This version of the form is not currently in use and is provided for reference only. Download this version of

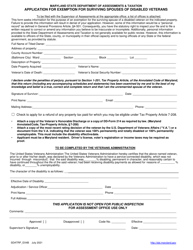

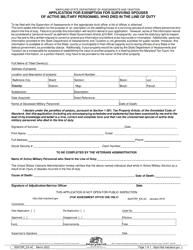

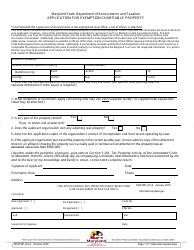

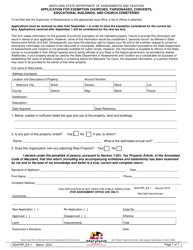

Form SDATRP_EX-4A

for the current year.

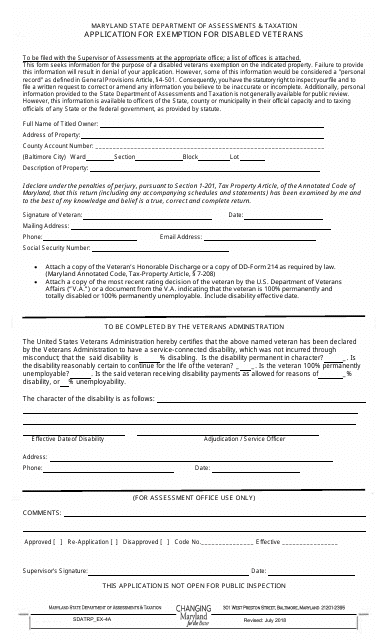

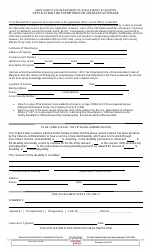

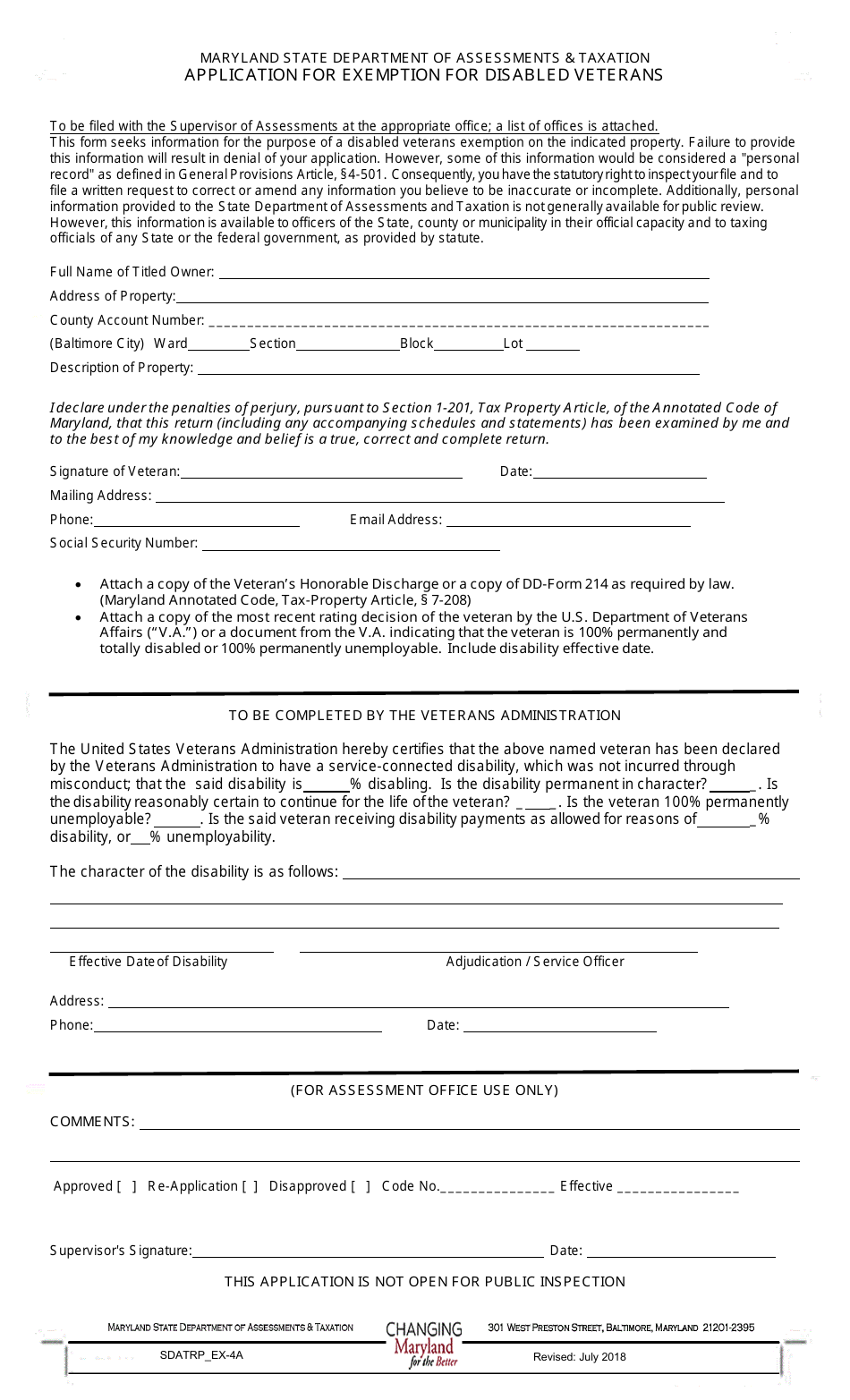

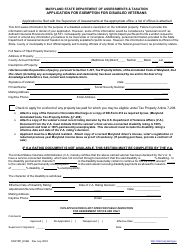

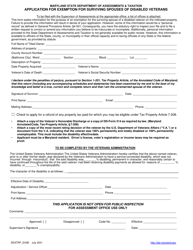

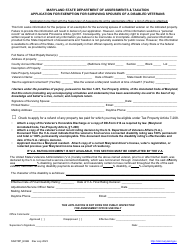

Form SDATRP_EX-4A Application for Exemption for Disabled Veterans - Maryland

What Is Form SDATRP_EX-4A?

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SDATRP_EX-4A?

A: SDATRP_EX-4A is an application for exemption for disabled veterans in Maryland.

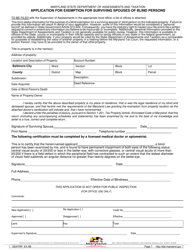

Q: Who is eligible for the exemption?

A: Disabled veterans who meet certain criteria are eligible for the exemption.

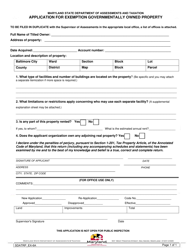

