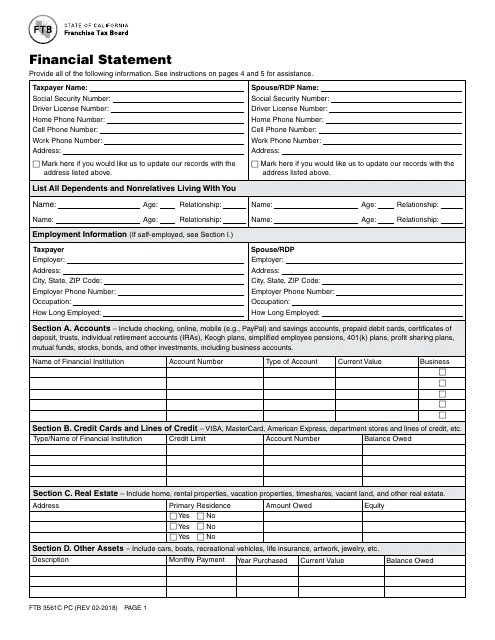

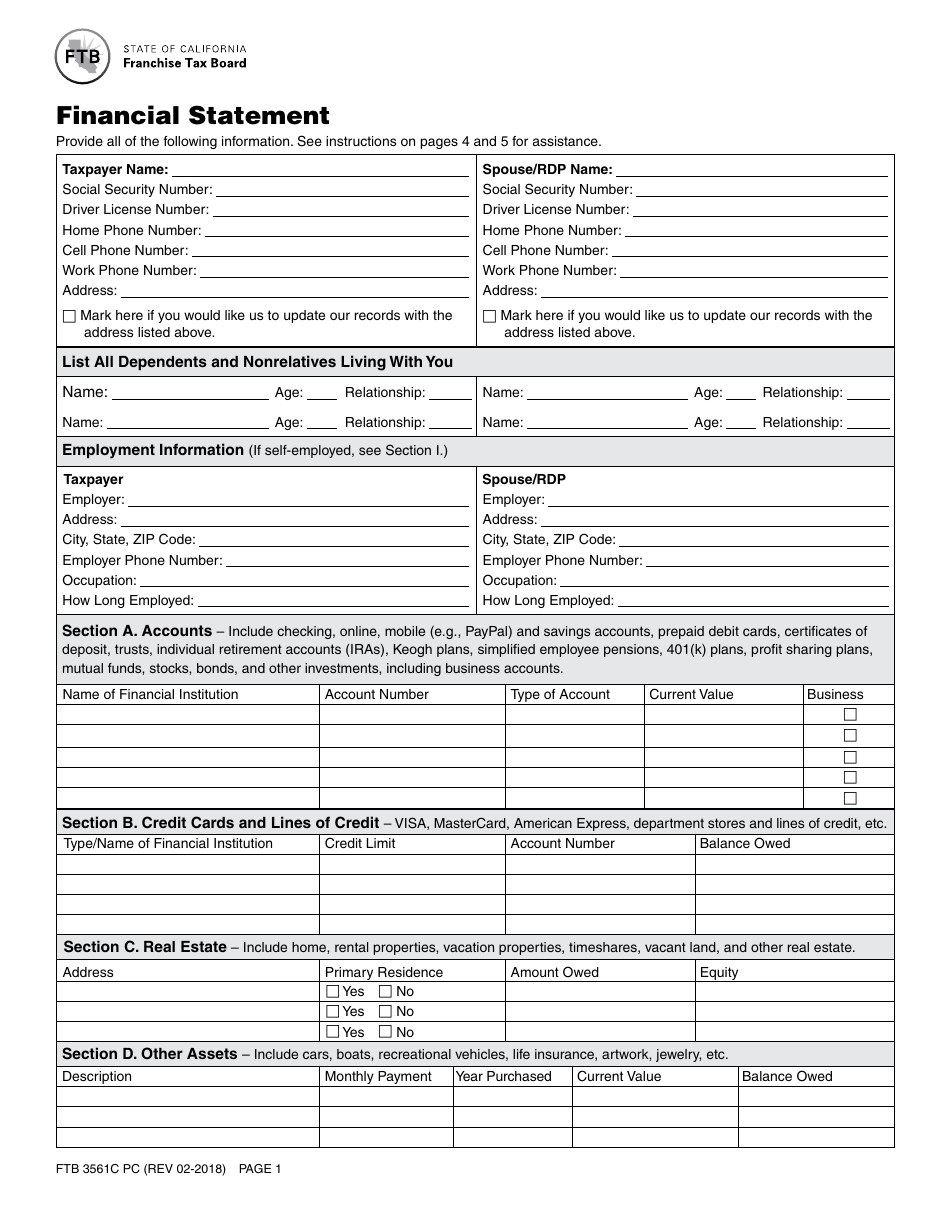

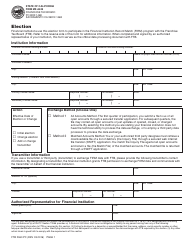

Form FTB3561C PC Financial Statement - California

What Is Form FTB3561C PC?

