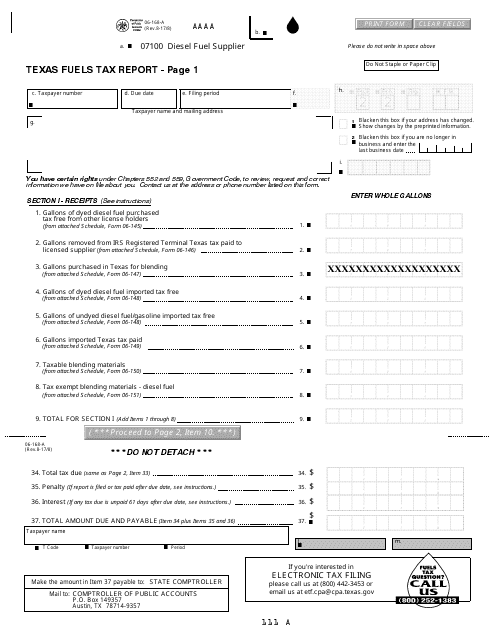

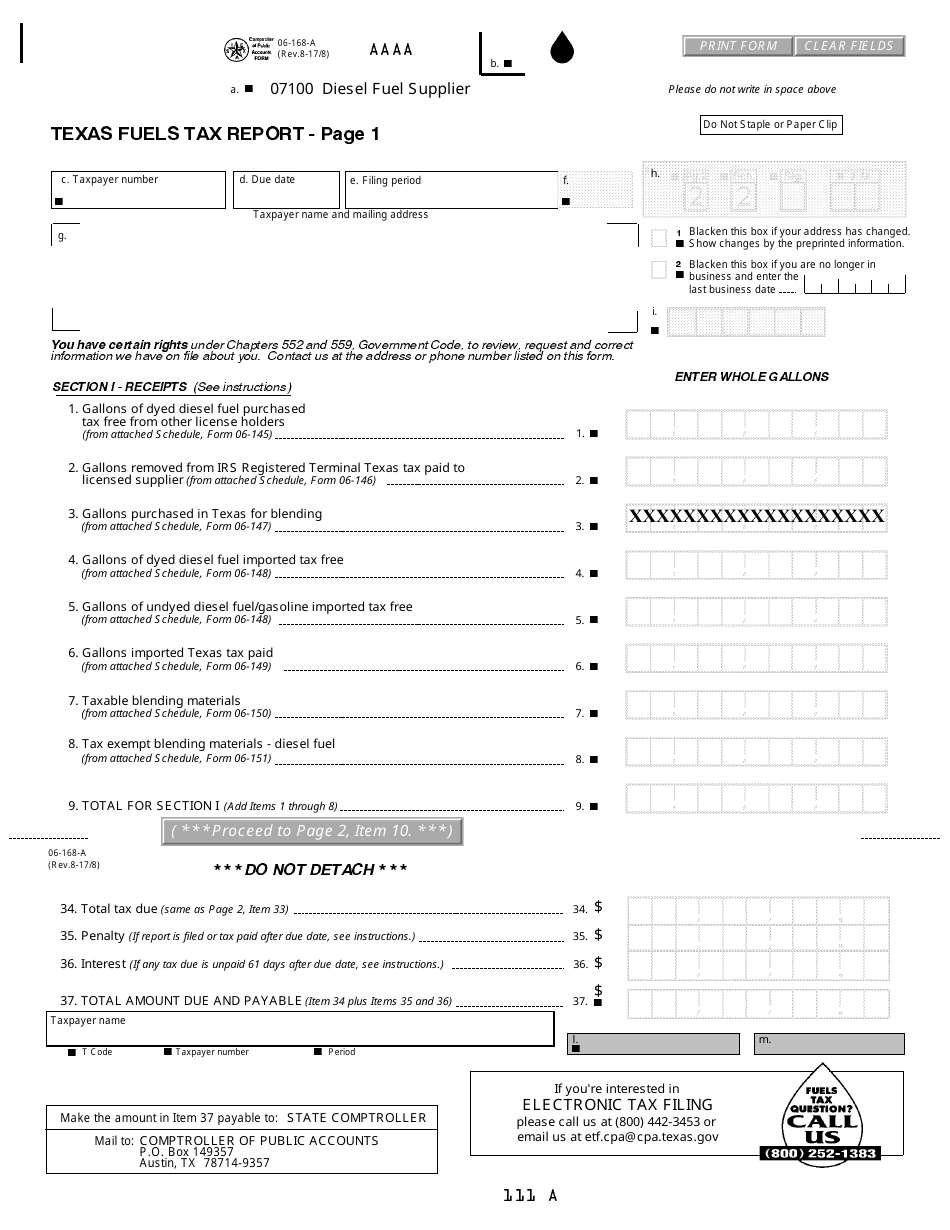

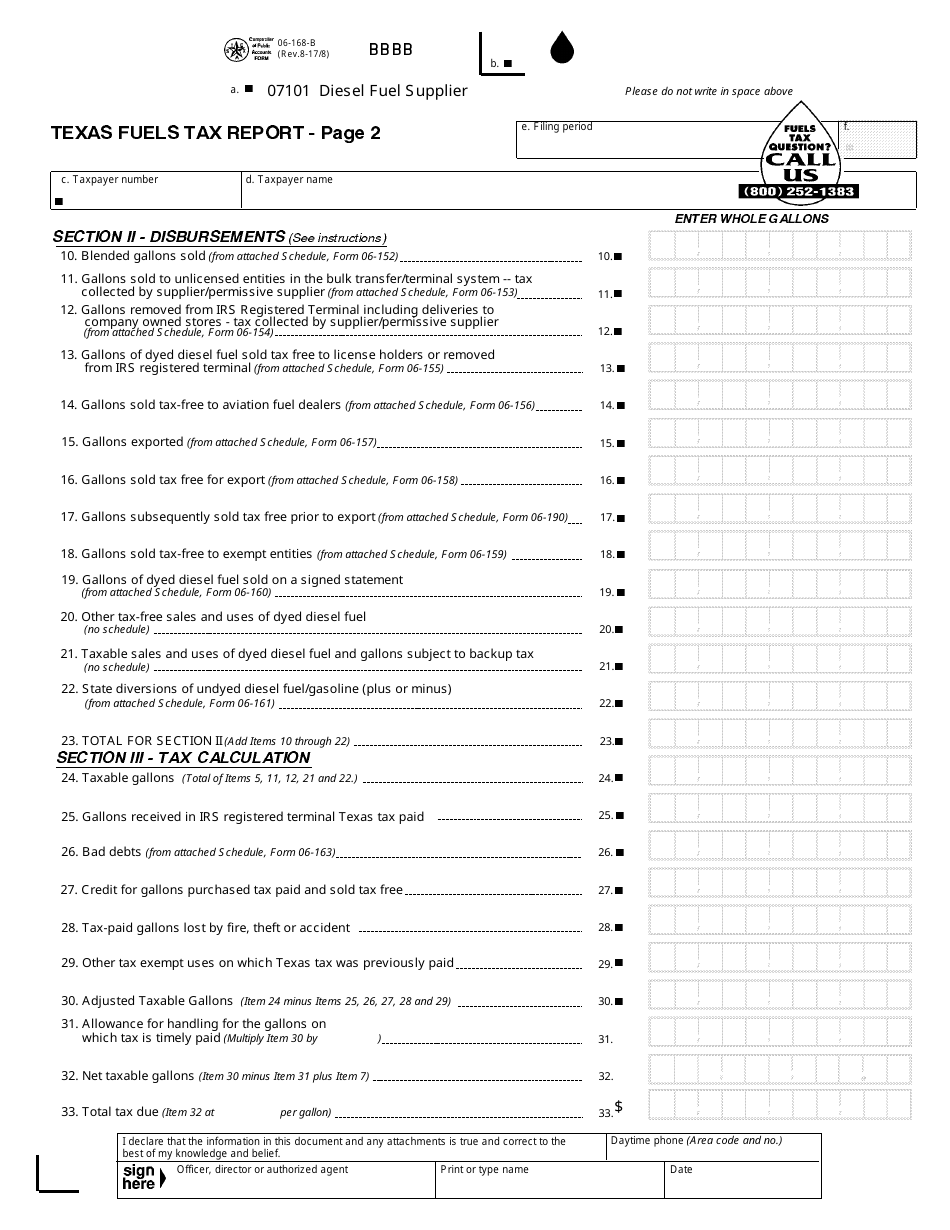

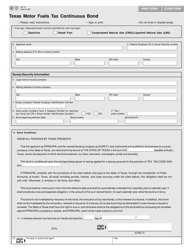

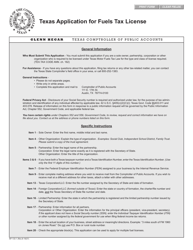

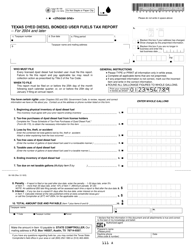

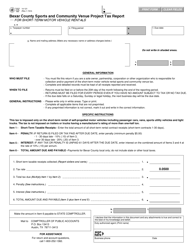

Form 06-168-A Texas Fuels Tax Report - Texas

What Is Form 06-168-A?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

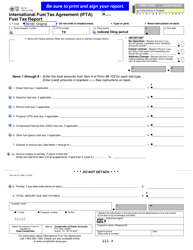

Q: What is the Form 06-168-A?

A: Form 06-168-A is the Texas Fuels Tax Report.

