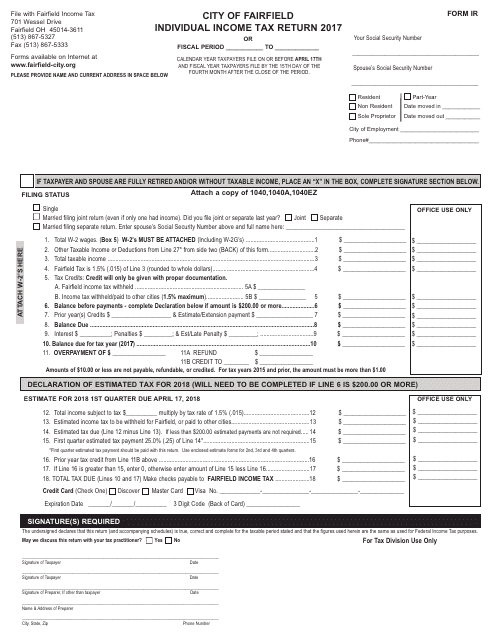

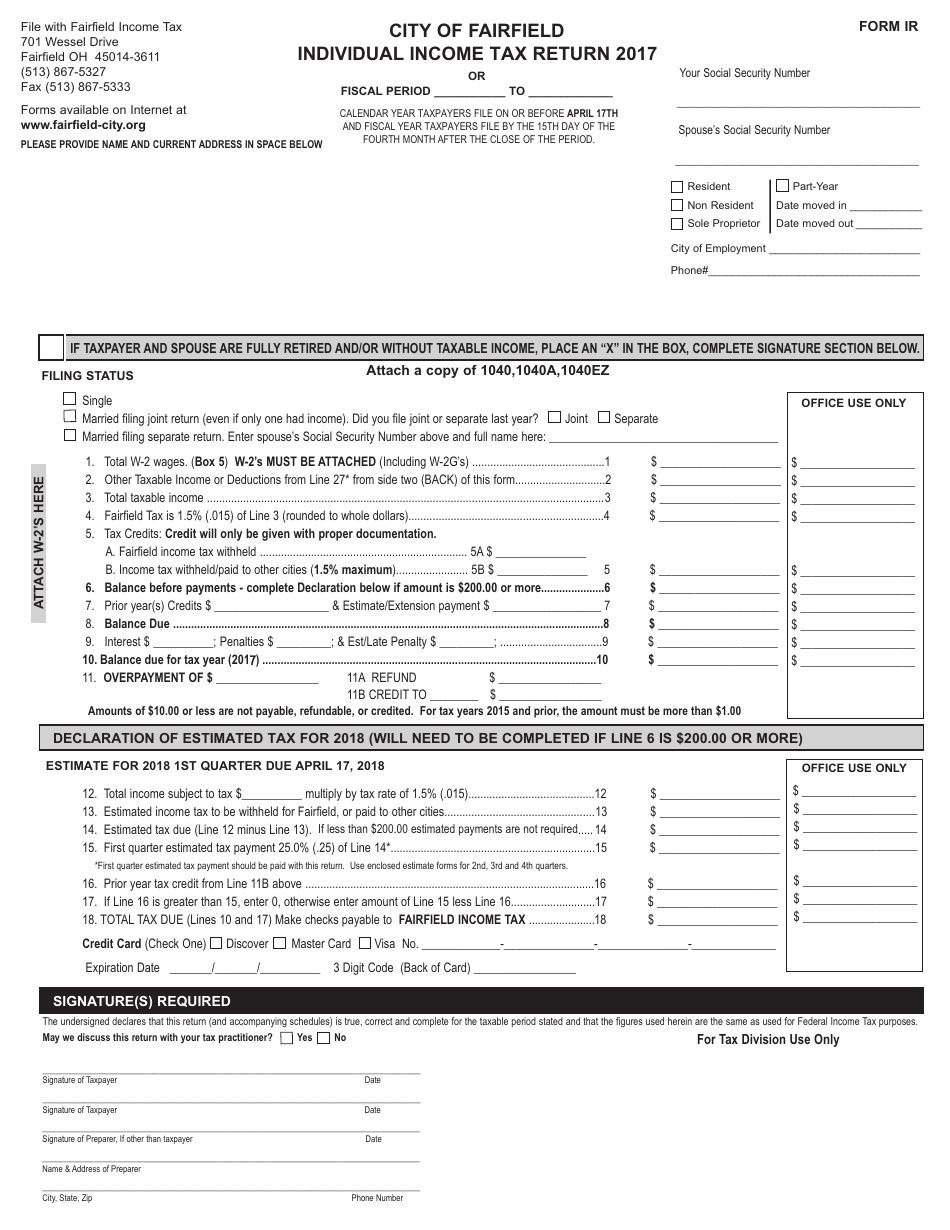

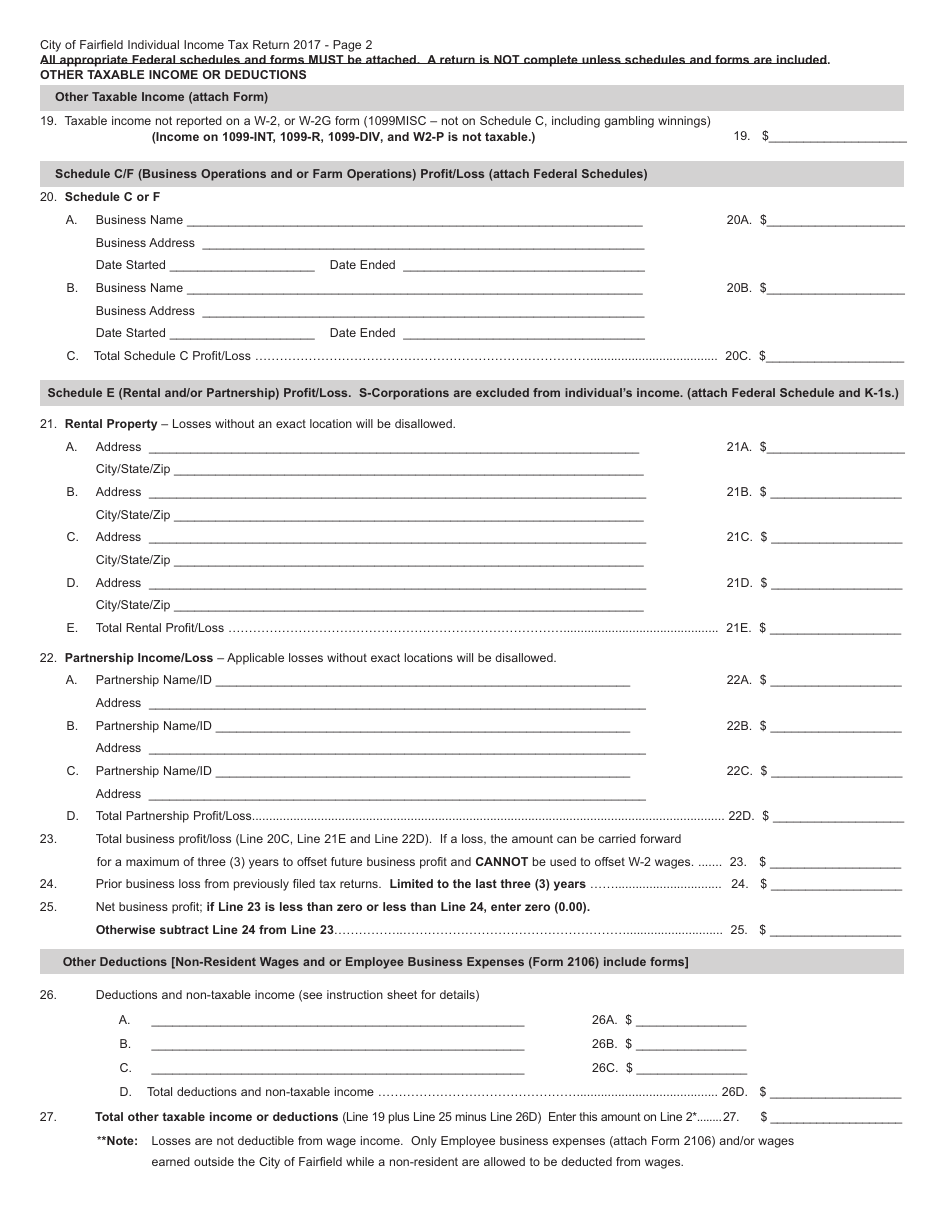

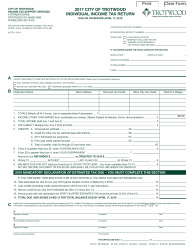

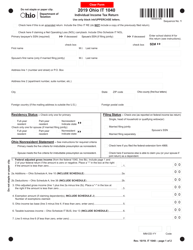

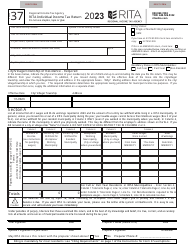

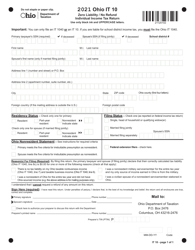

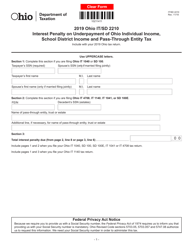

Individual Income Tax Return - City if Fairfield, Ohio

Individual Income Tax Return is a legal document that was released by the Ohio Department of Taxation - a government authority operating within Ohio. The form may be used strictly within City if Fairfield.

FAQ

Q: Who needs to file an individual income tax return in Fairfield, Ohio?

A: Any resident of Fairfield, Ohio who meets the income threshold needs to file an individual income tax return.

Q: What is the income threshold for filing an individual income tax return in Fairfield, Ohio?

A: The income threshold for filing an individual income tax return in Fairfield, Ohio is $500.

Q: How can I file my individual income tax return in Fairfield, Ohio?

A: You can file your individual income tax return in Fairfield, Ohio through various methods like e-filing, in-person, or by mail.

Q: Is there a deadline for filing an individual income tax return in Fairfield, Ohio?

A: Yes, the deadline for filing an individual income tax return in Fairfield, Ohio is April 15th.

Q: Are there any deductions or credits available for residents filing an individual income tax return in Fairfield, Ohio?

A: Yes, there are various deductions and credits available for residents filing an individual income tax return in Fairfield, Ohio. Some common deductions and credits include mortgage interest deduction, education credits, and child tax credit.

Form Details:

- The latest edition currently provided by the Ohio Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.