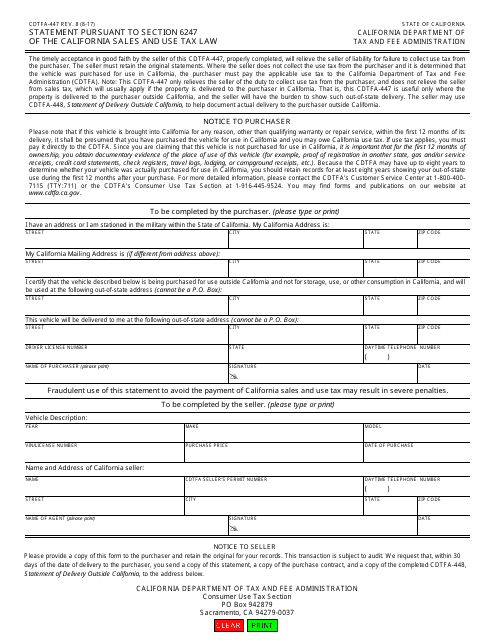

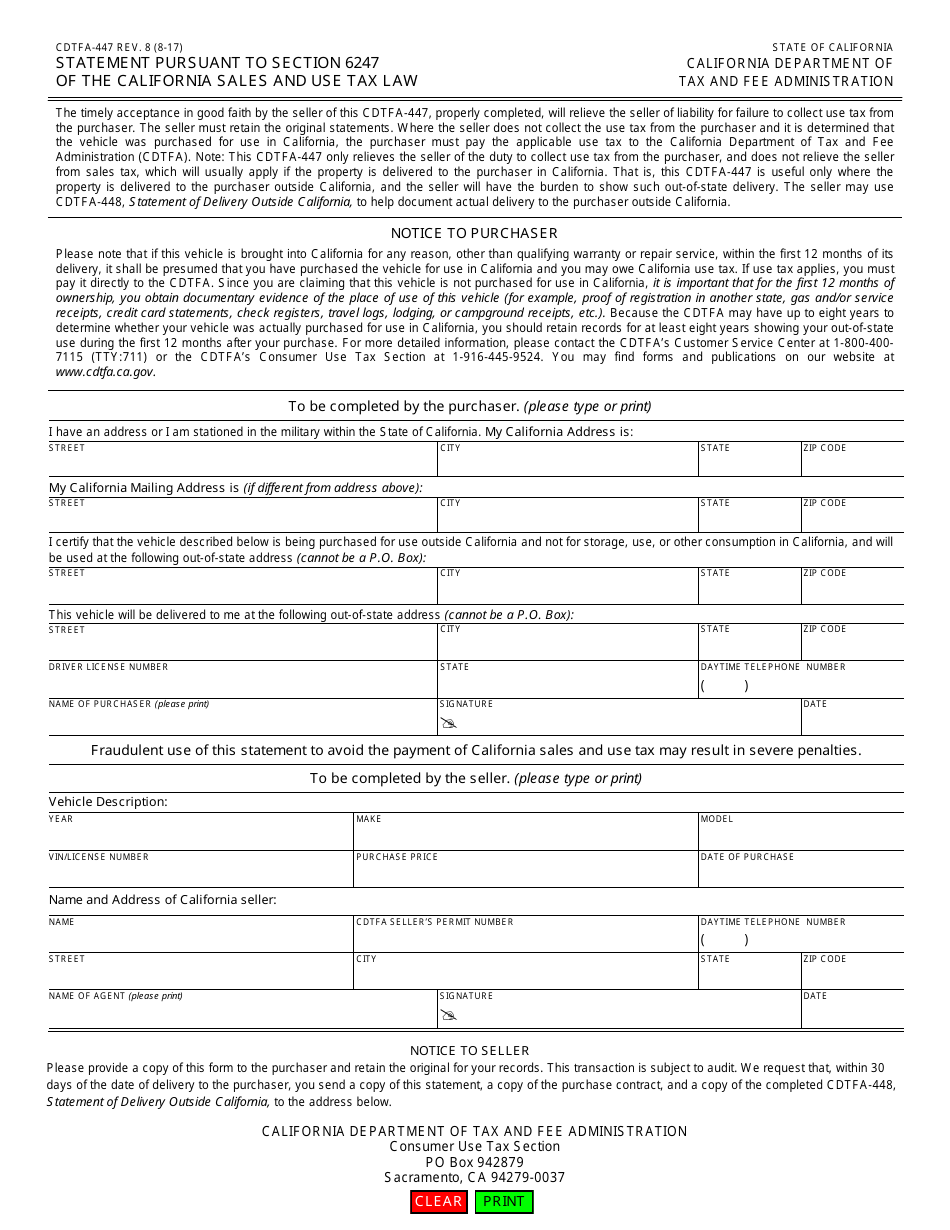

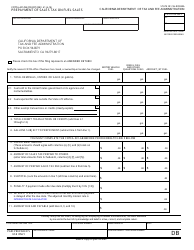

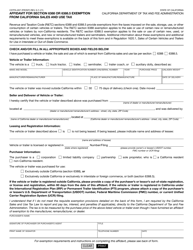

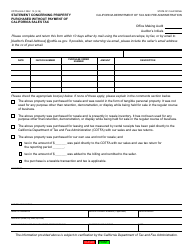

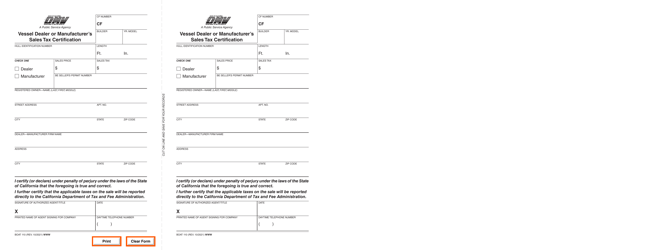

Form CDTFA-447 Statement Pursuant to Section 6247 of the California Sales and Use Tax Law - California

What Is Form CDTFA-447?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-447?

A: Form CDTFA-447 is a statement required under Section 6247 of the California Sales and Use Tax Law.

Q: Who must file Form CDTFA-447?

A: Anyone who is subject to the California Sales and Use Tax Law and meets the requirements of Section 6247.

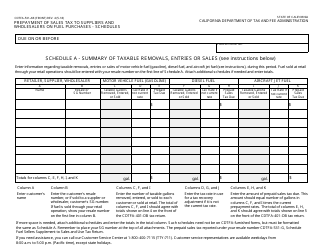

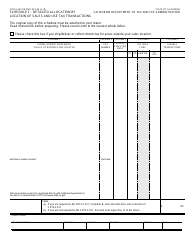

Q: What information is required on Form CDTFA-447?

A: Form CDTFA-447 requires the taxpayer's name, address, tax identification number, and a statement of the amount of tax being paid or refunded.

Q: When is Form CDTFA-447 due?

A: Form CDTFA-447 is due on or before the last day of the month following the close of the reporting period.

Q: Are there any penalties for not filing Form CDTFA-447?

A: Yes, failing to file Form CDTFA-447 can result in penalties and interest charges.

Q: Is Form CDTFA-447 required for all taxpayers?

A: No, Form CDTFA-447 is only required for taxpayers subject to the California Sales and Use Tax Law and who meet the requirements of Section 6247.

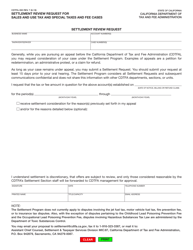

Q: What is the purpose of Form CDTFA-447?

A: Form CDTFA-447 is used to report and pay or claim a refund for sales and use tax liabilities under the California Sales and Use Tax Law.

Q: Can I amend Form CDTFA-447?

A: Yes, if you need to make changes or corrections to a previously filed Form CDTFA-447, you can file an amended form.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-447 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.