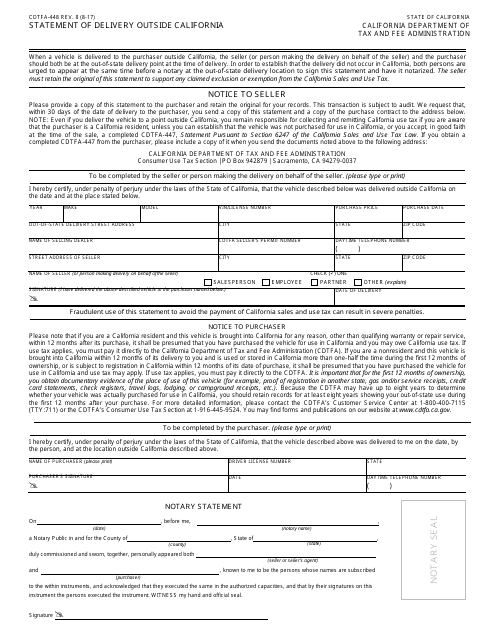

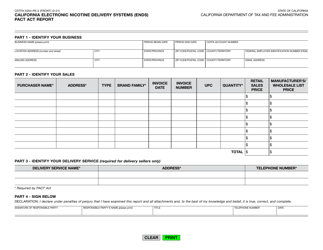

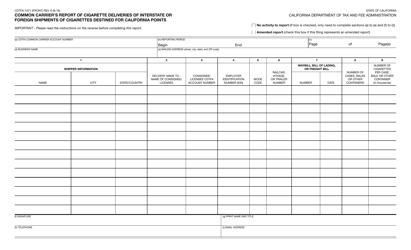

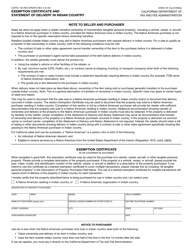

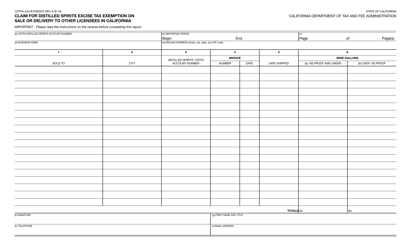

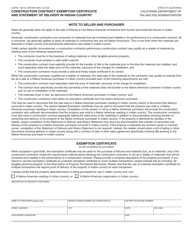

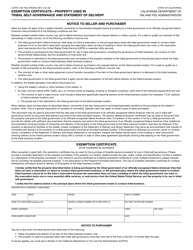

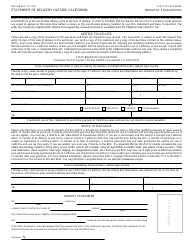

Form CDTFA-448 Statement of Delivery Outside California - California

What Is Form CDTFA-448?

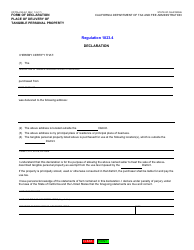

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-448?

A: Form CDTFA-448 is the Statement of Delivery Outside California.

Q: What is the purpose of Form CDTFA-448?

A: The purpose of Form CDTFA-448 is to report deliveries made outside of California.

Q: Who needs to file Form CDTFA-448?

A: Businesses that make deliveries outside of California need to file Form CDTFA-448.

