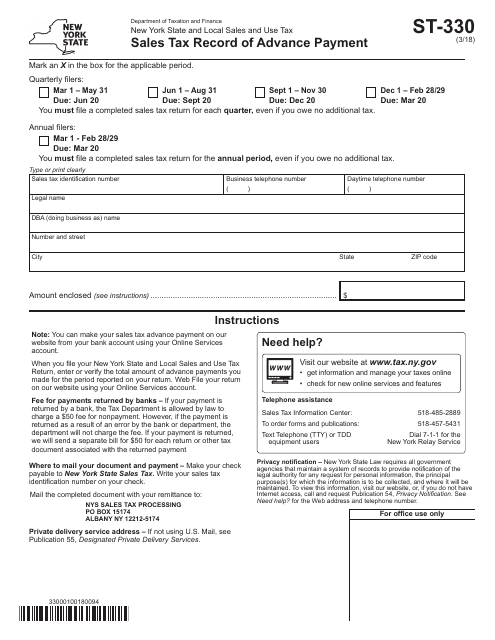

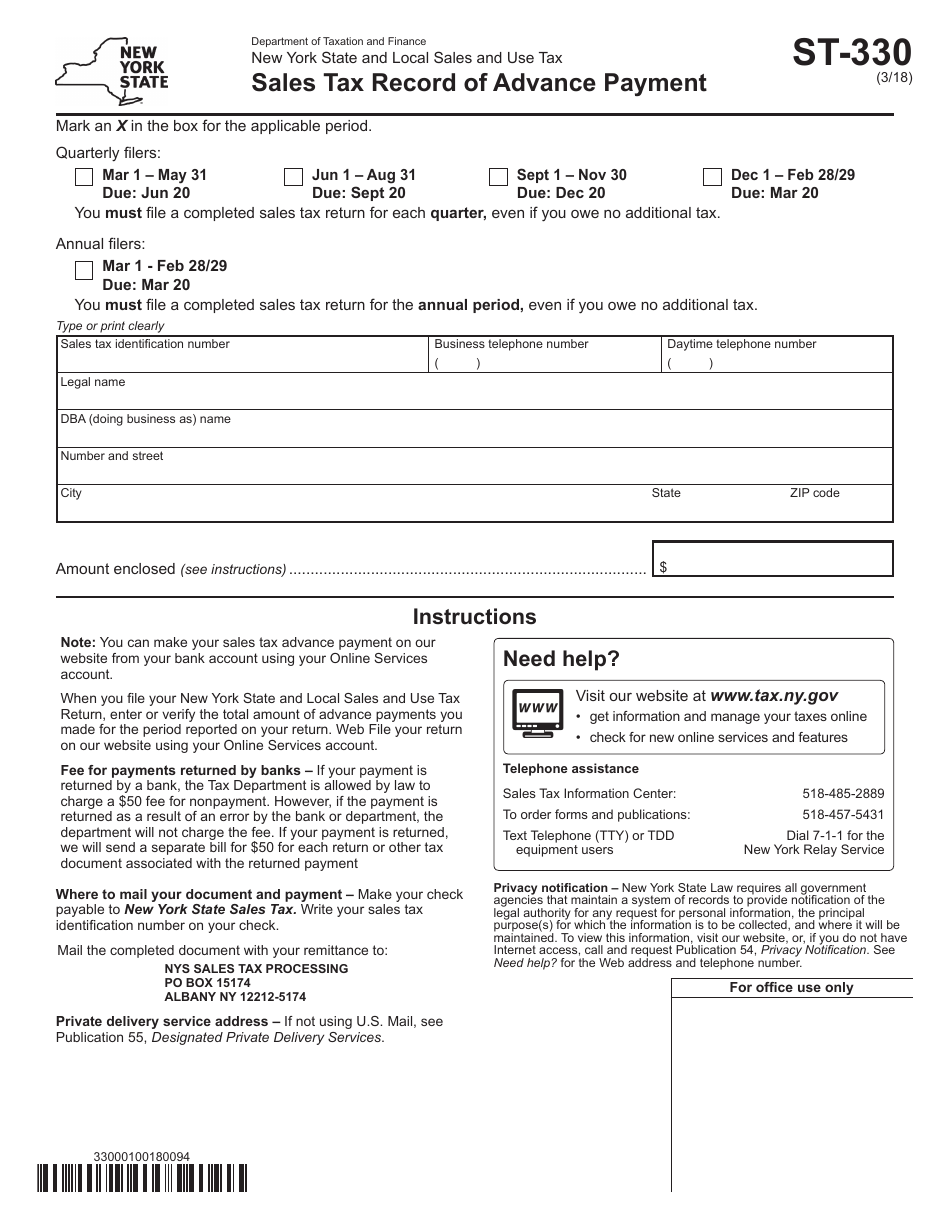

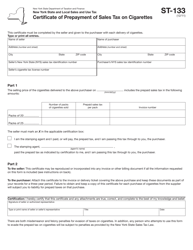

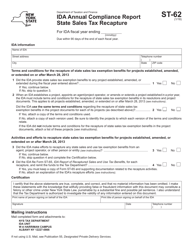

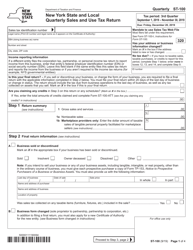

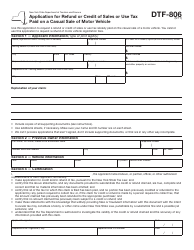

Form ST-330 Sales Tax Record of Advance Payment - New York

What Is Form ST-330?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-330?

A: Form ST-330 is the Sales Tax Record of Advance Payment used in New York.

Q: What is the purpose of Form ST-330?

A: The purpose of Form ST-330 is to report and record the advance sales tax payment made by a taxpayer.

Q: Who needs to fill out Form ST-330?

A: Taxpayers in New York who have made an advance payment of sales tax are required to fill out Form ST-330.

Q: When should Form ST-330 be filed?

A: Form ST-330 should be filed at the time the advance payment is made.

Q: Are there any penalties for not filing Form ST-330?

A: Yes, failure to file Form ST-330 or filing it late may result in penalties and interest charges.

Q: What information is required on Form ST-330?

A: Form ST-330 requires information about the taxpayer, the advance payment amount, and the purpose of the payment.

Q: Can I amend a filed Form ST-330?

A: Yes, a filed Form ST-330 can be amended by submitting a corrected form with the updated information.

Q: Is Form ST-330 used for all types of sales tax payments?

A: No, Form ST-330 is specifically used for reporting and recording advance sales tax payments only.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-330 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.