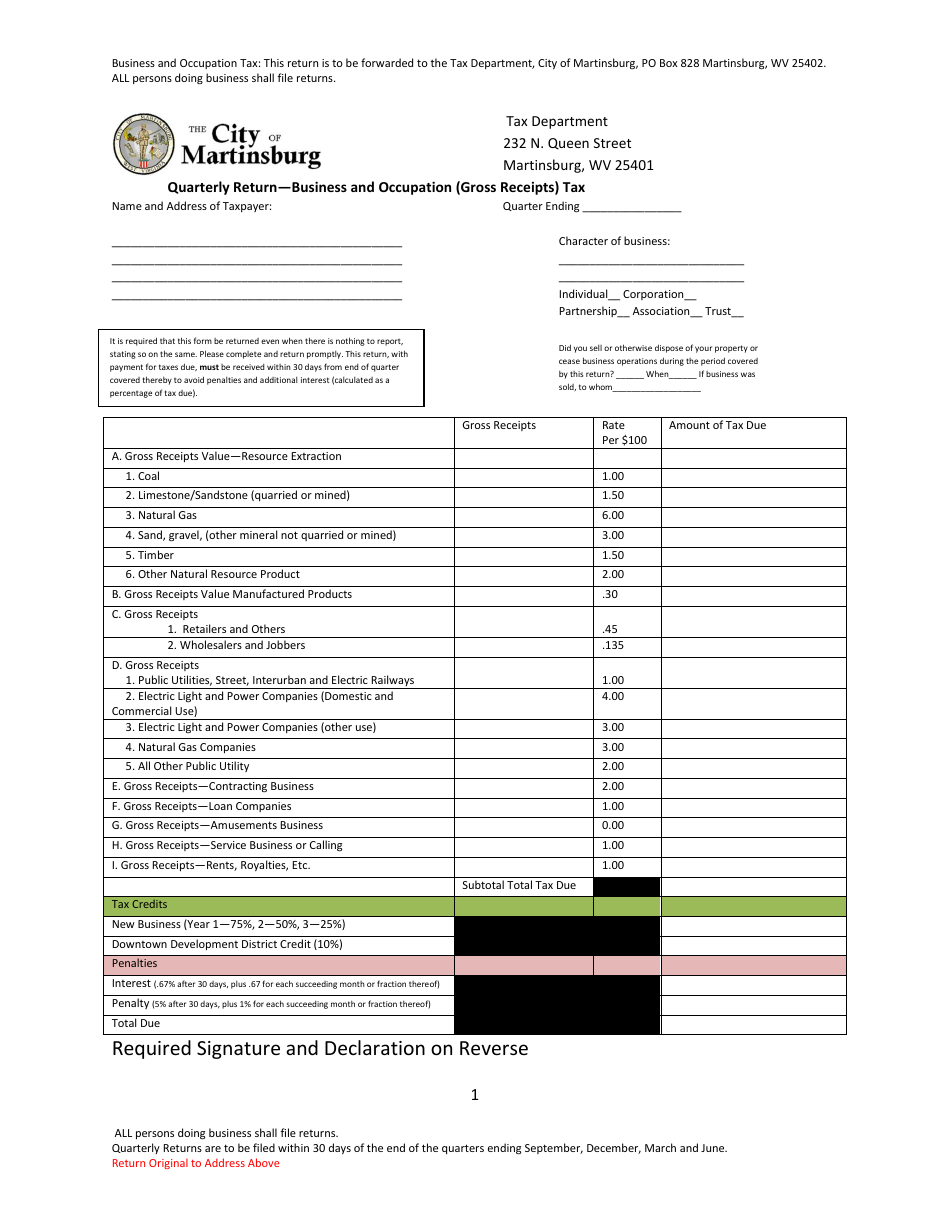

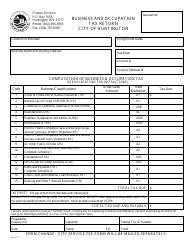

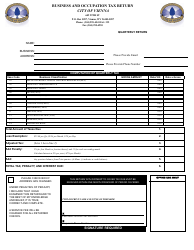

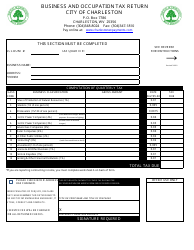

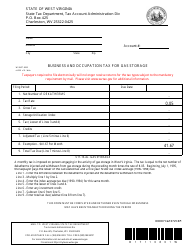

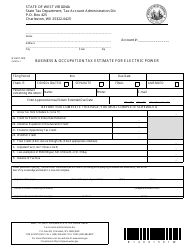

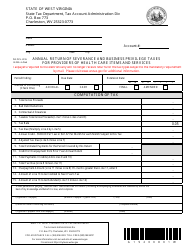

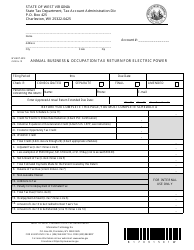

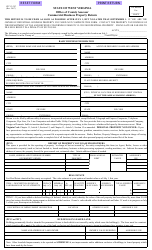

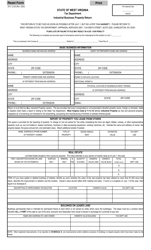

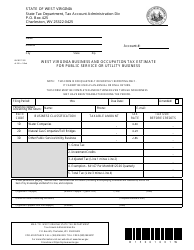

Quarterly Return - Business and Occupation (Gross Receipts) Tax - West Virginia

Quarterly Return - Business and Occupation (Gross Receipts) Tax is a legal document that was released by the Finance Department - City of Martinsburg, West Virginia - a government authority operating within West Virginia.

