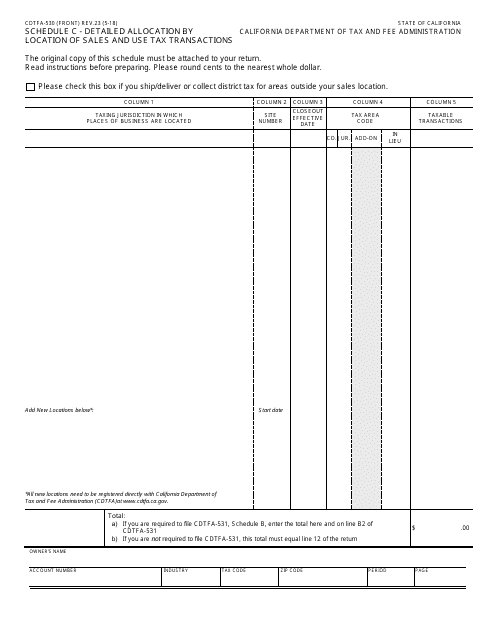

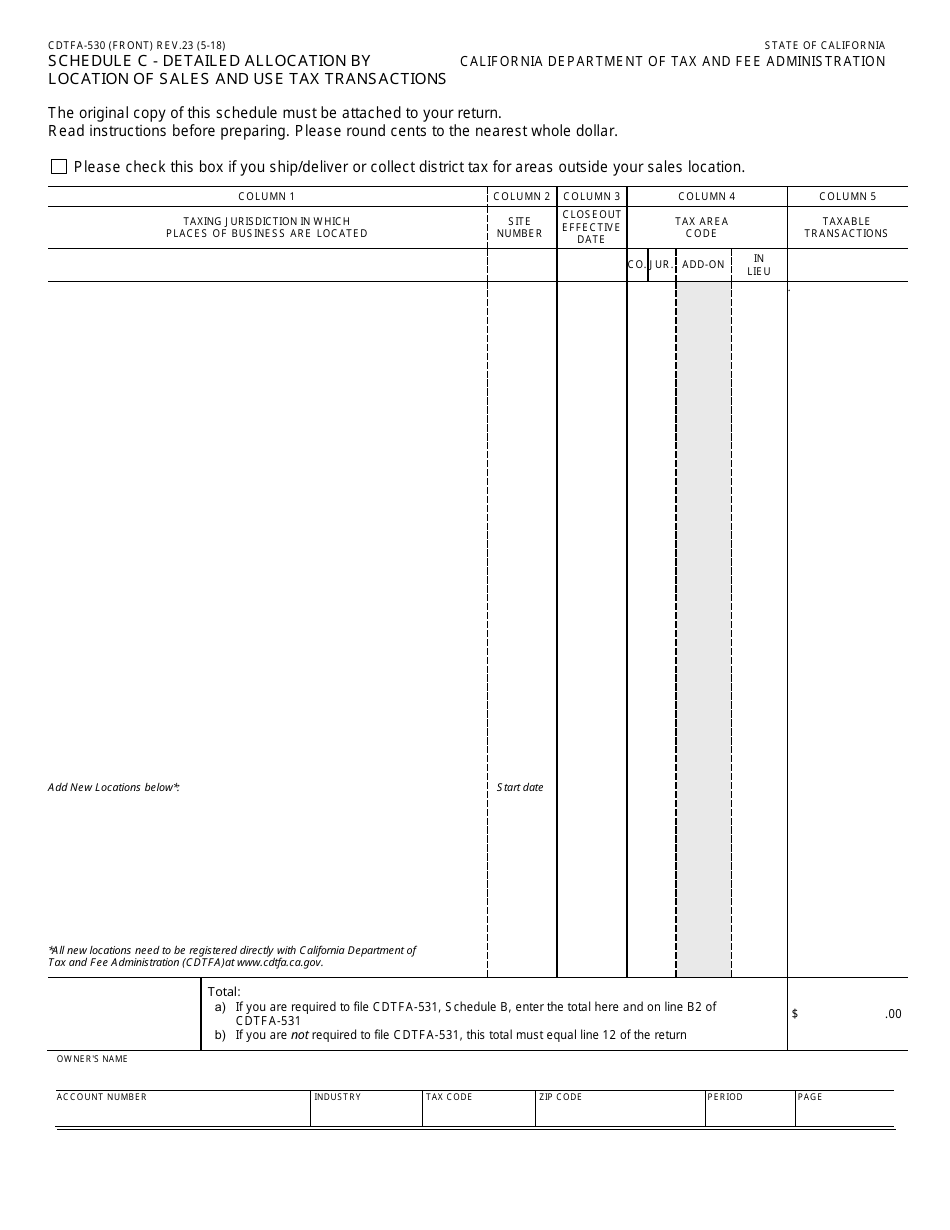

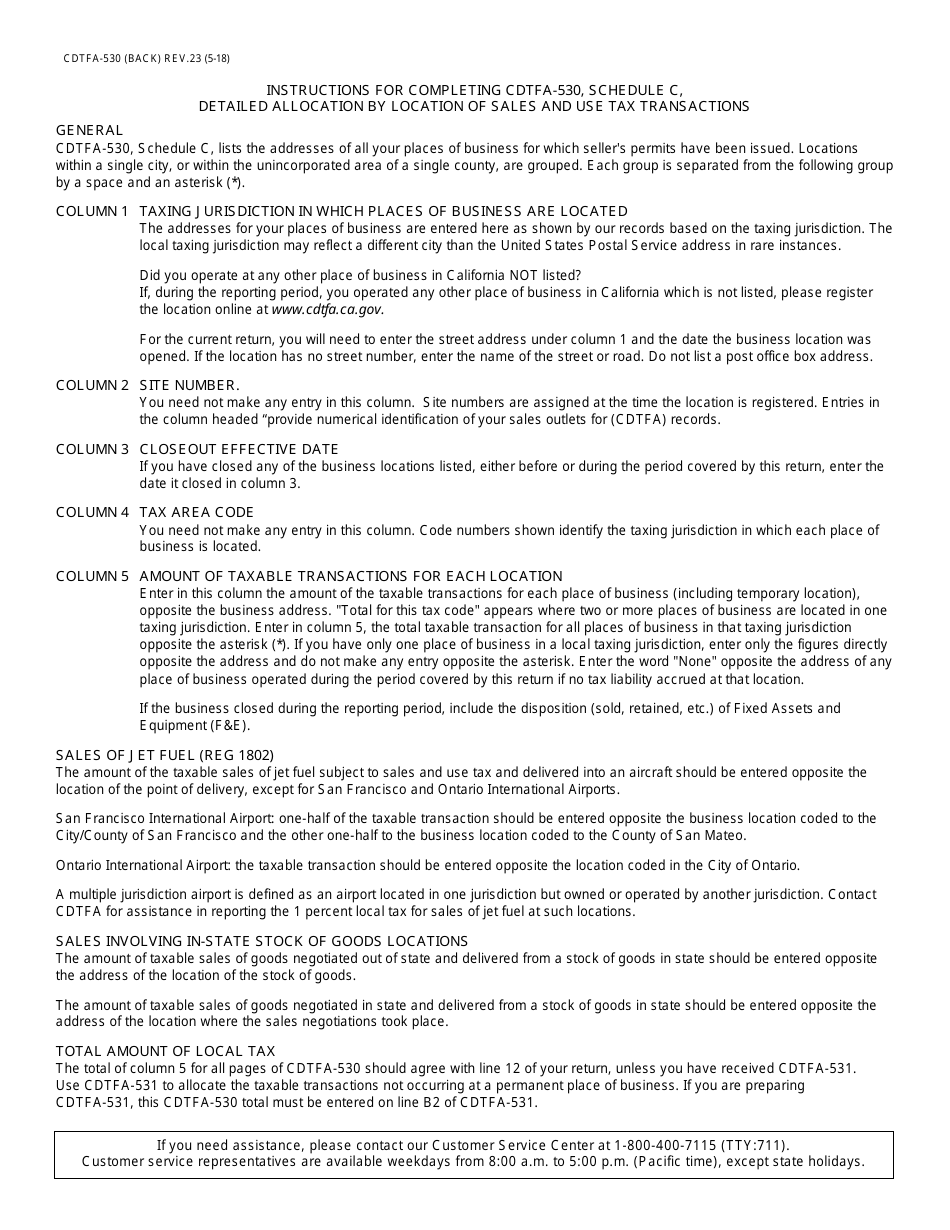

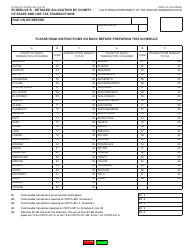

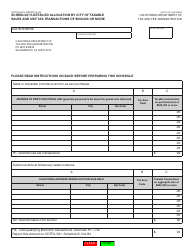

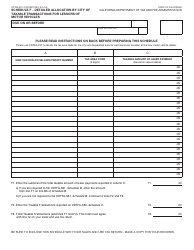

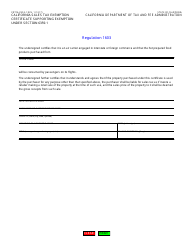

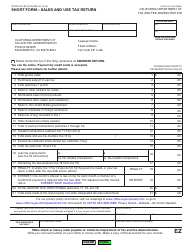

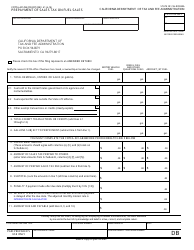

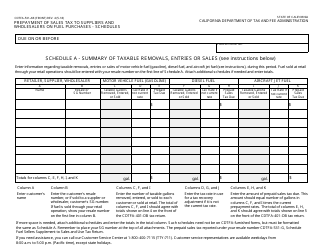

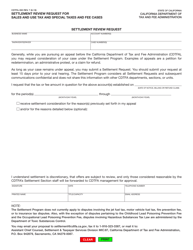

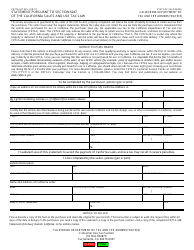

Form CDTFA-530 Schedule C Detailed Allocation by Location of Sales and Use Tax Transactions - California

What Is Form CDTFA-530 Schedule C?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-530 Schedule C?

