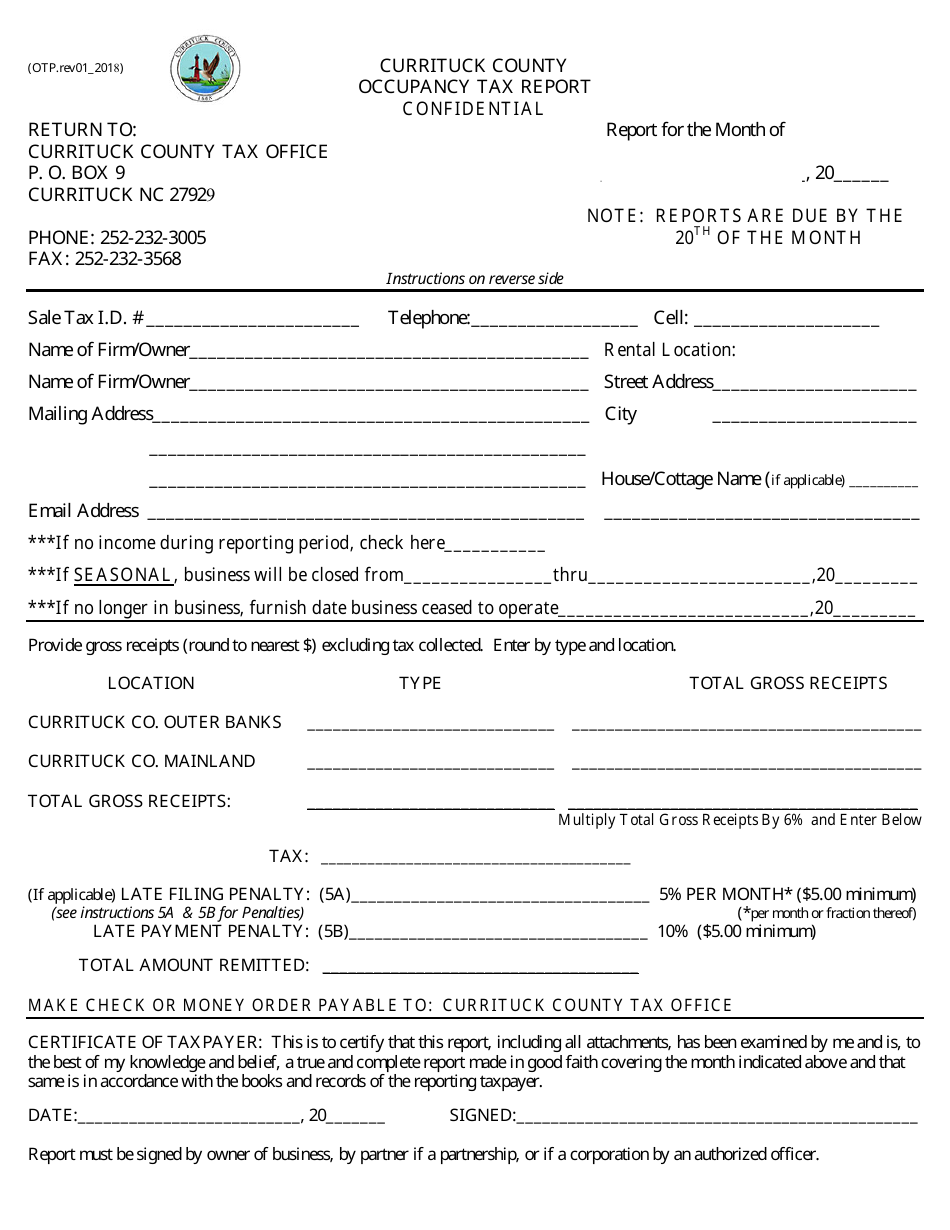

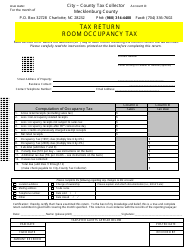

Occupancy Tax Report Form - Currituck county, North Carolina

Occupancy Tax Report Form is a legal document that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. The form may be used strictly within Currituck county.

FAQ

Q: What is the occupancy tax rate in Currituck County, North Carolina?

