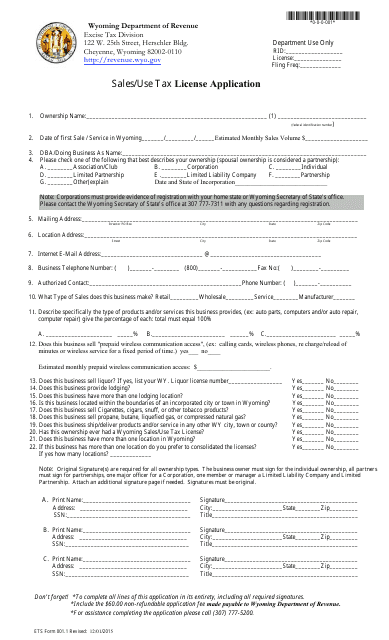

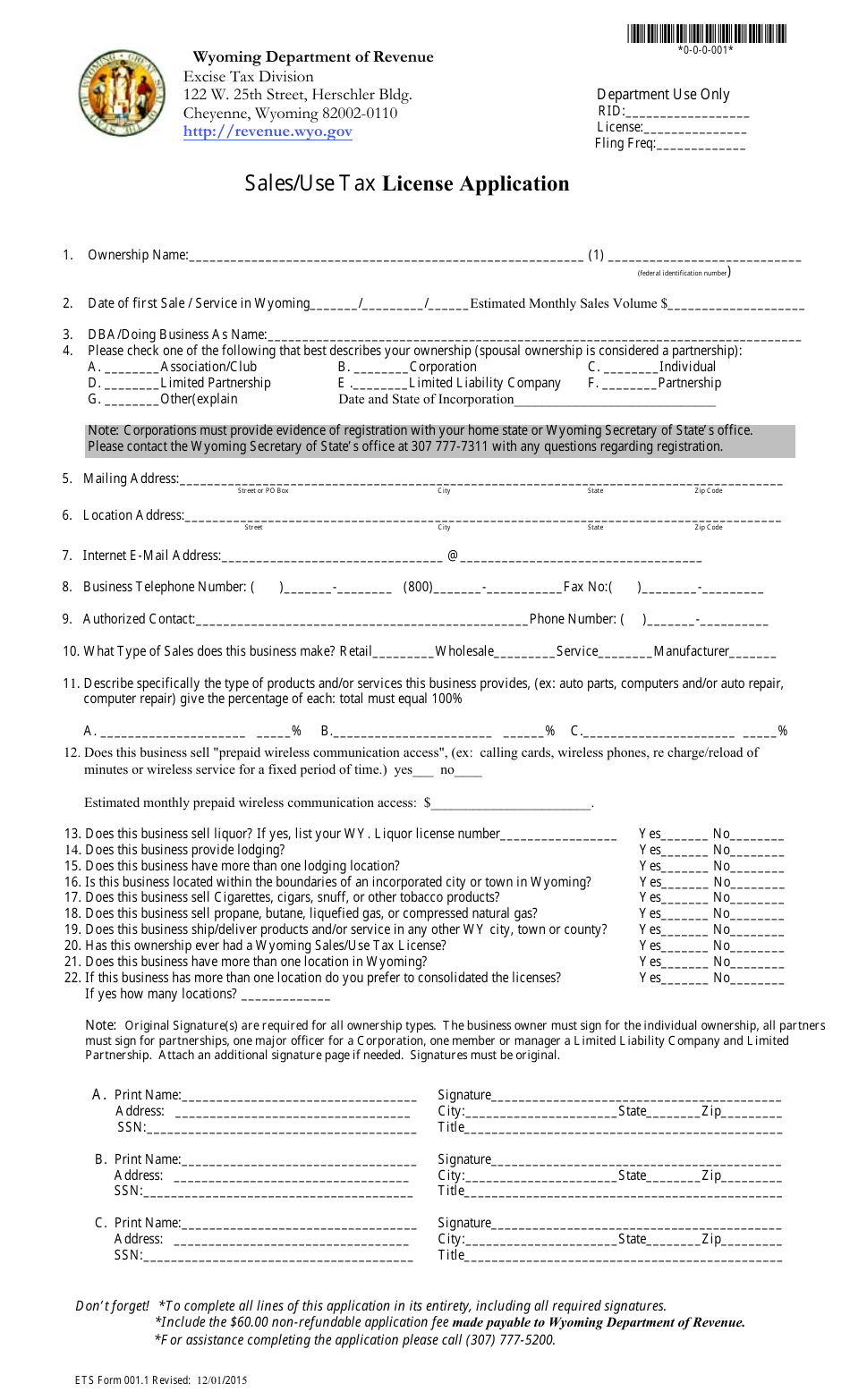

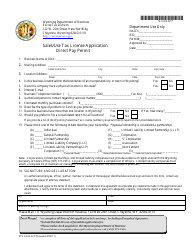

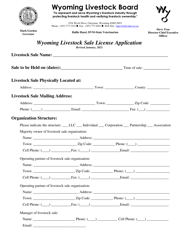

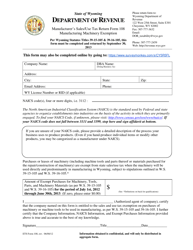

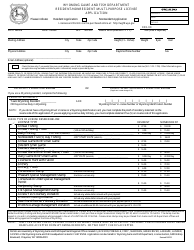

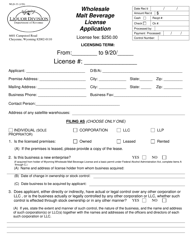

ETS Form 001.1 Sales / Use Tax License Application - Wyoming

What Is ETS Form 001.1?

This is a legal form that was released by the Wyoming Department of Revenue - Excise Tax Division - a government authority operating within Wyoming. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is ETS Form 001.1?

A: ETS Form 001.1 is the Sales/Use Tax License Application for the state of Wyoming.

Q: What is the purpose of ETS Form 001.1?

A: The purpose of ETS Form 001.1 is to apply for a Sales/Use Tax License in Wyoming.

Q: Who needs to use ETS Form 001.1?

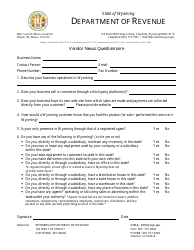

A: Anyone who wants to conduct sales or engage in the use of taxable products or services in Wyoming needs to use ETS Form 001.1 to obtain a Sales/Use Tax License.

Q: What information do I need to provide on ETS Form 001.1?

A: You will need to provide your personal and business information, as well as details about the products or services you plan to sell or use.

Q: Are there any fees associated with ETS Form 001.1?

A: Yes, there is a $60 fee for filing ETS Form 001.1.

Q: When should I submit ETS Form 001.1?

A: You should submit ETS Form 001.1 at least 10 days before you plan to engage in sales or use of taxable products or services in Wyoming.

Q: How long does it take to process ETS Form 001.1?

A: It typically takes about 10 business days to process ETS Form 001.1.

Q: Do I need to renew my Sales/Use Tax License?

A: Yes, the Sales/Use Tax License needs to be renewed annually by submitting a renewal application and paying the required fee.

Q: Can I operate without a Sales/Use Tax License in Wyoming?

A: No, it is illegal to conduct sales or engage in the use of taxable products or services in Wyoming without a Sales/Use Tax License.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the Wyoming Department of Revenue - Excise Tax Division;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of ETS Form 001.1 by clicking the link below or browse more documents and templates provided by the Wyoming Department of Revenue - Excise Tax Division.