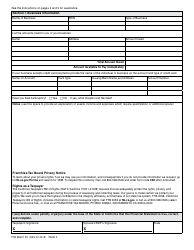

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form FTB3561C PC?

A: Form FTB3561C PC is the Financial Statement for California.

Q: Who needs to file form FTB3561C PC?

A: Any entity doing business in California that fulfills certain requirements needs to file form FTB3561C PC.

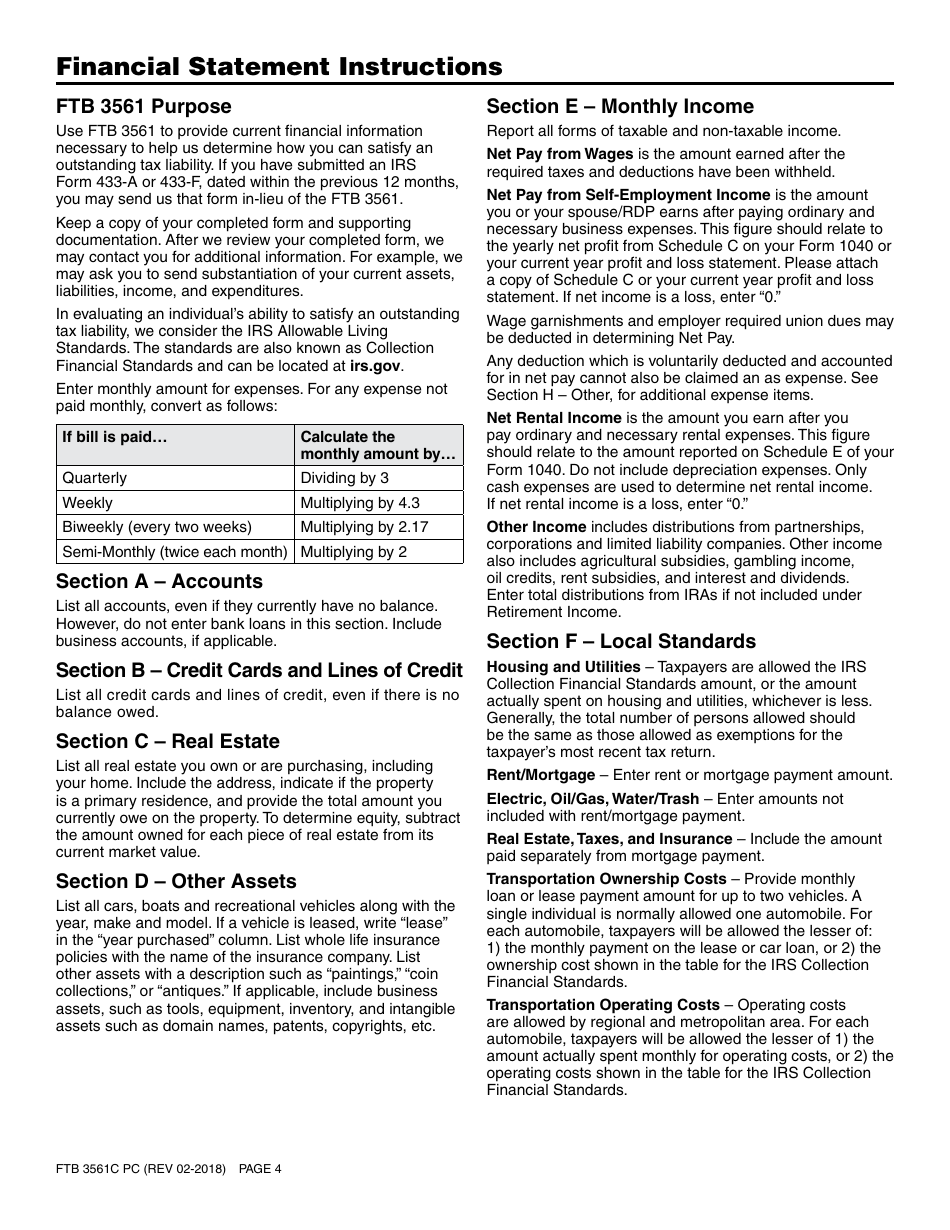

Q: What is the purpose of form FTB3561C PC?

