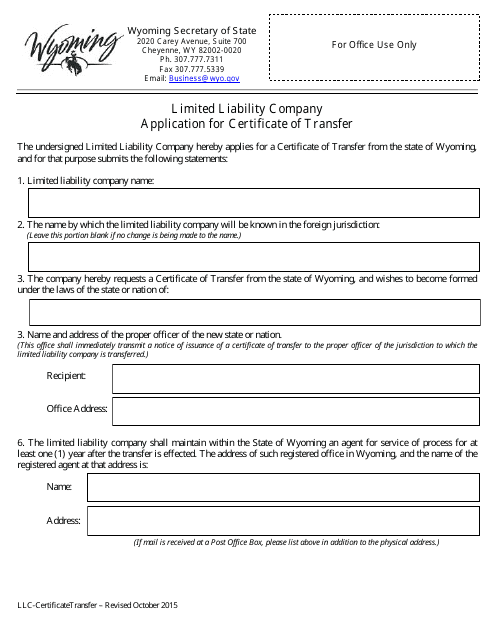

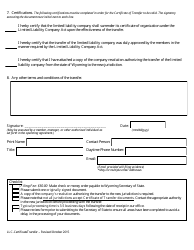

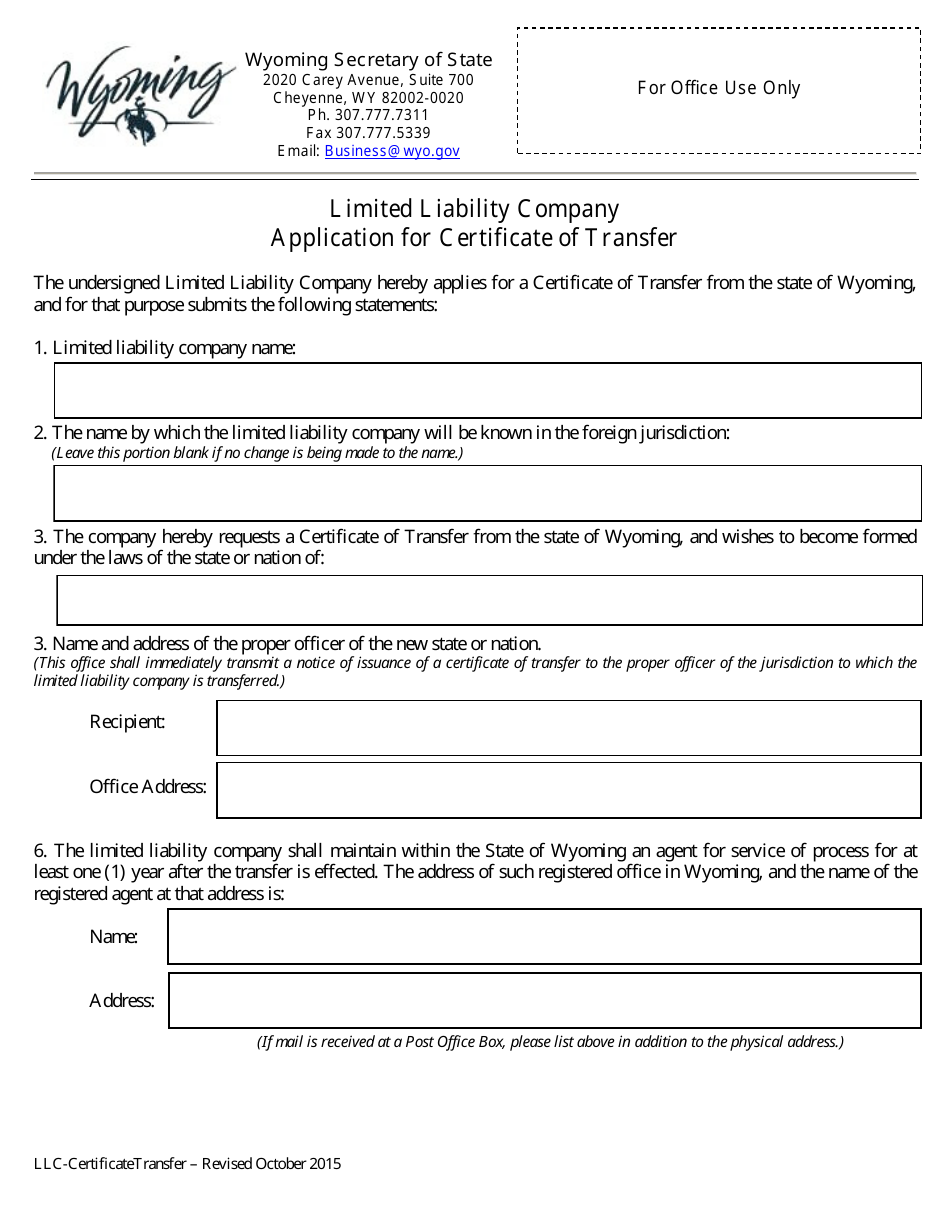

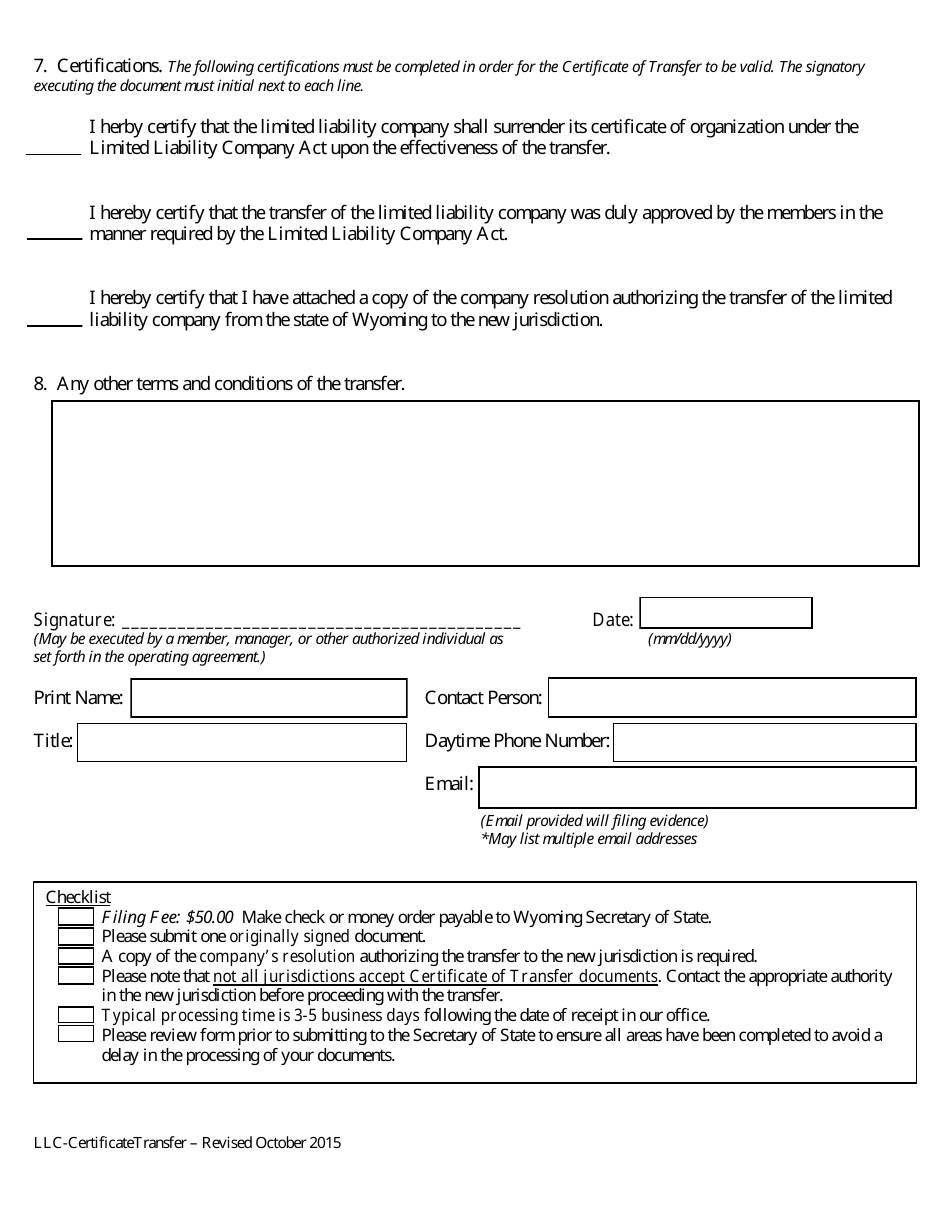

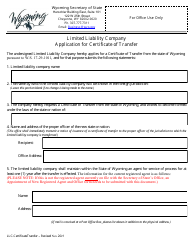

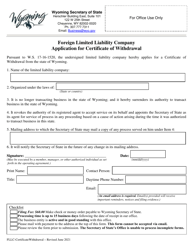

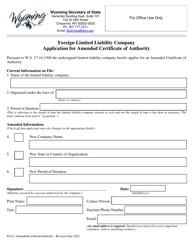

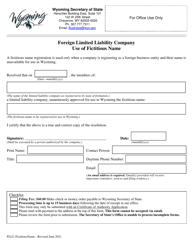

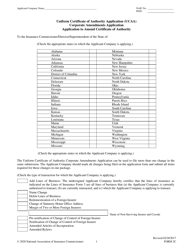

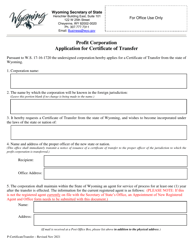

Application for Certificate of Transfer - Limited Liability Company - Wyoming

Application for Certificate of Transfer - Limited Liability Company is a legal document that was released by the Wyoming Secretary of State - a government authority operating within Wyoming.

FAQ

Q: What is a Certificate of Transfer for a Limited Liability Company in Wyoming?

A: A Certificate of Transfer is a document used to transfer the ownership of a limited liability company (LLC) from one person or entity to another in Wyoming.

Q: Why would I need a Certificate of Transfer for my LLC in Wyoming?

A: You would need a Certificate of Transfer if you are selling, buying, or transferring the ownership of your LLC in Wyoming.

