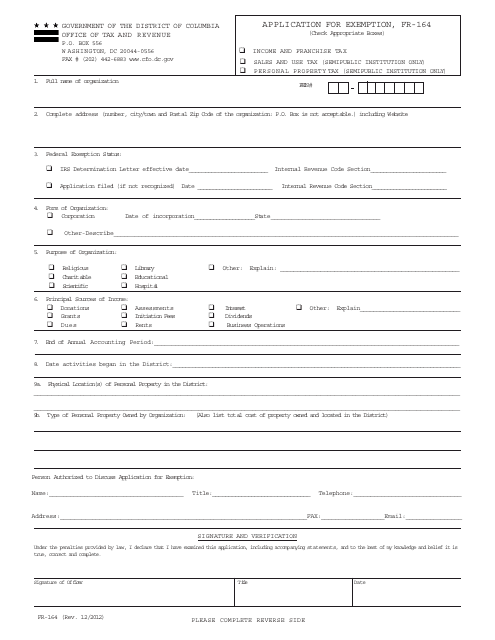

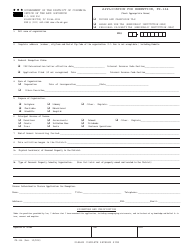

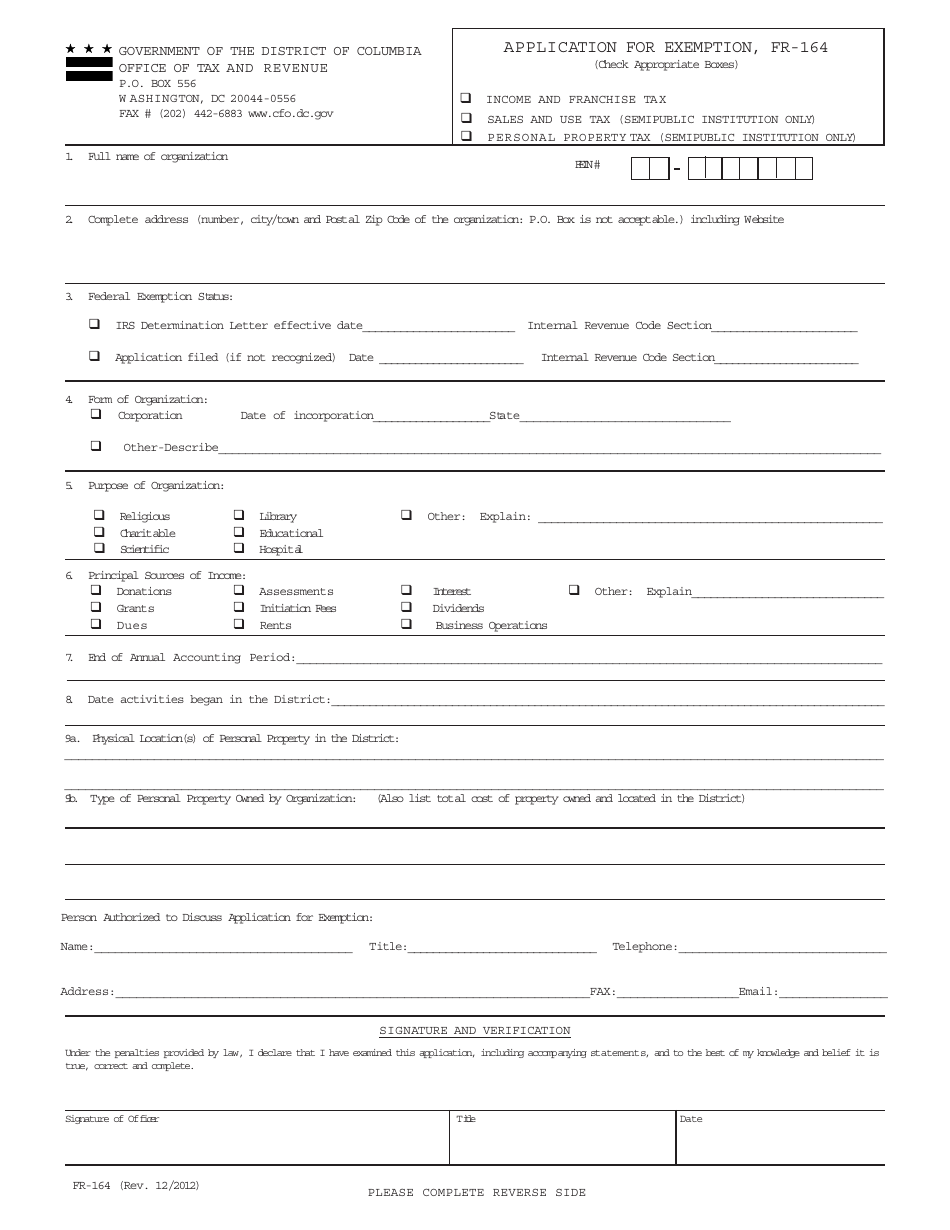

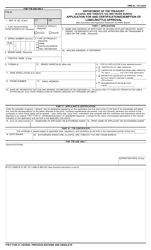

Form FR-164 Application for Exemption - Washington, D.C.

