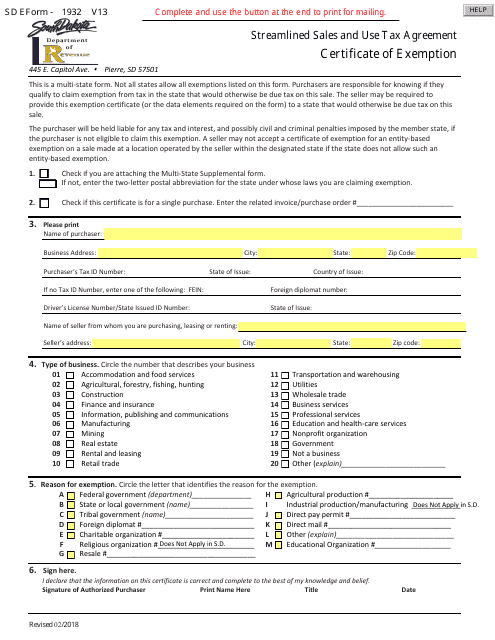

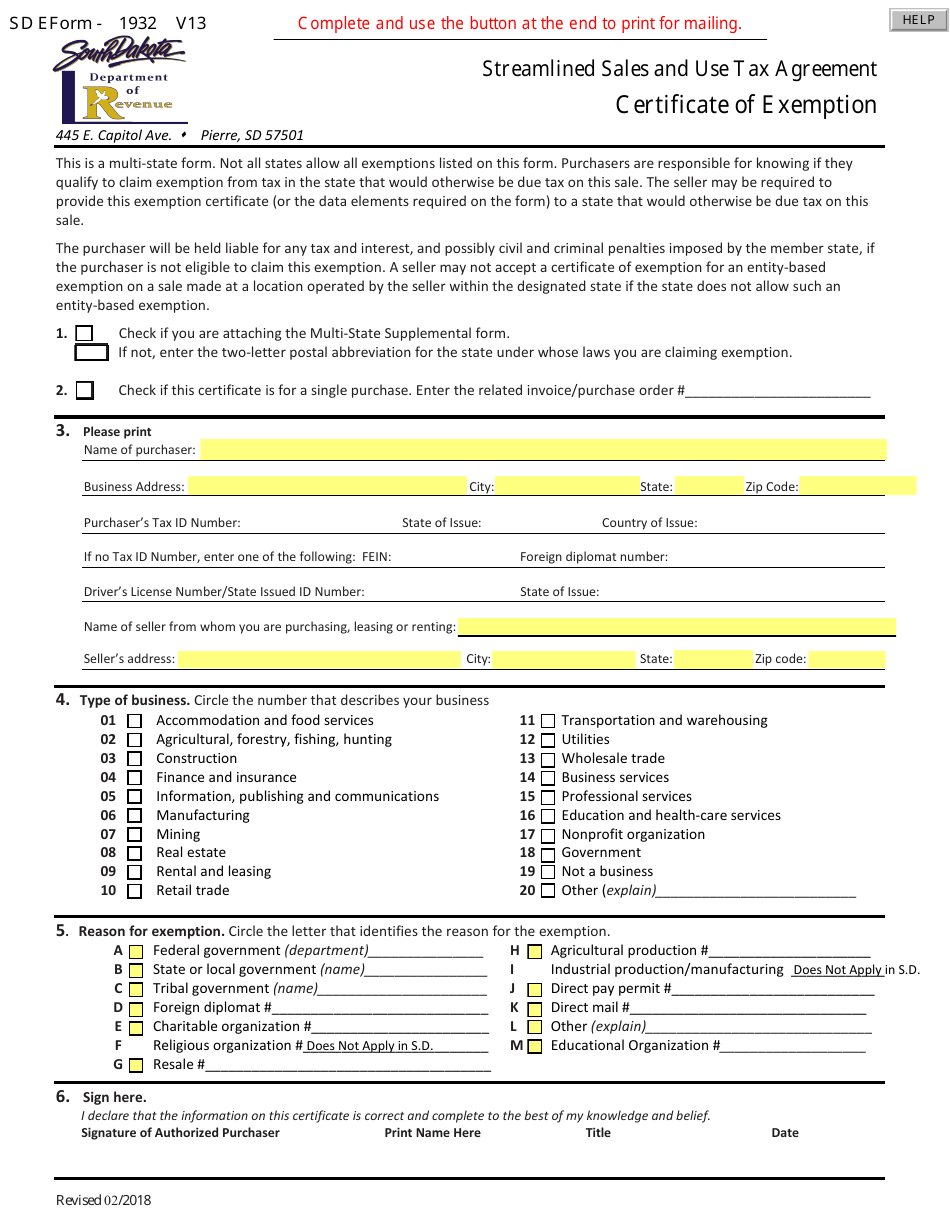

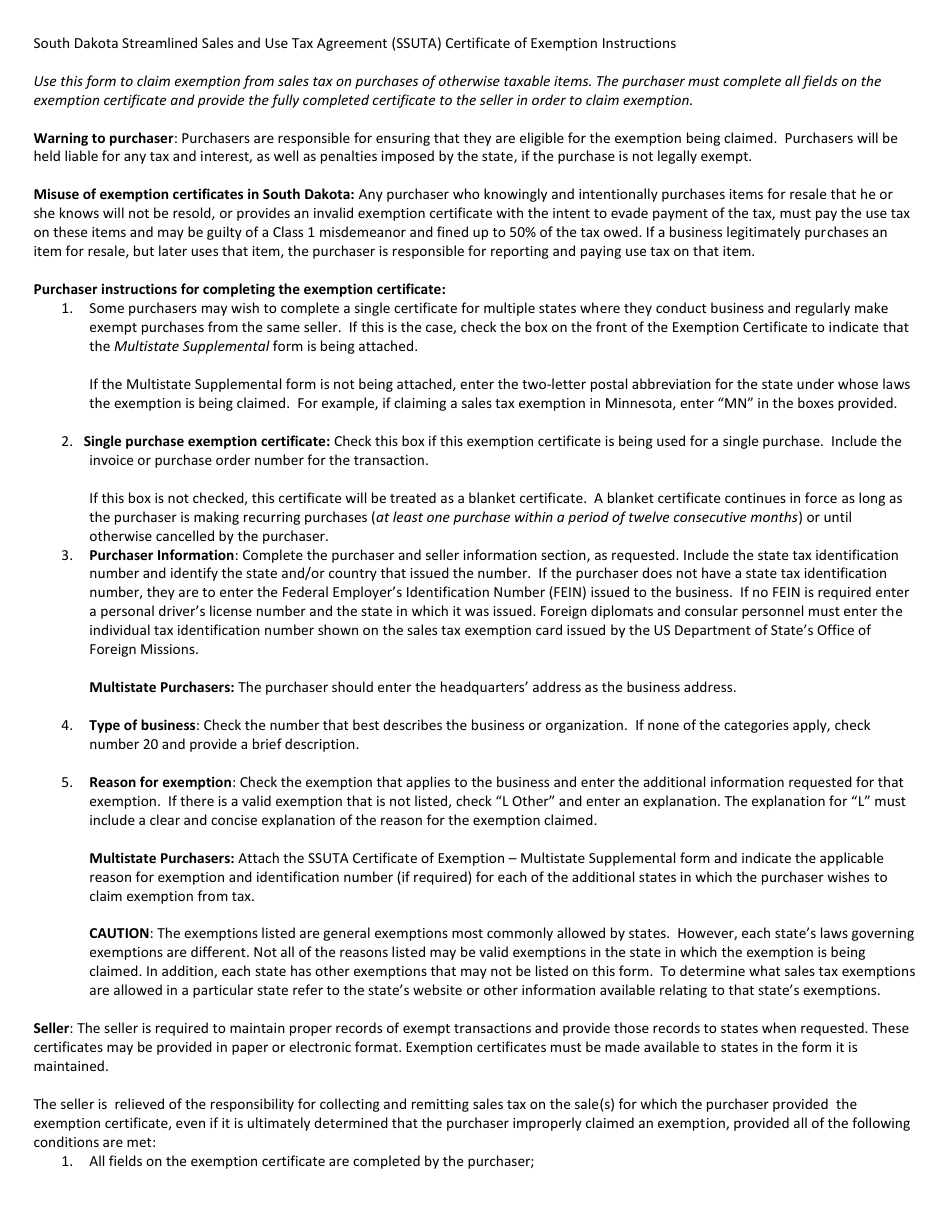

Form 1932 Certificate of Exemption - Streamlined Sales and Use Tax Agreement - South Dakota

What Is Form 1932?

This is a legal form that was released by the South Dakota Department of Revenue - a government authority operating within South Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1932?

A: Form 1932 is a Certificate of Exemption.