FAQ

Q: What is the Quarterly Return - Business and Occupation (Gross Receipts) Tax?

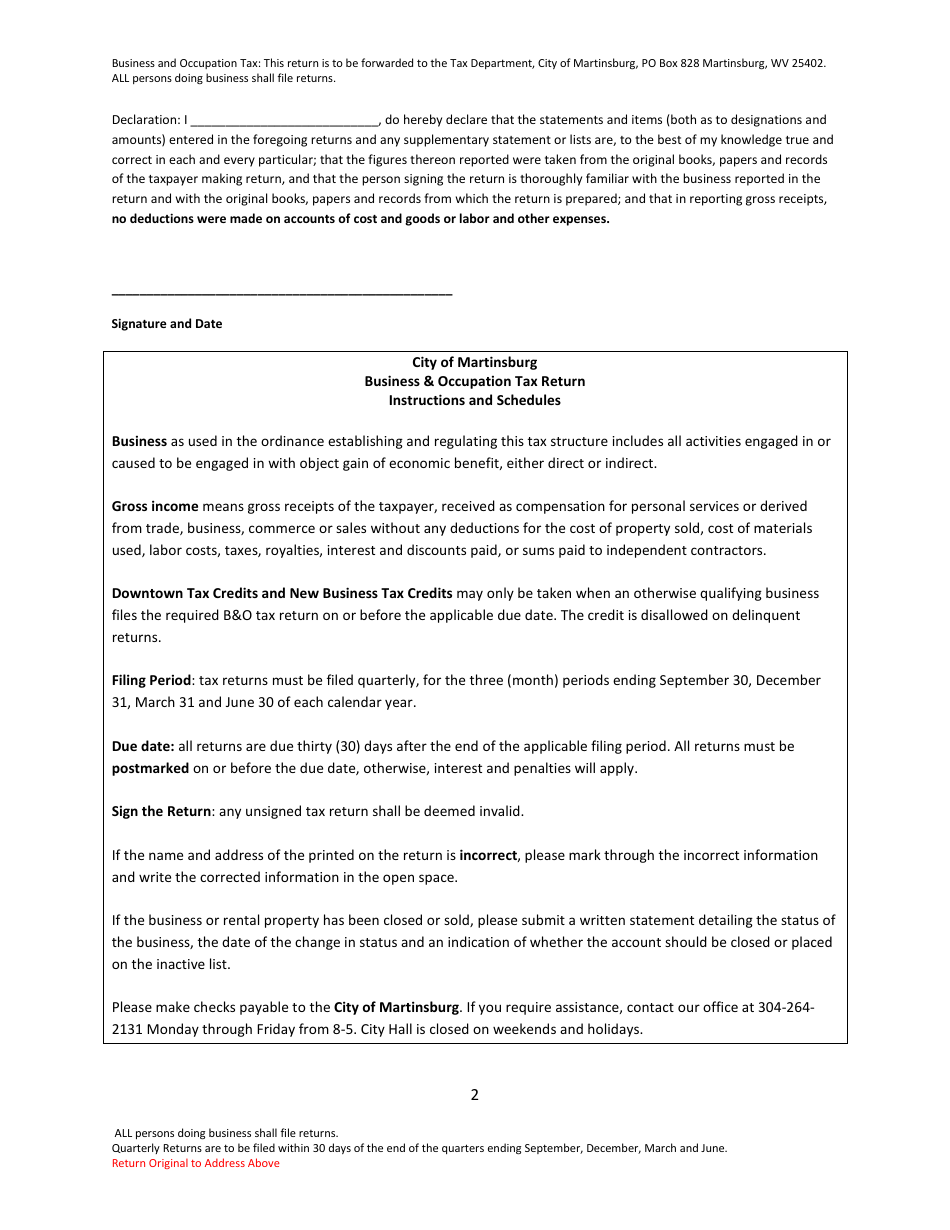

A: The Quarterly Return - Business and Occupation (Gross Receipts) Tax is a tax that businesses in West Virginia must pay based on their gross receipts.

Q: Who needs to file the Quarterly Return - Business and Occupation (Gross Receipts) Tax?

A: All businesses operating in West Virginia are required to file the Quarterly Return - Business and Occupation (Gross Receipts) Tax.

Q: How often do I need to file the Quarterly Return - Business and Occupation (Gross Receipts) Tax?

A: The Quarterly Return - Business and Occupation (Gross Receipts) Tax is filed on a quarterly basis, meaning it needs to be filed four times a year.

Q: What is considered gross receipts for the purpose of this tax?

A: Gross receipts include all revenue earned from sales, services, or any other business activity.

Q: What are the penalties for not filing or paying the Quarterly Return - Business and Occupation (Gross Receipts) Tax?

A: Penalties for not filing or paying the tax include interest on the unpaid amount and additional penalties that may be assessed by the tax department.

Q: Are there any exemptions or deductions available for this tax?

A: There may be certain exemptions or deductions available, depending on the nature of your business. It is recommended to consult with a tax professional or the West Virginia State Tax Department for more information.

Form Details:

- The latest edition currently provided by the Finance Department - City of Martinsburg, West Virginia;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Finance Department - City of Martinsburg, West Virginia.