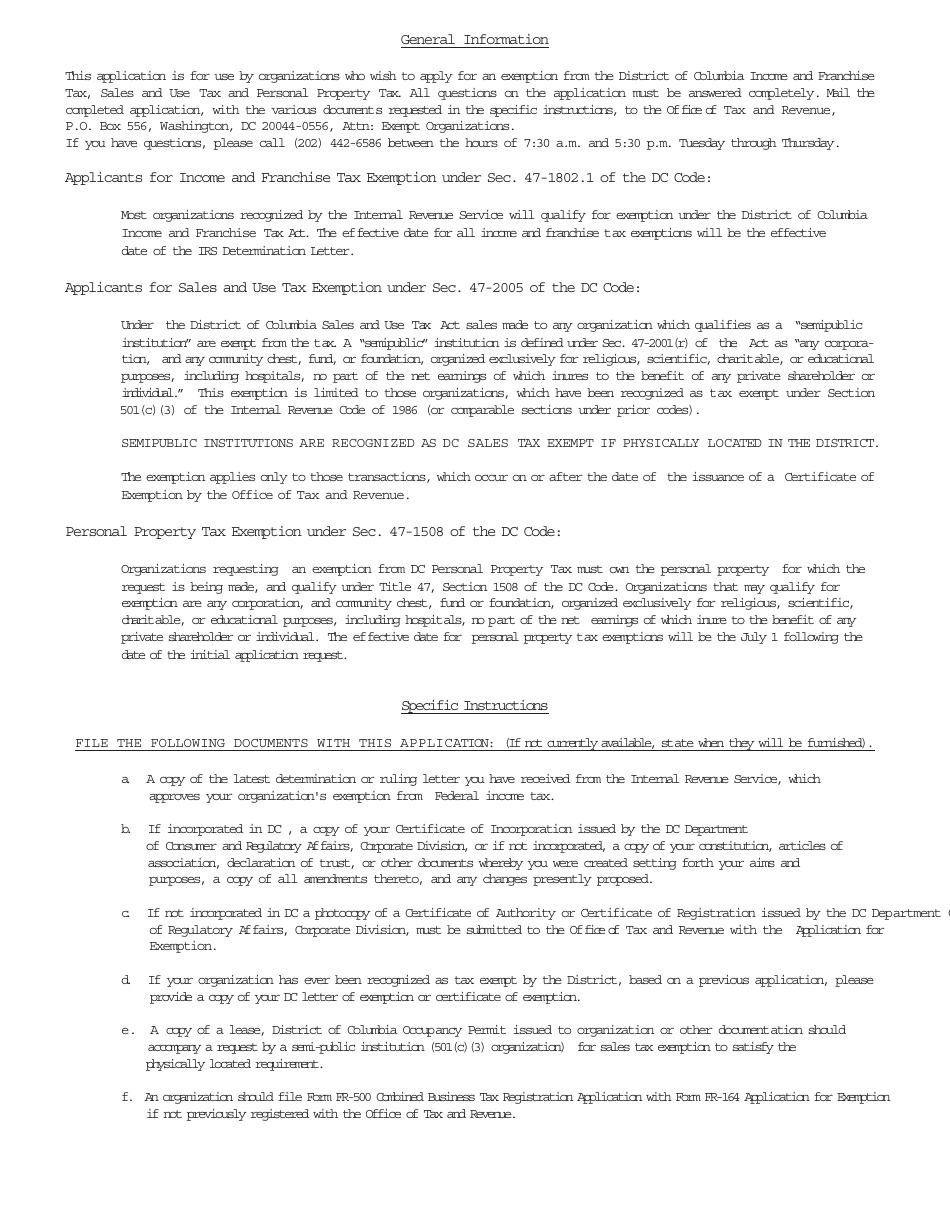

What Is Form FR-164?

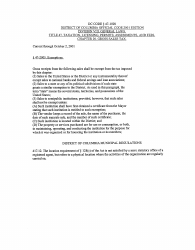

This is a legal form that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C.. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is FR-164?

A: FR-164 is the application for exemption in Washington, D.C.

Q: Who needs to fill out form FR-164?

A: Anyone seeking exemption in Washington, D.C. needs to fill out form FR-164.

Q: What is the purpose of form FR-164?

