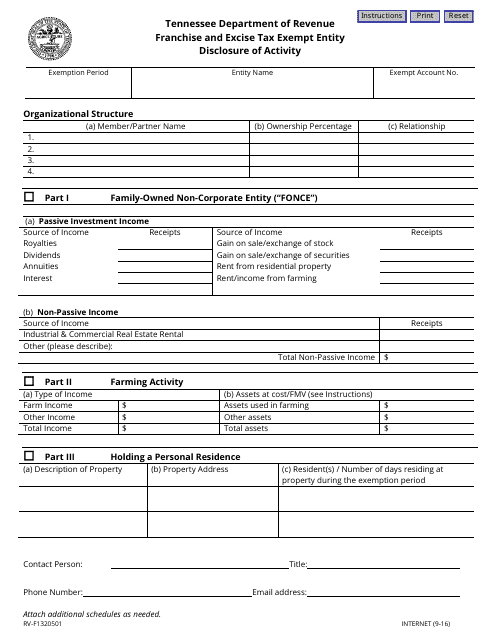

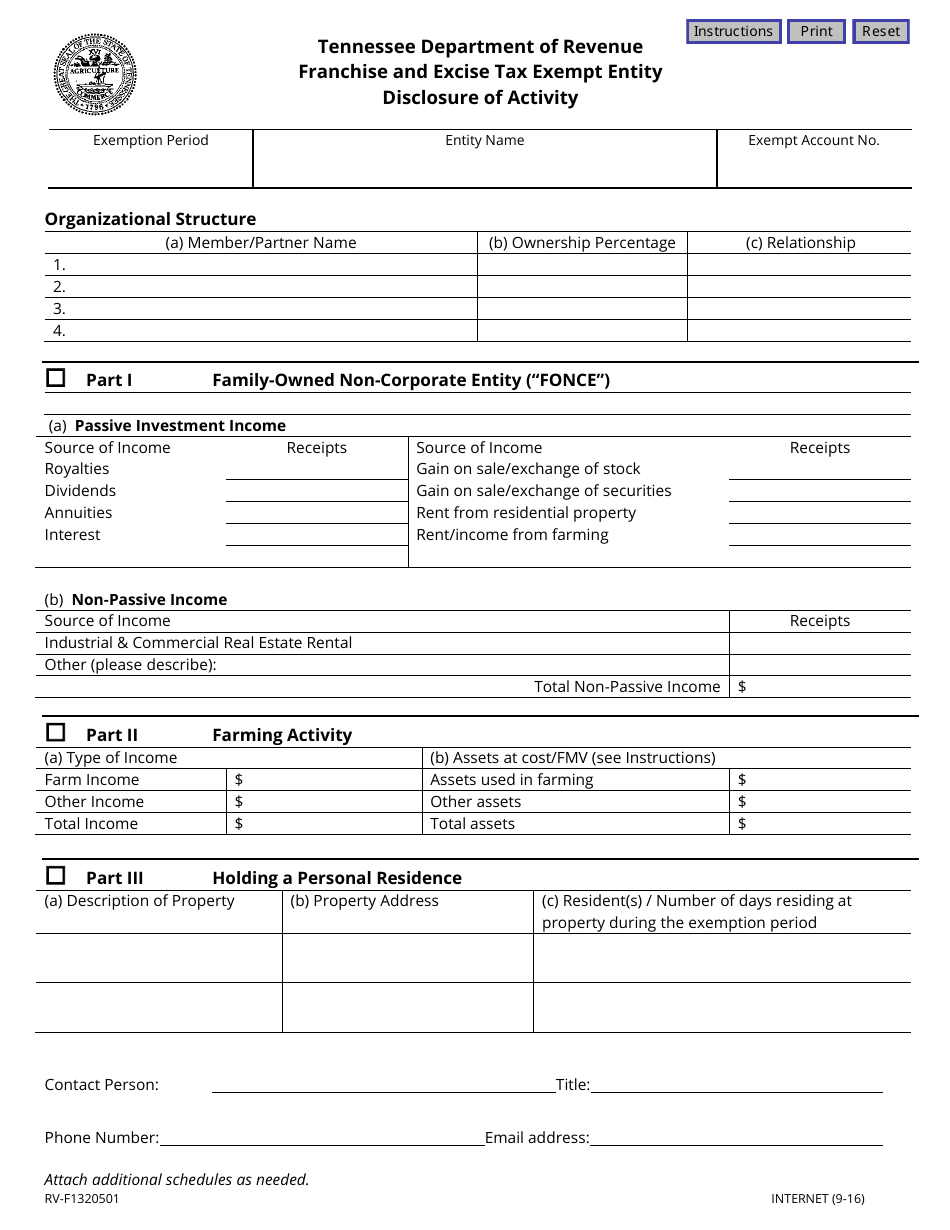

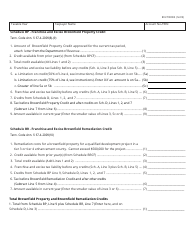

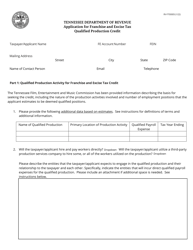

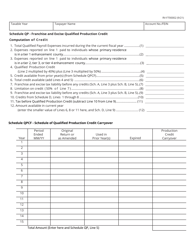

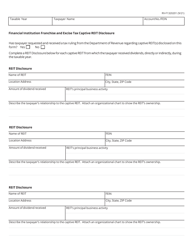

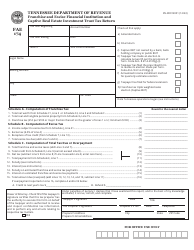

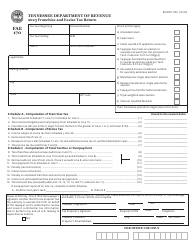

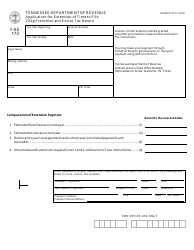

Form RV-F1320501 Franchise and Excise Tax Exempt Entity Disclosure of Activity - Tennessee

What Is Form RV-F1320501?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form RV-F1320501?

