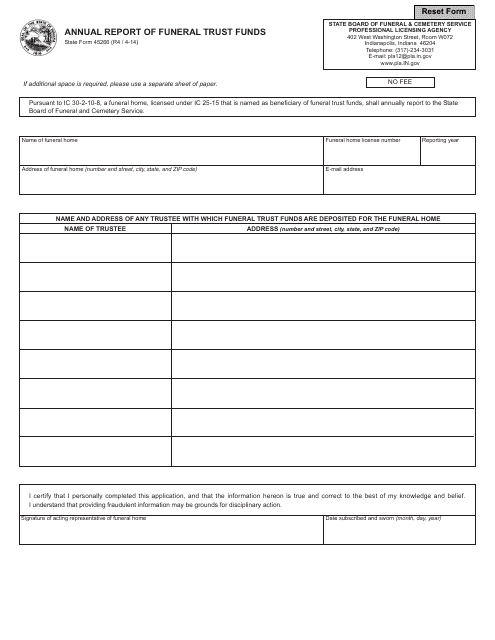

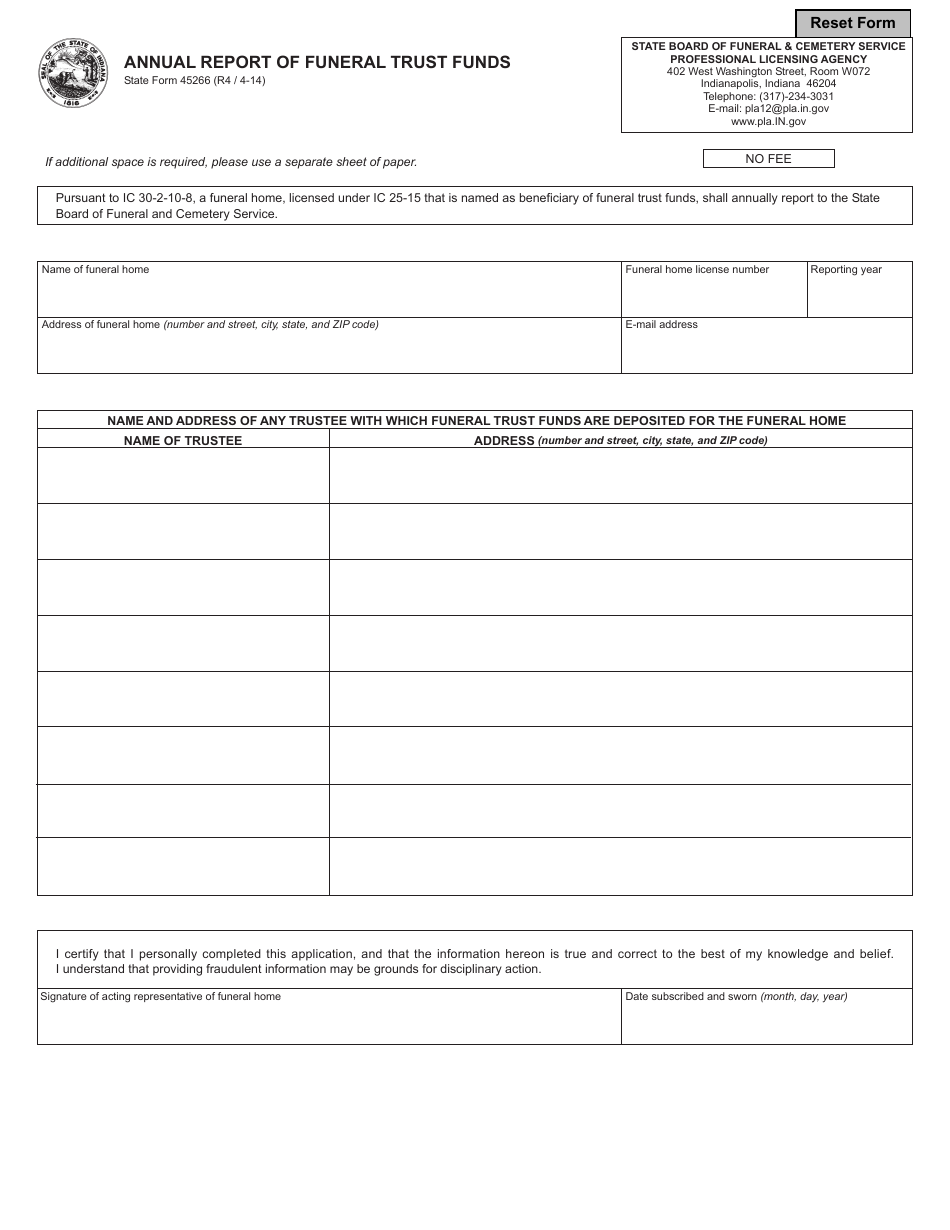

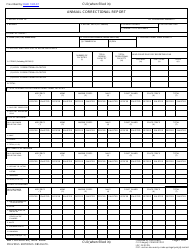

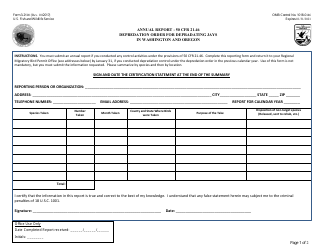

State Form 45266 Annual Report of Funeral Trust Funds - Indiana

What Is State Form 45266?

This is a legal form that was released by the Indiana Professional Licensing Agency - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 45266 Annual Report of Funeral Trust Funds - Indiana?

A: Form 45266 is an annual report that funeral homes in Indiana must submit regarding the status of their funeral trust funds.

Q: Who needs to file Form 45266?

A: Funeral homes in Indiana need to file Form 45266.

Q: What is the purpose of Form 45266?

A: The purpose of Form 45266 is to ensure transparency and accountability in the management of funeral trust funds.

Q: When is Form 45266 due?

A: Form 45266 is due on or before April 15th of each year.

Q: Are there any fees associated with filing Form 45266?

A: No, there are no fees associated with filing Form 45266.

Q: What information is required on Form 45266?

A: Form 45266 requires information such as the funeral home's name, address, trust fund account numbers, and the total funds held in trust.

Q: What happens if a funeral home fails to file Form 45266?

A: Failure to file Form 45266 may result in penalties or other enforcement actions by the Indiana State Department of Health.

Form Details:

- Released on April 1, 2014;

- The latest edition provided by the Indiana Professional Licensing Agency;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 45266 by clicking the link below or browse more documents and templates provided by the Indiana Professional Licensing Agency.