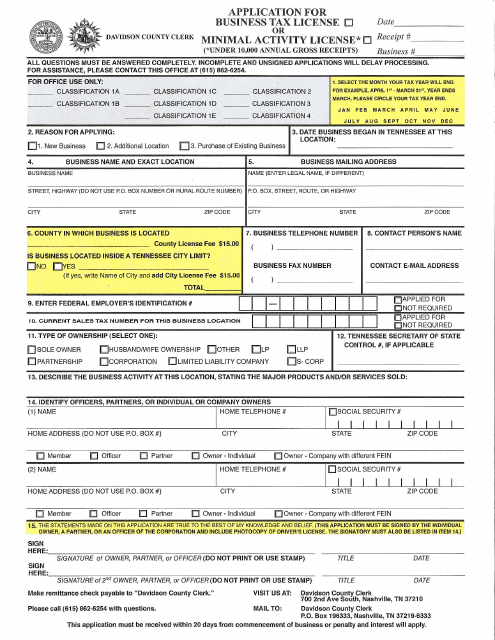

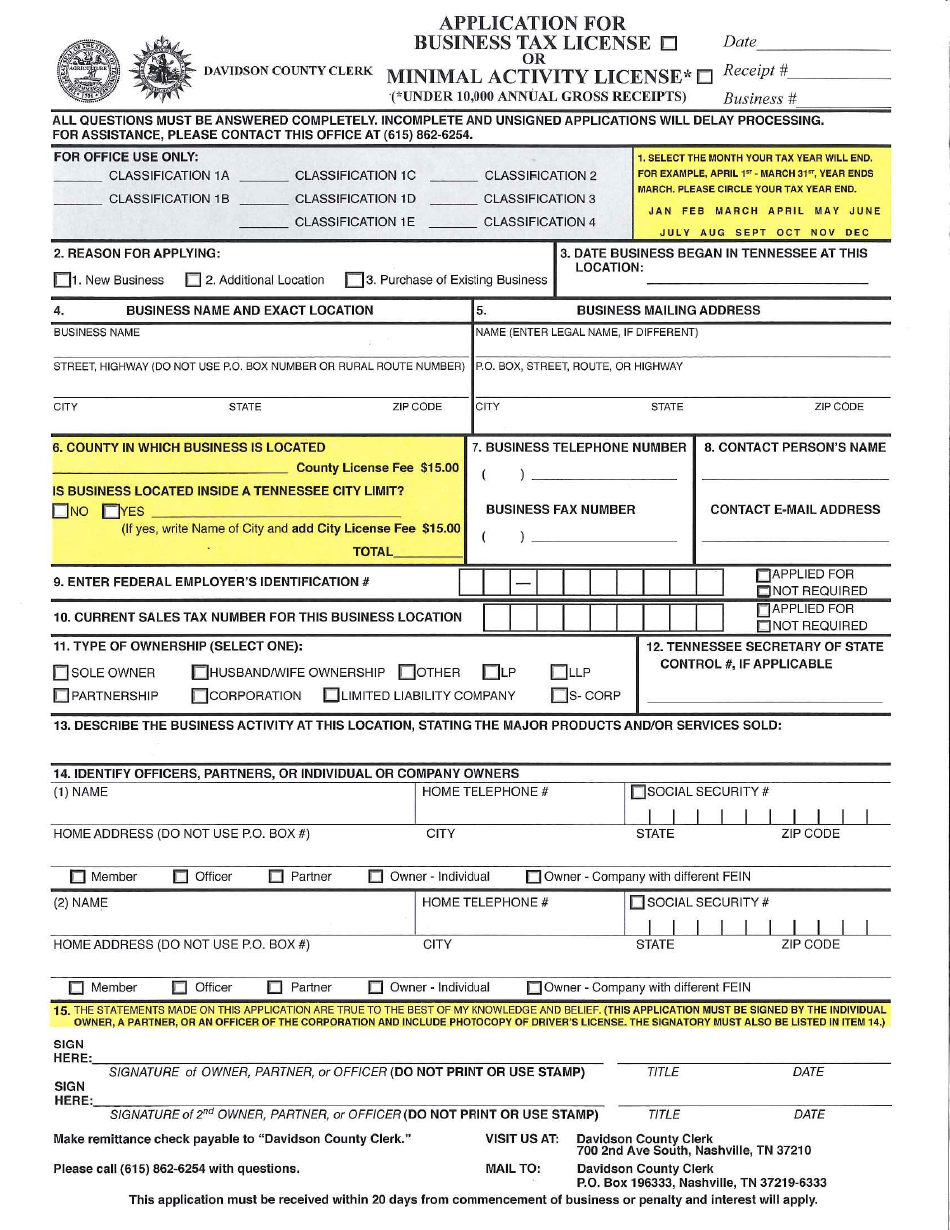

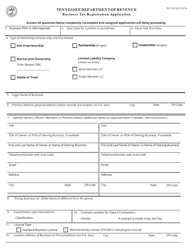

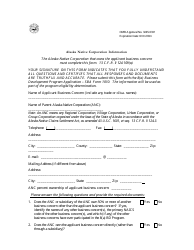

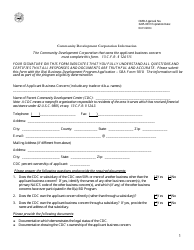

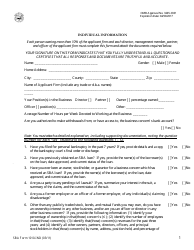

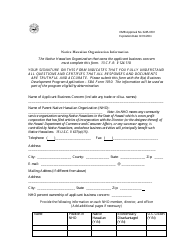

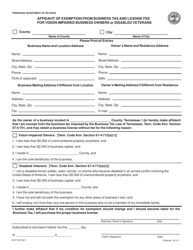

Application for Business Tax License or Minimal Activity License - Davidson county, Tennessee

Application for Business Tax License or Minimal Activity License is a legal document that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. The form may be used strictly within Davidson county.

FAQ

Q: How do I apply for a business tax license in Davidson county, Tennessee?

A: You can apply for a business tax license by completing the application form and submitting it to the Davidson county government.

Q: What is a minimal activity license?

A: A minimal activity license is a type of business license that is required for businesses with low levels of commercial activity in Davidson county, Tennessee.

Q: Who needs to apply for a business tax license in Davidson county?

A: All businesses operating in Davidson county, Tennessee are required to apply for a business tax license.

Q: What documents do I need to submit with my business tax license application?

A: The required documents may include proof of ownership or lease agreement, proof of identification, and any necessary permits or licenses for your specific business.

Q: Is there a fee for a business tax license in Davidson county?

A: Yes, there is a fee for a business tax license in Davidson county. The fee amount may vary depending on the type of business and other factors.

Q: How long does it take to process a business tax license application?

A: The processing time for a business tax license application in Davidson county can vary, but it typically takes a few weeks to receive a license once your application is submitted.

Q: What is the purpose of a business tax license?

A: A business tax license allows the Davidson county government to track and regulate businesses operating within the county, and it also ensures that the appropriate taxes are paid.

Q: Can I operate a business without a tax license in Davidson county?

A: No, it is illegal to operate a business without a tax license in Davidson county, Tennessee.

Q: What should I do if my business information changes after obtaining a tax license?

A: If your business information changes, such as your address or business activities, you should contact the Davidson county government to update your license information.

Form Details:

- The latest edition currently provided by the Tennessee Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.