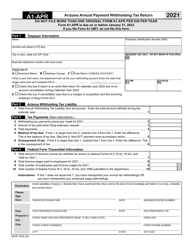

This version of the form is not currently in use and is provided for reference only. Download this version of

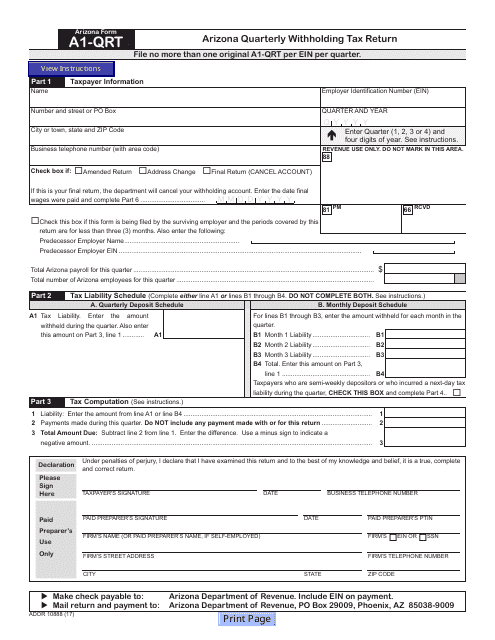

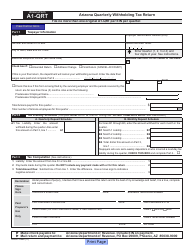

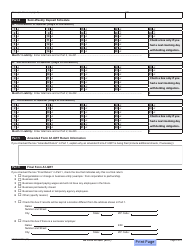

Arizona Form A1-QRT (ADOR10888)

for the current year.

