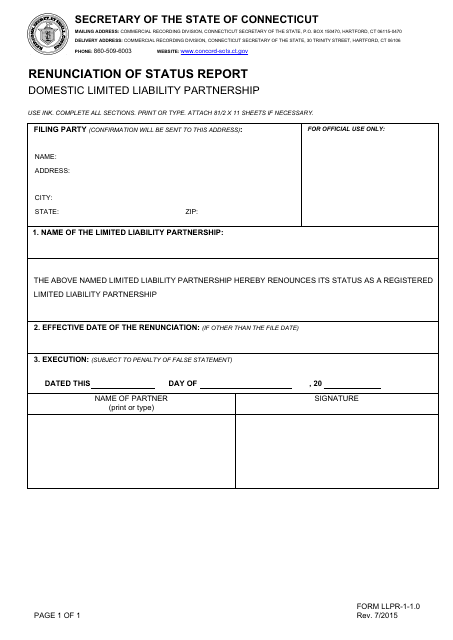

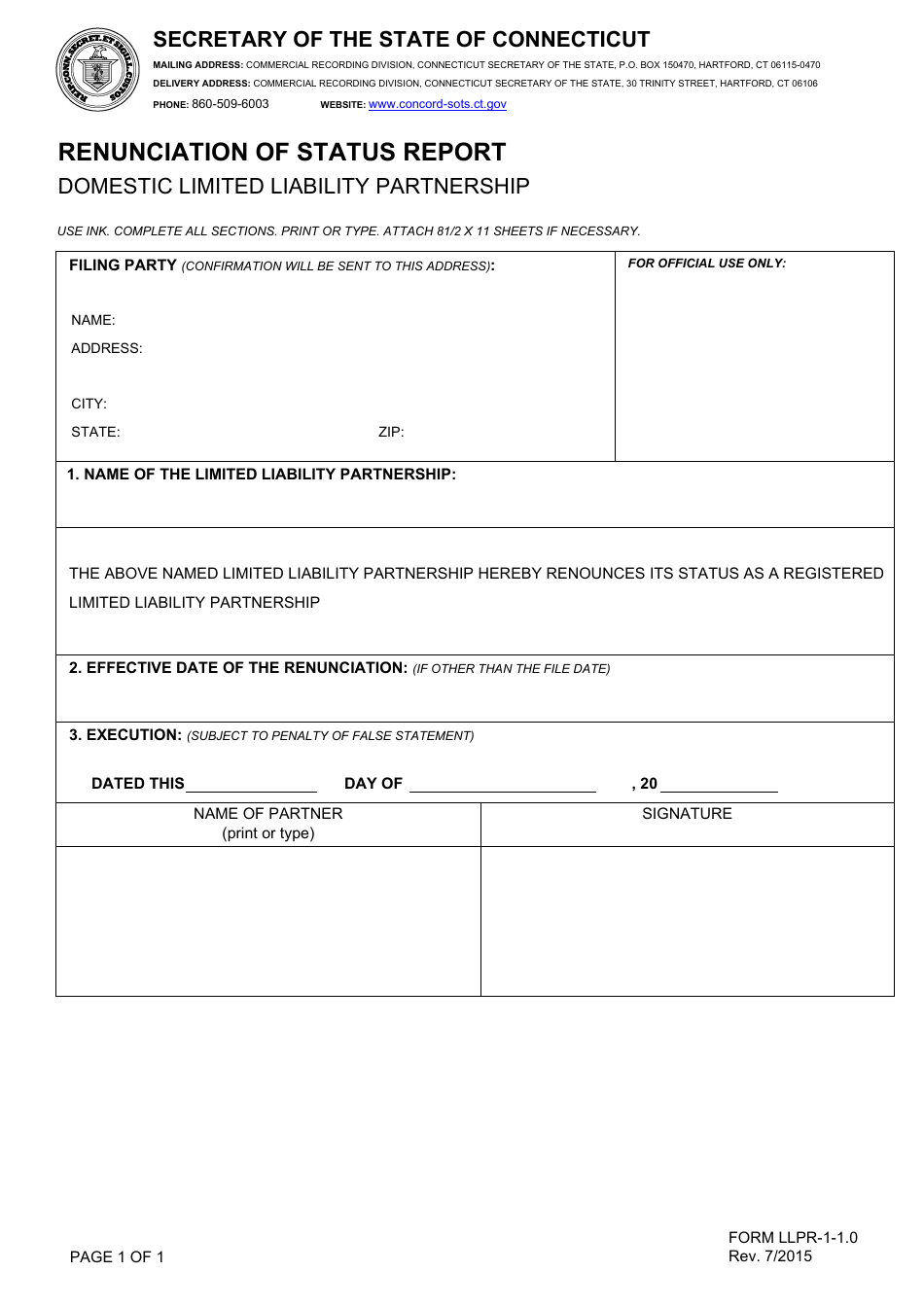

Form LLPR-1-1.0 Renunciation of Status Report - Domestic Limited Liability Partnership - Connecticut

What Is Form LLPR-1-1.0?

This is a legal form that was released by the Connecticut Secretary of the State - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LLPR-1-1.0?

A: Form LLPR-1-1.0 is a Renunciation of Status Report for Domestic Limited Liability Partnership in the state of Connecticut.

Q: What is a Domestic Limited Liability Partnership?

A: A Domestic Limited Liability Partnership is a type of business entity where the partners have limited personal liability for the partnership's debts and obligations.

Q: What is the purpose of Form LLPR-1-1.0?

A: The purpose of Form LLPR-1-1.0 is to renounce the status of a Domestic Limited Liability Partnership in Connecticut.

Q: Who needs to file Form LLPR-1-1.0?

A: Any Domestic Limited Liability Partnership in Connecticut that wishes to renounce its status needs to file Form LLPR-1-1.0.

Q: Are there any fees for filing Form LLPR-1-1.0?

A: Yes, there is a $60 filing fee for Form LLPR-1-1.0.

Q: What information do I need to provide on Form LLPR-1-1.0?

A: You will need to provide the name of the Domestic Limited Liability Partnership, the date of its formation, and the reason for renouncing its status.

Q: What happens after filing Form LLPR-1-1.0?

A: After filing Form LLPR-1-1.0 and paying the filing fee, the Domestic Limited Liability Partnership's status will be officially renounced in Connecticut.

Q: Is there a deadline for filing Form LLPR-1-1.0?

A: There is no specific deadline for filing Form LLPR-1-1.0, but it is recommended to file it as soon as the decision to renounce the status is made.

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the Connecticut Secretary of the State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LLPR-1-1.0 by clicking the link below or browse more documents and templates provided by the Connecticut Secretary of the State.