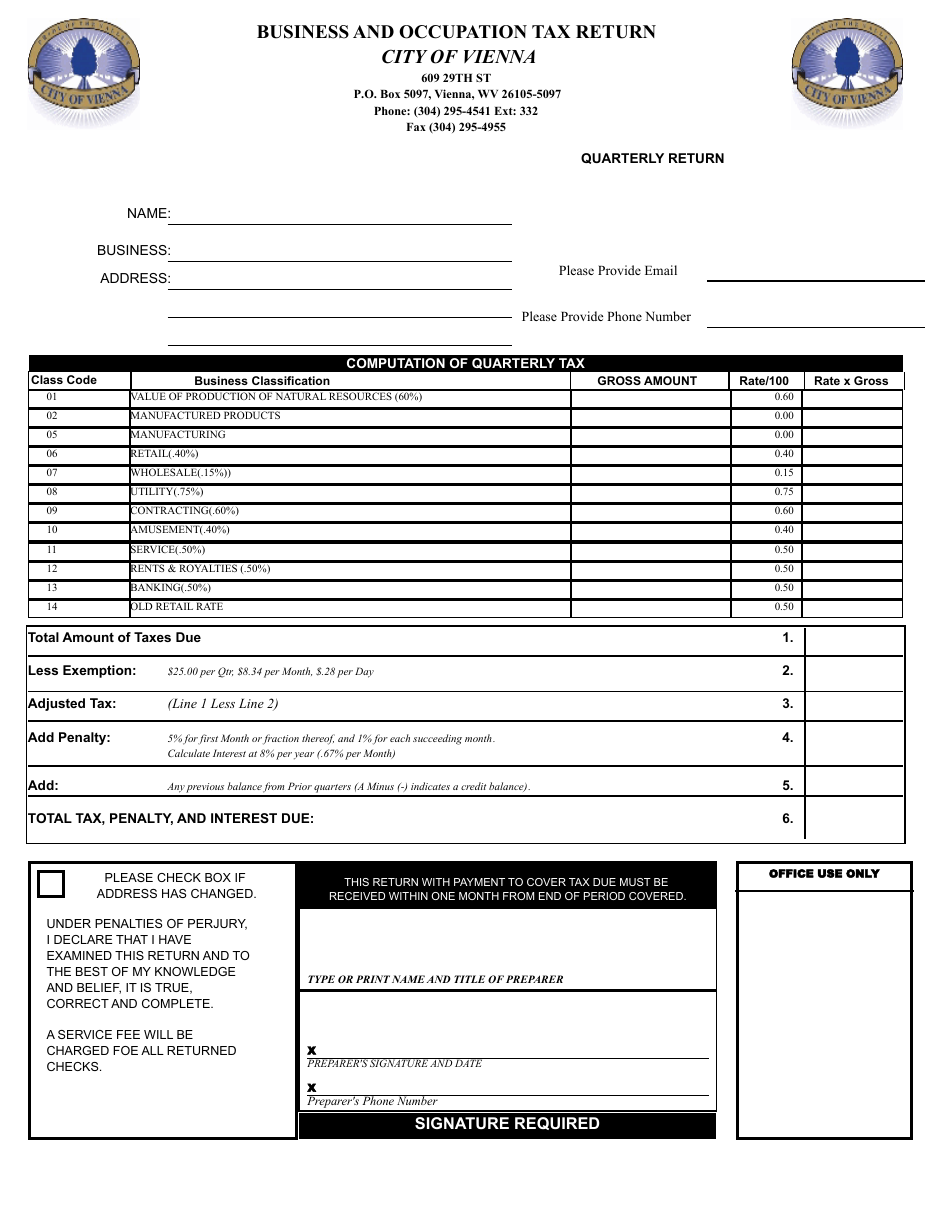

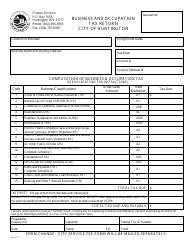

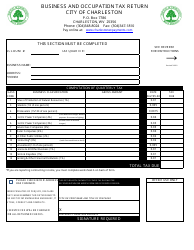

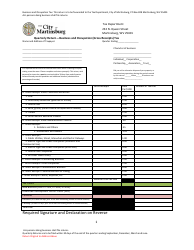

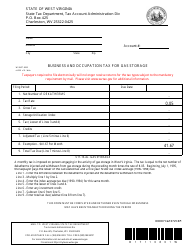

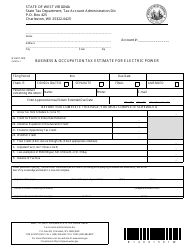

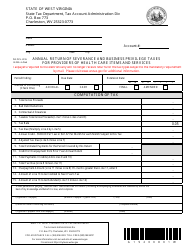

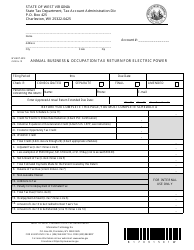

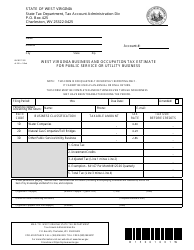

Business and Occupation Tax Return - City of Vienna, West Virginia

Business and Occupation Tax Return is a legal document that was released by the Office of the Treasurer - City of Vienna, West Virginia - a government authority operating within West Virginia. The form may be used strictly within City of Vienna.

