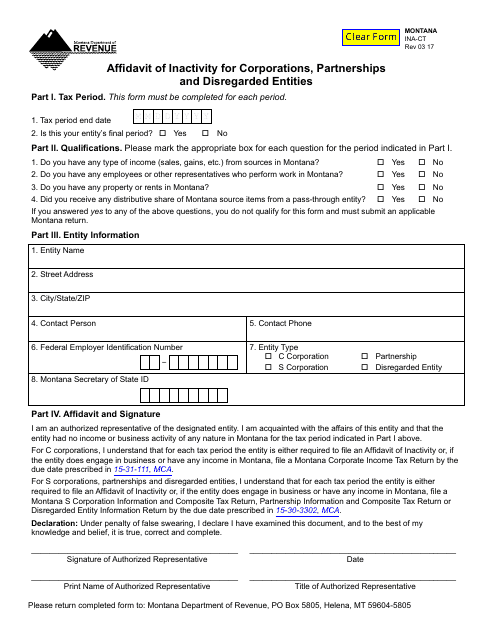

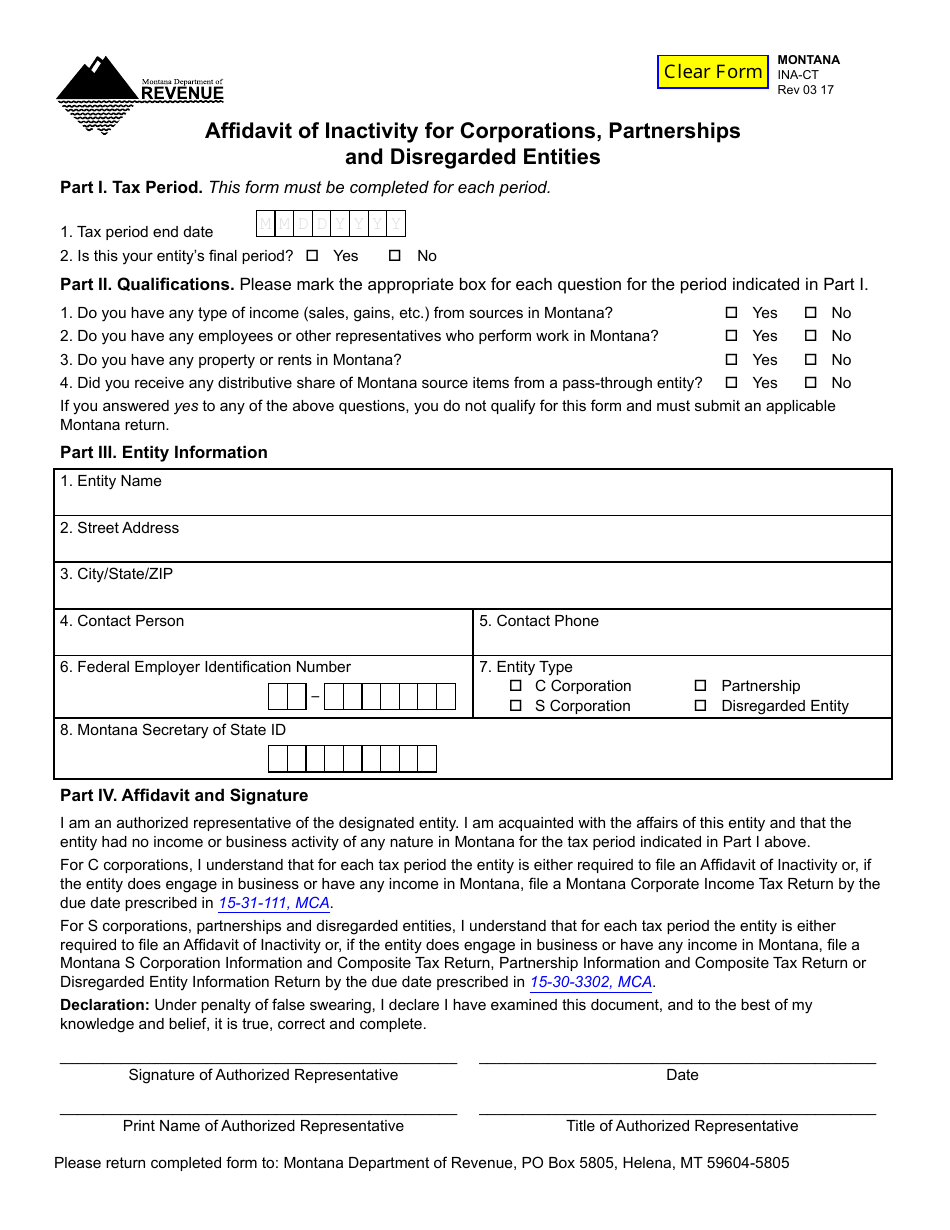

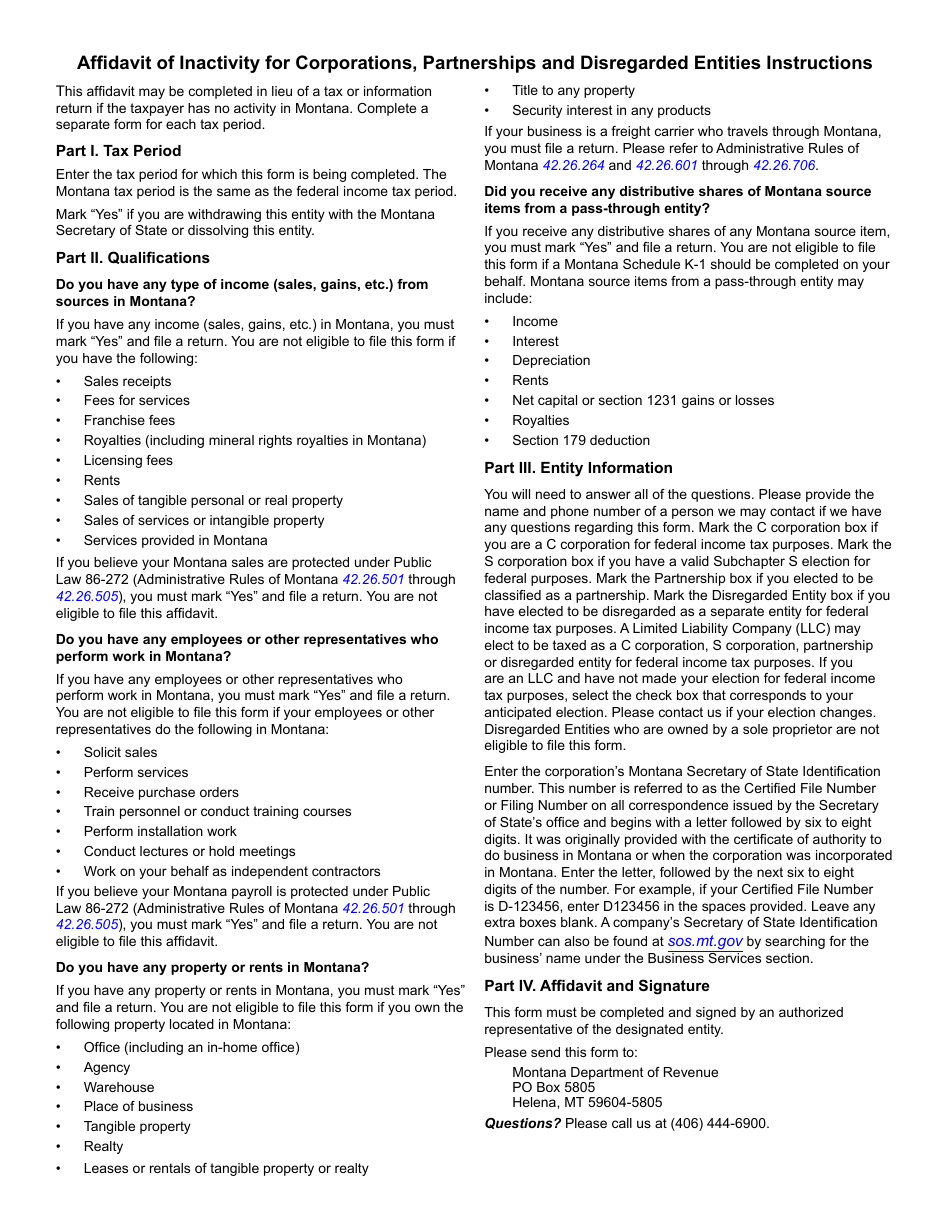

Form INA-CT Affidavit of Inactivity for Corporations, Partnerships and Disregarded Entities - Montana

What Is Form INA-CT?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form INA-CT?

A: Form INA-CT is the Affidavit of Inactivity for Corporations, Partnerships and Disregarded Entities in Montana.

Q: Who should use Form INA-CT?

A: Corporations, partnerships, and disregarded entities in Montana who have been inactive and want to certify their inactivity should use Form INA-CT.

Q: What is the purpose of Form INA-CT?

A: The purpose of Form INA-CT is to allow corporations, partnerships, and disregarded entities in Montana to certify that they have been inactive and therefore exempt from certain filing obligations.

Q: What information is required on Form INA-CT?

A: Form INA-CT requires basic information such as the name of the entity, its address, the date of inactivity, and the signature of an authorized representative.

Q: Are there any fees associated with filing Form INA-CT?

A: No, there are no fees for filing Form INA-CT.

Q: When should I file Form INA-CT?

A: Form INA-CT should be filed when the entity has been inactive for the entire tax year and wants to certify its inactivity.

Q: Is Form INA-CT required every year?

A: No, Form INA-CT is only required in years when the entity has been inactive.

Q: What happens after I file Form INA-CT?

A: After filing Form INA-CT, the entity will be considered inactive for tax purposes and exempt from certain filing obligations.

Q: Can I reactivate my entity after filing Form INA-CT?

A: Yes, you can reactivate your entity by submitting a new filing and fulfilling any additional requirements set by the Montana Department of Revenue.

Q: What if I have further questions about Form INA-CT?

A: If you have further questions about Form INA-CT, you can contact the Montana Department of Revenue for assistance.

Form Details:

- Released on March 10, 2017;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form INA-CT by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.