A: Form CDTFA-530 Schedule C is a document used for the detailed allocation of sales and use tax transactions in California.

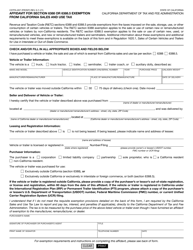

Q: What is the purpose of Form CDTFA-530 Schedule C?

A: The purpose of Form CDTFA-530 Schedule C is to provide a breakdown of sales and use tax transactions by location in California.

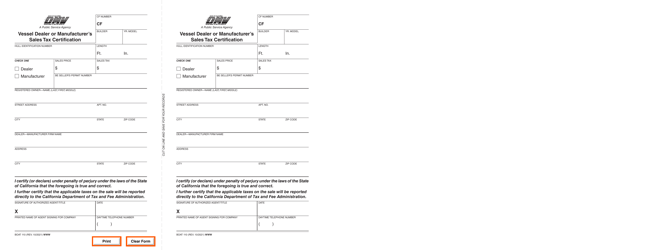

Q: Who uses Form CDTFA-530 Schedule C?

A: Form CDTFA-530 Schedule C is used by businesses that need to report their sales and use tax transactions in California.

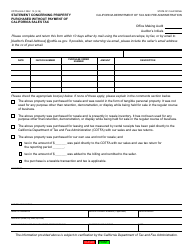

Q: What information is required on Form CDTFA-530 Schedule C?

A: Form CDTFA-530 Schedule C requires businesses to provide details of their sales and use tax transactions, including the location of each transaction.

Q: Is Form CDTFA-530 Schedule C specific to California?

A: Yes, Form CDTFA-530 Schedule C is specific to sales and use tax transactions in California.

Q: Are there any deadlines for submitting Form CDTFA-530 Schedule C?

A: Yes, businesses are required to submit Form CDTFA-530 Schedule C on a quarterly basis, with specific deadlines established by the CDTFA.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-530 Schedule C by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.