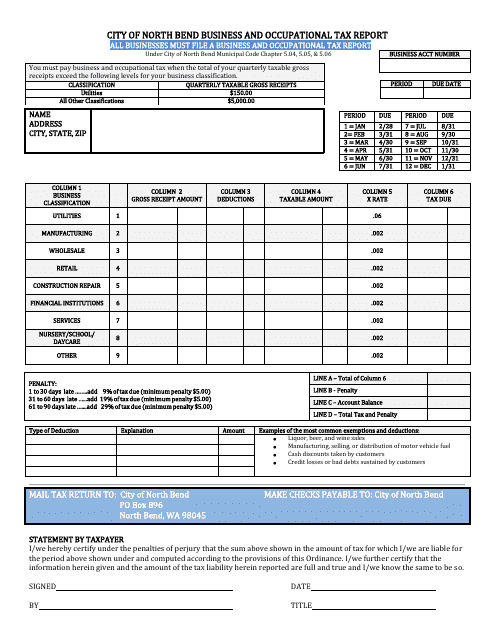

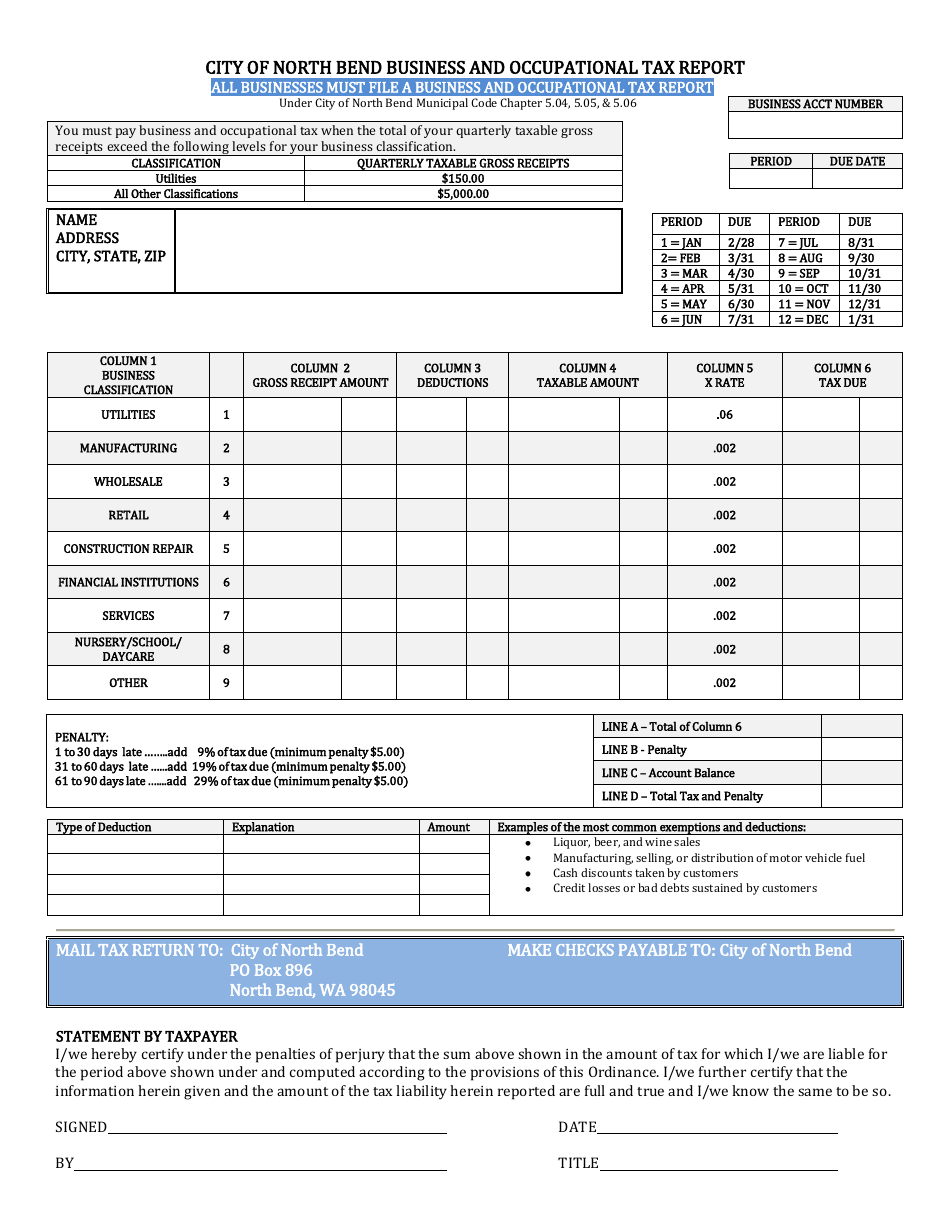

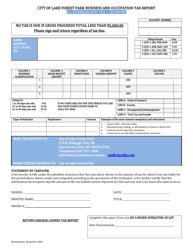

Business and Occupational Tax Report Form - City of North Bend, Washington

Business and Occupational Tax Report Form is a legal document that was released by the Washington State Department of Revenue - a government authority operating within Washington. The form may be used strictly within City of North Bend.

FAQ

Q: What is the Business and Occupational Tax Report Form?

A: The Business and Occupational Tax Report Form is a form used by businesses in the City of North Bend, Washington to report their business and occupational tax liabilities.

Q: Who needs to file the Business and Occupational Tax Report Form?

A: All businesses operating in the City of North Bend, Washington are required to file the Business and Occupational Tax Report Form.

Q: What information is required on the Business and Occupational Tax Report Form?

A: The form generally asks for information such as the business's gross receipts, number of employees, and type of business activity.

Q: When is the deadline to file the Business and Occupational Tax Report Form?

A: The deadline to file the form varies, but it is typically due annually on a specific date, such as April 30th.

Q: Are there any penalties for late filing of the Business and Occupational Tax Report Form?

A: Yes, there may be penalties for late filing, so it is important to submit the form on time to avoid any penalties.

Q: What is the purpose of the Business and Occupational Tax?

A: The Business and Occupational Tax helps fund various city services and infrastructure projects in the City of North Bend, Washington.

Q: Is the Business and Occupational Tax applicable to all types of businesses?

A: Yes, the tax is applicable to all businesses operating within the city limits of North Bend, Washington, regardless of their size or type of business activity.

Form Details:

- The latest edition currently provided by the Washington State Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.