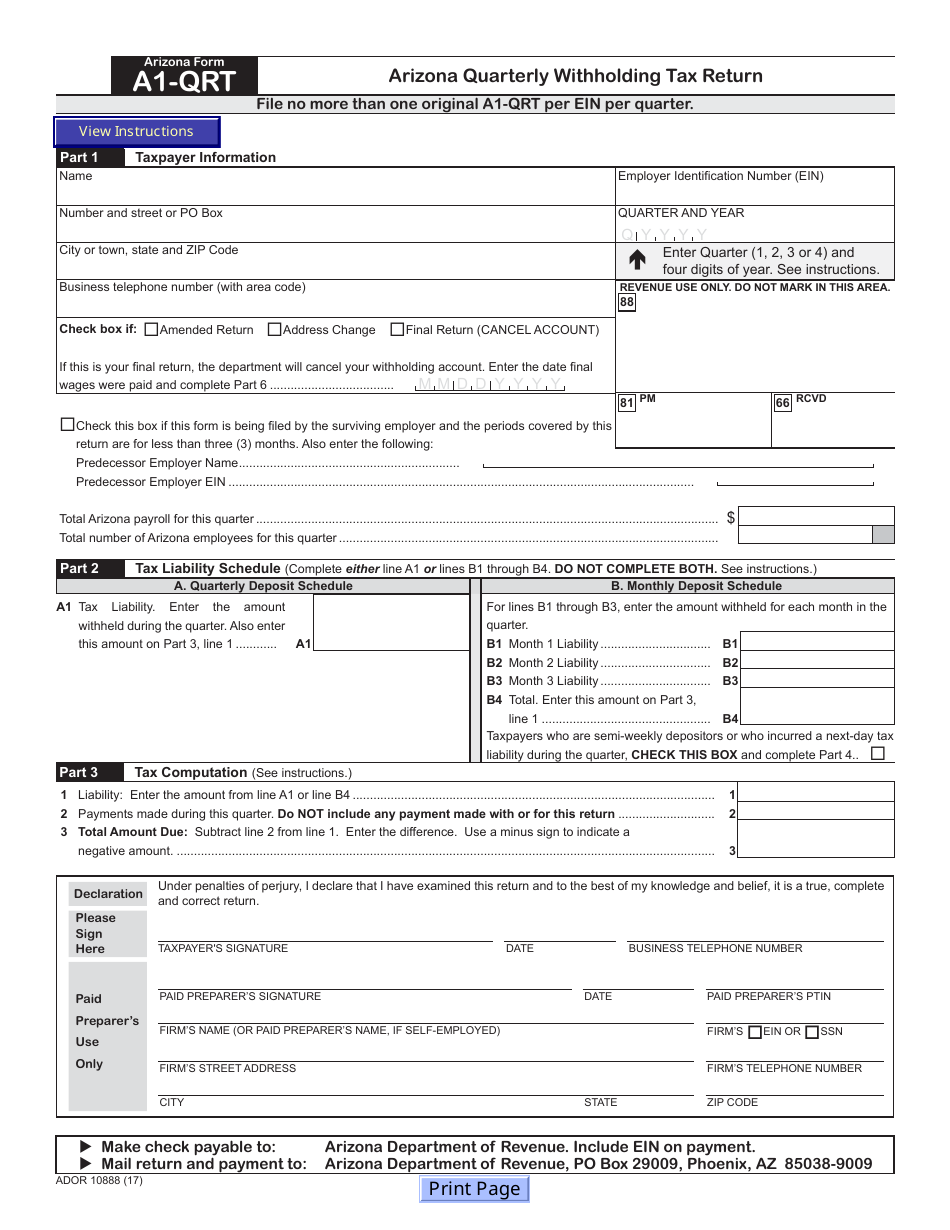

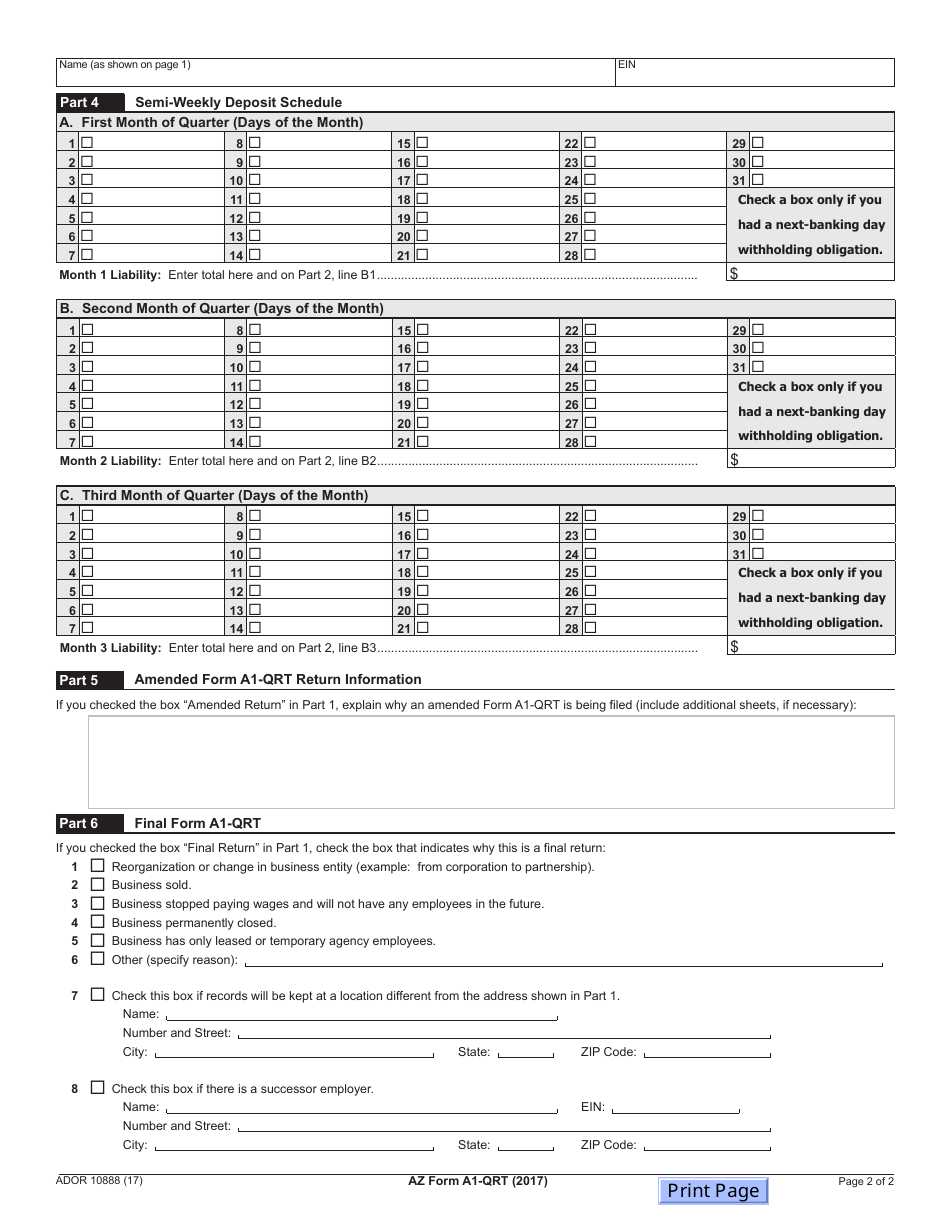

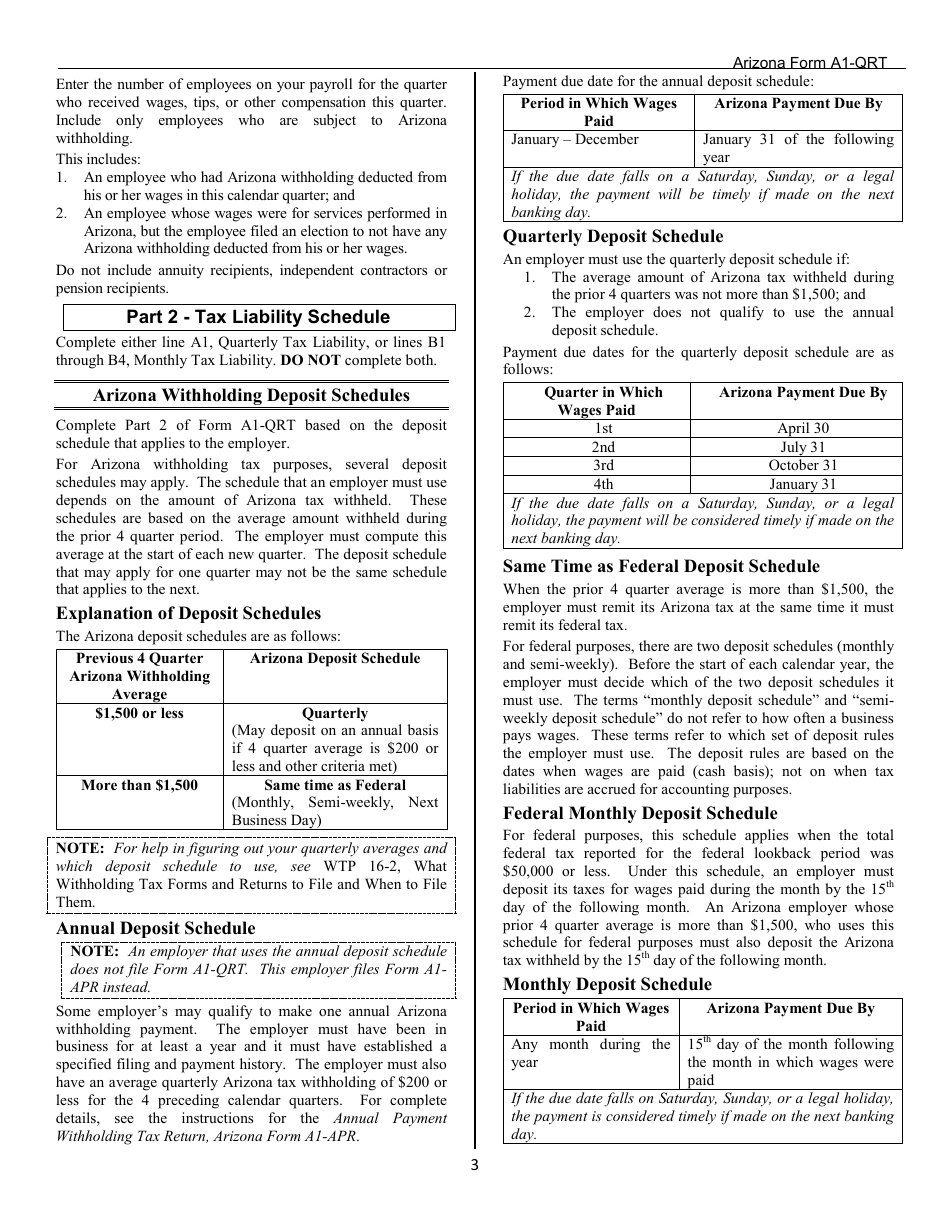

Arizona Form A1-QRT (ADOR10888) Arizona Quarterly Withholding Tax Return - Arizona

What Is Arizona Form A1-QRT (ADOR10888)?

