This version of the form is not currently in use and is provided for reference only. Download this version of

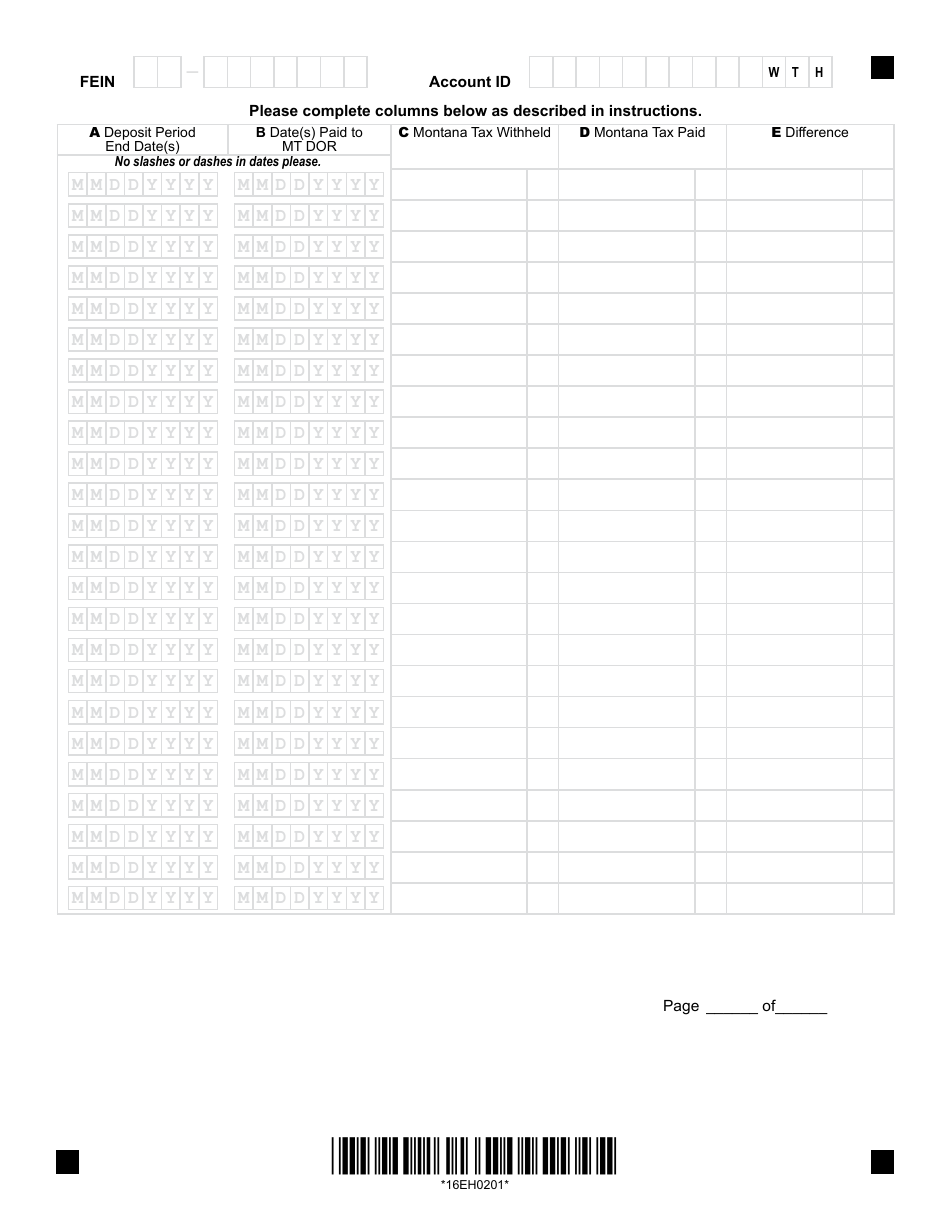

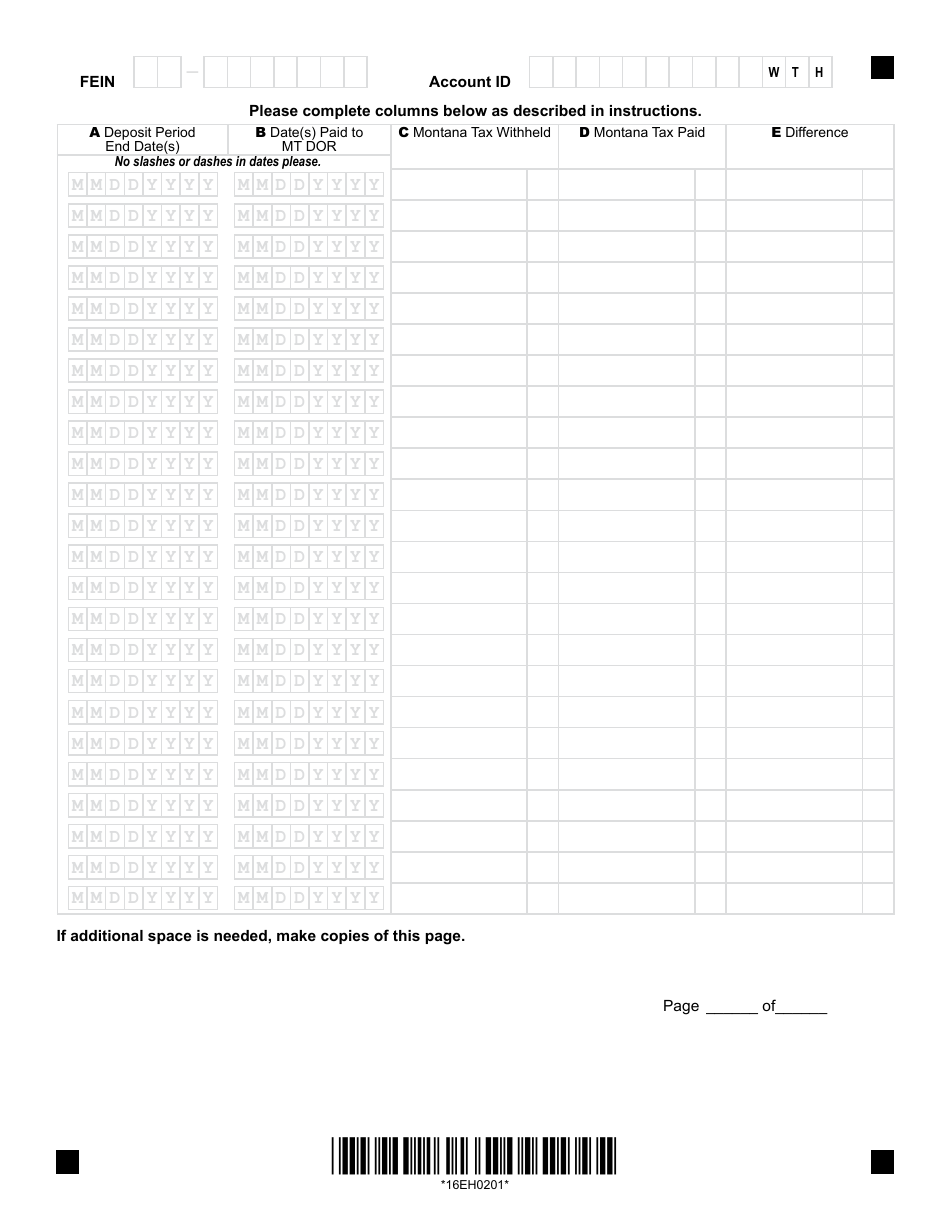

Form MW-3

for the current year.

