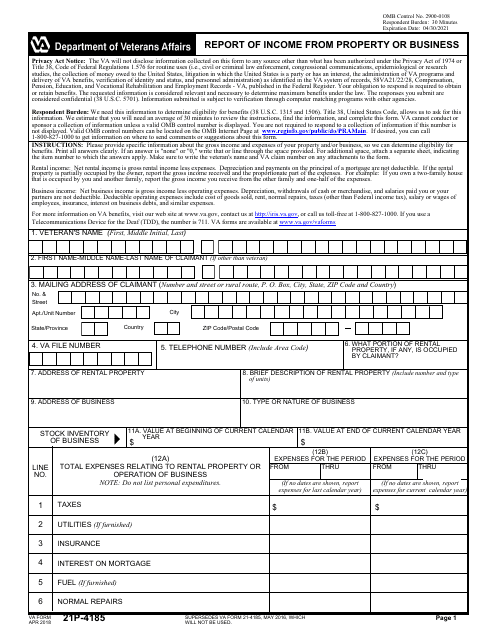

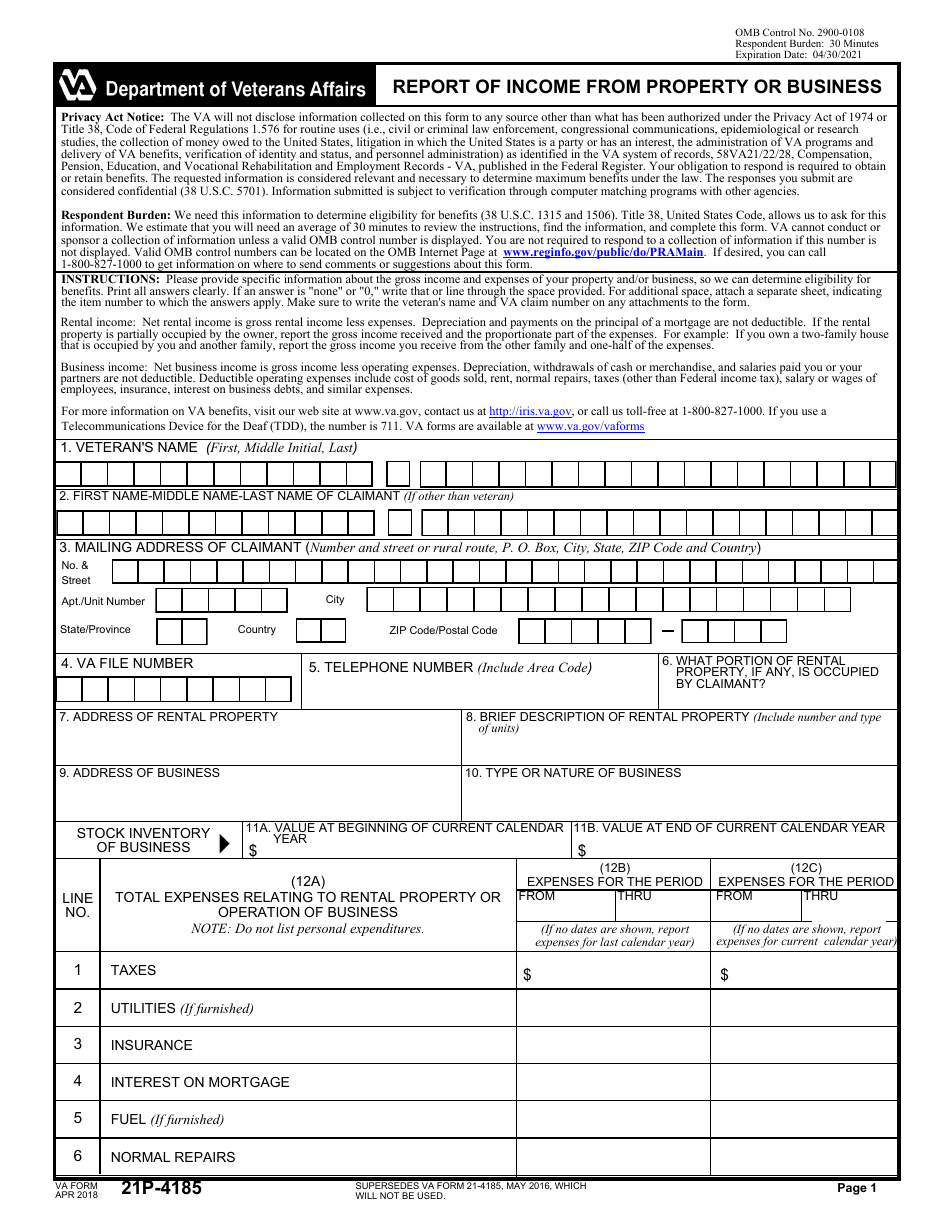

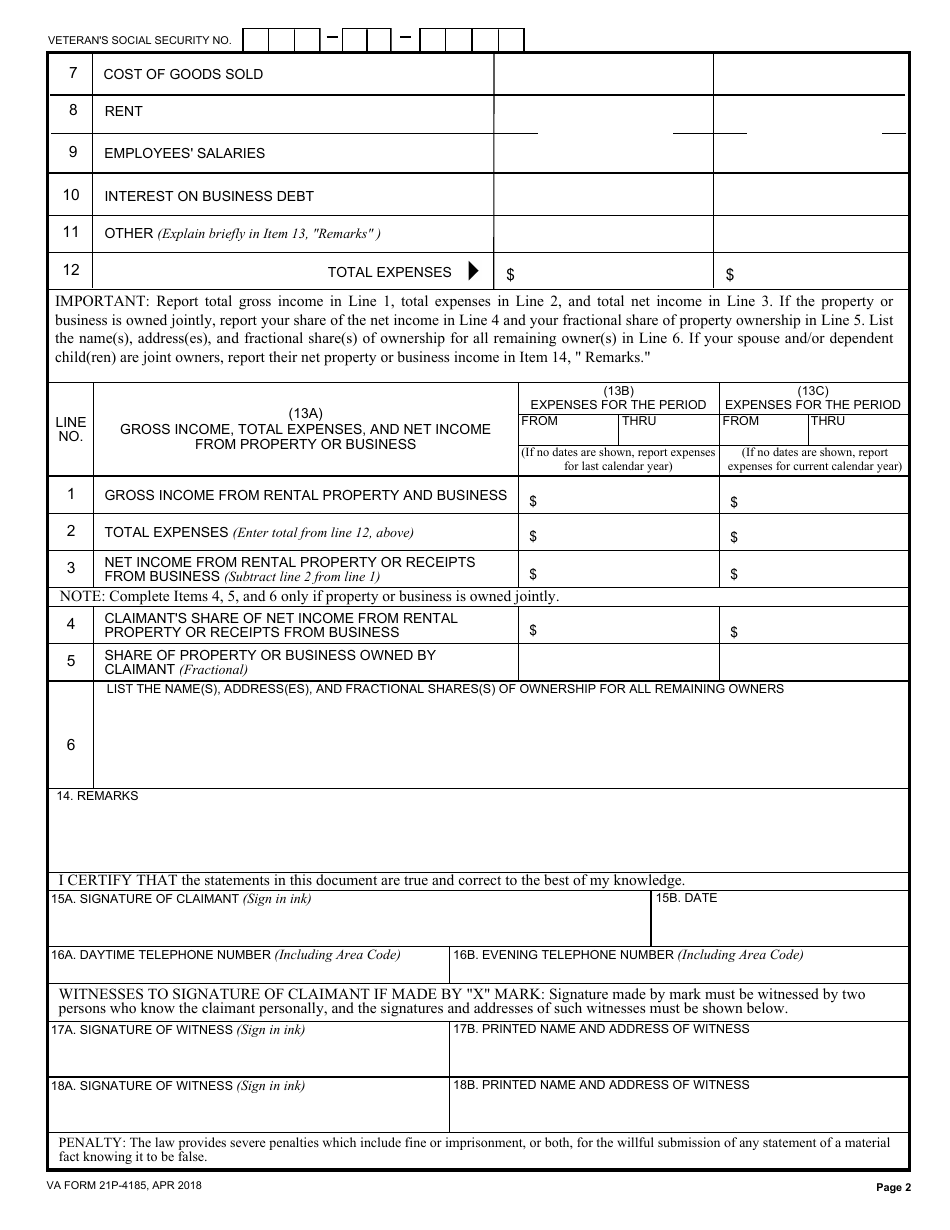

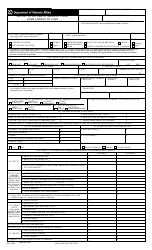

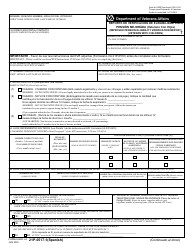

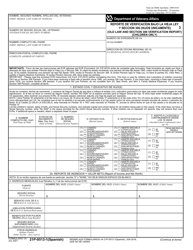

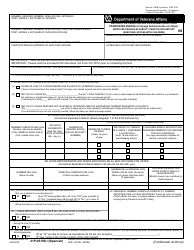

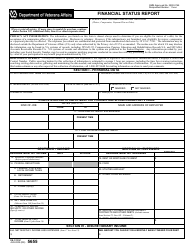

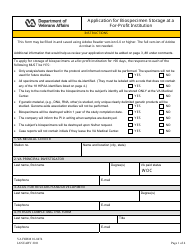

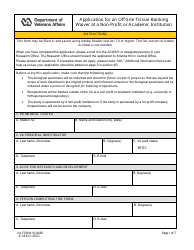

VA Form 21P-4185 Report of Income From Property or Business

What Is VA Form 21P-4185?

This is a legal form that was released by the U.S. Department of Veterans Affairs on April 1, 2018 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is VA Form 21P-4185?