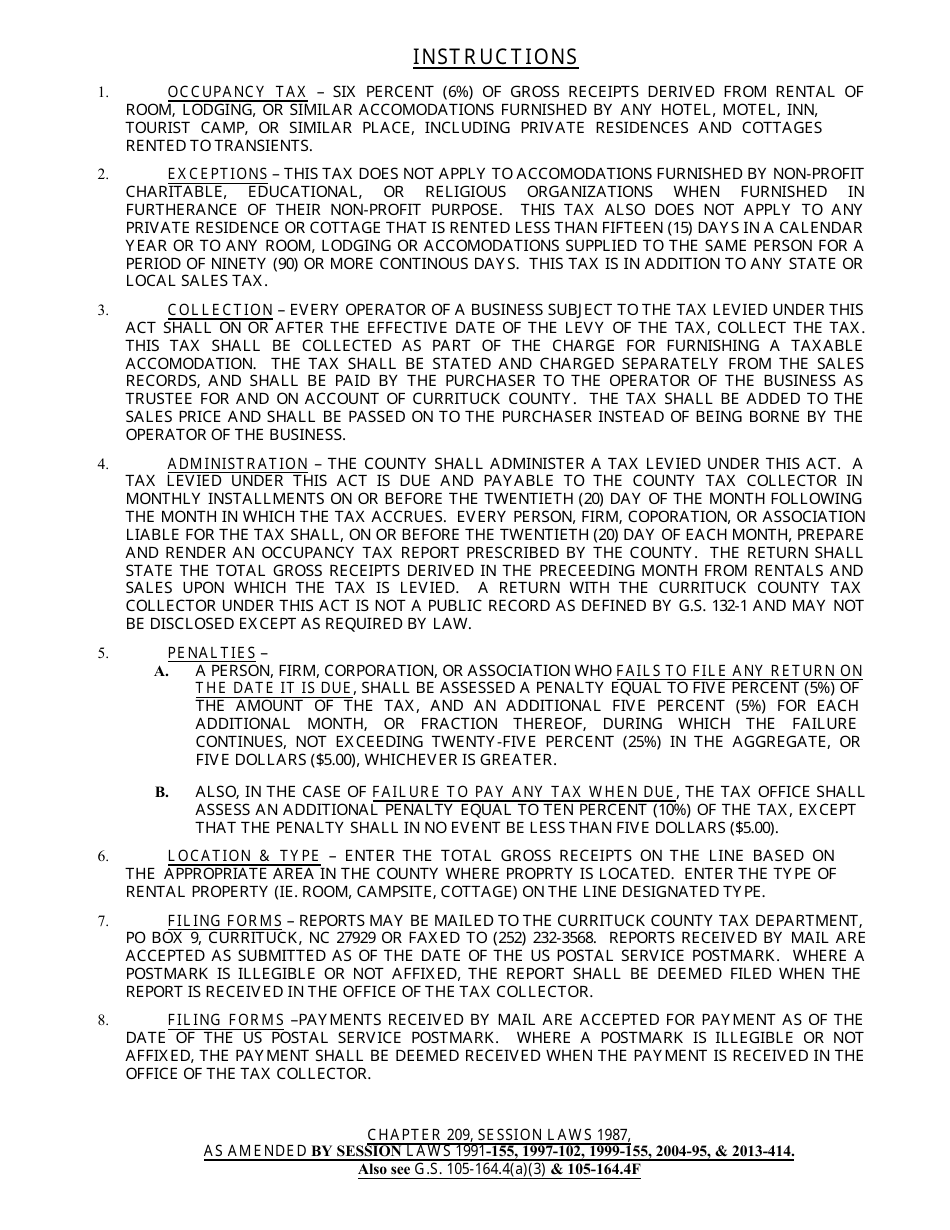

A: The occupancy tax rate in Currituck County, North Carolina is 6%.

Q: Who is required to pay the occupancy tax in Currituck County, North Carolina?

A: Anyone who rents or leases accommodations in Currituck County, North Carolina is required to pay the occupancy tax.

Q: How often do I need to file an occupancy tax report in Currituck County, North Carolina?

A: Occupancy tax reports in Currituck County, North Carolina must be filed on a monthly basis.

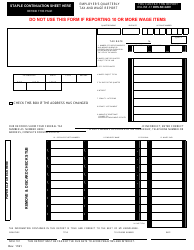

Q: What information do I need to include in the occupancy tax report form in Currituck County, North Carolina?

A: The occupancy tax report form in Currituck County, North Carolina requires you to include information such as the total gross rental receipts and the occupancy tax due.

Q: What is the deadline for filing the occupancy tax report in Currituck County, North Carolina?

A: The occupancy tax report in Currituck County, North Carolina must be filed by the 20th day of the following month.

Q: Are there any penalties for late filing of the occupancy tax report in Currituck County, North Carolina?

A: Yes, there are penalties for late filing of the occupancy tax report in Currituck County, North Carolina. The penalty is 5% of the tax due for each month or fraction of a month.

Q: Who do I contact for more information about the occupancy tax in Currituck County, North Carolina?

A: For more information about the occupancy tax in Currituck County, North Carolina, you can contact the Currituck County Tax Office.

Form Details:

- Released on January 1, 2018;

- The latest edition currently provided by the North Carolina Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.