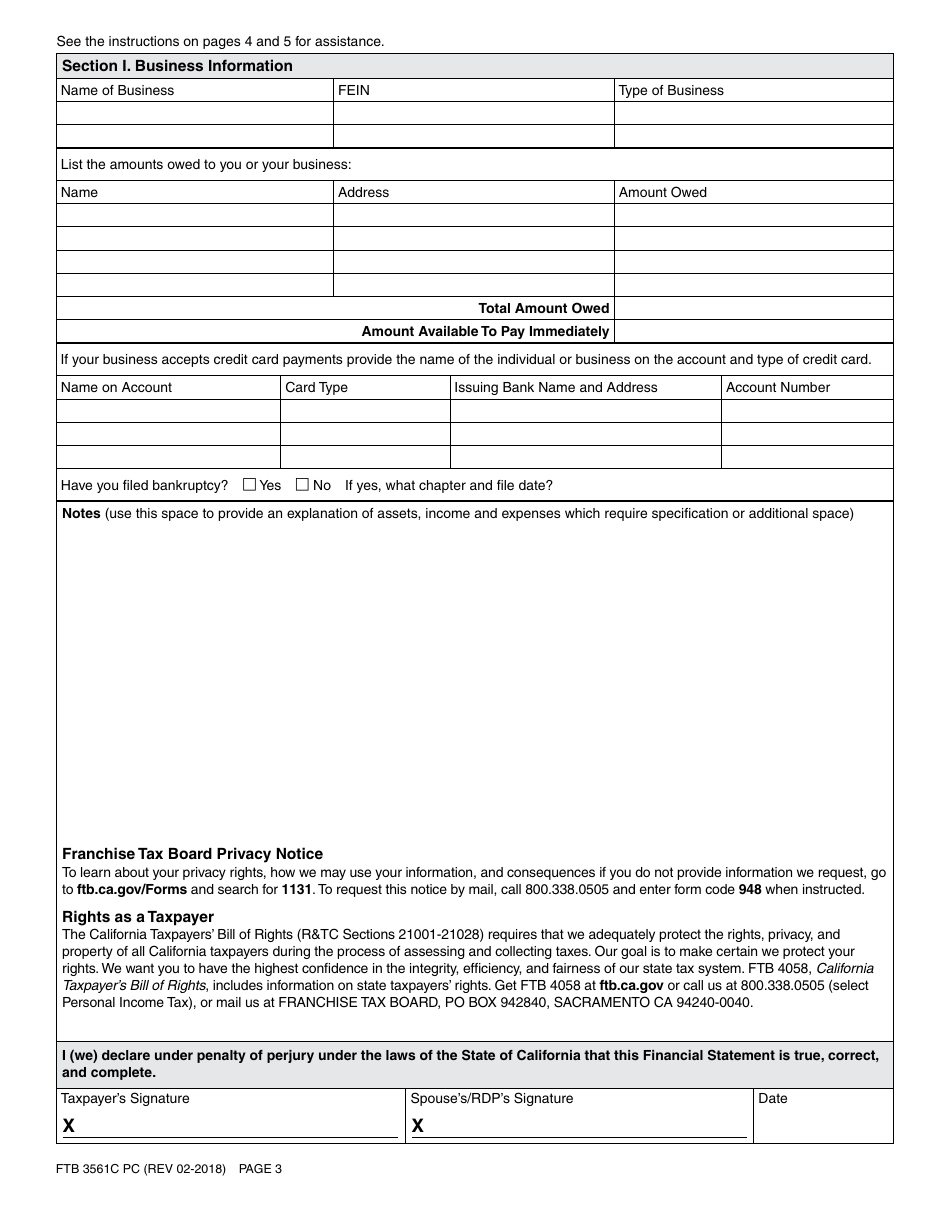

A: The purpose of form FTB3561C PC is to provide a financial statement to the California Franchise Tax Board (FTB) to determine the entity's financial condition.