Q: What is the purpose of Form 1932?

A: The purpose of Form 1932 is to claim exemption from sales and use taxes.

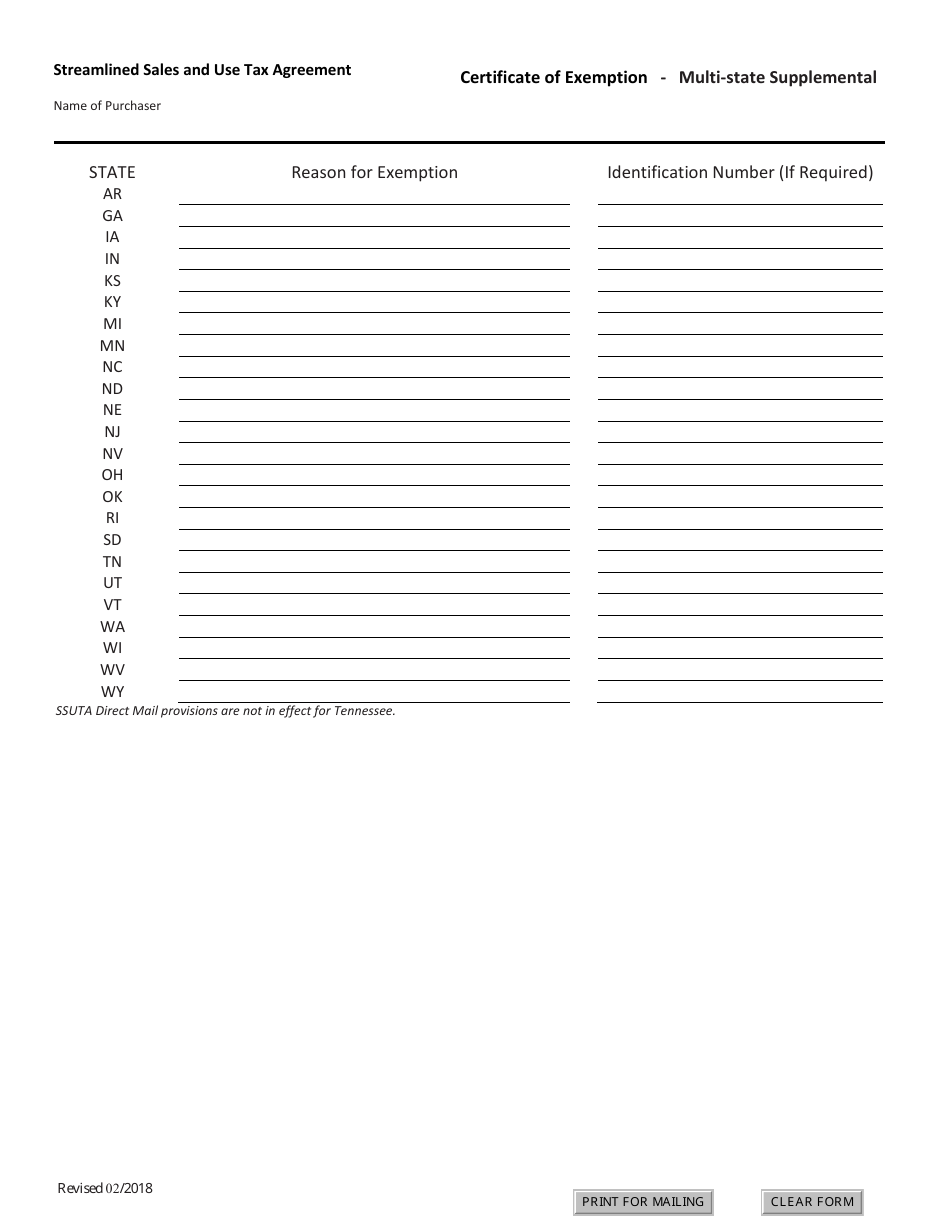

Q: What is the Streamlined Sales and Use Tax Agreement?

A: The Streamlined Sales and Use Tax Agreement is an initiative among states to simplify and modernize sales and use tax administration.

Q: Which state uses Form 1932?

A: South Dakota uses Form 1932.

Q: Who can use Form 1932?

A: Form 1932 can be used by individuals or businesses who are eligible for sales and use tax exemptions in South Dakota.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the South Dakota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1932 by clicking the link below or browse more documents and templates provided by the South Dakota Department of Revenue.