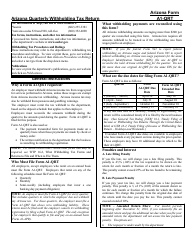

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

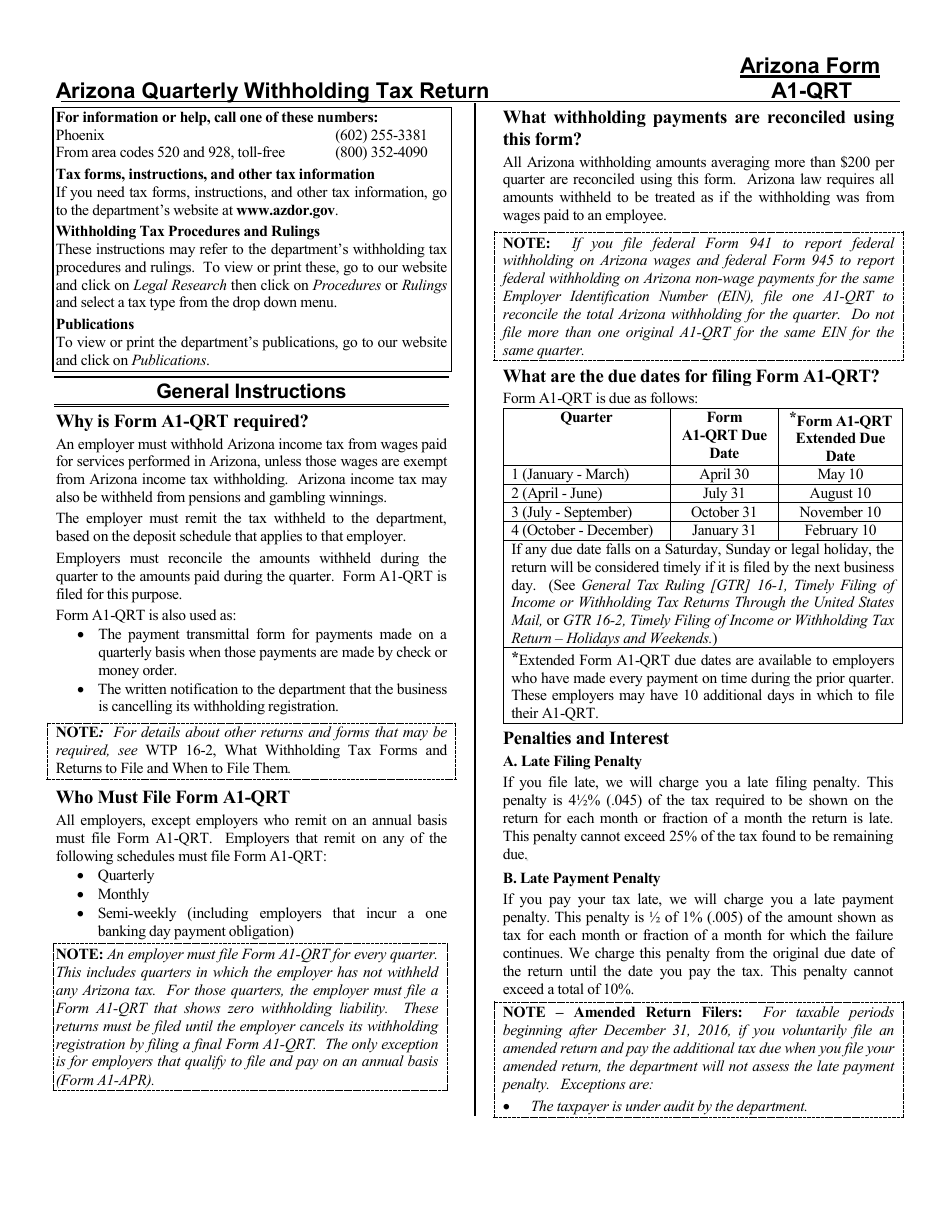

Q: What is Arizona Form A1-QRT?

A: Arizona Form A1-QRT is the Arizona Quarterly Withholding Tax Return.

