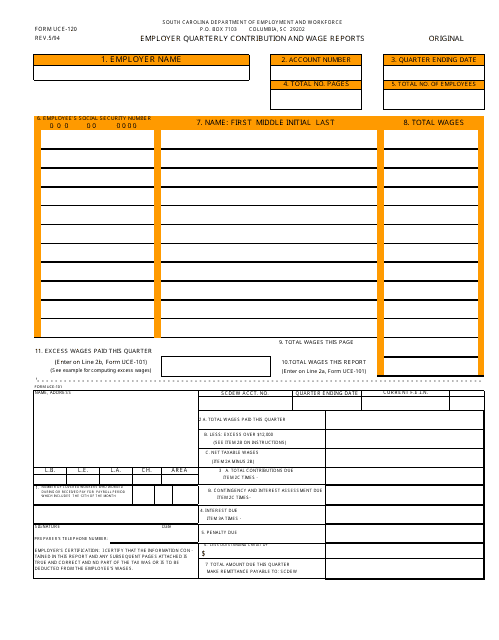

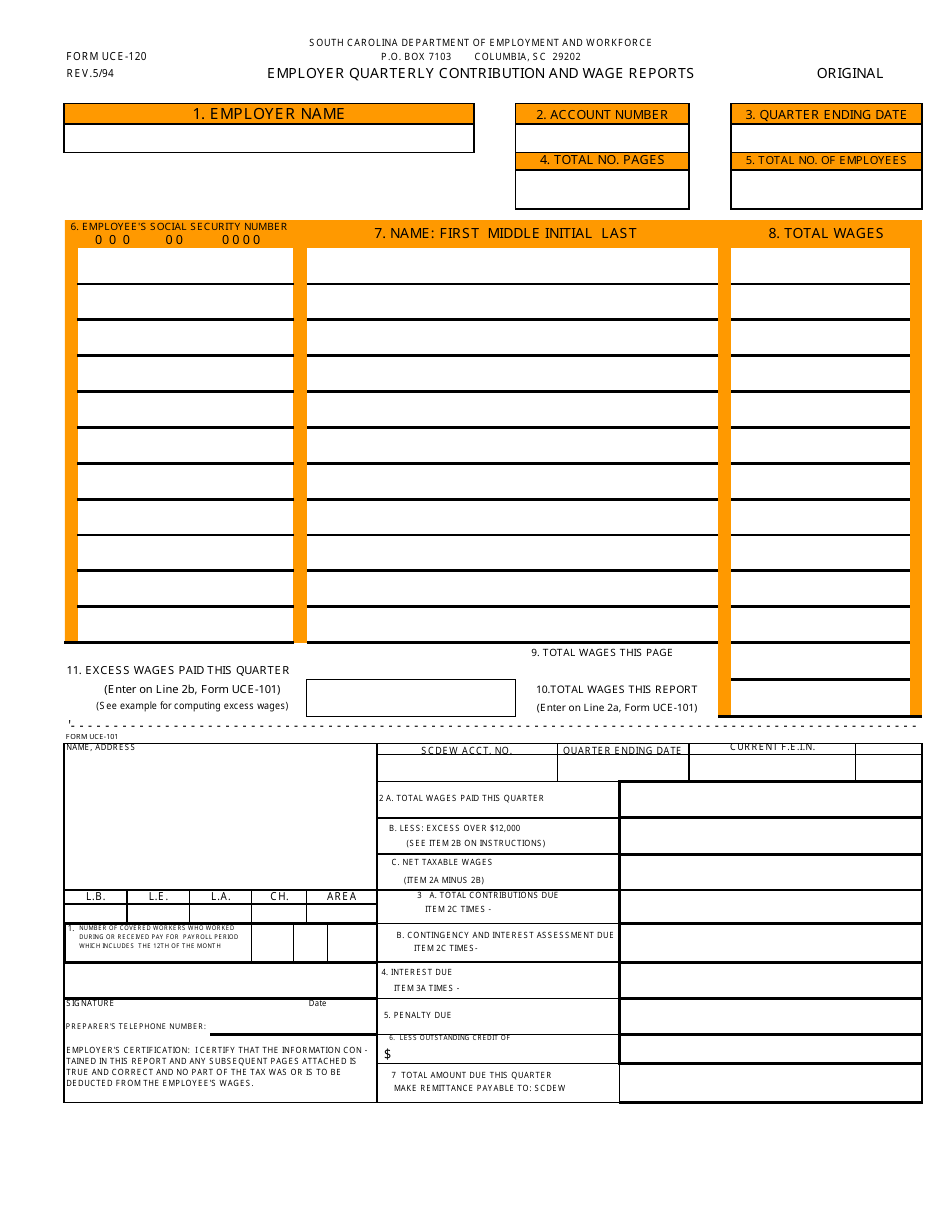

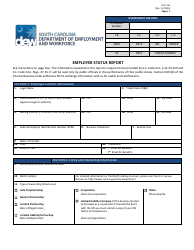

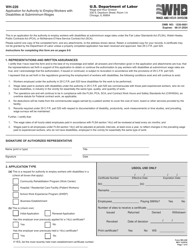

Form UCE-120 Employer Quarterly Contribution and Wage Reports - South Carolina

What Is Form UCE-120?

This is a legal form that was released by the South Carolina Department of Employment & Workforce - a government authority operating within South Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form UCE-120?

A: Form UCE-120 is the Employer Quarterly Contribution and Wage Report used in South Carolina.

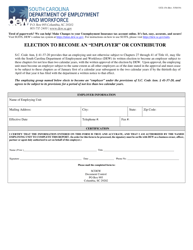

Q: Who is required to fill out Form UCE-120?

A: Employers in South Carolina are required to fill out Form UCE-120.

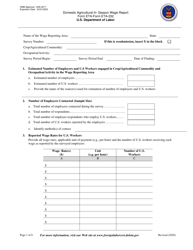

Q: When is Form UCE-120 due?

A: Form UCE-120 is due on the last day of the month following the end of the calendar quarter.

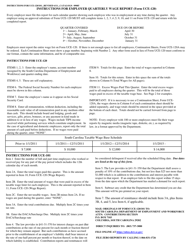

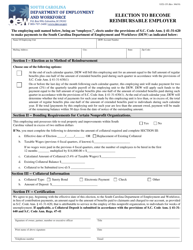

Q: What information do I need to fill out Form UCE-120?

A: You will need to provide information about your company, including your employer identification number, as well as information about your employees and their wages.

Q: Is there a penalty for late filing of Form UCE-120?

A: Yes, there is a penalty for late filing of Form UCE-120. The penalty is based on the amount of unpaid contributions due.

Form Details:

- Released on May 1, 1994;

- The latest edition provided by the South Carolina Department of Employment & Workforce;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form UCE-120 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Employment & Workforce.