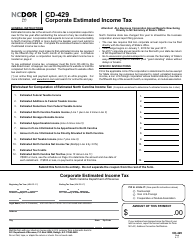

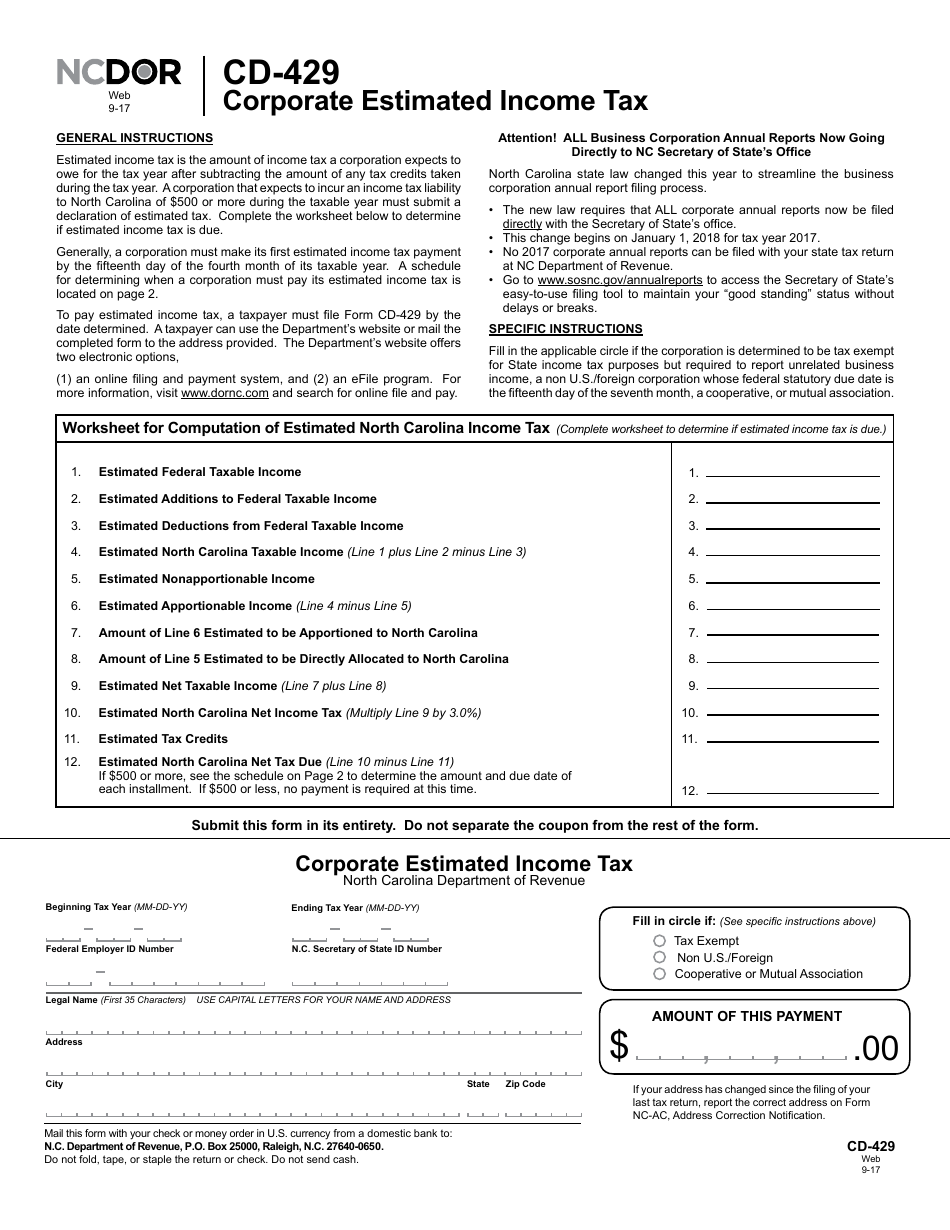

This version of the form is not currently in use and is provided for reference only. Download this version of

Form CD-429

for the current year.

Form CD-429 Corporate Estimated Income Tax - North Carolina

What Is Form CD-429?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CD-429?

A: Form CD-429 is the Corporate Estimated Income Tax form for North Carolina.

Q: Who needs to file Form CD-429?