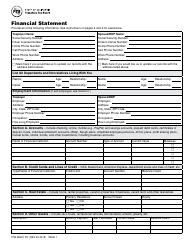

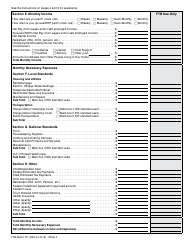

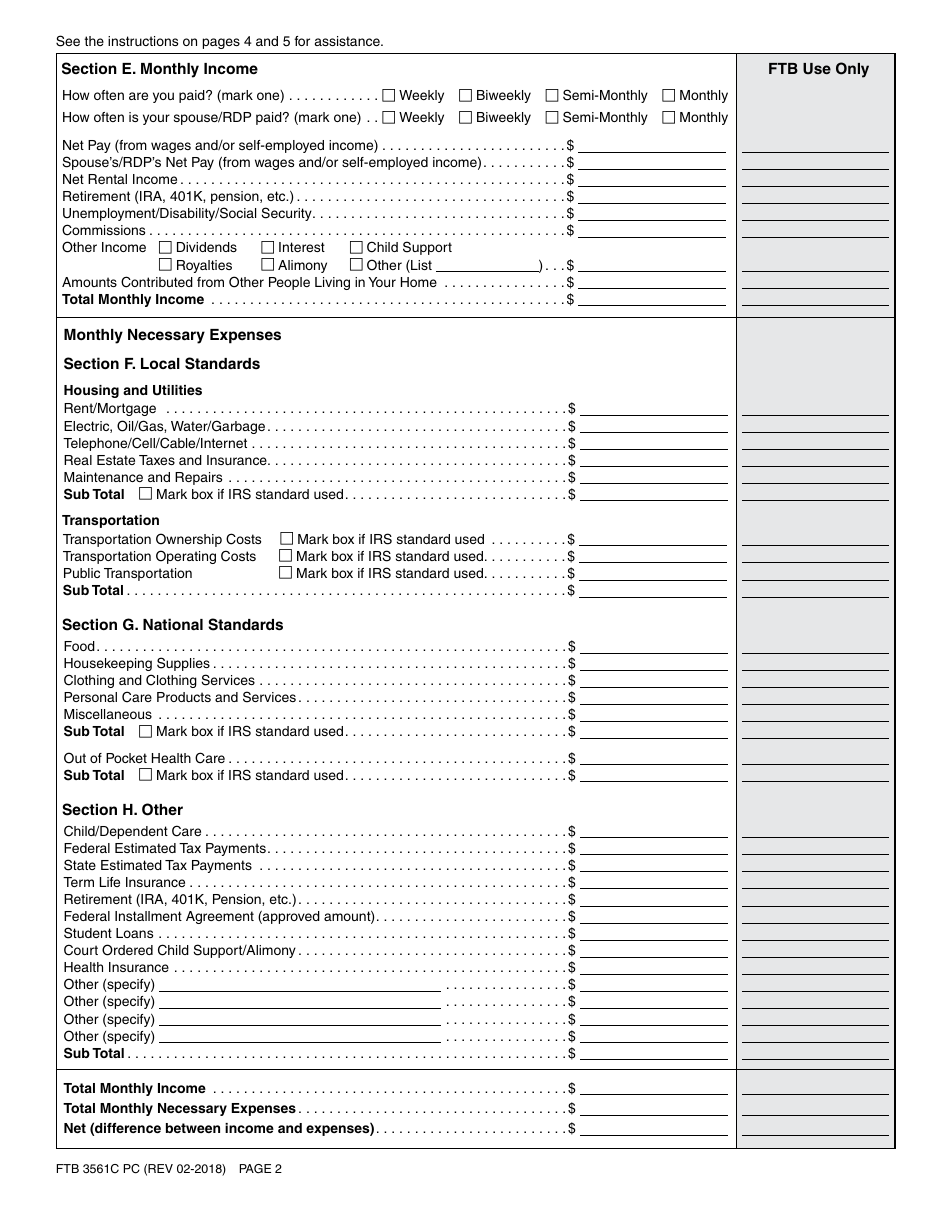

Q: What information is required on form FTB3561C PC?

A: Form FTB3561C PC requires information related to the entity's assets, liabilities, and equity.

Q: When is the deadline to file form FTB3561C PC?

A: The deadline to file form FTB3561C PC is the 15th day of the fourth month after the close of the taxable year.

Q: Is there a fee to file form FTB3561C PC?

A: No, there is no fee to file form FTB3561C PC.

Q: What happens if I don't file form FTB3561C PC?

A: Failure to file form FTB3561C PC may result in penalties and interest imposed by the California Franchise Tax Board (FTB).

Q: Do I need to attach supporting documents with form FTB3561C PC?

A: No, you do not need to attach supporting documents with form FTB3561C PC. However, you should keep them for your records in case of an audit.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3561C PC by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.