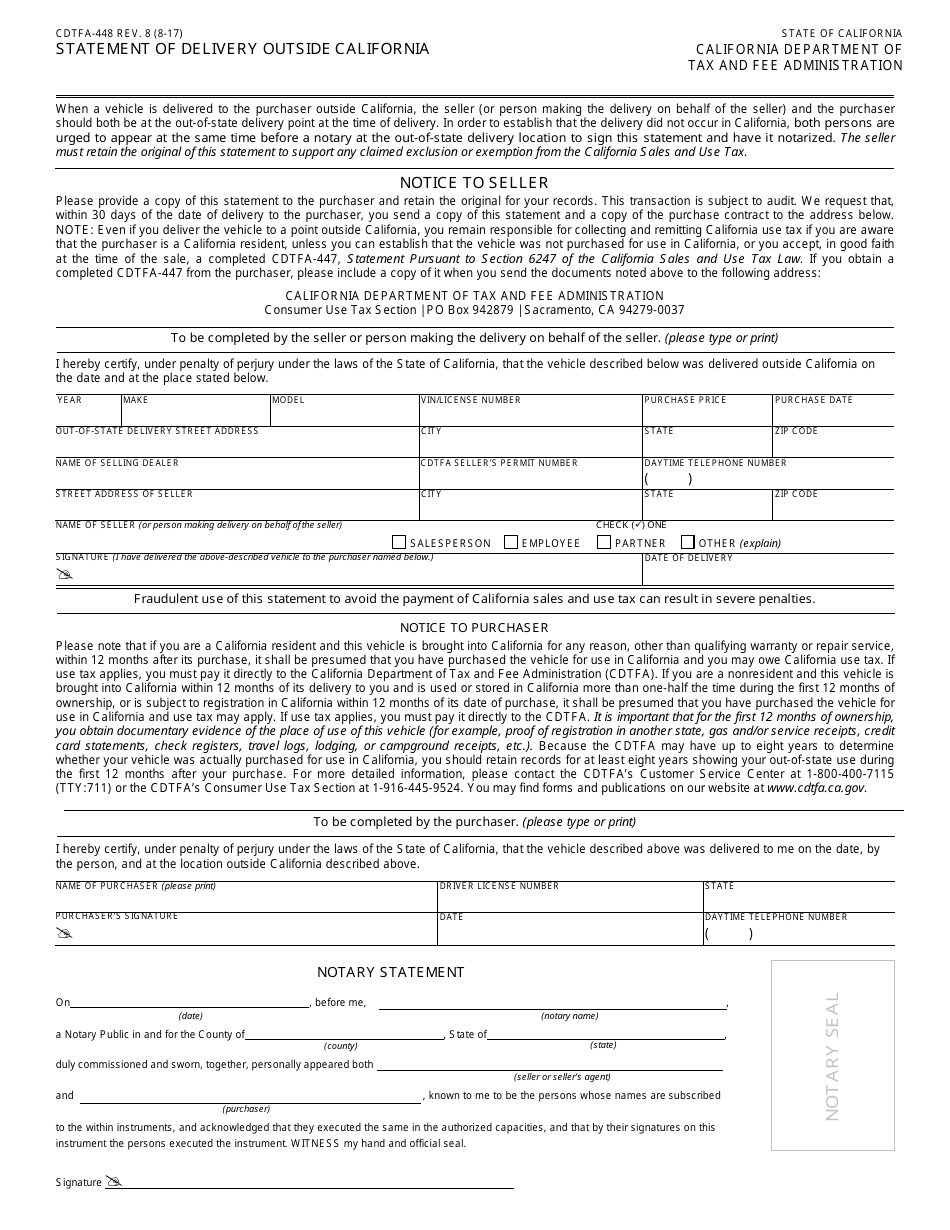

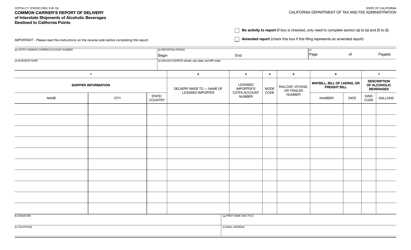

Q: What information is required on Form CDTFA-448?

A: Form CDTFA-448 requires information such as delivery details, purchaser information, and sales amounts.

Q: Is there a deadline for filing Form CDTFA-448?

A: Yes, Form CDTFA-448 must be filed by the 25th day of the month following the calendar month in which the deliveries were made.

Q: Are there any penalties for late filing of Form CDTFA-448?

A: Yes, there are penalties for late filing of Form CDTFA-448. The penalty amount depends on the amount of tax owed and the number of late filings.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-448 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.