A: VA Form 21P-4185 is a form used to report income from property or business to the Department of Veterans Affairs.

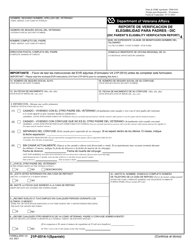

Q: Who needs to fill out VA Form 21P-4185?

A: Any veteran or beneficiary who receives income from property or business needs to fill out VA Form 21P-4185.

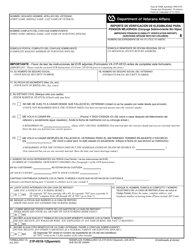

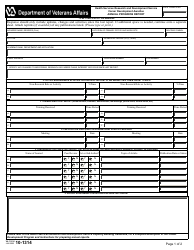

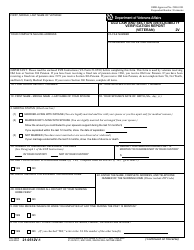

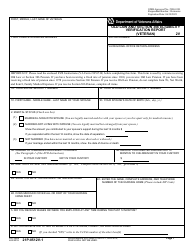

Q: What information is required on VA Form 21P-4185?

A: VA Form 21P-4185 requires information about the income received, such as the source of income, amount, and frequency.

Q: Is VA Form 21P-4185 mandatory?

A: Yes, veterans and beneficiaries who receive income from property or business are required to fill out VA Form 21P-4185.

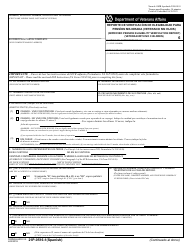

Q: When should I submit VA Form 21P-4185?

A: VA Form 21P-4185 should be submitted annually, or whenever there is a change in income from property or business.

Q: What happens if I don't submit VA Form 21P-4185?

A: Failure to submit VA Form 21P-4185 may result in a delay or denial of benefits from the Department of Veterans Affairs.

Form Details:

- Released on April 1, 2018;

- The latest available edition released by the U.S. Department of Veterans Affairs;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VA Form 21P-4185 by clicking the link below or browse more documents and templates provided by the U.S. Department of Veterans Affairs.