A: All corporations that expect to owe more than $500 in income tax to North Carolina during the year must file Form CD-429.

Q: What is the purpose of Form CD-429?

A: Form CD-429 is used to estimate and pay the annual incometax liability for corporations in North Carolina.

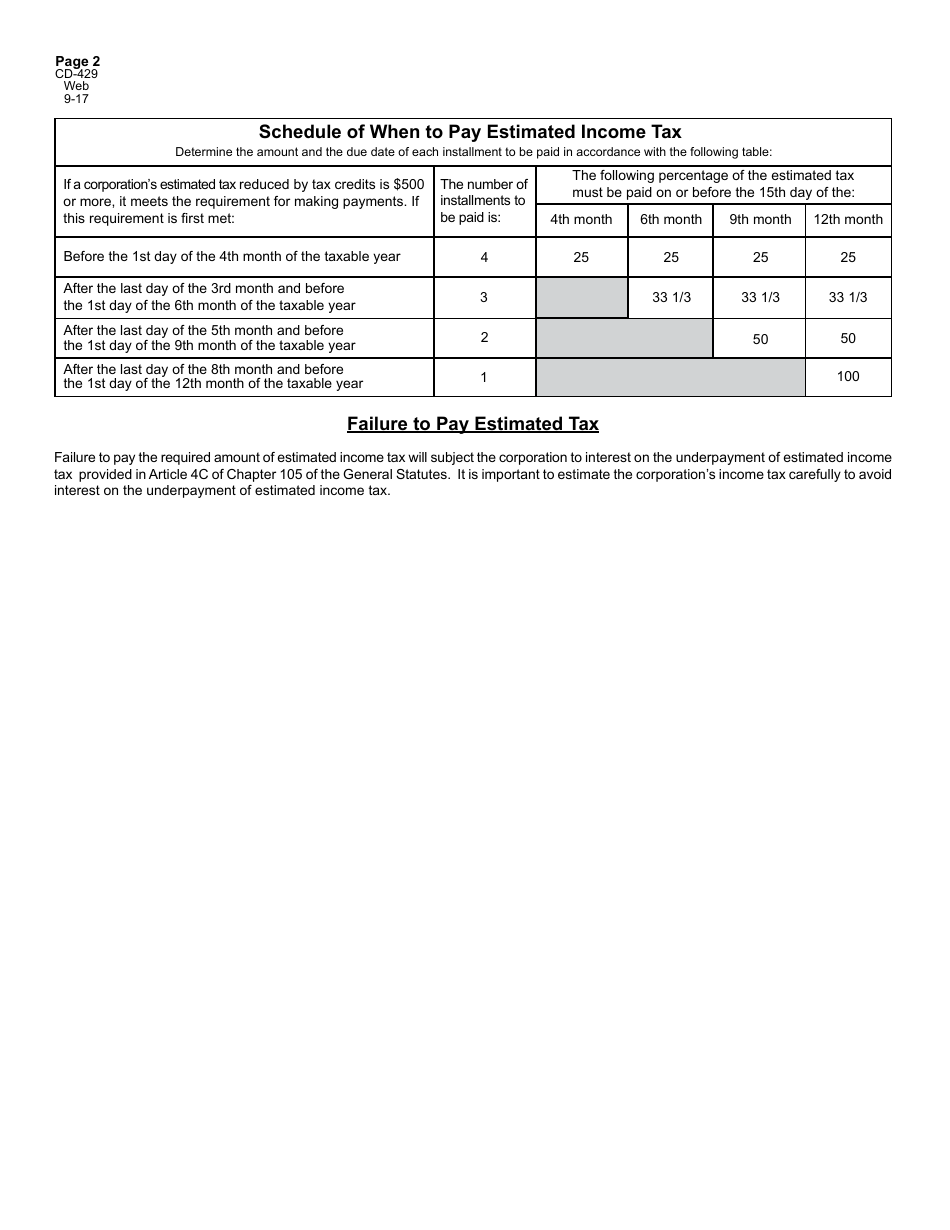

Q: When is Form CD-429 due?

A: Form CD-429 is due on the 15th day of the fourth month after the beginning of the taxable year.

Q: Are there any penalties for not filing Form CD-429?

A: Yes, failure to file or underpayment of estimated tax may result in penalties and interest charges.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CD-429 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.