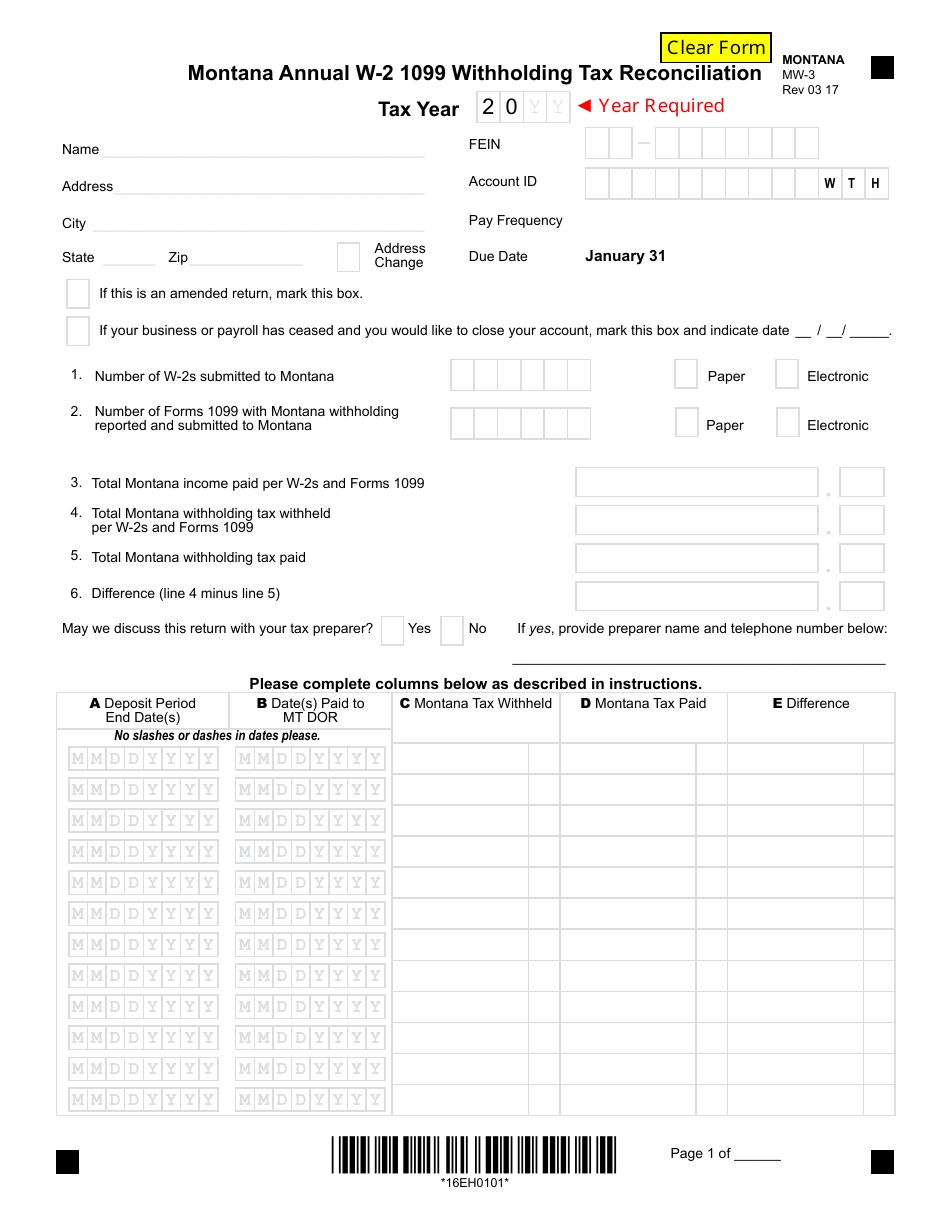

Form MW-3 Montana Annual W-2 1099 Withholding Tax Reconciliation - Montana

What Is Form MW-3?

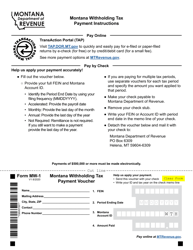

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MW-3?

A: Form MW-3 is the Montana Annual W-2 1099 Withholding Tax Reconciliation form.

Q: Who needs to file Form MW-3?

A: Employers who withheld Montana income tax from wages or non-wage payments need to file Form MW-3.

Q: What is the purpose of Form MW-3?

A: Form MW-3 is used to reconcile the total Montana income tax withheld with the total amount of withholding reported on the W-2 and 1099 forms.

Q: When is Form MW-3 due?

A: Form MW-3 is due on or before January 31st of the following year.

Q: Are there any penalties for not filing Form MW-3?

A: Yes, there are penalties for not filing or filing late. It is important to file Form MW-3 on time to avoid any penalties.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MW-3 by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.