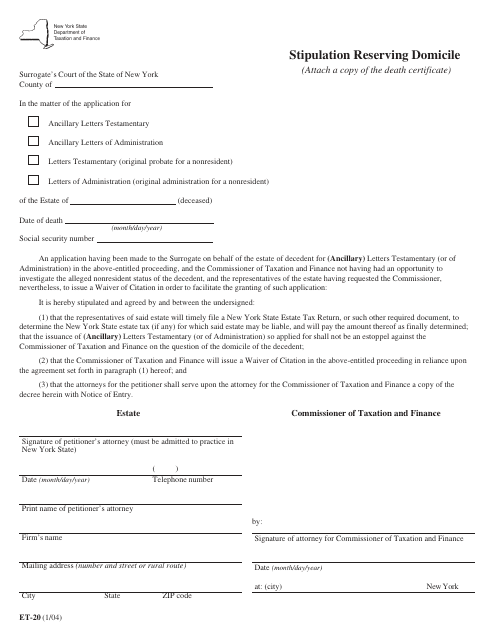

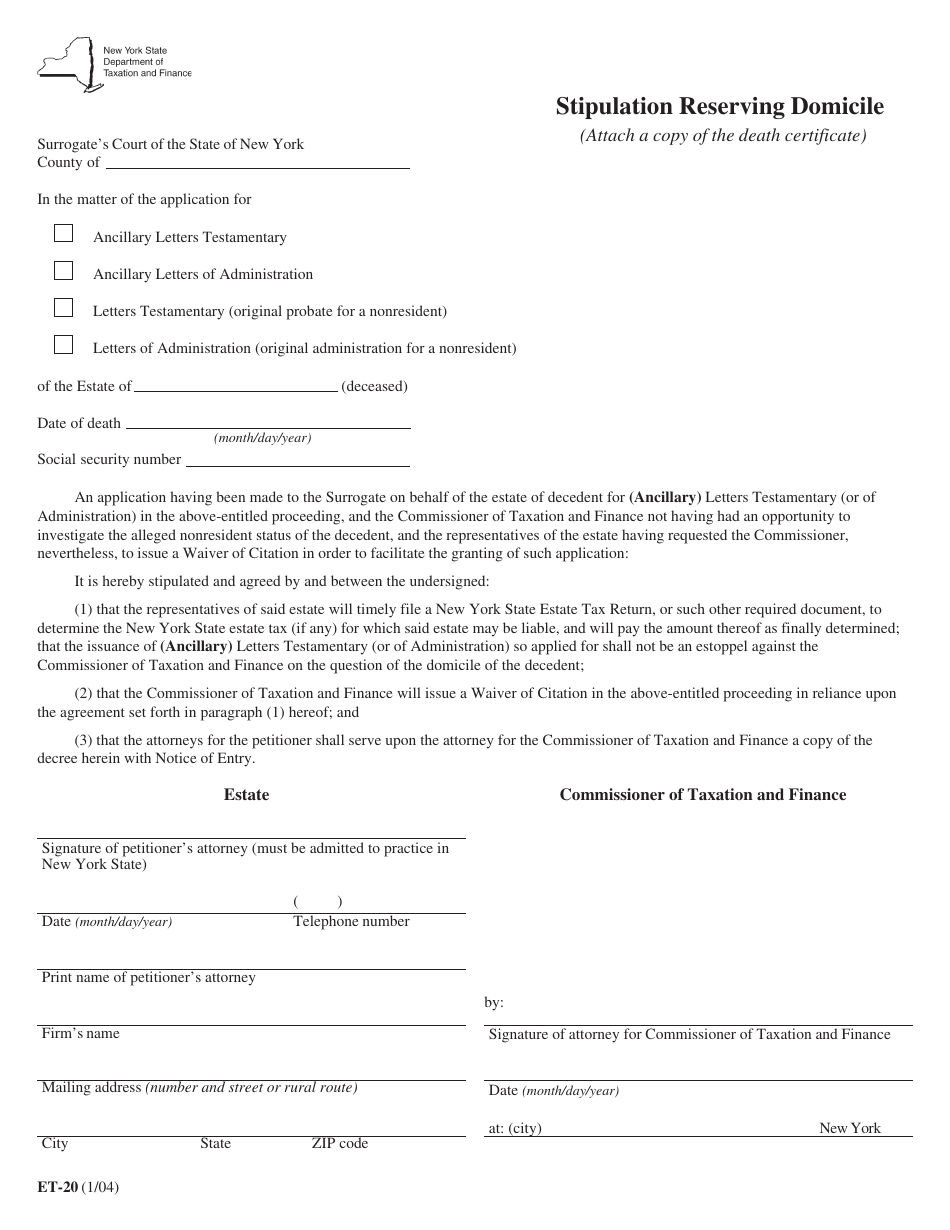

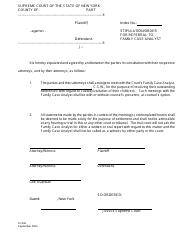

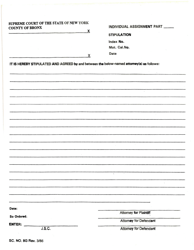

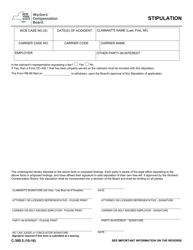

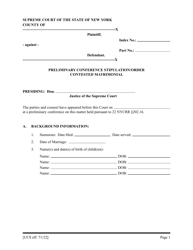

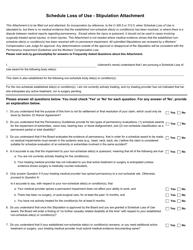

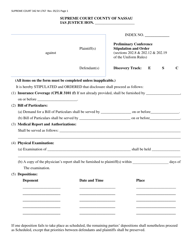

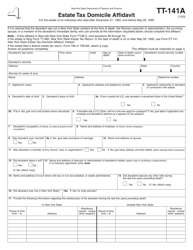

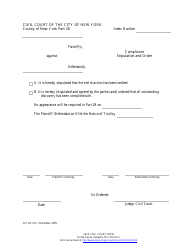

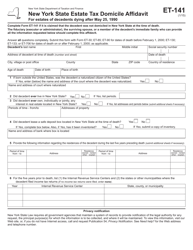

Form ET-20 Stipulation Reserving Domicile - New York

What Is Form ET-20?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ET-20?

A: Form ET-20 is a stipulation for reserving domicile in New York.

Q: What is the purpose of Form ET-20?

A: The purpose of Form ET-20 is to reserve domicile in New York.

Q: Who needs to use Form ET-20?

A: Anyone who wants to reserve domicile in New York needs to use Form ET-20.

Q: Are there any fees associated with Form ET-20?

A: There may be fees associated with filing Form ET-20, depending on the requirements of the government authority.

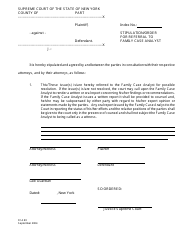

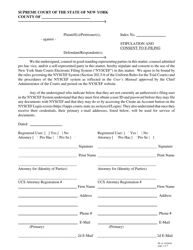

Q: What information is required in Form ET-20?

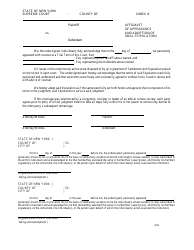

A: Form ET-20 typically requires personal information, such as name, address, and current domicile, as well as a statement of intent to reserve domicile in New York.

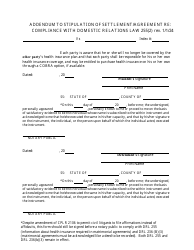

Q: Can Form ET-20 be used for other purposes?

A: No, Form ET-20 is specifically for reserving domicile in New York and should not be used for other purposes.

Q: Is Form ET-20 legally binding?

A: Yes, Form ET-20 is a legally binding stipulation.

Q: Do I need legal assistance to fill out Form ET-20?

A: While not required, legal assistance can be helpful in ensuring that you complete Form ET-20 correctly.

Q: Is there a deadline for submitting Form ET-20?

A: The deadline for submitting Form ET-20 may vary depending on the specific requirements set by the government authority.

Form Details:

- Released on January 1, 2004;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ET-20 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.