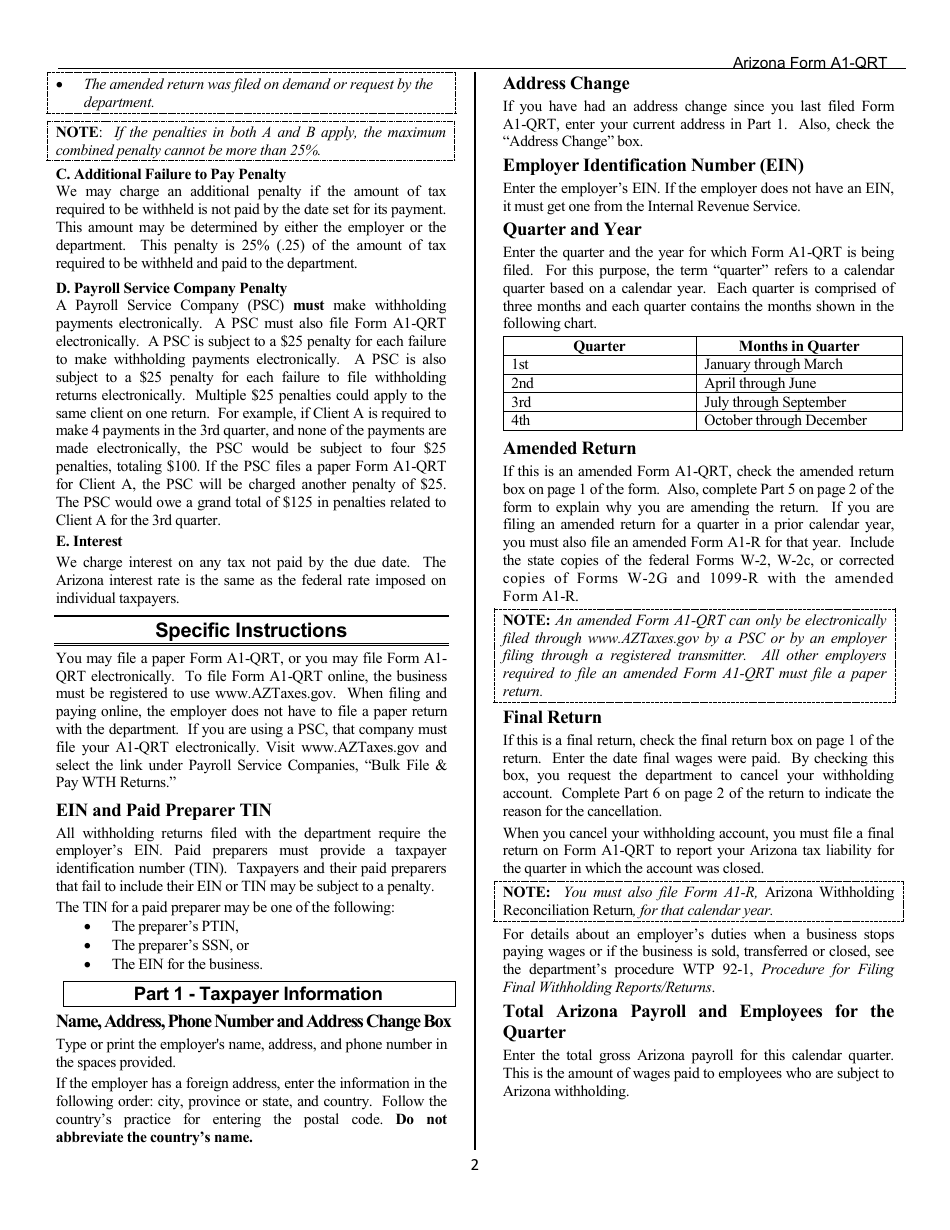

Q: Who is required to file Arizona Form A1-QRT?

A: Employers in Arizona who withhold state income tax from their employees' wages are required to file Arizona Form A1-QRT.

Q: When is Arizona Form A1-QRT due?

A: Arizona Form A1-QRT is due on the last day of the month following the end of the quarter. For example, the first quarter return is due by April 30th.

Q: What information do I need to complete Arizona Form A1-QRT?

A: To complete Arizona Form A1-QRT, you will need the total amount of state income tax withheld from your employees' wages during the quarter, as well as other relevant payroll information.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form A1-QRT (ADOR10888) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.