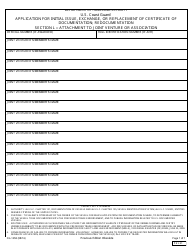

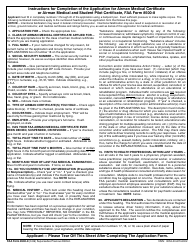

Q: What information is required on the application for a Certificate of Transfer for my LLC in Wyoming?

A: The application will typically require information about the current and new owners of the LLC, the effective date of the transfer, and any applicable fees.

Q: Is there a fee for filing a Certificate of Transfer for a Wyoming LLC?

A: Yes, there is a fee for filing a Certificate of Transfer for a Wyoming LLC. The fee amount can be obtained from the Wyoming Secretary of State's office.

Q: How long does it take to process a Certificate of Transfer for a Wyoming LLC?

A: Processing times can vary. It is best to contact the Wyoming Secretary of State's office for the most up-to-date information on processing times for LLC Certificate of Transfer applications.

Q: Are there any other requirements or documents needed in addition to the Certificate of Transfer for my LLC in Wyoming?

A: There may be additional requirements or documents needed depending on the specific circumstances of the transfer. It is advisable to consult with an attorney or the Wyoming Secretary of State's office to ensure compliance with all necessary requirements.

Q: What happens after I file the Certificate of Transfer for my Wyoming LLC?

A: After you file the Certificate of Transfer, the Wyoming Secretary of State's office will review the application and, if approved, the LLC ownership transfer will be officially recorded.

Q: Do I need to notify anyone else about the LLC ownership transfer in Wyoming?

A: You may need to notify other parties, such as the IRS, state tax authorities, or other regulatory agencies, about the LLC ownership transfer in Wyoming. It is recommended to consult with a tax professional or attorney for guidance on any additional notifications that may be required.

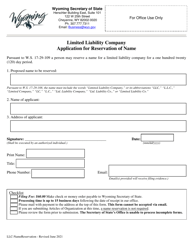

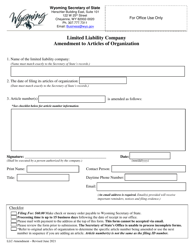

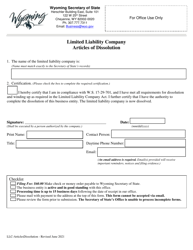

Form Details:

- Released on October 1, 2015;

- The latest edition currently provided by the Wyoming Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Wyoming Secretary of State.