Q: What does the SDATRP_EX-4A application entail?

A: The application requires veterans to provide information about their disability and military service.

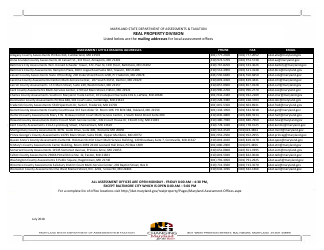

Q: How can I obtain the SDATRP_EX-4A application?

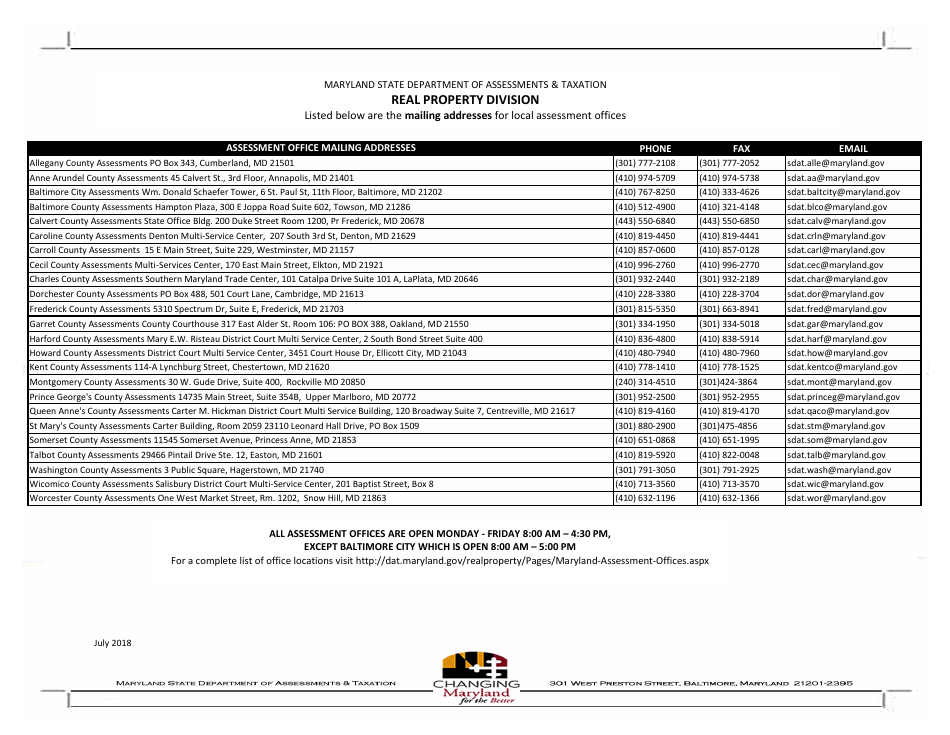

A: The application can be obtained from the Maryland State Department of Assessments and Taxation.

Q: What are the benefits of the exemption?

A: The exemption reduces or eliminates property taxes for eligible disabled veterans in Maryland.

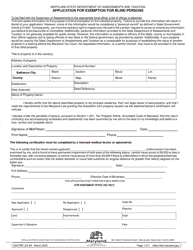

Q: Are there any deadlines for submitting the application?

A: The application should be submitted by a specific deadline each year. Consult the Maryland State Department of Assessments and Taxation for the current deadline.

Q: Are there any fees associated with the application?

A: There is no fee to apply for the SDATRP_EX-4A exemption.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SDATRP_EX-4A by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.