A: The purpose of Form RV-F1320501 is to disclose the activity of a tax-exempt entity for franchise and excise tax purposes in Tennessee.

Q: Who needs to file Form RV-F1320501?

A: Tax-exempt entities that are subject to franchise and excise tax in Tennessee need to file Form RV-F1320501.

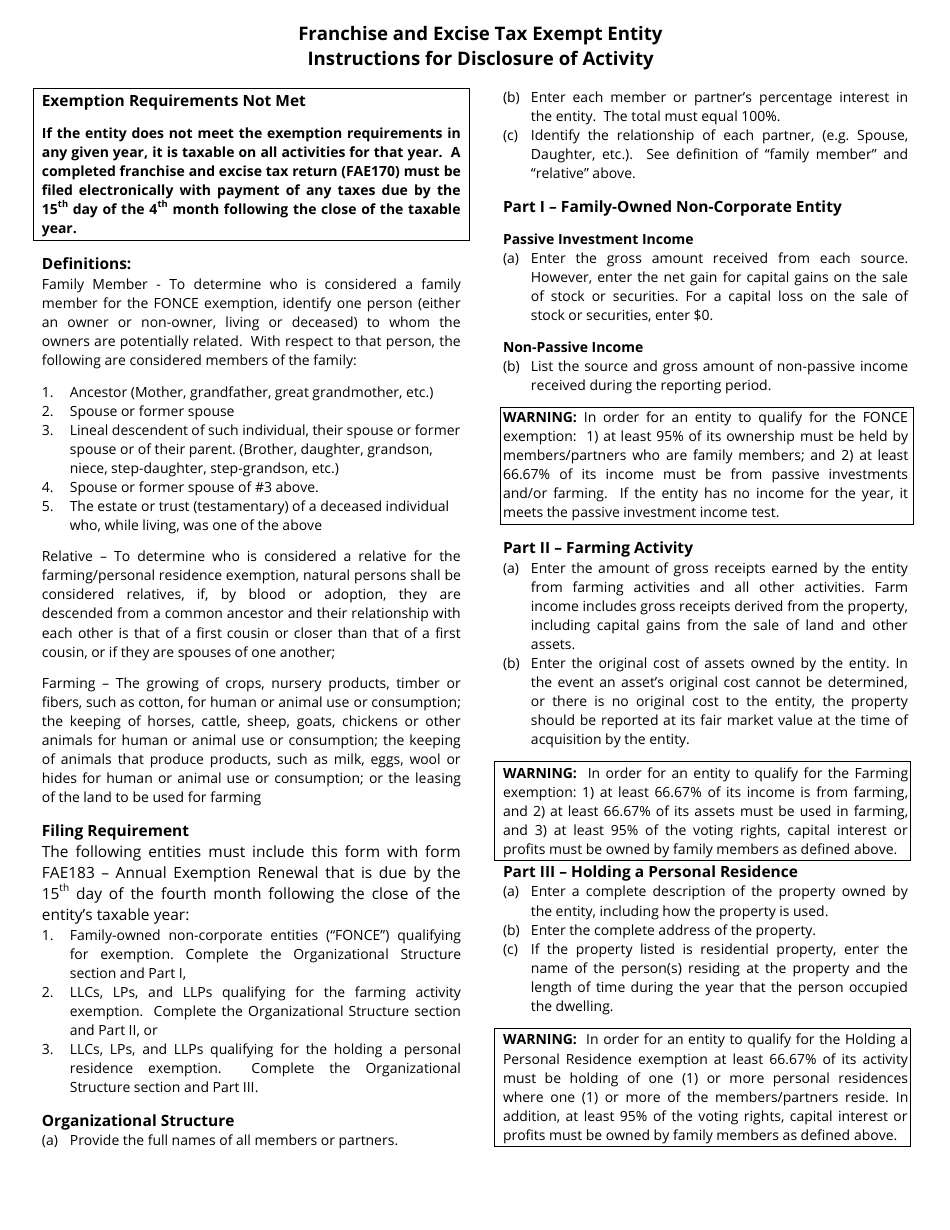

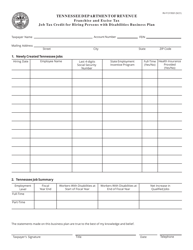

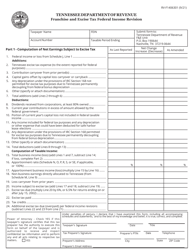

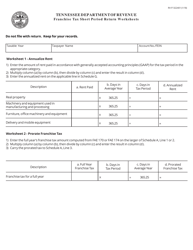

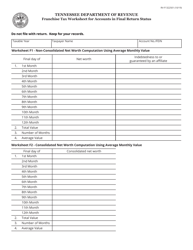

Q: What information does Form RV-F1320501 require?

A: Form RV-F1320501 requires tax-exempt entities to disclose their activities in Tennessee, including details on income, payroll, property ownership, and other relevant information.

Q: When is Form RV-F1320501 due?

A: Form RV-F1320501 is due on or before the 15th day of the 5th month following the close of the entity's taxable year.

Form Details:

- Released on September 1, 2016;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RV-F1320501 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.