Q: What is the purpose of Form 06-168-A?

A: Form 06-168-A is used to report and pay fuels tax in Texas.

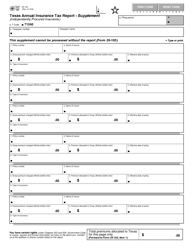

Q: Who needs to file Form 06-168-A?

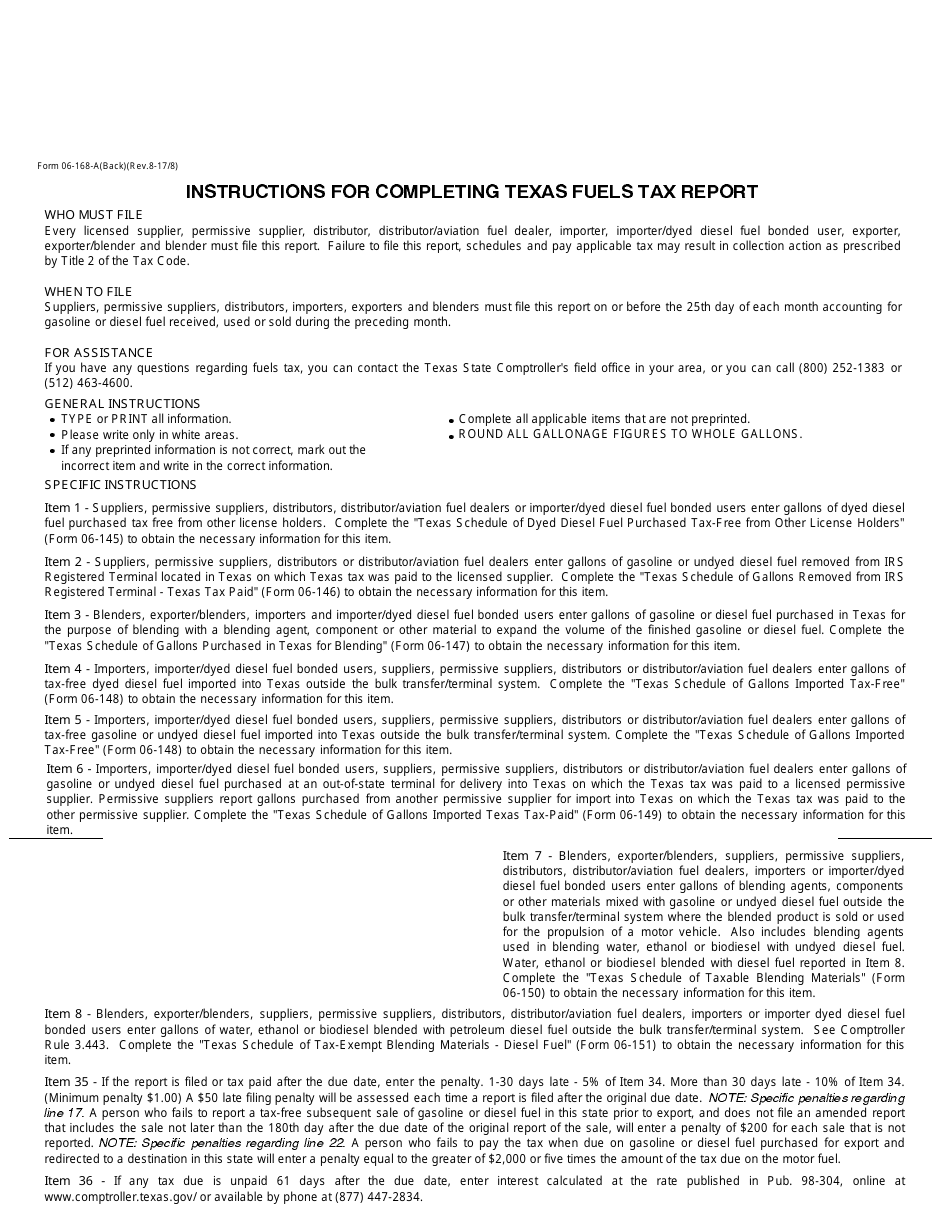

A: Anyone who sells or uses taxable fuels in Texas is required to file Form 06-168-A.

Q: When is Form 06-168-A due?

A: Form 06-168-A is due on the 25th day of the month following the reporting period.

Q: How should Form 06-168-A be filed?

A: Form 06-168-A can be filed electronically or by mail.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing, ranging from $50 to $500 per violation.

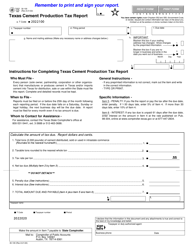

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

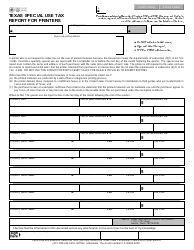

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 06-168-A by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.