A: Form FR-164 is used to apply for exemption from certain taxes in Washington, D.C.

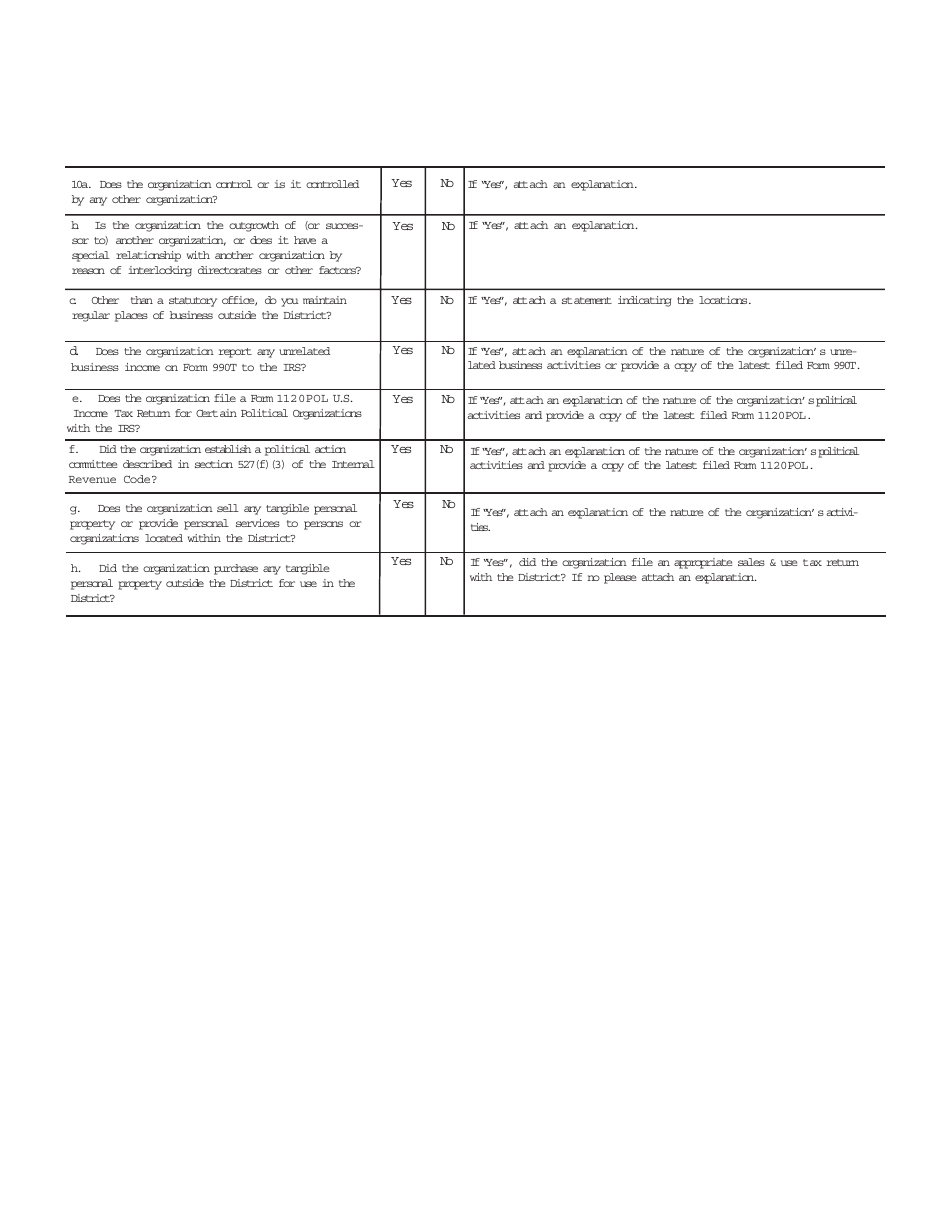

Q: What information is required on form FR-164?

A: Form FR-164 requires personal and/or organizational information, as well as details regarding the exemption being sought.

Q: Is there a fee for filing form FR-164?

A: No, there is no fee for filing form FR-164.

Q: How long does it take to process form FR-164?

A: Processing times can vary, but it typically takes several weeks to process form FR-164.

Q: What should I do if I need help filling out form FR-164?

A: If you need assistance, you can contact the Washington, D.C. tax office or consult a tax professional.

Q: Are there any exemptions available for individuals in Washington, D.C.?

A: Yes, there are certain exemptions available for individuals in Washington, D.C. that can be applied for using form FR-164.

Form Details:

- Released on December 1, 2012;

- The latest edition provided by the Washington DC Office of Tax and Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FR-164 by clicking the link below or browse more documents and templates provided by the Washington Dc Office of Tax and Revenue.