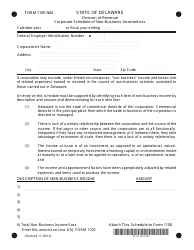

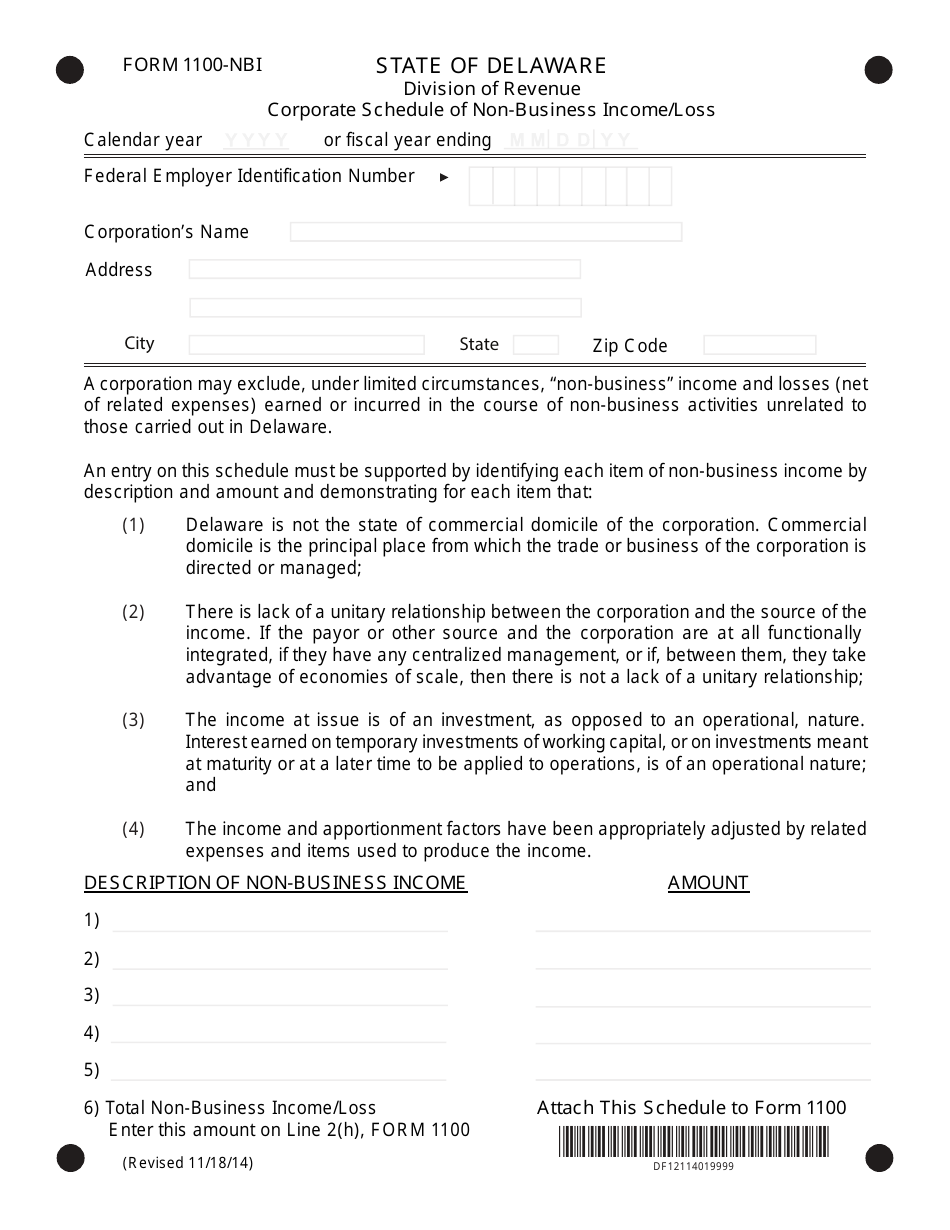

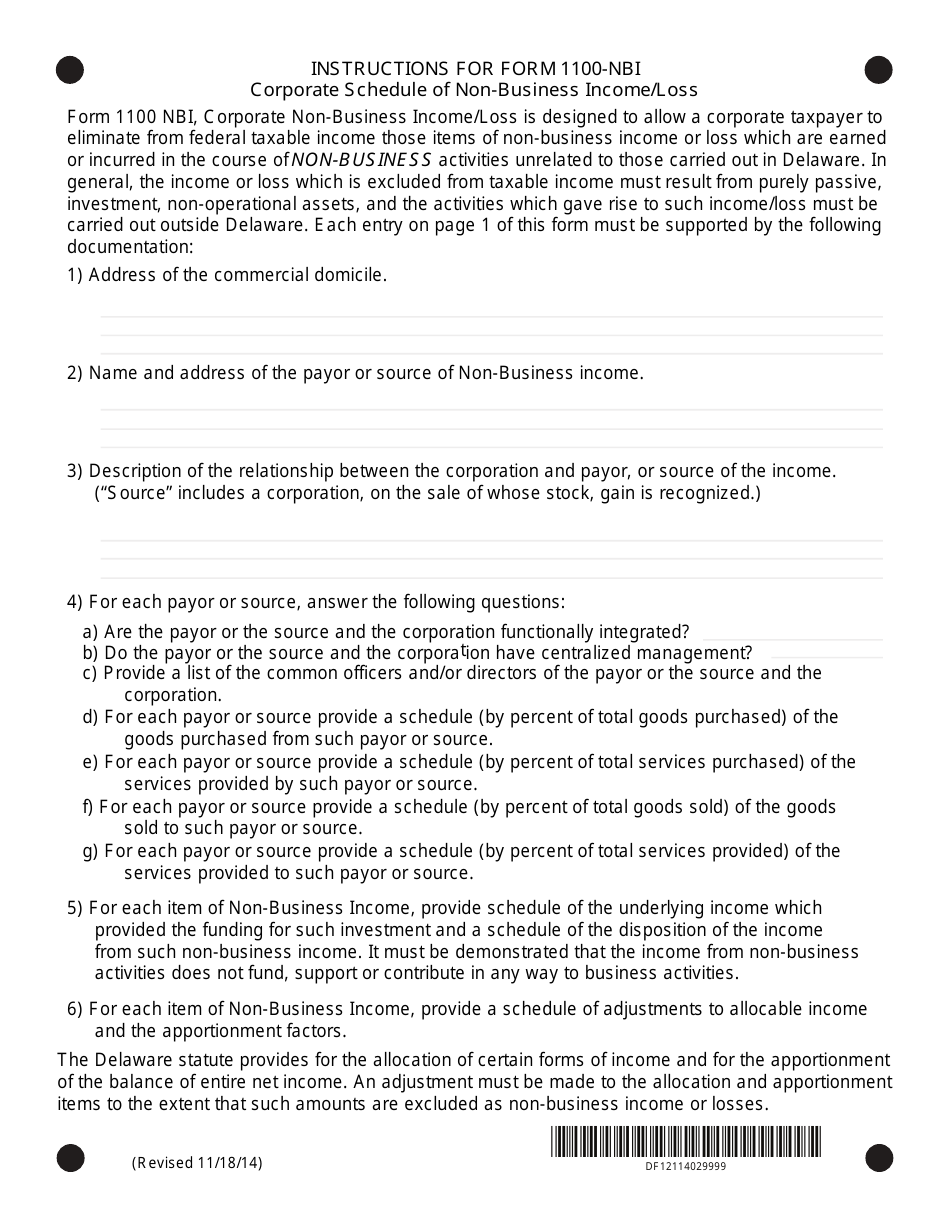

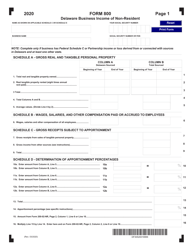

Form 1100-NBI Corporate Schedule of Non-business Income / Loss - Delaware

What Is Form 1100-NBI?

This is a legal form that was released by the Delaware Department of Finance - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1100-NBI?

A: Form 1100-NBI is a corporate tax form used to report non-business income or loss.

Q: What is the purpose of Form 1100-NBI?

A: The purpose of Form 1100-NBI is to calculate and report non-business income or loss for a corporation.

Q: Who needs to file Form 1100-NBI?

A: Corporations that have non-business income or loss in Delaware may need to file Form 1100-NBI.

Q: When is Form 1100-NBI due?

A: Form 1100-NBI is due on or before the 15th day of the fourth month following the close of the tax year.

Q: Are there any filing fees for Form 1100-NBI?

A: There are no filing fees for Form 1100-NBI.

Q: What should I do if I have questions about Form 1100-NBI?

A: If you have questions about Form 1100-NBI, you should contact the Delaware Division of Revenue or consult with a tax professional.

Form Details:

- Released on November 18, 2014;

- The latest edition provided by the Delaware Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 1100-NBI by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance.