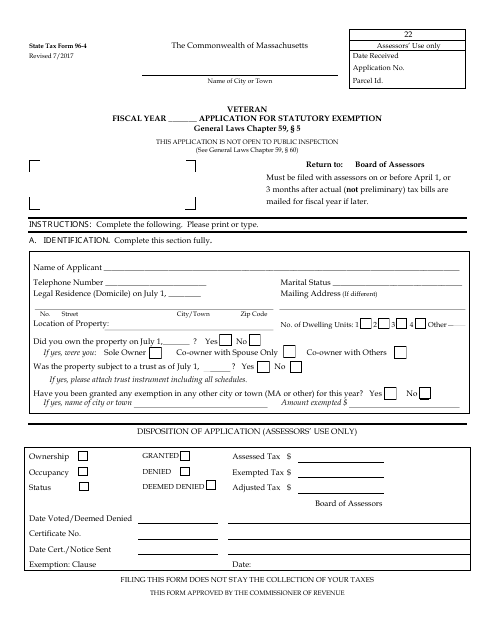

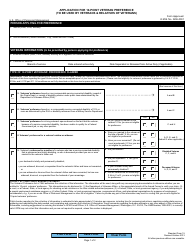

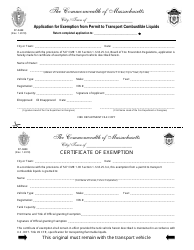

Form 96-4 Veteran Application for Statutory Exemption - Massachusetts

What Is Form 96-4?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

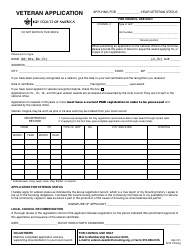

Q: What is Form 96-4?

A: Form 96-4 is the Veteran Application for Statutory Exemption in Massachusetts.

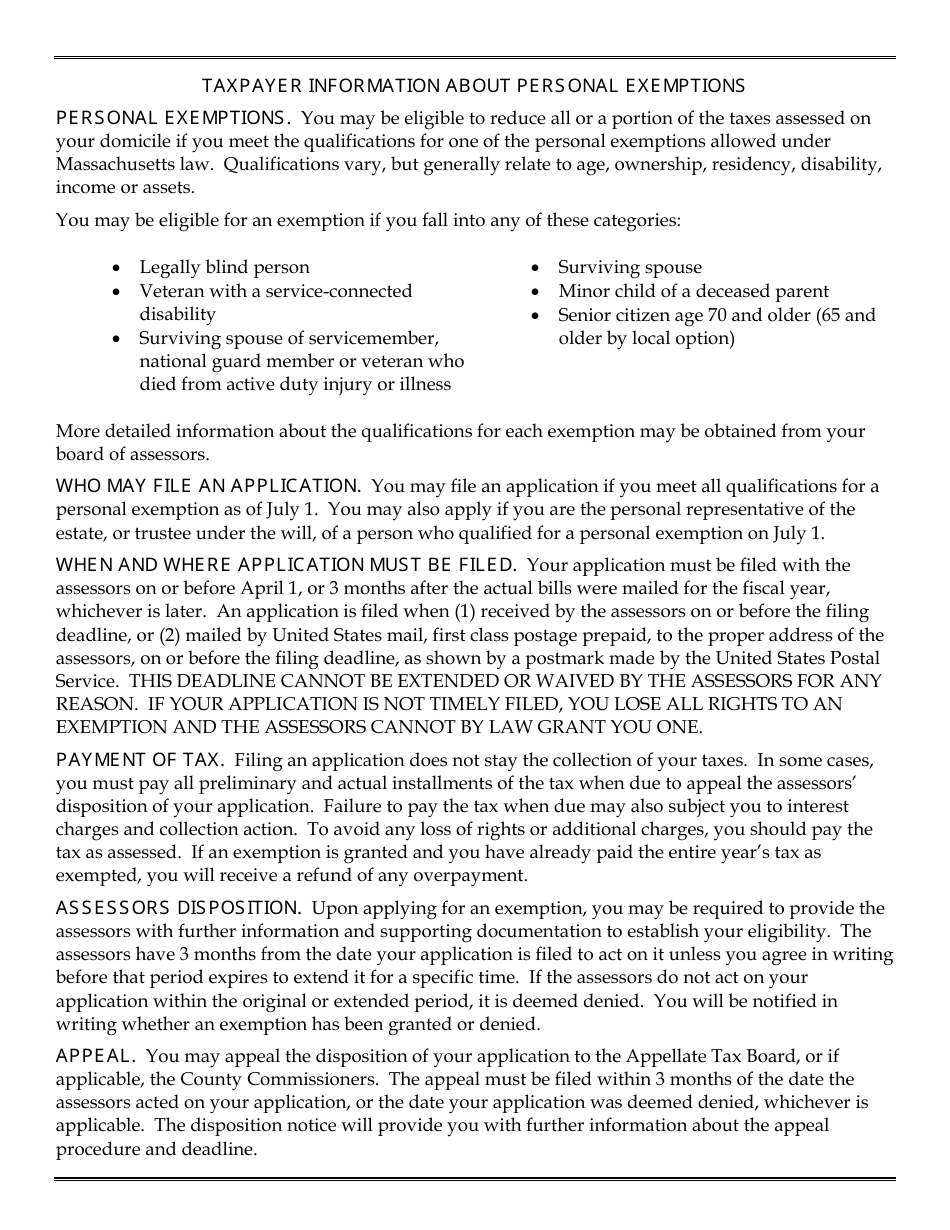

Q: Who is eligible to use Form 96-4?

A: Military veterans who meet certain criteria are eligible to use Form 96-4.

Q: What is the purpose of Form 96-4?

A: The purpose of Form 96-4 is to apply for a statutory exemption from certain taxes in Massachusetts for eligible veterans.

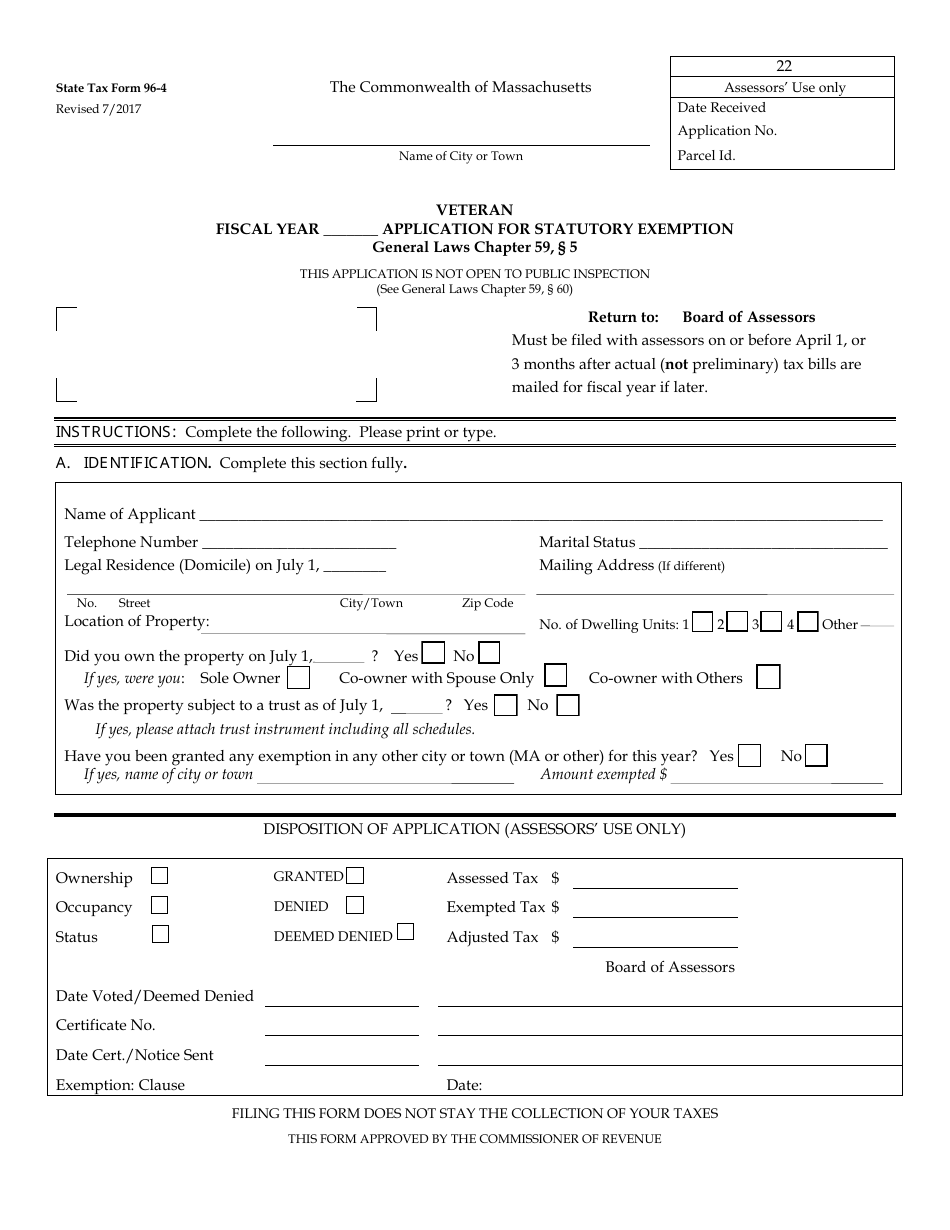

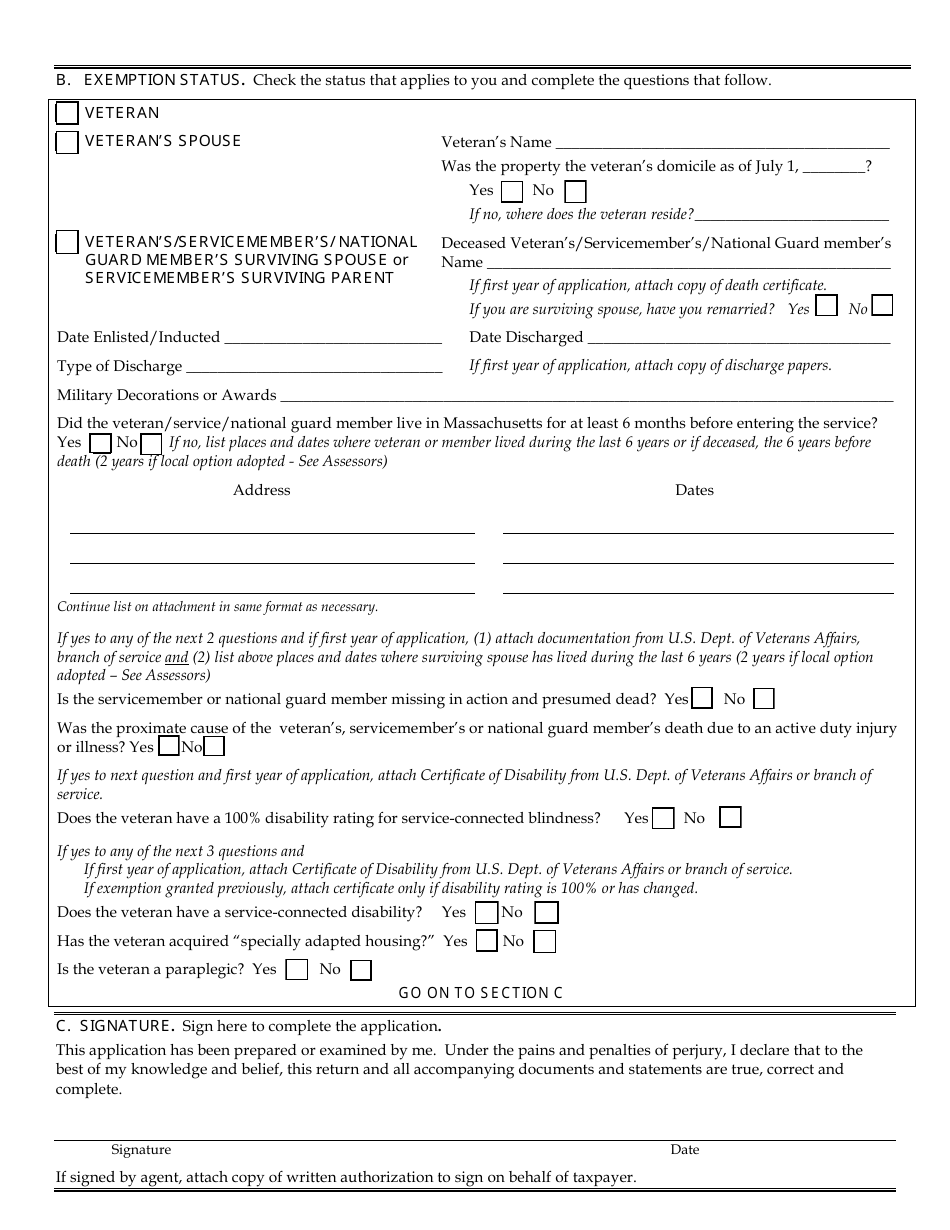

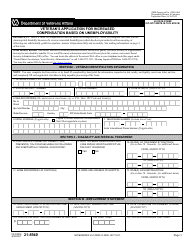

Q: What information is required on Form 96-4?

A: Form 96-4 requires personal and military service information, as well as details about the property for which the exemption is being sought.

Q: Are there any fees associated with submitting Form 96-4?

A: No, there are no fees associated with submitting Form 96-4.

Q: What is the deadline for submitting Form 96-4?

A: The deadline for submitting Form 96-4 may vary, so it is best to check with the Massachusetts Department of Revenue for the most up-to-date information on deadlines.

Q: How long does it take to process Form 96-4?

A: The processing time for Form 96-4 can vary, but it typically takes several weeks to a few months.

Q: What should I do if I have questions about Form 96-4?

A: If you have questions about Form 96-4, you should contact the Massachusetts Department of Revenue for assistance.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 96-4 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.