FAQ

Q: What is a Business and Occupation Tax Return?

A: A Business and Occupation Tax Return is a form that businesses in the City of Vienna, West Virginia must complete and submit to report their taxable business activities.

Q: Who is required to file a Business and Occupation Tax Return in Vienna, WV?

A: All businesses operating in the City of Vienna, West Virginia are required to file a Business and Occupation Tax Return, regardless of their size or type.

Q: How often do businesses need to file a Business and Occupation Tax Return in Vienna, WV?

A: Businesses in Vienna, WV are generally required to file a Business and Occupation Tax Return on a quarterly basis, although specific filing frequencies may vary depending on the nature of the business.

Q: What information is needed to complete a Business and Occupation Tax Return in Vienna, WV?

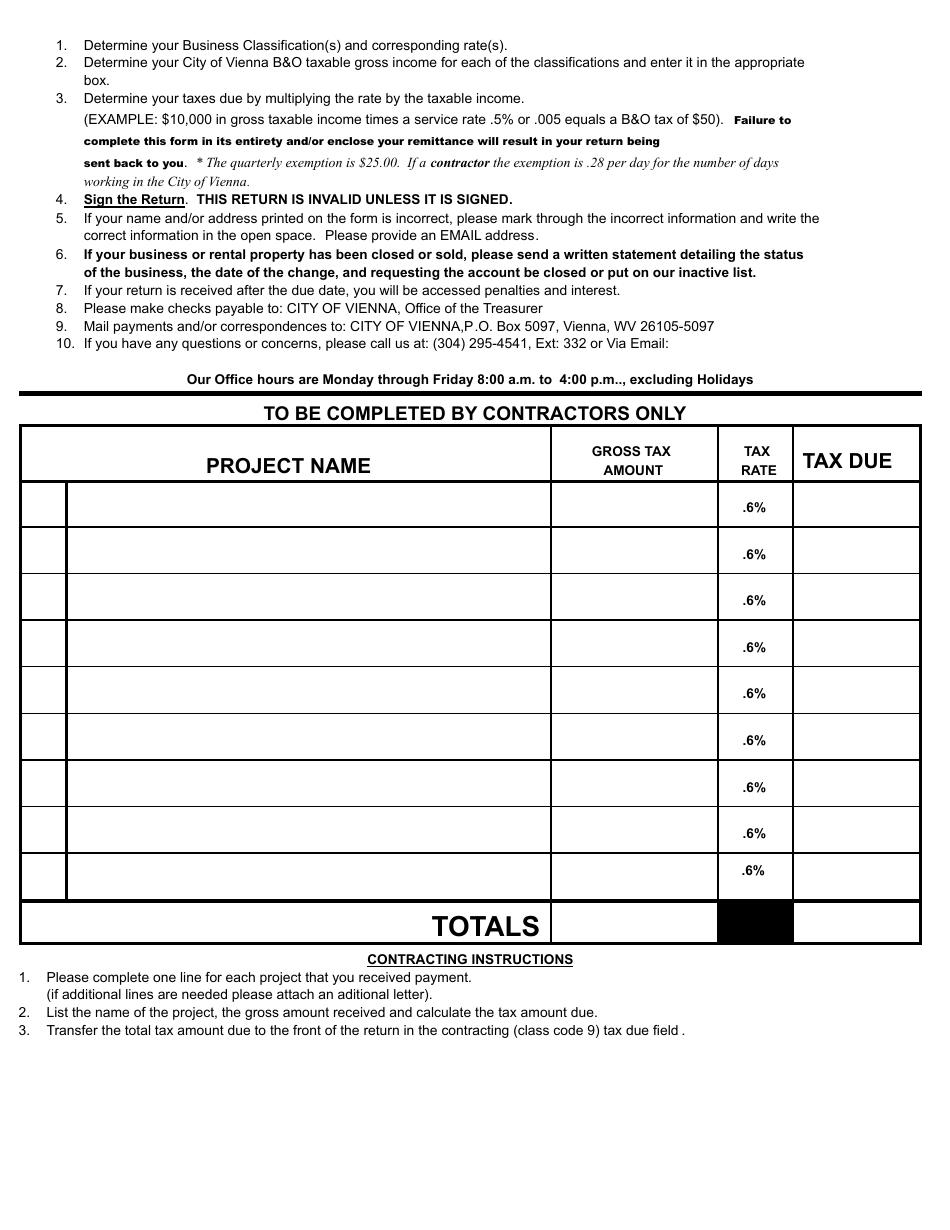

A: To complete a Business and Occupation Tax Return in Vienna, WV, businesses typically need to provide information such as their gross receipts, inventory values, and other relevant financial data.

Q: When is the deadline to file a Business and Occupation Tax Return in Vienna, WV?

A: The deadline to file a Business and Occupation Tax Return in Vienna, WV is typically on or before the 15th day of the month following the end of the reporting period.

Form Details:

- The latest edition currently provided by the Office of the Treasurer - City of Vienna, West Virginia;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Office of the Treasurer - City of Vienna, West Virginia.